AgVentures Grain Marketing Facilitator’s Notes

advertisement

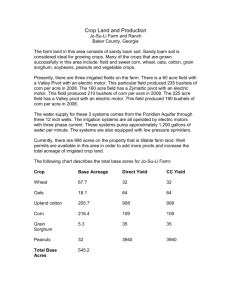

Facilitator’s Notes – Risk Tolerance II AgVentures Grain Marketing Facilitator’s Notes Risk Tolerance II TIME ALLOWED: 20-25 minutes INTRODUCTION: This second of Risk Tolerance gives examples of how to link financial management with grain marketing and risk management planning. Two different working scenarios are provided. Each one covers how downward price and yield movements can affect liquidity (the ability to pay the coming year’s bills and debt obligations) and a profitability measure, Net Farm Income from Operations. The first is price based, and the second yield based. OBJECTIVE(S): 1. Show how financial management links with Grain Marketing and Risk Management Planning. INSTRUCTIONS: Working Scenario I: A crop farmer currently has 100 acres of corn growing in a field (150 bushels per acre), or, alternatively, stored in her grain bin (15,000 bushels). Currently, the corn price is $2.25 per bushel. She has not hedged or locked in her price. Key Issues: Should she hedge or lock in her corn price? What would be the financial impact of her not hedging or locking in the price if the price drops? I. Liquidity Measure: Net Working Capital Liquidity measures the ability to pay the farm bills and debt obligations that are due within a year (current liabilities on a balance sheet) with the assets that will be converted to Grain Marketing Page 1 Facilitator’s Notes – Risk Tolerance II marketable products within a year (current assets on a balance sheet). Example of current liabilities: fertilizer bill, seed bill, interest due, principal due this year. Example of current assets: cash, securities, growing crops, stored grain, fertilizer and seed inventory, fuel, etc. A good liquidity measure to use for farmers: Net Working Capital Net Working Capital = Current Assets – Current Liabilities The producer currently has a Net Working Capital of $1,500. How much would the price have to erode before the net working capital is depleted? Net Working Capital / Total Bushels = $1,500 / 15,000 bushels = $0.10 If the price drops by ten cents per bushel, she will need to sell off assets, make arrangements with her bank or use non farm income in order to pay off her bills and debt obligations this year. What is the likelihood that price will drop this much? How much will it cost her to either hedge or lock in her corn price? II. Profitability Measure: Net Farm Income from Operations (NFIFO) Gross Farm Income - Operating Expense - Interest Expense - Depreciation Expense = NFIFO Assumptions: Gross Farm Revenues = 100 acres * 150 bushels * $2.25 = $33,750 Operating expense = $24,950 Interest expense = $ 3,500 Depreciation expense=$ 3,500 NFIFO = $33,750 – 24,950 – 3,500 - 3,500= $ 1,800 Grain Marketing Page 2 Facilitator’s Notes – Risk Tolerance II How much could the price drop before NFIFO becomes zero? Current or estimated NFIFO / (Total Yield) = $1,800 / (100 acres * 150 bushels per acres) = $0.12 This farm could withstand a twelve cent price drop before the NFIFO goes negative. What is the likelihood of this price drop? What would the cost be to either hedge the $2.25 corn price or lock in that price? Working Scenario II: A crop farmer is going to plant 100 acres of corn. Normally, the ground yields 150 bushels of corn per acre. The farmer has locked in his price of $2.25 per bushel. Key Issues: Should he seek yield or revenue insurance on his corn crop? What would be the financial impact of him not getting yield insurance? I. Liquidity Measure: Net Working Capital Liquidity measures the ability to pay the farm bills and debt obligations that are due within a year (current liabilities on a balance sheet) with the assets that will be converted to marketable products within a year (current assets on a balance sheet). Example of current liabilities: fertilizer bill, seed bill, interest due, principal due this year Example of current assets: cash, securities, growing crops, stored grain, fertilizer and seed inventory, fuel, etc. A good liquidity measure to use for farmers: Net Working Capital Net Working Capital = Current Assets – Current Liabilities The producer currently has a Net Working Capital of $1,500. How much would the yield have to decrease before the net working capital is depleted? Net Working Capital / Corn Price / Acres = $1,500 / $2.25/100= 6.7 bushels per acre If yields drop by 6.7 bushels per acre, he will need to sell off assets, make arrangements with his bank or use non farm income in order to pay off his bills and debt obligations this Grain Marketing Page 3 Facilitator’s Notes – Risk Tolerance II year. What is the likelihood that yields will drop this much? How much will it cost him to insure his yield? II. Profitability Measure: Net Farm Income from Operations (NFIFO) Gross Farm Income - Operating Expense - Interest Expense - Depreciation Expense = NFIFO Assumptions: Gross Farm Revenues = 100 acres * 150 bushels * $2.25 = $33,750 Operating expense = $24,950 Interest expense = $ 3,500 Depreciation expense= $ 3,500 NFIFO = $33,750 – 24,950 – 3,500 - 3,500= $ 1,800 How much could the yield drop before NFIFO becomes zero? Current or estimated NFIFO / Price per Bushel/ Acres = $1,800 / $2.25/ 100 = 8 bushels per acre This farm could withstand an eight bushel per acre drop before the NFIFO goes negative. What is the likelihood of this yield drop? What would the cost be to insure his yields? Grain Marketing Page 4