Production Costs in 1999 on Selected Wisconsin Organic Dairy Farms Introduction

advertisement

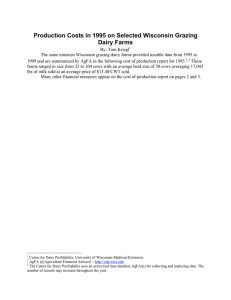

Production Costs in 1999 on Selected Wisconsin Organic Dairy Farms By: Tom Kriegl 1 Introduction (Pages two and three contain the actual cost of production report.) All of the organic farms in the summary met the organic grazing standards, but only two practiced management intensive grazing in 1999. Because six farms is a very small group to make conclusions from, this data was not released in the single year format until several years of data was judged to be reasonably consistent from year to year. Data Source The same six Wisconsin organic dairy farms provided useable data from 1999 to 2006 and are summarized by AgFA 2 3 in the following cost of production report for 1999. , These farms ranged in size from 31 to 61 cows with an average herd size of 48.4 cows averaging 15,260 lbs of milk sold at an average price of $18.12/CWT sold in 1999. Two farms dropped out after 2006, but fortunately data from additional farms was added after 1999. Selected Financial Measures of Studied Farms In 1999, income per cow averaged $3,225 with milk sales being $2,765 of that total. The average income per cow on the 721 Wisconsin dairy farms in AgFA that were NEITHER grazing nor organic was $3,606 with milk sales 4 accounting for $2,965 of that total. However, their allocated costs per cow were $2,975 versus only $2,378 for the organic farms in this study. This leaves this group of organic farms with a NFIFO/cow of $847 versus a NFIFO/cow of $631 for the other 721 dairy farms, although they had more cows - averaging 110 per farm. NFIFO is not economic profit. Economic profit requires farm income to exceed all costs, including the opportunity costs of unpaid labor, management, and equity. Economic profit was $200 per cow for the Wisconsin organic farm dairy herds in 1999. On the 721 Wisconsin dairy farms in AgFA that were NEITHER grazing nor organic it was $243 per cow. In 1999 the organic farm’s average cost per cow was $40 for breeding fees, $52 for insurance, $371 for purchased feed, $65 for utilities, $170 for supplies, $61 for property taxes, $50 for veterinary fees and medicine, $186 for interest, $1 for livestock depreciation and $500 for other depreciation. In 1999, for every dollar of income the average organic farm generated: 49.6 cents went to Basic Costs, 24.1 cents went to Non-basic Costs and 11.4 cents went to economic profit. Looking at it another way, 73.7 cents went to Allocated Costs (Basic plus Non-basic Costs) and 26.3 cents went to NFIFO. Wrapping Up When comparing the relative performance of dairy systems, recognize that manager of each system tended to have a different focus in their pursuit of profitability. The organic system focuses more on obtaining a higher and more consistent milk price. Graziers focus more on reducing all costs and confinement systems focus more on increasing income via high production levels. Yet, costs (in terms of face value dollars) continue to increase over time for all dairy systems. When comparing organic financial performance relative to other systems, recognize that it is at its relative best in years in which the organic price premium is highest relative to non-organic prices. This price premium was high in 2000, 2002, 2003, 2006, and 2009, but low in 2004, 2007, and 2008. 1 Farm Financial Analyst Emeritus, Center for Dairy Profitability, University of Wisconsin-Madison/Extension. The author thanks coworker Arlin Brannstrom and emeritus coworker Gary Frank for reviewing the document and making helpful suggestions. AgFA @(Agriculture Financial Advisor) – http://cdp.wisc.edu 3 The Center for Dairy Profitability uses an active/real time database AgFA@) for collecting and analyzing data. The number of records may increase throughout the year. Casual users of AgFA may not be able to exactly duplicate this report. 4 All costs except the opportunity cost of unpaid labor, management and equity are called “allocated costs.” Total income minus “allocated costs” equals Net Farm Income from Operations (NFIFO). “Total costs” are divided into two other categories: basic costs and non-basic and opportunity costs, with it having 3 sub-categories (1. paid interest, 2. all labor and management, and 3. nonlivestock depreciation plus equity interest). 2 Cost of Production 1999 Income Total Income 1999 1999 Cost (tax) per Head per CWT EQ 156,124.45 3,224.60 14.36 1999 1999 1999 Expenses per Farm per Head per CWT EQ Basic Cost Cost of Items for Resale 0.00 0.00 0.00 Breeding Fees 1,920.67 39.67 0.18 Car and Truck Expenses 761.83 15.73 0.07 Chemicals 436.17 9.01 0.04 Conservation Expenses 0.00 0.00 0.00 Custom Heifer Raising Expenses 0.00 0.00 0.00 Custom Hire (Machine Work) 3,894.33 80.43 0.36 Feed Purchase 17,943.50 370.61 1.65 Fertilizer and Lime 2,338.17 48.29 0.22 Freight and Trucking 1,139.00 23.52 0.10 Gasoline, Fuel, and Oil 3,669.33 75.79 0.34 Farm Insurance 2,526.50 52.18 0.23 Rent/Lease Equipment 117.67 2.43 0.01 Rent/Lease Other 5,145.83 106.28 0.47 Repairs and Maintenance 716.17 14.79 0.07 Building and Fence Repairs 943.50 19.49 0.09 Machinery Repairs 10,474.33 216.34 0.96 Seeds and Plants Purchased 3,116.83 64.38 0.29 Supplies Purchased 8,220.33 169.78 0.76 Taxes - Other 2,975.83 61.46 0.27 Utilities 3,165.33 65.38 0.29 Veterinary Fees and Medicine 2,408.33 49.74 0.22 Other Farm Expenses 1,835.67 37.91 0.17 Marketing & Hedging 2,594.33 53.58 0.24 Other Crop Expenses 416.17 8.60 0.04 Other Livestock Expenses 475.17 9.81 0.04 - Change in Prepaid Expenses 470.67 9.72 0.04 Change in Accounts Payable (305.00) (6.30) (0.03) Depreciation on Purchased Breeding Livestock 25.33 0.52 0.00 77,426.00 1,599.16 7.12 Total Basic Cost Interest Cost Mortgage Interest 4,886.50 100.93 0.45 Other Interest 4,117.17 85.04 0.38 9,003.67 185.96 0.83 Total Interest Cost Labor Cost Employee Benefits - Dependents 0.00 0.00 0.00 Employee Benefits - Non-Dependents 878.50 18.14 0.08 Labor Hired - Dependents 0.00 0.00 0.00 Labor Hired - Non-Dependents 3,624.67 74.86 0.33 Value of Unpaid Labor & Management 17,086.40 352.90 1.57 Total Labor Cost 21,589.56 445.91 1.99 Depreciation & Equity Cost Machinery, Equipment, Building Depreciation 24,188.00 499.58 2.22 Interest on Equity Capital 14,230.24 293.91 1.31 Total Depreciation & Equity Cost 38,418.24 793.49 3.53 Total Non-Basic and Opportunity Costs 69,011.46 1,425.37 6.35 Total Expenses 146,437.46 3,024.53 13.47 Total Income - Total Expenses 9,686.99 200.08 0.89 Net Farm Income from Operations (NFIFO) Summary Total Allocated Costs 115,120.83 2,377.71 10.59 Net Farm Income From Operations (NFIFO) 41,003.62 846.89 3.77 Gain (Loss) on Sale of All Farm Capital Assets 0.00 0.00 0.00 Net Farm Income (NFI) 41,003.62 846.89 3.77 Benchmark Criteria Number of Cows Pounds of Milk Sold per Cow Hundredw eight Equivalent (CWT EQ) per Cow Gross Milk Price Total Crop Acres per Cow Pasture Acres per Cow Owner/Operator/Families Primary Enterprise: Dairy Report On: All Data Sets 1999 Data Sets: 6 Confidence Level Range: 88 to 100 States: Wisconsin Organic Producer: Yes 1999 1999 1999 48.42 15,260 225 $18.12 4.70 1.02 1.00 48.42 15,260 225 $18.12 4.70 1.02 1.00 48.42 15,260 225 $18.12 4.70 1.02 1.00