Production Costs in 2009 on Selected Wisconsin Grazing Introduction

advertisement

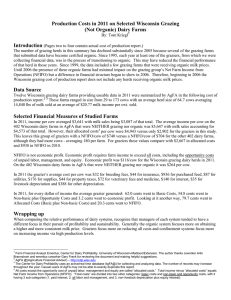

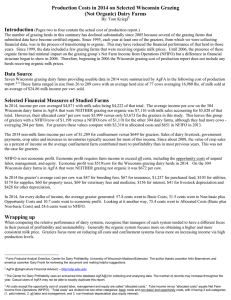

Production Costs in 2009 on Selected Wisconsin Grazing (Not Organic) Dairy Farms By: Tom Kriegl 1 Introduction (Pages two to four contain the actual cost of production report.) The number of grazing herds in this summary has declined substantially since 2005 because several of the grazing farms that submitted data have become certified organic. Since 1995, each year at least one of the graziers, from which we were collecting financial data, was in the process of transitioning to organic. This may have reduced the financial performance of that herd in those years. Since 1999, the data included a few grazing farms that were receiving organic milk prices. Until 2006 the presence of these organic farms had minimal impact on the grazing group’s Net Farm Income from Operations (NFIFO) but a difference in financial structure began to show in 2006. Therefore, beginning in 2006 the Wisconsin grazing cost of production report does not include any herds receiving organic milk prices. Data Source Fourteen Wisconsin grazing dairy farms providing useable data in 2009 were summarized by AgFA in the following cost of production report. 2 3 These farms ranged in size from 25 to 155 cows with an average herd size of 66.39 cows averaging 15,583 lbs of milk sold at an average of $14.00 milk income per cwt. sold. Selected Financial Measures of Studied Farms In 2009, income per cow averaged $2,736 with milk sales being $2,175 of that total. The average income per cow on the 454 Wisconsin dairy farms in AgFA that were NEITHER grazing nor organic was $3,938 with milk sales accounting for $3,048 of that total. However, their allocated costs 4 per cow were $4,132 versus only $2,293 for the graziers in this study. This leaves this group of graziers with a NFIFO/cow of $442 versus a NFIFO/cow of -$194 for the other 454 dairy farms, although they had more cows - averaging 186 per farm. For graziers these values compare with $2,556 in allocated costs and $1,098 in NFIFO in 2008. NFIFO is not economic profit. Economic profit requires farm income to exceed all costs, including the opportunity costs of unpaid labor, management, and equity. Economic profit was -$180/cow for the Wisconsin grazing dairy herds in 2009. On the 454 Wisconsin dairy farms in AgFA that were NEITHER grazing nor organic it was -$612 per cow. In 2009 the grazier’s average cost per cow was $38 for breeding fees, $44 for insurance, $711 for purchased feed, $88 for utilities, $129 for supplies, $36 for property taxes, $48 for veterinary fees and medicine, $131 for interest, $6 for livestock depreciation and $280 for other depreciation. In 2009, for every dollar of income the average grazier generated: 65.0 cents went to Basic Costs, 41.6 cents went to Non-basic plus Opportunity Costs and -6.6 cents went to economic loss. Looking at it another way, 83.8 cents went to Allocated Costs (Basic plus Non-basic Costs) and 16.2 cents went to NFIFO. Wrapping up When comparing the relative performance of dairy systems, recognize that managers of each system tended to have a different focus in their pursuit of profitability and sustainability. Generally the organic system focuses more on obtaining a higher and more consistent milk price. Graziers focus more on reducing all costs and confinement systems focus more on increasing income via high production levels. 1 Farm Financial Analyst Emeritus, Center for Dairy Profitability, University of Wisconsin-Madison/Extension. The author thanks coworker Arlin Brannstrom and emeritus coworker Gary Frank for reviewing the document and making helpful suggestions. 2 AgFA @(Agriculture Financial Advisor) – http://cdp.wisc.edu 3 The Center for Dairy Profitability uses an active/real time database AgFA@) for collecting and analyzing data. The number of records may increase throughout the year. Casual users of AgFA may not be able to exactly duplicate this report. 4 All costs except the opportunity cost of unpaid labor, management and equity are called “allocated costs.” Total income minus “allocated costs” equals Net Farm Income from Operations (NFIFO). “Total costs” are divided into two other categories: basic costs and non-basic and opportunity costs, with it having 3 sub-categories (1. paid interest, 2. all labor and management, and 3. non-livestock depreciation plus equity interest). This benchmark report's selection criteria are on the last page. Benchmark Report Cost of Production Report Basis: Whole Farm, per Head, per Hundredweight Equivalent, Depreciation Method: "Cost (tax)" Income 2009 per Farm Animal Product Sales Raised Non-Breeding Livestock Sales Crop Sales Sale of Raised Breeding Livestock Other Income Total Income Expenses 2009 per Head 2009 per CWT EQ 144,396.30 4,669.29 697.14 8,102.29 23,767.67 2,174.88 70.33 10.50 122.04 357.99 10.20 0.33 0.05 0.57 1.68 181,632.69 2,735.73 12.83 2009 per Farm 2009 per Head 2009 per CWT EQ Basic Costs Cost of Items for Resale Depreciation on Purchased Breeding Livestock 0.00 2,545.86 1,652.75 1,093.93 0.00 214.29 9,853.07 47,179.27 4,165.47 2,084.93 5,197.72 2,934.29 366.64 2,618.36 4,075.17 993.27 196.14 4,678.29 49.29 8,553.35 2,414.60 190.71 5,822.54 3,210.33 2,076.03 1,781.84 692.43 1,009.51 2,007.12 0.00 426.36 0.00 38.35 24.89 16.48 0.00 3.23 148.41 710.61 62.74 31.40 78.29 44.20 5.52 39.44 61.38 14.96 2.95 70.46 0.74 128.83 36.37 2.87 87.70 48.35 31.27 26.84 10.43 15.21 30.23 0.00 6.42 0.00 0.18 0.12 0.08 0.00 0.02 0.70 3.33 0.29 0.15 0.37 0.21 0.03 0.18 0.29 0.07 0.01 0.33 0.00 0.60 0.17 0.01 0.41 0.23 0.15 0.13 0.05 0.07 0.14 0.00 0.03 Total Basic Costs 118,083.54 1,778.56 8.34 Breeding Fees Car and Truck Expenses Crop Chemicals Conservation Expenses Custom Heifer Raising Expenses Custom Hire (Machine Work) Feed Purchase Fertilizer and Lime Freight and Trucking Gasoline, Fuel, and Oil Farm Insurance Rent/Lease Equipment Rent/Lease Other Repairs and Maintenance Building and Fence Repairs Machinery Repairs Seeds and Plants Purchased Storage and Warehousing Supplies Purchased Taxes - Other Taxes - Payroll Utilities Veterinary Fees and Medicine Other Farm Expenses Marketing & Hedging Other Crop Expenses Other Livestock Expenses - Change in Prepaid Expenses Change in Accounts Payable Printed: 11-01-2013 Page 1 of 3 AgFA Center for Dairy Profitability Non-Basic Costs Interest Cost Mortgage Interest Other Interest 5,093.43 3,589.43 76.72 54.06 0.36 0.25 Total Interest Cost 8,682.86 130.78 0.61 Employee Benefits - Dependents Value of Unpaid Labor & Management 329.57 903.14 0.00 5,639.81 0.00 32,891.57 4.96 13.60 0.00 84.95 0.00 495.41 0.02 0.06 0.00 0.40 0.00 2.32 Total Labor Cost 39,764.09 598.92 2.81 Machinery, Equipment, Building Depreciation Interest on Equity Capital 18,618.04 8,425.05 280.42 126.90 1.32 0.60 Total Depreciation & Equity Cost 27,043.09 407.32 1.91 Total Non-Basic and Opportunity Costs 75,490.04 1,137.02 5.33 Total Expenses 193,573.58 2,915.58 13.67 (11,940.89) (179.85) (0.84) 152,256.96 29,375.73 2,293.27 10.75 Net Farm Income From Operations (NFIFO) 442.45 2.08 Gain (Loss) on Sale of All Farm Capital Assets 403.14 6.07 0.03 Net Farm Income (NFI) 29,778.87 448.53 2.10 Labor Cost Employee Benefits - Non-Dependents Labor Hired - Dependents Labor Hired - Non-Dependents Pension and Profit-Sharing Plans - Non-Dependents Depreciation & Equity Cost Total Income - Total Expenses Net Farm Income from Operations (NFIFO) Summary Total Allocated Costs Printed: 11-01-2013 Page 2 of 3 Prepared by: AgFA Center for Dairy Profitability 2009 Benchmark Criteria Number of Cows Pounds of Milk Sold per Cow Hundredweight Equivalent (CWT EQ) per Cow Gross Milk Price Total Crop Acres per Cow Pasture Acres per Cow Owner/Operator/Families Primary Enterprise: Report On: 2009 Data Sets: Confidence Level Range: States: Pasture Management: Organic Producer: Printed: 11-01-2013 2009 66.39 15,583 213 $14.00 3.27 1.82 1.00 2009 66.39 15,583 213 $14.00 3.27 1.82 1.00 66.39 15,583 213 $14.00 3.27 1.82 1.00 Dairy All Data Sets 14 14 14 82 to 100 Wisconsin = Management Intensive Grazing <> Yes Page 3 of 3 Prepared by: AgFA Center for Dairy Profitability