Administration's FY 2015 Budget Proposal All Major Tax Provisions

advertisement

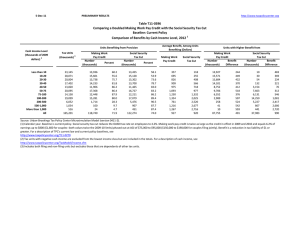

30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0051 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Summary Table Expanded Cash Income Level (thousands of 2013 dollars) 2 Number (thousands) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All 11,178 22,170 19,574 15,956 13,025 24,877 15,960 28,866 8,770 1,076 629 163,798 Tax Units Percent of Total 6.8 13.5 12.0 9.7 8.0 15.2 9.7 17.6 5.4 0.7 0.4 100.0 Percent Change in After-Tax Income 3 2.3 0.8 0.0 -0.1 -0.1 -0.1 -0.1 -0.1 -0.6 -1.4 -3.3 -0.6 Share of Total Federal Tax Change -2.3 -4.3 -0.1 0.7 0.8 1.6 1.4 5.0 19.3 11.7 66.2 100.0 Average Federal Tax Change ($) -133 -128 -4 30 40 43 56 114 1,450 7,141 69,269 402 Average Federal Tax Rate 4 Change (% Points) -2.2 -0.8 0.0 0.1 0.1 0.1 0.1 0.1 0.5 1.0 2.1 0.5 Under the Proposal 2.3 1.6 4.9 8.0 10.5 13.8 16.0 18.4 23.1 29.4 37.5 20.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). Number of AMT Taxpayers (millions). Baseline: 4.5 Proposal: 4.4 (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0051 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table Expanded Cash Income Level (thousands of 2013 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax 3 Income Share of Total Federal Tax Change 2.3 0.8 0.0 -0.1 -0.1 -0.1 -0.1 -0.1 -0.6 -1.4 -3.3 -0.6 -2.3 -4.3 -0.1 0.7 0.8 1.6 1.4 5.0 19.3 11.7 66.2 100.0 Average Federal Tax Change Dollars -133 -128 -4 30 40 43 56 114 1,450 7,141 69,269 402 Share of Federal Taxes Percent Change (% Points) -49.3 -34.1 -0.3 1.1 0.8 0.5 0.4 0.4 2.2 3.6 6.0 2.3 -0.1 -0.1 0.0 0.0 0.0 -0.1 -0.2 -0.5 0.0 0.1 0.9 0.0 Under the Proposal 0.1 0.2 0.8 1.6 2.2 7.5 7.8 25.7 20.4 7.5 26.1 100.0 Average Federal Tax Rate Change (% Points) -2.2 -0.8 0.0 0.1 0.1 0.1 0.1 0.1 0.5 1.0 2.1 0.5 4 Under the Proposal 2.3 1.6 4.9 8.0 10.5 13.8 16.0 18.4 23.1 29.4 37.5 20.1 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Expanded Cash Income Level (thousands of 2013 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 11,178 22,170 19,574 15,956 13,025 24,877 15,960 28,866 8,770 1,076 629 163,798 Pre-Tax Income Percent of Total 6.8 13.5 12.0 9.7 8.0 15.2 9.7 17.6 5.4 0.7 0.4 100.0 Average (dollars) 6,076 15,744 25,753 36,289 46,641 64,010 89,951 142,712 296,335 700,375 3,264,593 89,403 Percent of Total 0.5 2.4 3.4 4.0 4.2 10.9 9.8 28.1 17.8 5.2 14.0 100.0 Federal Tax Burden Average (dollars) 270 375 1,262 2,860 4,835 8,785 14,369 26,188 67,084 198,974 1,153,221 17,604 Percent of Total 0.1 0.3 0.9 1.6 2.2 7.6 8.0 26.2 20.4 7.4 25.2 100.0 After-Tax Income 3 Average (dollars) 5,807 15,369 24,490 33,429 41,806 55,225 75,582 116,524 229,251 501,401 2,111,372 71,799 Percent of Total 0.6 2.9 4.1 4.5 4.6 11.7 10.3 28.6 17.1 4.6 11.3 100.0 Average Federal Tax 4 Rate 4.4 2.4 4.9 7.9 10.4 13.7 16.0 18.4 22.6 28.4 35.3 19.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). Number of AMT Taxpayers (millions). Baseline: 4.5 Proposal: 4.4 (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0051 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table - Single Tax Units Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax Income 3 Share of Total Federal Tax Change 2.9 1.1 0.1 -0.1 -0.1 -0.1 -0.1 -0.1 -0.7 -1.4 -4.2 -0.2 -25.1 -45.5 -4.9 2.9 4.8 9.6 5.2 6.6 23.7 13.6 109.6 100.0 Average Federal Tax Change Dollars -162 -165 -24 20 45 54 62 87 1,539 6,662 87,233 79 Share of Federal Taxes Percent Change (% Points) -40.6 -19.9 -1.1 0.5 0.7 0.5 0.3 0.3 2.0 3.2 7.0 0.9 -0.2 -0.4 -0.1 0.0 0.0 -0.1 -0.1 -0.1 0.1 0.1 0.8 0.0 Under the Proposal 0.3 1.6 4.0 5.5 6.5 18.2 13.7 20.6 10.5 3.9 14.9 100.0 Average Federal Tax Rate 4 Change (% Points) -2.7 -1.1 -0.1 0.1 0.1 0.1 0.1 0.1 0.5 1.0 2.6 0.2 Under the Proposal 3.9 4.3 8.7 11.8 14.7 18.1 20.6 22.9 26.3 31.3 40.3 18.9 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 9,172 16,267 12,067 8,699 6,316 10,551 4,998 4,453 913 121 74 74,471 Pre-Tax Income Percent of Total 12.3 21.8 16.2 11.7 8.5 14.2 6.7 6.0 1.2 0.2 0.1 100.0 Average (dollars) 6,047 15,651 25,560 36,250 46,495 63,958 89,284 135,426 293,103 691,787 3,325,129 47,608 Percent of Total 1.6 7.2 8.7 8.9 8.3 19.0 12.6 17.0 7.5 2.4 7.0 100.0 Federal Tax Burden Average (dollars) 398 834 2,237 4,248 6,803 11,509 18,313 30,952 75,441 209,796 1,252,565 8,920 Percent of Total 0.6 2.0 4.1 5.6 6.5 18.3 13.8 20.8 10.4 3.8 14.0 100.0 After-Tax Income 3 Average (dollars) 5,649 14,817 23,324 32,002 39,693 52,449 70,971 104,474 217,662 481,990 2,072,564 38,688 Percent of Total 1.8 8.4 9.8 9.7 8.7 19.2 12.3 16.2 6.9 2.0 5.4 100.0 Average Federal Tax Rate 4 6.6 5.3 8.8 11.7 14.6 18.0 20.5 22.9 25.7 30.3 37.7 18.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0051 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table - Married Tax Units Filing Jointly Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax Income 3 Share of Total Federal Tax Change 0.3 0.2 -0.1 -0.1 0.0 -0.1 -0.1 -0.1 -0.6 -1.4 -3.1 -0.7 0.0 -0.1 0.1 0.2 0.1 0.6 0.8 4.5 19.5 12.1 62.3 100.0 Average Federal Tax Change Dollars -14 -38 15 25 13 38 55 110 1,410 7,183 64,908 885 Share of Federal Taxes Percent Change (% Points) -11.0 -49.8 3.0 2.0 0.5 0.6 0.5 0.4 2.1 3.6 5.8 2.7 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.6 -0.1 0.1 0.9 0.0 Under the Proposal 0.0 0.0 0.1 0.2 0.5 2.7 4.9 27.4 24.6 9.1 30.3 100.0 Average Federal Tax Rate 4 Change (% Points) -0.3 -0.2 0.1 0.1 0.0 0.1 0.1 0.1 0.5 1.0 2.0 0.6 Under the Proposal 2.0 0.2 1.9 3.6 5.6 9.5 13.3 17.4 22.6 29.2 37.0 21.6 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 850 1,869 3,039 3,256 3,586 9,047 8,453 22,471 7,599 925 529 62,259 Pre-Tax Income Percent of Total 1.4 3.0 4.9 5.2 5.8 14.5 13.6 36.1 12.2 1.5 0.9 100.0 Average (dollars) 5,409 16,299 26,098 36,414 46,902 64,385 90,693 145,046 296,744 701,317 3,202,772 154,113 Percent of Total 0.1 0.3 0.8 1.2 1.8 6.1 8.0 34.0 23.5 6.8 17.7 100.0 Federal Tax Burden Average (dollars) 124 75 491 1,270 2,597 6,086 11,982 25,147 65,781 197,277 1,121,475 32,396 Percent of Total 0.0 0.0 0.1 0.2 0.5 2.7 5.0 28.0 24.8 9.1 29.4 100.0 After-Tax Income 3 Average (dollars) 5,285 16,224 25,607 35,145 44,306 58,298 78,711 119,899 230,962 504,041 2,081,297 121,717 Percent of Total 0.1 0.4 1.0 1.5 2.1 7.0 8.8 35.6 23.2 6.2 14.5 100.0 Average Federal Tax Rate 4 2.3 0.5 1.9 3.5 5.5 9.5 13.2 17.3 22.2 28.1 35.0 21.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0051 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table - Head of Household Tax Units Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax Income 3 Share of Total Federal Tax Change 0.0 0.1 -0.1 -0.2 -0.1 0.0 -0.1 -0.1 -0.8 -1.3 -3.1 -0.2 0.1 -4.2 7.3 9.8 7.8 5.2 3.7 7.6 17.2 5.8 39.3 100.0 Average Federal Tax Change Dollars Share of Federal Taxes Percent Change (% Points) -0.3 1.5 -3.1 7.9 2.0 0.3 0.3 0.4 2.6 3.2 5.9 1.5 0.0 0.0 0.2 0.1 0.0 -0.3 -0.3 -0.3 0.1 0.1 0.4 0.0 3 -23 36 56 58 24 37 99 1,848 6,430 62,572 86 Under the Proposal -0.6 -4.3 -3.5 2.0 6.1 25.6 21.1 29.9 10.1 2.8 10.7 100.0 Average Federal Tax Rate 4 Change (% Points) 0.0 -0.1 0.1 0.2 0.1 0.0 0.0 0.1 0.6 0.9 2.0 0.2 Under the Proposal -11.4 -9.6 -4.4 2.1 6.4 12.0 15.7 19.5 24.8 29.6 36.6 11.1 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 1,041 3,834 4,122 3,620 2,789 4,580 2,060 1,581 191 19 13 24,016 Pre-Tax Income Percent of Total 4.3 16.0 17.2 15.1 11.6 19.1 8.6 6.6 0.8 0.1 0.1 100.0 Average (dollars) 6,861 15,876 26,043 36,244 46,656 63,472 88,731 132,072 289,760 694,174 3,073,454 51,174 Percent of Total 0.6 5.0 8.7 10.7 10.6 23.7 14.9 17.0 4.5 1.1 3.2 100.0 Federal Tax Burden Average (dollars) -784 -1,498 -1,185 700 2,931 7,563 13,858 25,593 69,938 198,732 1,063,415 5,576 Percent of Total -0.6 -4.3 -3.7 1.9 6.1 25.9 21.3 30.2 10.0 2.8 10.3 100.0 After-Tax Income 3 Average (dollars) 7,645 17,374 27,228 35,544 43,724 55,909 74,873 106,479 219,822 495,442 2,010,039 45,598 Percent of Total 0.7 6.1 10.3 11.8 11.1 23.4 14.1 15.4 3.8 0.8 2.4 100.0 Average Federal Tax Rate 4 -11.4 -9.4 -4.6 1.9 6.3 11.9 15.6 19.4 24.1 28.6 34.6 10.9 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0051 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table - Tax Units with Children Expanded Cash Income Level (thousands of 2013 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax 3 Income Share of Total Federal Tax Change -0.6 -0.3 -0.2 -0.2 -0.1 -0.1 -0.1 -0.1 -0.7 -1.5 -2.8 -0.6 0.2 0.7 1.0 0.9 0.7 0.8 0.8 4.8 24.4 13.2 52.6 100.0 Average Federal Tax Change Dollars 47 46 58 57 53 31 39 105 1,661 7,504 55,422 567 Share of Federal Taxes Percent Change (% Points) -4.7 -2.2 -3.3 -58.1 2.6 0.5 0.3 0.4 2.6 3.9 5.1 2.6 0.0 0.0 0.1 0.0 0.0 -0.1 -0.1 -0.6 0.0 0.1 0.7 0.0 Under the Proposal -0.1 -0.8 -0.8 0.0 0.7 4.4 6.2 28.6 24.9 9.1 27.7 100.0 Average Federal Tax Rate 4 Change (% Points) 0.7 0.3 0.2 0.2 0.1 0.1 0.0 0.1 0.6 1.1 1.8 0.5 Under the Proposal -14.8 -12.7 -6.6 -0.1 4.6 10.1 13.6 17.0 22.4 29.0 36.9 19.1 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Expanded Cash Income Level (thousands of 2013 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 1,373 4,412 5,023 4,528 3,818 7,643 5,719 13,208 4,259 509 275 51,185 Pre-Tax Income Percent of Total 2.7 8.6 9.8 8.9 7.5 14.9 11.2 25.8 8.3 1.0 0.5 100.0 Average (dollars) 6,549 15,963 25,966 36,268 46,711 64,137 90,283 145,049 296,704 699,639 3,098,566 116,097 Percent of Total 0.2 1.2 2.2 2.8 3.0 8.3 8.7 32.2 21.3 6.0 14.4 100.0 Federal Tax Burden Average (dollars) -1,017 -2,068 -1,768 -97 2,073 6,447 12,225 24,517 64,680 195,131 1,086,497 21,631 Percent of Total -0.1 -0.8 -0.8 0.0 0.7 4.5 6.3 29.3 24.9 9.0 27.0 100.0 After-Tax Income 3 Average (dollars) 7,566 18,031 27,734 36,366 44,638 57,690 78,059 120,533 232,024 504,508 2,012,069 94,467 Percent of Total 0.2 1.7 2.9 3.4 3.5 9.1 9.2 32.9 20.4 5.3 11.5 100.0 Average Federal Tax 4 Rate -15.5 -13.0 -6.8 -0.3 4.4 10.1 13.5 16.9 21.8 27.9 35.1 18.6 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0051 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table - Elderly Tax Units Expanded Cash Income Level (thousands of 2013 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax 3 Income Share of Total Federal Tax Change -0.1 -0.1 0.0 0.0 0.0 0.0 0.0 -0.1 -0.4 -1.4 -4.6 -0.7 0.1 0.4 0.1 -0.2 -0.2 0.5 0.7 1.7 9.1 8.2 79.6 100.0 Average Federal Tax Change Dollars Share of Federal Taxes Percent Change (% Points) 8.4 10.7 0.8 -0.5 -0.4 0.3 0.3 0.3 1.5 3.4 8.3 3.3 0.0 0.0 0.0 0.0 -0.1 -0.2 -0.2 -0.7 -0.4 0.0 1.5 0.0 7 10 4 -7 -12 15 33 56 1,008 6,819 98,406 447 Under the Proposal 0.0 0.1 0.6 1.2 1.7 6.3 7.8 21.4 19.7 8.1 33.0 100.0 Average Federal Tax Rate 4 Change (% Points) 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.3 1.0 3.0 0.6 Under the Proposal 1.4 0.7 2.3 4.1 5.9 9.0 12.6 16.3 23.1 30.1 38.6 17.7 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Expanded Cash Income Level (thousands of 2013 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 1,600 6,764 5,182 4,055 3,258 5,716 3,604 4,957 1,493 201 134 37,154 Pre-Tax Income Percent of Total 4.3 18.2 14.0 10.9 8.8 15.4 9.7 13.3 4.0 0.5 0.4 100.0 Average (dollars) 6,404 15,959 25,430 36,345 46,607 63,444 90,042 137,873 296,738 700,400 3,311,838 79,405 Percent of Total 0.4 3.7 4.5 5.0 5.2 12.3 11.0 23.2 15.0 4.8 15.1 100.0 Federal Tax Burden Average (dollars) 83 96 571 1,484 2,747 5,711 11,263 22,454 67,664 203,819 1,180,303 13,590 Percent of Total 0.0 0.1 0.6 1.2 1.8 6.5 8.0 22.0 20.0 8.1 31.4 100.0 After-Tax Income 3 Average (dollars) 6,321 15,863 24,859 34,861 43,859 57,734 78,778 115,419 229,075 496,581 2,131,535 65,815 Percent of Total 0.4 4.4 5.3 5.8 5.8 13.5 11.6 23.4 14.0 4.1 11.7 100.0 Average Federal Tax 4 Rate 1.3 0.6 2.2 4.1 5.9 9.0 12.5 16.3 22.8 29.1 35.6 17.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income.