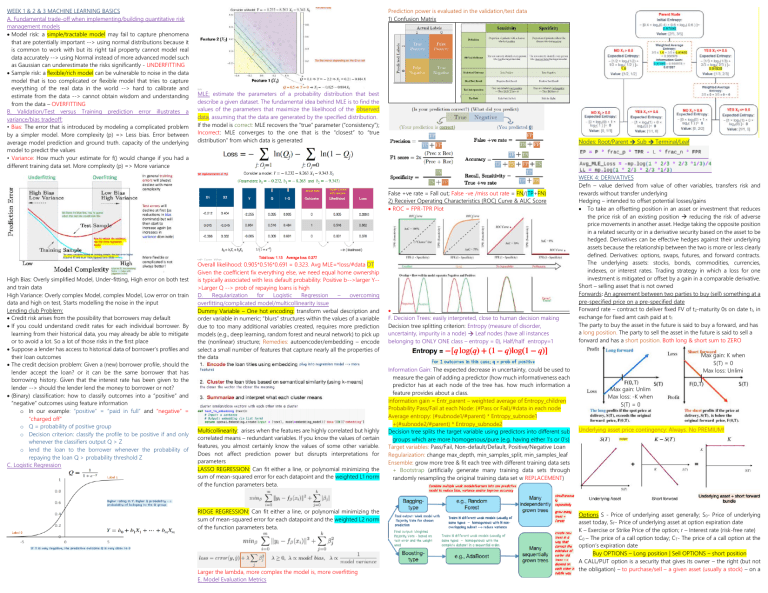

WEEK 1 & 2 & 3 MACHINE LEARNING BASICS

A. Fundamental trade-off when implementing/building quantitative risk

management models

Model risk: a simple/tractable model may fail to capture phenomena

that are potentially important --> using normal distributions because it

is common to work with but its right tail property cannot model real

data accurately --> using Normal instead of more advanced model such

as Gaussian can underestimate the risks significantly - UNDERFITTING

Sample risk: a flexible/rich model can be vulnerable to noise in the data

model that is too complicated or flexible model that tries to capture

everything of the real data in the world --> hard to calibrate and

estimate from the data --> cannot obtain wisdom and understanding

from the data – OVERFITTING

B. Validation/Test versus Training prediction error illustrates a

variance/bias tradeoff:

• Bias: The error that is introduced by modeling a complicated problem

by a simpler model. More complexity (p) => Less bias. Error between

average model prediction and ground truth. capacity of the underlying

model to predict the values

• Variance: How much your estimate for f() would change if you had a

different training data set. More complexity (p) => More variance

Prediction power is evaluated in the validation/test data

1) Confusion Matrix

MLE: estimate the parameters of a probability distribution that best

describe a given dataset. The fundamental idea behind MLE is to find the

values of the parameters that maximize the likelihood of the observed

data, assuming that the data are generated by the specified distribution.

If the model is correct: MLE recovers the “true” parameter (“consistency”);

Incorrect: MLE converges to the one that is the “closest” to “true

distribution” from which data is generated

Nodes: Root/Parent Sub Terminal/Leaf

False +ve rate = Fall out; False -ve /miss out rate = FN/(TP+FN)

2) Receiver Operating Characteristics (ROC) Curve & AUC Score

ROC = FPR-TPR Plot

High Bias: Overly simplified Model, Under-fitting, High error on both test

and train data

High Variance: Overly complex Model, complex Model, Low error on train

data and high on test, Starts modelling the noise in the input

Lending club Problem:

Credit risk arises from the possibility that borrowers may default

If you could understand credit rates for each individual borrower. By

learning from their historical data, you may already be able to mitigate

or to avoid a lot. So a lot of those risks in the first place

Suppose a lender has access to historical data of borrower’s profiles and

their loan outcomes

The credit decision problem: Given a (new) borrower profile, should the

lender accept the loan? or it can be the same borrower that has

borrowing history. Given that the interest rate has been given to the

lender --> should the lender lend the money to borrower or not?

(Binary) classification: how to classify outcomes into a “positive” and

“negative” outcomes using feature information

o In our example: “positive” = “paid in full” and “negative” =

“charged off”

o Q = probability of positive group

o Decision criterion: classify the profile to be positive if and only

whenever the classifiers output Q > Z

o lend the loan to the borrower whenever the probability of

repaying the loan Q > probability threshold Z

C. Logistic Regression

Overall likelihood: 0.905*0.516*0.691 = 0.323. Avg MLE=*loss/#data DT

Given the coefficient fix everything else, we need equal home ownership

is typically associated with less default probability: Positive b-->larger Y->Larger Q --> prob of repaying loans is high

D.

Regularization

for

Logistic

Regression

–

overcoming

overfitting/complicated model/multicollinearity issue

Dummy Variable – One hot encoding: transform verbal description and

order variable in numeric; “blurs” structures within the values of a variable

due to too many additional variables created, requires more prediction

models (e.g., deep learning, random forest and neural network) to pick up

the (nonlinear) structure; Remedies: autoencoder/embedding – encode

select a small number of features that capture nearly all the properties of

the data

Multicollinearity: arises when the features are highly correlated but highly

correlated means – redundant variables. If you know the values of certain

features, you almost certainly know the values of some other variable.

Does not affect prediction power but disrupts interpretations for

parameters

LASSO REGRESSION: Can fit either a line, or polynomial minimizing the

sum of mean-squared error for each datapoint and the weighted L1 norm

of the function parameters beta.

RIDGE REGRESSION: Can fit either a line, or polynomial minimizing the

sum of mean-squared error for each datapoint and the weighted L2 norm

of the function parameters beta.

Larger the lambda, more complex the model is, more overfitting

E. Model Evaluation Metrics

F. Decision Trees: easily interpreted, close to human decision making

Decision tree splitting criterion: Entropy (measure of disorder,

uncertainty, impurity in a node) Leaf nodes (have all instances

belonging to ONLY ONE class – entropy = 0), Half/half entropy=1

Information Gain: The expected decrease in uncertainty, could be used to

measure the gain of adding a predictor (how much informativeness each

predictor has at each node of the tree has. how much information a

feature provides about a class.

Information gain = Entr_parent – weighted average of Entropy_children

Probability Pass/Fail at each Node: (#Pass or Fail)/#data in each node

Average entropy: (#subnode1/#parent) * Entropy_subnode1

+(#subnode2/#parent) * Entropy_subnode2

Decision tree splits the target variable using predictors into different sub

groups which are more homogenous/pure (e.g. having either 1’s or 0’s)

Target variables: Pass/Fail, Non-default/Default, Positive/Negative Loan

Regularization: change max_depth, min_samples_split, min_samples_leaf

Ensemble: grow more tree & fit each tree with different training data sets

+ Bootstrap (artificially generate many training data sets through

randomly resampling the original training data set w REPLACEMENT)

WEEK 4: DERIVATIVES

Defn – value derived from value of other variables, transfers risk and

rewards without transfer underlying

Hedging – intended to offset potential losses/gains

To take an offsetting position in an asset or investment that reduces

the price risk of an existing position reducing the risk of adverse

price movements in another asset. Hedge taking the opposite position

in a related security or in a derivative security based on the asset to be

hedged. Derivatives can be effective hedges against their underlying

assets because the relationship between the two is more or less clearly

defined. Derivatives: options, swaps, futures, and forward contracts.

The underlying assets: stocks, bonds, commodities, currencies,

indexes, or interest rates. Trading strategy in which a loss for one

investment is mitigated or offset by a gain in a comparable derivative.

Short – selling asset that is not owned

Forwards: An agreement between two parties to buy (sell) something at a

pre-specified price on a pre-specified date

Forward rate – contract to deliver fixed FV of t2-maturity 0s on date t1, in

exchange for fixed amt cash paid at t1

The party to buy the asset in the future is said to buy a forward, and has

a long position. The party to sell the asset in the future is said to sell a

forward and has a short position. Both long & short sum to ZERO

Max gain: K when

S(T) = 0

Max loss: Unlimi

Max gain: Unlim

Max loss: -K when

S(T) = 0

Underlying asset price contingency: Always. No PREMIUM!

Options S - Price of underlying asset generally; S0- Price of underlying

asset today, ST- Price of underlying asset at option expiration date

K – Exercise or Strike Price of the option; r – Interest rate (risk-free rate)

C0 – The price of a call option today; CT- The price of a call option at the

option’s expiration date

Buy OPTIONS – Long position | Sell OPTIONS – short position

A CALL/PUT option is a security that gives its owner – the right (but not

the obligation) – to purchase/sell – a given asset (usually a stock) – on a

given date (or given the type of option, anytime before a given date) – for

a predetermined price (referred to as exercise or strike price)

In the money: if today expire, holder will exercise the option, S>K for call,

K>S for put . At the money: if today expire, holder is indifferent S=K

Out of money: holder will give up the right to exercise the option S<K for

call, K<S for put *If the call is in the money, then the put is out!

Intrinsic value = payoff. Profit that could have be made if the option was

immediately exercised. *Only have IV when in or at the money

IV Call: S – K | IV Put: K– S

Time value – the diff b/w options price and IV (most of TV is volatility

value, paying a premium for the volatility!)

Factors affecting call option value:

Value of call option increases as stock prices increase. For same stock

price, lower K, higher value of call. Value increases with i/r, time to

maturity, volatility and exercise price relative to mkt price. Value increase

if expected dividend decrease

Long Call option payoff: max (S0 – K, 0) ≤ C0 ≤ S0, asset price cont: S> K

Max loss: - FV(Pc), Max Gain: Unlimited. Good when P asset rises

Long Call option profit: max (S0 – K, 0) – Fair value of Premium Paid

Short Call option payoff: -max (S0 – K, 0) ≤ C0 ≤ S0

Max loss: FV(Pc), Max Gain: FV(Pc)

Short Call option profit: -max (S0 – K, 0) + Fair value of Premium Received

Long Put option payoff: max (0, K – So),

Max loss: - FV(Pp), Max Gain: K – FV(Pp). Good when P asset decreases

Short wrt underlying, long wrt derivative

Long Put option profit: max (0, K – So) – Fair value of Premium Paid

Short Put option payoff: - max (0, K – So), asset price cont: K > S

Max loss: - K + FV(Pp), Max Gain: FV(Pp)

Short Put option profit: - max (0, K – So) + Fair value of Premium Received

*IF not fulfilled = Arbitrage! (Misprice check!)

Esp. when C0 < K-S

Value/Price cannot be < 0, min is 0 i.e. “out of money”

Payoff of a call at Maturity: Ct = Max (ST – K, 0)

Fair value of forward = difference between current forward price and strike

price

Buyer Value of forward, 𝑉0 = ((𝐹0 − 𝐾) ∗ 𝐴) ∗ 𝑑𝑡

Seller Value of forward, 𝑉0 = −((𝐹0 − 𝐾) ∗ 𝐴) ∗ 𝑑𝑡

𝐹0 is cash inflow or current exchange rate or closing forward rate, or

current forward price

K is cash outflow or agreed future rate or set fixed rate; A is amt of units

being buy/sell and 𝑑𝑡 is discount factor. If L>R, profit made by buying

security, sell forward. If L<R, profit made by doing reverse

Put-Call parity theory Investment 1: protective put (stock position and a

put option on that position). Investment 2: buy a call option on the same

stock and treasury bills with face value equal to the exercise price. Since e

two payoffs are identical, they must cost the same

C+X/ (1+rf)T = S0 + P if prices not equal, arbitrage happens

Cost of 1st strategy = cost of 2nd strategy

Price of underlying stock (S) + Price of put (P) =

Price of call (C) + PV of Exercise price PV(X)

P = C+ PV(X) – S Given the price of 3, we can find the other!

*1 contract = 100 options for 100 shares Assume 1 yr period if not stated

**Valuing/pricing options only at/in the money

To find value at maturity/terminal, no need to DC

To find value before maturity/terminal must DC (X price)

C0 = S0 – PV(X)

|

P0 = PV(X) - S0

Break even stock price = strike price + premium

*Profit for buyer: payoff – option price/premium

*Profit for seller: payoff (can be –ve) + option price/premium

*BEP (Find the St): IV (X-ST) = Option Price/value

easier to use than the tedious algorithm involved in the binomial model.

Two more assumptions: that both the risk-free interest rate and stock

price volatility are constant over the life of the option. As the time to

expiration is divided into ever-more subperiods, the distribution of the

stock price at expiration progressively approaches the lognormal

distribution derive the exact option-pricing formula

Frequent rebalancing, transaction-cost free, independent price changes

Tells you the PRESENT VALUE OF AN OPTION POSITION

Gives you the FAIR VALUE OF THE CALL OPTION PREMIUM

𝑐 = 𝑆0 𝑁(𝑑1 ) − 𝐾𝑒 −𝑟𝑇 𝑁(𝑑2 ), 𝑒 𝑟𝑇 = PV of $1 at end of time T

2

𝑑1 =

Hedge and arbitrage are two sides of the same coin

Hedge: reduce/eliminate risk exposure to an explicit market variable

(price, interest rate…)

- Usually comes with a cost (i.e., price of derivative) that off sets return

premium

- If return still persists after risks are hedged away, we have an arbitrage

opportunity (happens when the offset is not exact --> still have some

benefits/profits lefts after all the downward possibilities/risks are hedged

away)

• The theoretical value of the derivative is derived from an idealized

environment where no arbitrage opportunities exist

- Requires only that there is at least one intelligent investor in the

economy

-When market value ≠ theoretical value, arbitrage opportunities emerge

Forward & Futures

[Step 1] Calculate the present value of the derivative

1. Check PV values

If positive: take a long position (of the derivative)

• If negative: take a short position (of the derivative)

• If zero: no arbitrary opportunity (theoretical price matches the actual

price --> no need for additional transactions to neutralise --> no missed

pricing in the market)

2. OR is the value is delta neutral?

[Step 2] Delta hedging: pair the derivative with long/short position in the

underlying to reach delta neutrality

[Step 3] Create the “arbitrage table” to achieve/verify the arbitrage

condition

Long Position Hedging Table

𝐾

2

𝜎√𝑇

and 𝑑2 = 𝑑1 − 𝜎√𝑇

Gives you the FAIR VALUE OF THE PUT OPTION PREMIUM

𝑝 = 𝐾𝑒 −𝑟𝑇 𝑁(−𝑑2 ) − 𝑆0 𝑁(−𝑑1 )

where r is the continually compounded APR, NOT the annual

compounded one, use EAR = eAPR – 1, to get APR, 𝝈 is annual volatility or

SD; S is stock price

To get N(d), use GC, normalcdf or norm.cdf, lower bound put -1e99, upper

bound put the d figure. 𝑲𝒆−𝒓𝑻 is PV of exercise price, discounted at riskfree rate. Higher 𝜎 2 will make d1 higher and d2 lower, which give

higher/lower cumulative probability respectively and higher call value.

Option’s value = option’s payoff = option’s payoff

Underlying asset price e.g. stock price

When the stock price = 49. The theoretical fair value of the option is $2.4

WEEK 5: DYNAMIC VOLATILITY MODELS

Implied volatility: the volatility that gives the market price of the option

under BSM

A. BASIC ESTIMATE

Mean E[X] = ∑𝒏𝒊=𝟏 𝒑𝒊 𝑿𝒊 ; Var(x) = ∑𝒏𝒊=𝟏 𝒑𝒊 (𝑿𝒊 − 𝑬[𝑿])𝟐;

Annualized/Yearly Volatility: √𝟐𝟓𝟐𝝈𝒊

Method 1 – Usual Formula

Method 2 – Simplified Formula

Show the value: payoff or net cashflow

Hedging = combine a bunch of different positions and transactions-->

a lock in arbitrage profit of 9.62 risk free as of today without danger of

any loss

Short Position Hedging Table

-Present Value (P) of Long Position = S - K/(1 + r) = 1000 - 1060/(1+0.04)

=( - 19.23)

-Present Value of Short Position = K/(1 + r) - S = 19.23

Hence, to satisfy no arbitrage condition, we should enter a short forward

contract.

Method 1: In the money S > K of 50 exercise option. Cost of hedging

= $5,263,300 - ($50) * 100,000 = $263,300. Method 2: min{0, k – S(T)}

banks|: call payoff is (50-57.25*100K buy; share’s payoff = 57.25*100K

Out of the money not exercise Cost of hedging: 256.6K – 0 = 256.6K

bank: call payoff = 0 , shares payoff = 0 (no selling)

Discounted to week 0: W20 cost/1.005^(20/52),BMS = 240K

𝑆

𝜎

ln( 0 )+(𝑟+ )𝑇

Options

Black-Scholes-Merton model ONLY for European Call & Put (underlying

asset is non-dividend paying stock)

While the binomial model is extremely flexible, a computer is needed for

it to be useful in actual trading. An option-pricing formula would be far

If stock price is too low almost never exercise the option hence option

value is 0. Delta is closely related

We can still use delta hedging to exploit the mispricing and lock in the

arbitrage profit

1) LINEAR: just needs to hedge once - on arbitrage table combine

portfolio with the right amount of asset once then ==> you are

guaranteed to be freed from any possible risks of making losses - EASY

case

2) NON-LINEAR: combine once is not enough, Require the hedge to be

repeatedly rebalanced to preserve delta neutrality ~

Put-Call Parity: To derive Put option fair value from Call option Fair Value

𝑃 = 𝐶 + (𝐾𝑒 −𝑟𝑇 − 𝑆0 ) where P and C are value of Euro put and call

options. How: find 𝑑1 and 𝑑2 , find N(𝑑1 ) and N(𝑑2 ), estimate C, estimate

Put

Sample Path Delta Hedging – to lock in arbitrage profit: rate of change in

total portfolio value with respect to the value of market variable (stock

price) – N(d1) how much option will change for every $1 move in the

underlying. Option: $3, D: 0.50, underlying ↑ 50 to 51, option ↑ $3 to $3.5

B. Expo Weighted Moving Avg (EWMA) Model – lamda

lamb = 0.94

C. Generalized AutoRegressive Conditional Heteroskedasticity (GARCH)

(1,1), we combine the ideas of ARCH and EWMA

D. GARCH(1,1) – Variance Targeting

One way of

Garch(1,1) – omega, α and β

implementing

GARCH(1,1) that

increases stability

is by using

variance

targeting

• The long-run

average variance

Garch VT - α and β

equal to the

sample variance

• Only two other

parameters (i.e.,

α and β) then

have to be

estimated