Budget Based Adjusted Cost of Production Cost of Production

advertisement

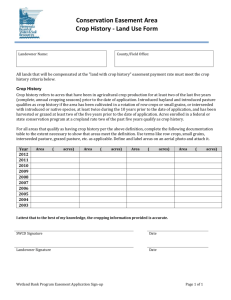

Cost of Production Budget Based Adjusted Cost of Production The Challenges of Determining Accurate Cost of Production Estimates for Crop Enterprises Cost of production is a term used to describe the average cost of producing one unit of a commodity. Estimates of cost of production are useful for setting target prices for crop marketing. Farm business owners that primarily raise crops for cash sale often do not know their cost of production because of a variety of reasons. First, the process of developing a detailed crop enterprise budget, used to accurately determine cost of production estimates and differentiate the costs between enterprises, is usually not implemented because of time constraints and the mental effort required. Second, accurate information often isn’t available. Information provided by input suppliers can be lacking, combined as one item and/or confusing. In addition, certain information is very hard to determine. Allocation of fuel usage by crop or fixed costs of machinery ownership and use (the D,I,R,T,I five) and labor hours for each crop enterprise are difficult for even producers with advanced record keeping skills. Therefore, even with a great deal of time and effort detailed enterprise budgets have limitations. There are software programs available to assist farm business owners determine the cost of production for crop and livestock enterprises. The FINAN (FINancial ANalysis) portion of the FINPACK software package is designed to do this. Unfortunately for the reasons outlined above, the task is difficult and the resulting cost of production estimates has limitations. Other Methods of Determining Cost of Production Estimates In the absence of detailed enterprise budgets farm business owners may rely on their own SWAG estimates. Others may estimate their cost of production using their known total expenses for crops and calculating a figure based on the acres and yield as an expense per bushel. Alternatively, some farm business owners may use pooled university or industry information for average cost of production estimates. The Enterprise Profitability Workgroup has developed a way for farm business owners to more accurately estimate the cost of production for various crop rotations grown. The estimate is based on crop enterprise budgets that are adjusted for the individual farm business owner’s total cost structure. This estimate is called the Budget Based Adjusted Cost of Production (BBACOP). Evaluating the Accuracy of Cost of Production Estimates – A Continuum The premise of the proposed BBACOP approach is that a producer’s knowledge of the cost of production for the crop enterprises grown falls along some point of a continuum. A B C D E ________________________________________________________________________ Continuum of knowledge about cost of production estimates Grain Marketing Page 1 Cost of Production At one extreme (point A), producers may rely on the use of the SWAG method of approximating their costs of production. The producer really doesn’t know the cost of production; therefore the estimate is an approximated guess. The SWAG estimate could be based on a previous effort to break out costs of production by crop enterprise or by the producer’s knowledge of general production costs using figures reported in the popular press or University or industry estimates. At some other extreme (point E), producers with advanced record keeping skills are developing detailed enterprise budgets to analyze their operation. These are likely the best cost of production estimates even though they have the limitations outlined above. At point B of the continuum, producers may estimate their cost of production using their known total crop expenses, allocating these total expenses between crop enterprises and calculating cost figures based on the acres and yield as an expense per bushel. Is the estimate at point B better than the SWAG estimate at point A? Probably, but the estimate isn’t very accurate. Point C of the continuum represents University and/or industry estimates of production costs. These can be derived from pooled data from various sources including farm management associations, record keeping services, and research projects. Generally, these estimates do take into account all expenses that should be considered and allocations are based on previous research. Are these estimates very accurate? Yes, these are accurate average cost estimates for the pooled data. However, an individual producer’s actual costs can be higher or lower than these average estimates. The Budget Based Adjusted Cost of Production is represented by point D on the continuum. It is more accurate than the average pooled university or industry data represented by point C. However, the BBACOP estimate may not be as accurate as the detailed enterprise budget-based cost of production estimate represented by point E, if the producer is spending the time and effort to use accurate information to develop the enterprise budget and allocations are made correctly. Advantages of the Budget Based Adjusted Cost of Production Approach There are many advantages to the Budget Based Adjusted Cost of Production estimate. Advantages include the following: The cost of production estimate is a “reasoned” base estimate for target prices The estimate is more accurate than most other methods of estimating cost of production The estimate can be determined in a short amount of time The estimate adjusts for high- and low-cost producers Limited financial information and production numbers are needed Additional field experience is needed to evaluate the BBACOP approach. Information Needed for the Budget Based Adjusted Cost of Production Estimate The following information is inputted into the BBACOP Excel spreadsheet: Schedule F Expenses - Total Interest Paid - Wages and Benefits Paid - Depreciation Claimed - Total Livestock Expenses (if applicable) Grain Marketing Page 2 Cost of Production Acres of each crop in the rotation Yield estimate for the next year Change in Accounts Payable (if applicable) Change in Prepaid Expenses (if applicable) Grain Marketing Page 3 Cost of Production Able Acres Example Crop Marketing Plan Able Acres Example - Business and Family Situation as of January 1 The Able Acres decision-makers are sitting down on New Years Day to talk business. They want to get an early start by developing a marketing plan for the crops that they plan to grow. They realize that there are many factors that can influence crop prices throughout the year – weather, domestic use, exports and local supply and demand situations to name just a few. Able Acres has done a so-so job of marketing their production in recent years. They believe that part of their problem is a lack of confidence in knowing the prices they need to meet production, business and family goals. Able Acres has decided that one of the first steps in developing a marketing plan is to determine some target prices for the crops they plan to grow. These target prices will help them evaluate prices available to them from the market. Able Acres does not know the cost of production for the crops they grow. They have decided to use Budget Based Adjusted Cost of Production estimates to determine target prices they can use in the development of their marketing plan. Information for Worksheet 1A: Determination of Basic Cost of Production First, the Able Acres decision-makers pull out copies of their Schedule F tax returns and end of the year balance sheets for the last 4 years. They have operated about 2000 acres for the past several years. For the coming year they plan to grow 1200 acres of corn, 700 acres of soybeans and 100 acres of hay. For the coming year Able Acres projects the following: Total Schedule F Expenses: Able Acres has gone through their Schedule F tax returns for the past several years and have made projections for each of the expense categories. They are projecting total Schedule F expenses to be $561,500. Accounts Payable: There has been $4,700 in accounts payable at the end of each of the past two years. No change is anticipated in accounts payable at the end of the coming year. Prepaid Expenses: For tax planning purposes and to take advantage of year-end discounts, Able Acres has tended to increase their year-end prepaid expense purchases. For the coming year-end prepaid expenses are projected to increase $5500 Livestock Expenses: Able Acres does not plan to raise any livestock in the coming year. Total Interest Paid: Able Acres has been trying to pay down their debt and total farm liabilities have been decreasing. Interest rates are also expected to be lower in the coming year. Interest expense is projected to be $41,500. Grain Marketing Page 4 Cost of Production Wages and Benefits Paid: For the past three years, wages and benefits paid have been $33,000, $24,950 and $32,700. Hired labor expenses are expected to be considerably higher this year with a projected total of $41,500 ($33,000 labor hired and $7,500 employee program benefits). Depreciation Claimed: Able Acres has purchased additional farm machinery and equipment over the past few years. They expect to claim roughly $30,000 of depreciation in the coming year. [Complete Worksheet 1A] From Worksheet 1A, Able Acres’ total projected Basic Cost of Production is $444,000 Information for Worksheet 1B: Calculation of Adjusted Basic Crop Production Costs Able Acres will use Worksheet 1B to determine a Budget Based Adjusted Cost of Production estimate for each of the crops they plan to grow in the coming year. Able Acres is planning to raise 2000 acres of crops in the coming year – 1200 acres of corn, 700 acres of soybeans and 100 acres of hay. Of the total 2000 acres, Able Acres determines that 60% of their planned crop rotation will be in corn (1200 divided by 2000), 35% in soybeans (700 divided by 2000) and 5% in hay (100 divided by 2000). The list of crops to be raised, planned acres and percent of each crop in the rotation are written in columns a, b and c. UW-Extension has developed estimated crop budgets for Central Wisconsin, Southern Wisconsin and a Wisconsin Dairy Farm. These crop budget figures are shown in the table below Worksheet 1B. Detailed information about these estimated crop budgets is presented in the Appendix. Able Acres is located in Southern Wisconsin. Using the budget figures, Able Acres multiplies the acres of crops in the planned rotation (column b) by the crop budget figure for each crop in the planned rotation. These figures are placed in column d. For example, 1200 acres of corn multiplied by $259.75 per acre for corn in Southern Wisconsin provides a cost of $311,700 that is placed in column d. Based on the crop budget figures, Able Acres’ total basic cost of production would be $460,231 based on Southern Wisconsin data. This figure is $16,231 higher than the predetermined basic cost of production value of $444,000 that Able Acres determined in Worksheet 1A. In other words, Able Acres has a cost of production that is lower than average for Southern Wisconsin. Able Acres now determines the percent of the total $460,231 budget based cost that would be attributed to each of the crops Able Acres plans to grow. To do this Able Acres divides the total expected cost for each crop (column d, $311,700 for corn for example) by the total expected cost of all crops ($460,231) and enters the figure for each crop in column e. 67.7% of total expected crop expense would come from corn, 27.7% of total expected crop expense would come from Grain Marketing Page 5 Cost of Production soybeans and 4.6% of total expected expense would come from hay. Using the $444,000 total basic costs determined in Worksheet 1A, Able Acres now uses the budget based percentage of total costs to determine the basic costs they can expect for each of the crops they plan to grow in the coming year. To do this Able Acres multiplies the projected $444,000 total basic costs by the percentage of total costs for each crop listed in column e. These figures are placed in column f. Able Acres determines that they can expect the basic costs for corn to be $300,707, the basic costs for soybeans to be $123,069 and the basic costs for hay to be $20,224. The expected cost per acre for each crop is now determined. This is accomplished by dividing the total expected costs for each crop (column f) by the acres of each crop Able Acres plan to grow in the coming year. These figures are entered in column g. Able Acres’ basic cost to raise an acre of corn, soybeans and hay is $250.59, $175.81 and $202.24 respectively. In column h, Able Acres enters its estimated yields, 150 bushels of corn, 50 bushels of soybeans and 5 tons of hay. Using the total basic cost per acre for each crop and the estimated yield for each crop, Able Acres is now able to determine the basic cost per unit of yield for each of the crops they plan to grow - $1.67 per bushel for corn, $3.52 per bushel for soybeans and $40.45 per ton for hay. Able Acres understands that these are estimates for prices to cover only the basic costs of production for each crop, that is, Schedule F Expenses excluding projected interest, wages and benefits and depreciation. [Complete Worksheet 1B] Determining and Prioritizing Farm Business and Family Goals List of Farm Business and Family Goals: The Able Acres decision-makers and other family members sat down and discussed what farm business and family goals they want the crop enterprises to pay for. They did not try to hold themselves to reality at this point. Rather, they let their minds wonder and dream about what their crop business would pay for in a perfect world so to speak. Setting Priorities: Finally, the family came to the difficult decision of prioritizing what they are going to pay for first, second, third, etc. Table 1 summarizes their results. They took into consideration what absolutely had to be paid for to stay in business and those family goals that are a must. One of their tractors needs to be replaced as soon as possible. They, of course, want to keep the bank happy and some minimal level of family living has to be a priority. Of utmost importance for them is paying the basic costs of production – seed, fertilizer, chemicals, land rent and other production expenses. They enjoyed a good reputation in the county and very much desired to maintain that. Paying their hired help (family and non-family) was also right up there Grain Marketing Page 6 Cost of Production at the top of their priority list. The far-left column of Table 1 gives the final priority ranking results. Able Acres is surprised to know that to meet all of the identified business and family goals they need $645,500. TABLE 1 Able Acres Production Costs and Farm Business and Family Goals To Be Paid By Crops in the Coming Year Priority For Payment Cost/Goal Estimated Total Dollar Needs This Coming Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Basic Costs Interest Wages & Benefits Term Debt Service Minimum Family Living Draw Additional Family Living Draw Tractor Replacement Field Cultivator Grain Storage Bin Winter Vacation College Fund Replace Pickup Truck Savings Savings Price to Meet All Goals $444,000 41,500 40,500 32,000 18,000 12,000 8,500 9,500 18,000 3,500 2,500 5,500 5,000 5,000 $645,500 Information for Worksheets 2A, 2B and 2C: Estimating, Prioritizing, and Determining Price Targets To Meet Production, Business and Family Goals Able Acres now has the task of determining some target prices for the three different crops they plan to grow – corn, soybeans and hay. They do this by completing a Worksheet 2 for each crop they plan to grow. To begin, the costs to meet production, business and family goals are arranged in prioritized order, starting with the $444,000 needed to cover the total basic production costs and ending with their second $5000 goal for savings. Previously, in Worksheet 1A Able Acres determined that the percent of total costs by crop is Grain Marketing Page 7 Cost of Production 67.7% for corn, 27.7% for soybeans and 4.6% for hay. In worksheets 2A for corn, 2B for soybeans and 2C for hay, they use these same percentages to determine the amount each crop should contribute to pay for the basic financial costs & goals to be achieved. To do this, Able Acres multiplies the amount needed for each item of the basic financial costs & goals to be achieved by the percent of total costs to be paid by each crop. For example total basic costs are projected to be $444,000. As a minimum, Able Acres would like their 1200 acres of corn to pay for 67.7% ($300,707) of that cost. Likewise, for the final $5,000 Able Acres would like to save, $3,386 would come from the corn enterprise ($5,000 multiplied by 67.7%). Finally, to determine the price per unit of yield needed for each cost/goal item, Able Acres divides the amount each crop should contribute by the total yield projected for each crop. For example, the $300,707 amount that corn should contribute to pay for total basic production costs translates to $1.67 for each unit of the estimated yield of 180,000 units (in this case bushels). Likewise, for the final $5,000 Able Acres would like to save, an additional $.02 per unit (bushel) will be needed. [Complete Worksheet 2A, 2B, 2C and 2D] Information for Worksheet 3: Summary of Cumulative Crop Price Needs to Meet Target Worksheet 3 carries the price per unit of yield needed for each crop (Worksheet 2A, 2B and 2C) one-step further. In Worksheet 3 Able Acres sees the cumulative price needed for each crop to pay its share of the total basic financial costs & goals to be achieved. As we found in Worksheet 1B the basic cost per unit of yield stays the same for all three crops - $1.67 per bushel for corn, $3.52 for soybeans and $40.45 per ton of hay. [Complete Worksheet 3d] Information for Worksheet 4 Finally, the Able Acres decision-makers determine some price targets. They know that they can always go back to Worksheet 3 for more detailed information. They start by looking back over Worksheet 3 to determine what costs/goals can be grouped together in common categories of priority. They follow the four suggested descriptions of priority categories as shown on worksheet 4 to determine a Red, Blue, and Purple Ribbon price target. For Able Acres the Red Ribbon Target Price is a “breakeven plus” price goal. This target price would cover total basic costs, interest costs and wages and benefits. To achieve this cost/goal Able Acres has target prices of $1.98 per bushel for corn, $4.17 per bushel for soybeans and $47.92 per ton for hay. The Blue Ribbon Target Prices are at a level that Able Acres believes their farm business will be successful. In addition to covering all the costs/goals of the Red Ribbon Price, the Blue Ribbon Grain Marketing Page 8 Cost of Production Target Price pays for the term debt service, the minimum family living draw, the additional family living draw and the tractor replacement. To achieve this cost/goal Able Acres has target prices of $2.24 per bushel for corn, $4.72 per bushel for soybeans and $54.34 per ton for hay. The Purple Ribbon Target Prices are above expectations. The Purple Ribbon Target Prices pay for all of the costs/goals of the Blue Ribbon Price as well as $9,500 for the field cultivator, $18,000 for the grain storage bin, $3,500 for the winter vacation, $2,500 for the college fund, $5,500 for a pickup truck replacement and $5,000 for savings. . To achieve this cost/goal Able Acres has target prices of $2.41 per bushel for corn, $5.07 per bushel for soybeans and $58.35 per ton for hay. Grand Champion Target Prices reflect an exceptional market. At these prices Able Acres will be able to put even more money ($5,000) into savings. To achieve this cost/goal Able Acres has target prices of $2.43 per bushel for corn, $5.11 per bushel for soybeans and $58.80 per ton for hay. Finally however, Able Acres decides they should add a fifth category that describes for them a “drop dead” price that just covers production costs. Paying their bills is very important to them. Even in the toughest of times, the family has made sure the bills got paid. If they have to borrow money for family living, etc. then so be it, but they all agree that one major price target for them is one that allows the production costs to be paid. They title this their “drop dead” price. It’s the prices needed to cover just the basic costs of production; $1.67 per bushel for corn, $3.52 per bushel for soybeans and $40.45 per ton for hay. In addition to Worksheet 4, Able Acres highlights the 4 target price levels they have determined on Worksheet 3. [Complete Worksheet 4] Grain Marketing Page 9