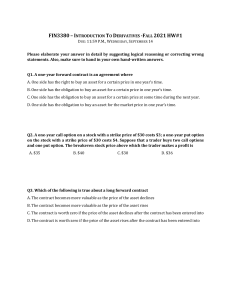

Abstract We look at a dynamic asset pricing model with one... against liquidity traders and a competitive market maker. Informed trader...

advertisement

Abstract We look at a dynamic asset pricing model with one asset, in which an informed trader trades against liquidity traders and a competitive market maker. Informed trader has private information about the fundamental value of the asset as well as the exogenous demand shock on the market. While the model with just information about fundamentals has the price smoothly converging to the fundamental value (Kyle ’85), we show that the model with arbitrarily small demand shocks exhibits asset price bubbles. The bubbles are created by the insider for strategic reasons. In the equilibrium the insider exacerbates the demand shock, possibly trading at a loss (contrarian behavior) to manipulate information revelation. Finally, both payoff relevant and payoff irrelevant information is revealed to the market.