Variance Risk Premium Dynamics Job Market Paper Viktor Todorov Duke University

advertisement

Variance Risk Premium Dynamics

Job Market Paper

Viktor Todorov

Duke University

Current Draft: January 3, 2007

∗†

Abstract

This paper uses high-frequency S&P 500 index futures data and data on the VIX index to provide an

arbitrage-free explanation of the variance risk premium and its dynamics. Using the high-frequency

data only, I select a semiparametric two-factor stochastic volatility model, containing jumps in the price

and the stochastic variance. For this model I derive prices of diffusive and jump risk that determine

the variance risk premium. Unlike other studies of the variance risk premium, this study allows compensation for both stochastic volatility and jumps to be reflected in the variance risk premium. The

price of jump risk considered here is novel and allows the jump risk premium to depend on the level of

past price jumps. Using the selected stochastic volatility model and the prices of risk, I conduct a joint

inference and detect a non-trivial variance risk premium. The estimation results show that the variance

risk premium varies significantly over time. It increases in periods of high volatility and straight after

big jumps. The empirical findings of this paper suggest habit persistence in investors’ fear of jumps,

i.e., after a market crash investors are willing to pay more to protect themselves from future market drops.

Key words: Change of measure, continuous-time stochastic volatility model, diffusive risk, jump risk,

Lévy process, quadratic variation, realized multipower variation, variance risk premium, variance swap

rate.

JEL classification: G12, C51, C52.

∗

Author’s Contact: Viktor Todorov: viktor.todorov@duke.edu. Department of Economics, Duke University, Box 90097,

Durham NC 27708.

†

I would like to thank the members of my committee George Tauchen(chair), Tim Bollerslev, Ron Gallant and Han Hong

for many discussions and encouragement along the way. I thank also seminar participants in the Duke Economics and Finance

seminars, Javier Cicco, Pedro Duarte, Paul Dudenhefer, Silvana Krasteva, Jonathan Mattingly and Barbara Rossi for helpful

comments. I benefited from discussions with Jean Jacod, Albert Shiryaev, Ernesto Mordecki, Mark Podolskij and other

seminar participants at the Conference on Stochastics in Science in Honor of Ole Barndorff-Nielsen, Guanajuato, Mexico,

March 2006.

1

Introduction

A central topic in finance concerns the risk premium that investors require for bearing different risks. Much

of the work so far has been centered on explaining the equity risk premium, i.e. the compensation for the

variation in asset prices (the price risk). However, the price risk is not the only risk from holding assets

that investors face. Over the last few decades the financial econometrics literature has provided strong

and unambiguous evidence that the variances of financial assets exhibit significant variation over time (e.g.

Bollerslev, Engle, and Nelson (1994) and more recently Andersen, Bollerslev, and Diebold (2005a)). This

variation introduces an additional source of risk from holding assets, referred to as variance risk. The

importance of the variance risk for the investors is directly underlined by the development and trading

of variance swap contracts, i.e., forward contracts on future variance1 . Investors generally dislike the

randomness of the future variance and in equilibrium require a premium for accepting it. This is known

as the variance risk premium.

The main goal of this paper is to analyze the dynamics of the variance risk premium. Studying the

dynamics of the variance risk premium is important for at least two reasons. First, given the increased

interest in the direct trading of variance contracts, we need to be able to price these products. Moreover,

in many cases the variance products are part of a portfolio containing the underlying asset. Thus, the

pricing of the variance should not be done in isolation, but rather in a way that is consistent with the

pricing of the underlying asset. If the variance risk premium is constant, the substantial literature on

modeling and forecasting the returns variance (e.g. Andersen, Bollerslev, and Diebold (2005a)) is directly

applicable for pricing the variance products. Things are different, however, if the variance risk premium

has time-variation. Second, the analysis of the dynamics of the variance risk premium has implications for

the existence and properties of the pricing kernel, also known as the stochastic discount factor. In that

sense the importance of the analysis in the paper goes well beyond the pricing of variance products.

In this paper I provide an arbitrage-free explanation of the dynamics of the variance risk premium.

The analysis is based on high-frequency data on the S&P 500 index and data on the variance swap rate

(the VIX index). Using a general semiparametric stochastic volatility model and flexible prices of risk in

this model, I am able to account for the dynamics of the variance risk premium implied by the data.

Previous studies of the dynamics of the variance risk premium include Bollerslev, Gibson, and Zhou

(2005) and Wu (2005)2 3 . There are two substantial differences between these two papers and the current

work, which also synthesize the major contributions of this paper to the existing literature. The first

difference is the separation of the price jumps from the continuous price component. Bollerslev, Gibson,

and Zhou (2005) do not allow for price jumps in their model, while Wu (2005) allows them but he does not

consider their separation from the continuous price component in the estimation. In contrast, in this paper

I allow for jumps in the model and use the high-frequency data on the index to separate the continuous

from the discontinuous component of the price. The advantage of this separation is that it allows to isolate

1

These contracts give exposure only to variance risk and hence provide an instrument to hedge against it. The recent

theoretical results in Carr and Wu (2004) and Britten-Jones and Neuberger (2000) imply that the variance swap can be

replicated with a static portfolio of option contracts written on the underlying asset. In 2003 CBOE adopted these theoretical

results in calculating its volatility index, the VIX index, and as a result the new VIX index reflects the theoretical price of

a variance swap contract. The ability to replicate the VIX index (i.e. the variance swap) directly with standard options

increased further the interest in trading future variance. As a result in 2004, CBOE launched trading of futures contracts on

the VIX index and at the beginning of 2006 it started trading option contracts written on the VIX index as well.

2

Other studies of the variance risk premium include Bakshi and Kapadia (2003), Carr and Wu (2004) and Bakshi and

Madan (2006). These papers, however, do not consider modeling the dynamics of the variance risk premium.

3

Of course, since the variance risk premium (and its dynamics) can be determined from the pricing kernel, all papers which

consider estimation of the pricing kernel are also indirectly related with the current study of the dynamics of the variance risk

premium. An incomplete list includes Bates (2000), Chernov and Ghysels (2000), Ait-Sahalia, Wang, and Yared (2001), Pan

(2002), Rosenberg and Engle (2002), Eraker (2004), Santa-Clara and Shu (2005), Broadie, Chernov, and Johannes (2006). A

major difference between the current study and these papers is the data. The current paper uses high-frequency data on the

underlying index and a variance swap (portfolio of options) data, while the above-cited papers use low-frequency data on the

underlying asset and data on a set of options. As discussed later, the use of high-frequency data is crucial for the analysis

here.

2

the effect of the price jumps on the variance risk premium and hence it allows for a deeper analysis of the

determinants of the variance risk premium.

The second difference between Bollerslev, Gibson, and Zhou (2005) and Wu (2005) and the current

paper is the source of the variance risk premium. Variance risk premium in Bollerslev, Gibson, and Zhou

(2005) and Wu (2005) is associated with the compensation for the time-variation in the conditional variance.

However, when the model contains price jumps, the variance of the asset will vary over time even if there

is no time-variation in the conditional variance of the returns. The variance risk premium in general,

therefore, reflects also compensation demanded by investors for the presence of price jumps. In contrast

to the above-cited papers, I allow compensation for both presence of price jumps and time-variation in the

conditional variance to determine the variance risk premium. In fact, it is the flexible specification of the

compensation for jump risk, considered in the present paper, that allows me to explain the dynamics of

the variance risk premium implied by the data.

The analysis of the dynamics of the variance risk premium has two major building blocks. The first is

the specification of a model for the dynamics of the underlying index, while the second one is specification

of prices of risk in the model (i.e. specification of a valid pricing kernel). The paper starts with a selection of

a stochastic volatility model. I work with a very general semiparametric model which nests the affine-jump

diffusion models of Duffie, Pan, and Singleton (2000) (with constant jump intensity) and the jump-diffusion

jump-driven stochastic volatility models of Todorov (2006a) (which include the non-Gaussian OU model of

Barndorff-Nielsen and Shephard (2001)). Empirically relevant features of the model include the presence of

jumps both in the price and the stochastic variance (the spot variance of the continuous price component)

as well as the multifactor-type structure of the stochastic variance. The modeling of the jumps in the

price and the variance is quite flexible and allows for all possible dependencies between them. Using only

high-frequency data on the underlying index, I estimate different specifications of the general stochastic

volatility model and select one of them for the analysis of the variance risk premium. The selected model

has two variance factors. The one is diffusive (modelled as a square-root process) and very persistent. The

other variance factor is driven by jumps and has a very short memory.

In the selected model, the variation both in the price and in the stochastic variance of the underlying

asset is driven by diffusive shocks (modelled with a Brownian motion) and jumps (modelled with a general

pure-jump Lévy process). Therefore, to determine the variance risk premium, we need prices of diffusive

and jump risks in the model. The compensation for diffusive risk, considered here, is the generalized affine

price of risk, as recently defined in Cheridito, Filipović, and Kimmel (2005) in the context of affine diffusion

models. The price of jump risk that is used is novel and quite flexible. It allows jumps to have very different

behavior under the physical and the risk-neutral measure. For example, the compensation for the jumps

allows for a situation where the jumps are time-homogenous under the physical measure and yet exhibit

significant persistence under the risk-neutral measure. This flexibility turns out to be empirically relevant.

Following Todorov (2006b), the estimation in the present paper is based on matching moments of

realized multipower variation. Realized multipower variation statistics aggregate high-frequency data on

a daily level and provide a good approximation of latent quantities of the model (see Barndorff-Nielsen,

Graversen, Jacod, Podolskij, and Shephard (2005)4 ). In the estimation I treat the realized multipower

variation statistics as their (unobservable) asymptotic limits. This introduces error in the parameter

estimation. The error converges in probability to zero for the general stochastic volatility model used in

the paper under the condition that the number of intraday observations goes to infinity. Further, under

the additional condition that the number of intraday observations increases slightly faster than the number

√

of days in the sample, T , this approximation error is asymptotically negligible, i.e. it is of order op (1/ T ).

A final remark regarding the estimation is related to the jump specification. In the estimation, the

distribution of the jumps in the price and the variance is left unspecified. Instead, only certain moments

4

Their asymptotic behavior in the case of no price jumps, as the number of intraday observations goes to infinity, is derived

in Barndorff-Nielsen, Graversen, Jacod, Podolskij, and Shephard (2005). These results are partially extended to the case when

the price process contains jumps, which is the case of interest in this paper, by Barndorff-Nielsen, Shephard, and Winkel

(2006) and Jacod (2006a,b).

3

of the jumps are estimated. The advantage of this approach is that the results of the paper are immune

to misspecification of the distribution of the jumps. This is particularly relevant for the dependence

between the jumps in the price and the variance. The estimation results indicate that this dependence

is statistically significant. The estimated dependence between the jumps, however, is different from that

implied by most parametric specifications for the jumps used in the financial literature. This finding

underscores the advantage of the estimation approach adopted here of not modeling parametrically the

jumps.

My main empirical findings can be summarized as follows. I find a non-trivial variance risk premium.

Its estimated mean is 0.6827, while the sample mean of the variance swap rate is 1.6542 (both estimates

are in daily variance units). Further, the variance risk premium shows significant variation over time. An

estimated lower bound for its variance is 0.3401, while the sample variance of the variance swap rate is

1.2775. I find that both price jumps and stochastic variance are important determinants of the variance risk

premium. The dependence of the variance risk premium on the price jumps, to the best of my knowledge,

is a new finding. The empirical evidence indicates that after a big jump in the price, the variance risk

premium increases and takes a while to revert to its mean. This is explained with a compensation for jumps

that depends on a very persistent state variable, which, in turn, is related with the price jumps. At the

same time, the price jumps in the model are time-homogeneous (under the physical measure), since they

are modelled as a Lévy process, and further the estimation results show that their effect on the stochastic

variance disappears quickly. Thus, the empirical finding of a persistent jump risk premium suggests a habit

persistence in investors’ fear of jumps: immediately after a market crash investors are willing to pay more

to protect themselves against future market drops.

Finally, my findings for the importance of the time-varying jump risk premium are consistent with the

results of Bates (2000), Pan (2002) and Santa-Clara and Shu (2005), among others. However, there are

two major differences between this study and the above-cited papers in the modeling of the time-varying

jump risk premium. First, in this study the compensation for jump risk depends on the past jumps in the

stock market index and this accounts for the observed dependence of the variance risk premium on past

price jumps. Second, the jump risk premium here is not directly linked with a state variable in the model

such as the variance jump factor. This is important since the estimation results show that the jump risk

premium, although related with past jumps, has much longer memory than does the variance jump factor.

The remainder of the paper is organized as follows. Section 2 introduces the general stochastic volatility model for the dynamics of the underlying asset under the physical measure. I discuss how the model

can capture key empirical features of asset prices and derive the moments to be used later in the estimation. Section 3 describes the estimation technique based on the realized multipower variation statistics

constructed from the high-frequency data. This Section also contains an asymptotic result for realized multipower variation based inference in the context of the stochastic volatility model used here. In Section 4

I estimate different specifications of the general stochastic volatility model, introduced in Section 2, and

select one of them to be used for the analysis of the variance risk premium. The estimation is done using

only high-frequency data on the underlying asset. In Section 5 I construct a measure for the variance risk

premium and report significant empirical evidence for time-variation in this measure. Section 6 derives

general prices of diffusive and jump risk within the selected stochastic volatility model and discusses their

implication for the variance risk premium. In this Section I also test the different specifications of diffusive

and jump risk using high-frequency data on the underlying asset and data on the variance swap data.

Section 7 concludes. All the proofs are given in Appendices at the end of the paper.

2

Dynamics under the Physical Measure

In this Section I specify the general stochastic volatility model and define key quantities associated with it

that are used for the definition and estimation of the variance risk premium. Later in Section 4 I estimate

different specifications of the general stochastic volatility model, introduced in this Section, and select

4

one of them for the analysis of the variance risk premium. The current Section also discusses the main

characteristics of the model and argues for its flexibility. Finally, moments of the return process, to be

used in the estimation, are also derived.

2.1

The Stochastic Volatility Model

I fix a filtered probability space (Ω, F , P), with F = (Ft )t∈R its filtration. On this space I define with F (t)

the price at time t of a futures contract on the stock market index expiring at some future date. I assume

for f (t) = log(F (t)) the following dynamics under the physical measure P

Z

Z

t

f (t) = f (0) +

0

Z tZ

t

α(s)ds +

σ(s−)dW (s) +

0

0

Rn

0

h(x)µ̃(ds, dx),

(1)

σ 2 (t) = V c (t) + V j (t),

V c (t) =

p

X

Vic (t),

and dVic (t) = κi (θi − Vic (t))dt + σiv

i=1

Z

j

t

V (t) =

−∞

(2)

q

Vic (t)dBi (t),

i=1,...,p,

(3)

Z

Rn

0

g(t − s)k(x)µ(ds, dx),

(4)

where (W (t), B1 (t), ..., Bp (t)) is a (p + 1)-dimensional Brownian motion with B1 (t), ..., Bp (t) independent

of each other and having correlation coefficients ρ1 , ρ2 , ..., ρp respectively with W (t); x is an n-dimensional

vector on Rn0 ; µ is a time-homogenous Poisson random measure with compensator ν such that ν(dt, dx) =

dtG(dx) for some G : Rn0 → R+ ; g : R+ → R+ , h : Rn0 → R and k : Rn0 → R+ and µ̃ := µ − ν is the

compensated measure.

Sufficient conditions for the existence of all processes in the model (1)-(4) are given in Section 3

(Assumption 4). The futures price in (1) has three components. The first is the drift term which is

absolutely continuous. In this paper it is left unspecified.

The second component of the price is a continuous local martingale. Its time-variation is determined

by the process σ 2 (t). I refer to σ 2 (t) as the stochastic variance, since it determines the time-variation

in the conditional variance of the returns5 . σ 2 (t) is a sum of two factors. The first factor, V c (t), is the

continuous component of the stochastic variance. I model it as a sum of square-root processes as in the

standard affine stochastic volatility models (Duffie, Pan, and Singleton (2000) and Duffie, Filipović, and

Schachermayer (2003)).

The second component of the stochastic variance, V j (t), is its discontinuous part6 . I model V j (t) as a

moving average of a pure jump Lévy process. To guarantee nonnegativity of V j (t) I define it as an integral

with respect to the random measure µ and not with respect to its compensated version µ̃. Further, I

restrict k(·) > 0 and g(·) > 0 as already specified in the definition of the stochastic volatility model. A

more familiar representation for V j (t) is (with the normalization g(0) = 1)

X

V j (t) =

g(t − s)∆V j (s).

s≤t

This shows that V j (t) is a weighted sum of past variance jumps. The impact of the past jumps on the

current level of V j (t) is determined by the function g(·). In other words g(·) controls the persistence in

the process V j (t). This modeling of the discontinuous component of the stochastic variance follows the

general dynamics of the jump-driven stochastic volatility models introduced in Todorov (2006a) (which

include also the non-Gaussian OU model of Barndorff-Nielsen and Shephard (2001) and its extensions in

5

6

This is because the jump martingale is time-homogeneous.

V j (t) is discontinuous provided g(0) 6= 0, which will be assumed.

5

Brockwell (2001a) and Brockwell and Marquardt (2005)). In these models the stochastic variance is driven

solely by nonnegative jumps.

The last component of the price in equation (1) is a jump martingale and as a result is defined as

an integral with respect to the compensated martingale measure µ̃. This notation is less familiar in the

empirical finance literature. If the price jumps are of finite variation, e.g. all compound Poisson processes,

we have

Z tZ

Z tZ

Z

h(x)µ̃(ds, dx) =

h(x)µ(ds, dx) − t

h(x)G(dx).

(5)

0

Rn

0

Rn

0

0

Rn

0

The second term in the above equation is constant and can be added to the drift term. For the first term

in (5) we have

Z tZ

X

h(x)µ(ds, dx) =

∆f (s),

0

Rn

0

0<s≤t

which is more familiar and shows that this integral is simply a sum of all price jumps up to time t. The

reason the price jumps are written as in equation (1) is that this allows considering more general cases in

which the decomposition in (5) does not work, i.e. the case of infinite variation price jumps7 . Therefore,

the jumps in the price are allowed to be completely general as far as their activity is concerned8 .

I proceed with defining key variables, associated with the stochastic volatility model (1)-(4), to be used

throughout the paper. The return of holding the futures contract over the period (t, t + a] is denoted with

ra (t) = f (t + a) − f (t). The quadratic variation (hereafter QV) of the futures price f (t) over the period

(t, t + a] is given by

Z t+a

Z t+a Z

2

(6)

[f, f ](t,t+a] =

σ (s)ds +

h2 (x)µ(ds, dx).

t

t

Rn

0

The first term in the quadratic variation is due to the continuous martingale in the futures price. This is

the continuous part of the quadratic variation. I refer to it as Integrated Variance (hereafter IV)

Z

IVa (t) =

t+a

σ 2 (s)ds.

(7)

t

The second component of the quadratic variation is due to the discontinuous martingale in the price. It

can be written as

Z

Z t+a Z

Z t+a Z

2

2

h2 (x)µ̃(ds, dx).

h (x)µ(ds, dx) = a

h (x)G(dx) +

(8)

t

Rn

0

Rn

0

Rn

0

t

The first term in (8) is a constant due to the time-homogeneity property of the Lévy processes. The second

term in (8) is a jump martingale with jumps equal to h2 (x) (i.e. the squares of the price jumps).

Further, it is convenient to decompose IV into two components corresponding to the continuous and

jump components of σ 2 (t)

IVa (t) = IVac (t) + IVaj (t),

(9)

where

Z

IVac (t)

=

t+a

Z

c

V (s)ds,

and

t

IVaj (t)

=

t+a

V j (s)ds.

(10)

t

7

In intuitive terms a function is of finite variation if its trajectory over a finite interval is finite. If this is not the case the

function is of infinite variation. If the jumps are of infinite variation we need to compensate them in order to be able to define

the last integral in (1). In this case the integral is defined as a stochastic integral, see e.g. Jacod and Shiryaev (2003).

8

In the empirical part the activity of the price jumps is restricted and the infinite variation case is excluded. However,

for this Section I keep the model as general as possible and allow for infinite variation price jumps since the analysis in this

Section covers this case as well and nothing is gained from excluding it.

6

The second integral in (10) can be expressed as another integral with respect to the random measure µ.

This could be easily done using Fubini’s theorem9

Z t+a Z

j

IVa (t) =

Ha (t, s)k(x)µ(ds, dx),

(11)

−∞

where

Rn

0

( R

t+a

g(z − s)dz if s < t

Rtt+a

Ha (t, s) =

g(z − s)dz if t ≤ s < t + a.

s

(12)

Note that the quadratic variation of the price varies over time. There are two reasons for this. The

first is that σ 2 (t) has time-variation. The second reason for the randomness of the quadratic variation is

the presence of jumps in the price process. This observation is important for the analysis of the variance

risk premium.

Finally, the unit of measurement in this paper is a trading day and if a = 1, in order to simplify

notation, I will omit the dependence on a in the notation of all the quantities defined above.

2.2

Model Characteristics

I continue with a short discussion of the empirically relevant features of the stochastic volatility model

(1)-(4).

Price Jumps. The presence of jumps in the price process has two implications. The first consequence

of price jumps is that the generated distributions (both conditional and unconditional) of the returns are

much more general. Thus, for example, price jumps (together with the time-varying stochastic variance) can

easily account for the observed fat-tailedness in the unconditional return distribution. This implication of

the price jumps could be detected even with the use of low-frequency data. Indeed, the studies of Andersen,

Benzoni, and Lund (2002), Chernov, Gallant, Ghysels, and Tauchen (2003) and Eraker, Johannes, and

Polson (2003) provide empirical evidence, based on daily financial returns, in favor of parametric models

containing price jumps. The second implication of price jumps is the discontinuity of the price trajectory.

This is a pathwise implication of the presence of jumps in the price. Naturally, if we want to separate the

price jumps from the continuous martingale component of the price, based on their difference in pathwise

behavior, we need high-frequency observations. Recently, Barndorff-Nielsen and Shephard (2004, 2006)

developed nonparametric tests for the presence of price jumps based on realized multipower variation

statistics. These statistics are constructed from high-frequency data and behave differently depending on

whether the price contains jumps10 . Using the tests of Barndorff-Nielsen and Shephard (2004, 2006) 11 ,

Barndorff-Nielsen and Shephard (2006), Andersen, Bollerslev, and Diebold (2005b) and Huang and Tauchen

(2005) find strong empirical evidence for a non-trivial jump component in the price. Further, Ait-Sahalia

(2004) and Ait-Sahalia and Jacod (2005), working in a time-homogenous setting, show theoretically that

jumps could be disentangled in a parametric estimation with the use of high-frequency data. Bollerslev

and Zhou (2002), Jiang and Oomen (2006), and Todorov (2006a) use high-frequency data to estimate

different parametric models with and without price jumps. These studies find strong support for models

containing price jumps. Thus, overall, there is overwhelming evidence for the presence of price jumps and

their inclusion is necessary. In the model here the jumps in the price are12

∆f (t) = h(x).

9

(13)

The integral in the definition of the second variance factor V j (t) is with respect to µ and thus could be defined pathwise.

In the estimation I use realized multipower variation statistics and Section 3 contains the definitions and properties of the

ones used in this paper.

11

These tests are valid asymptotically, as the intraday sampling interval goes to zero. However, the Monte Carlo analysis in

Huang and Tauchen (2005) suggests that they are good jump detectors for the frequencies at which the high-frequency data

is recorded.

12

This notation is a bit loose, but underlies the fact jumps are time-homogenous.

10

7

As seen from equation (13), the jumps in the price are time-homogenous, i.e., they are modelled as a Lévy

process. In the empirical part in Section 4 I find that for the data used in this study there is no significant

time-variation in the price jumps, at least when looking at their quadratic variation only. Therefore, in

this study I restrict the price jumps to be time-homogenous. Indeed, the empirical evidence (e.g. Andersen

et al. (2005b)) suggests that the continuous and discontinuous martingale components of the futures price

process differ substantially in their persistence. This is why in this paper these two components of the

price are modelled separately, instead of working with a more parsimonious model where σ 2 (t) determines

the time-variation both of the continuous and discontinuous martingales or even working with a model

where the price is a pure jump process. An extension of the current work is to allow for time-variation in

the jumps, which can be relevant especially if the jumps are identified not only through their quadratic

variation13 .

Stochastic Variance. Another important feature of the financial data is the persistence in the returns

variance. Since in the model here the price jumps are time-homogenous their conditional variance is

constant. Therefore, persistence in the returns variance can be generated only through time-variation in

σ 2 (t). This, in turn, can be done in the following way. First, the continuous component of the stochastic

variance, V c (t), is a sum of independent square-root processes. Secondly, the jump variance component,

V j (t), is modelled as a moving average of past jumps. A typical choice for the function g(·) in equation (4)

is a CARMA (continuous-time autoregressive moving average) kernel (see Brockwell (2001a,b)), but other

choices like the fractionally-integrated CARMA kernels introduced in Brockwell and Marquardt (2005) are

also possible. The choice of the function g(·) and the number of factors in the continuous variance part

determine the persistence of the stochastic variance. In Section 4 I provide further details on the particular

choice used in the empirical implementation.

An important feature of the stochastic variance σ 2 (t) (e.g. Eraker, Johannes, and Polson (2003) among

others) is its ability to increase rather quickly. Such sudden changes in the stochastic variance are hard to

be generated with a continuous path process such as the square-root process. However, they are naturally

generated by allowing for jumps in the variance. In the model here the jumps in the variance are (assuming

g(·) is a continuous function)

∆σ 2 (t) = g(0)k(x).

(14)

Jump Dependence. The modeling of the jumps in the price and the variance is quite flexible. In

equations (1) and (3) the jump sizes in the price and the variance are expressed as functions of jumps in an

n-dimensional space. This way all possible dependencies between the jumps can be captured in a practical

and intuitive way. I demonstrate with several examples, which have been used in the financial literature,

the flexibility of the jump modeling used here. I start with two examples which use a one-dimensional

Poisson measure, i.e. in which x = x. The first of these two examples is of a perfect linear dependence

between the jumps in the price and the variance. Such modeling is used in the non-Gaussian model of

Barndorff-Nielsen and Shephard (2001) (which is nested in the general stochastic volatility model here).

In the setting of the model (1)-(4) this type of dependence is generated with

h(x) ∝ x k(x) ∝ x.

Note that, since the jumps in the variance are restricted to be positive, this dependence has the potentially

limiting feature that the price jumps are of the same sign14 .

13

Time-variation in the price jumps can be generated either by introducing time-variation in the compensator ν (e.g. the

time-changed Lévy processes considered in Carr, Geman, Madan, and Yor (2003)) or by time-changing the jump size (e.g. the

COGARCH model of Klüppelberg, Lindner, and Maller (2004) and the pure-jump jump-driven stochastic volatility models in

Todorov (2006a)).

14

Another restrictive feature of this modeling of the jumps is that the price jumps are constrained to be of finite variation.

However, in the empirical part I exclude infinite variation price jumps from the analysis.

8

The second example, where the jumps in the price and the variance are modelled using a one-dimensional

measure, is when the variance jumps are proportional to the squared price jumps, i.e.

h(x) ∝ x k(x) ∝ x2 .

This dependence structure is used in Todorov (2006a). It induces non-linear relationship between the price

and the variance jumps. However, note that it implies perfect linear dependence between the squared

price jumps and the jumps in the variance. This modeling of the jumps resembles the modeling of the

conditional variance in the GARCH models. It is potentially more flexible than the previous case since the

price jumps can be of either sign and are not restricted to those of finite variation.

The above two examples consider the use of one-dimensional Poisson measures in modeling the price

and variance jumps. However, the analysis here encompasses more general cases, where x can be multidimensional. For example, independent jumps in the setting here can be modelled as follows.

x = (x1 , x2 ) h(x) = h(x1 ) k(x) = k(x2 ),

and the compensator G(·) is such that

Z

R20

1(x1 x2 6=0) G(dx) = 0,

i.e., the measure G(·) is concentrated on the two axes in R20 . Finally, the Lévy copula approach of Tankov

(2003), which describes the dependence of a two-dimensional Lévy process in its full generality, could be

also analyzed in the setting here.

For the purposes of the analysis in this paper I leave h(·), k(·) and G(·) unspecified for two reasons.

First, their parametric (or semiparametric) modeling does not simplify the analysis here. Secondly, since

we do not have a clear idea of the dependence structure of the jumps, it is better to leave this structure

unspecified and let the data “choose” the right one. This way potential misspecification problems can be

avoided.

Leverage Effect. Another empirically relevant feature of the model is the “leverage effect”, i.e. the

(negative) linear relationship between the price and variance innovations. In this study I am not interested

in measuring the “leverage effect”. However, in order for the model to be empirically realistic it should

allow for a flexible way of generating “leverage effect”. Therefore, I explain shortly how the model can

account for this feature of the data. Since the price and the variance are both driven by Brownian motions

as well as Poisson jumps, the “leverage effect” could be generated in two different ways in this model. One

way, which has been used predominantly in the financial literature, is to correlate the Brownian motions

in the price and in the variance. It is interesting to note that if this correlation is zero the Brownian

innovations in the price and in the variance will be independent. However, this could be restrictive as we

could have no “leverage effect” while the innovations in the price and in the variance are still dependent

(e.g. the standard GARCH model in discrete time or the jump-driven stochastic volatility models in

Todorov (2006a)). The second way of generating “leverage effect” is through a dependence between the

jumps in the price and the variance. In the financial literature the jumps are usually associated with very

big changes. However, here the jumps could be specified as infinitely active (having an infinite number

of jumps in any finite interval). Thus, a link between the jumps in the price and in the variance is not

necessarily capturing only the link between the excessive changes in price and variance.

2.3

Moments of the Return Process

I end this Section with a Theorem regarding moments of the return process which will be used later in

the estimation. The theorem provides further insight into the mechanism through which the stochastic

volatility model could account for the stylized features of the financial data.

9

Theorem 1 (Moments of the return process)

In the stochastic

R

R volatility model R(1)-(4) assume that

2 ≤ 2κ θ for i = 1, ..., p; ∞ g(s)ds < ∞ and ∞ g 2 (s)ds < ∞;

κi > 0, θi > 0 and σiv

k(x)G(dx) < ∞

i i

0

0

Rn

0

R

R

R

2

2

4

and Rn k (x)G(dx) < ∞; Rn h (x)G(dx) < ∞ and Rn h (x)G(dx) < ∞. Then if α(t) = 0 we have

0

0

0

Var(ra (t)) = a

p

X

Z

θi + a

g(s)ds

ÃZ

Z

4

Rn

0

+6a2

+3a2

Z

n

X

h2 (x)G(dx)

θi2 + 6a2

i=1

i=1

aZ s

+6

0

à p

X

R0n

h (x)G(dx)

−∞

Z

θi

+6

0

Z

θi +

i=1

n

X

Z

2

h (x)G(dx) + 3a

Rn

0

k(x)G(dx) + a

!2

2

Z

Z

Rn

0

0

i=1

¡

¢

E ra4 (t) = a

Z

∞

g(u)du

0

Rn

0

Ha (0, u)du

!

g(u)du

0

Z

Hs (0, u)g(s − u)duds

Rn

0

ÃZ

k(x)G(dx) + 3a2

2

Rn

0

Rn

0

h2 (x)k(x)G(dx)

k(x)G(dx)

Z

∞

(15)

Z

a

Z

∞

h2 (x)G(dx),

Rn

0

k (x)G(dx) + 6

Z

∞

g(u)du

0

p

X

σ 2 θi

iv

i=1

2κ3i

Rn

0

!2

k(x)G(dx)

(aκi − 1 + e−aκi ) + O(a5/2 ),

(16)

If in addition b ≥ a, we have

¶

µ

Z a

Z

p

−κi a 2 σ 2 θ

X

¡ 2

¢

2

−κi (b−a) 1 − e

iv i

Cov ra (0), ra (b) =

+

Ha (0, u)Ha (b, u)du

k 2 (x)G(dx)

e

n

κi

2κi

−∞

R

0

i=1

Z a

Z

+

Ha (h, u)du

h2 (x)k(x)G(dx) + O(a5/2 ).

(17)

0

Rn

0

The assumption of a zero drift term is not crucial for the results in the Theorem. It is assumed in order to

avoid trivial complications. In the case when the Brownian motions in the price and σ 2 (t) are independent,

the error terms in equations (16) and (17) are exactly zero. In this case the proof of the Theorem follows

essentially from the results in Todorov (2006a). When the Brownian motions in the price and σ 2 (t) are

correlated, the proof of (16) and (17) involves bounding terms coming from this correlation. The proofs

are easy, but somewhat tedious; therefore, they are given in a separate Appendix available upon request15 .

3

Realized Power Variation Based Inference

This Section introduces the estimation technique used in the paper and states an asymptotic result for the

resulting estimator. All results in this Section follow from Todorov (2006b), where the estimation of much

more general stochastic volatility models is considered. The discussion here is in the context of GMM, as

this is the estimation method used in the paper16 . The analysis is general in the sense that I do not specify

the moment conditions in the GMM estimator. The theoretical result here provides justification for the

estimation in Section 4 and Section 6. These two Sections contain the particular moment conditions and

other details on the estimation.

Estimation of stochastic volatility models has a long history in the empirical financial literature. One

difficulty in the estimation comes from the fact that σ(t) is stochastic and unobservable. The presence of

15

16

The Appendix with the proof of Theorem 1 can be downloaded from www.duke.edu/∼vst2.

Exactly the same analysis applies to M-type estimators.

10

price jumps additionally complicates the estimation problem. The availability of reliable high-frequency

data over the last two decades provides a way of making some of the unobservable quantities practically

observable. This can significantly simplify the estimation and in addition can provide big gains of efficiency.

In this paper I aggregate the high-frequency data into realized multipower variation statistics, which are

proxies for certain latent processes associated with the stochastic volatility model (e.g. QV and IV). The

inference is based on these realized multipower variation statistics.

I start with defining the realized multipower variation statistics that are used in this paper; see

Barndorff-Nielsen, Graversen, Jacod, Podolskij, and Shephard (2005) for a general definition. The first

statistic is the daily Realized Variance (hereafter abbreviated as RV). It is defined over a day t as

RVδ (t) =

M

X

rδ2 (t + (i − 1)δ),

(18)

i=1

where M = b1/δc. This statistic has been used extensively in finance (see Andersen, Bollerslev, and

Diebold (2005a) and references therein). Its usefulness for the inference is determined from the fact that

for δ close to zero, i.e. with high-frequency observations, it is close to QV defined in equation (6)17 .

The second realized multipower variation statistic used in this paper is the Realized Tripower Variation

(hereafter abbreviated as TV). It is defined over a day t as

T Vδ (t) = µ−3

2/3

M

X

|rδ (t + (i − 3)δ)|2/3 |rδ (t + (i − 2)δ|2/3 |rδ (t + (i − 1)δ)|2/3 ,

(19)

i=3

where µa = E(|u|a ) and u ∼ N (0, 1). Its usefulness is determined from the fact that for δ close to zero TV

is close to IV, defined in equation (7)18 . It should be mentioned that it is more common to use the Realized

Bipower Variation for testing for jumps and estimation of IV (e.g. Barndorff-Nielsen and Shephard (2004,

2006))19 . However, the Monte Carlo analysis in Todorov (2006b) shows that for estimating moments of

IV, TV performs better for values of δ comparable with those of the available high-frequency data (see

also the Monte Carlo evidence in Barndorff-Nielsen et al. (2006)).

For high-frequency data δ is close to zero and consequently, as argued above, RV and TV are close to

QV and IV respectively. Therefore, estimation that is based on using RV and TV is approximately the

same as inference that is based on using the unobservable QV and IV (this statement is made precise in

Theorem 2). At the same time, estimation based on QV and IV is easy to be done since in this case we

have observations for the latent integrated variance and the squared jumps over the days in the sample.

A problem with implementing the inference based on realized multipower variation statistics is that in

many cases closed-form expressions for their moments are not available. However, given the fact that

for δ close to zero RV and TV are close to QV and IV respectively, the moments of RV and TV can be

approximated with the corresponding ones of QV and IV. Of course, this approximation introduces error

in the estimation, the magnitude of which is controlled by δ. In Theorem 2 I provide conditions under

which the consistency and the efficiency in the estimation is not affected by the approximation error. I

proceed with stating the assumptions needed for Theorem 2.

17

This statement can be made more formal. As δ → 0 RV converges in probability to QV. Under certain integrability

conditions, Todorov (2006b) shows that the convergence holds also in moments. Finally, a CLT result is also available; see

Jacod (2006a,b).

18

As for RV this statement can be made formal. For δ → 0 TV converges in probability to IV. Also, provided certain

integrability conditions are satisfied, the convergence holds in moments. A CLT result also holds, provided the activity of the

price jumps is restricted; see Barndorff-Nielsen et al. (2006).

19

The Realized Bipower Variation over a day t is formally defined as

BVδ (t) = µ−2

1

M

X

|rδ (t + (i − 2)δ||rδ (t + (i − 1)δ)|.

i=2

11

Assumption 1. θ is a vector of parameters of the stochastic volatility model (1)-(4), {z(t)} is a data

vector consisting of daily statistics associated with the price process f (t), whose only “infeasible” elements

are IV and QV (and possibly lags of them). The infeasible estimator is defined as

θ̂nf = argmin mT (θ)0 Ŵ mT (θ),

(20)

θ∈Θ

P

p

where mT (θ) = T1 Tt=1 m(z(t), θ); Ŵ → W and W is a positive definite matrix. Assume that θ̂nf in (20)

is consistent and asymptotically normal.

Assumption 2. ẑ(t) is constructed from z(t) by replacing QV with RV and IV with TV. The feasible

estimator θ̂f is defined as

θ̂f = argmin m̂T (θ)0 Ŵ m̂T (θ),

(21)

where m̂T (θ) =

1

T

PT

θ∈Θ

t=1 m(ẑ(t), θ).

Assumption 3. α < 4/5, where α is the Blumenthal-Getoor index (Blumenthal and Getoor (1961)) of

the price jumps defined as

¾

½

Z

γ

1|h(x)|≤1 |h(x)| G(dx) < ∞ .

α = inf γ ≥ 0 :

(22)

Rn

0

p

2

Assumption 4. α(t) is stationary

2κi θi for i = 1, ..., p;

R ∞and Ep|α(t)| < ∞; κi > 0, θi > R0 and σiv ≤λ|h(x)|

G(dx) < ∞ and

g(·) is bounded around zero and 0 |g(s)| ds < ∞ for every p > 0; Rn 1|h(x)|>² e

0

R

λk(x)

G(dx) < ∞ for some ² > 0 and λ > 0.

Rn 1k(x)>² e

0

For the next

qPassumptions we need the following notation. For an arbitrary matrix A = [aij ] I denote

2

with ||A|| =

ij aij its Euclidean norm.

Assumption 5. ||m(z + y, θ) − m(z, θ)|| ≤ ||C(θ)||||P (z + y) − P (z)|| for every z and y and some matrix

valued functions C(·) and P (·) such that P (z) has at most polynomial growth.

Assumption 6. ||∇θ m(z + y, θ) − ∇θ m(z, θ)|| ≤ ||C(θ)||||P (z + y) − P (z)|| for every z and y and some

matrix valued functions C(·) and P (·) such that P (z) has at most polynomial growth.

Assumption 7. ∇z m(z, θ0 ) exists, it is continuous in z and has at most polynomial growth in z.

Before stating the asymptotic result for θ̂f , I make few remarks regarding the assumptions.

Remark 1. θ̂nf is an infeasible estimator which is used as a benchmark for the feasible one θ̂f . For

computing θ̂nf the econometrician has access to the unobservable QV and IV. Note that {z(t)} can contain

other variables besides QV and IV. However, if this is the case, then these variables are observable (e.g.

daily returns). In other words, the focus here is the error in the estimation coming from the substitution

of QV with RV and IV with TV.

Remark 2. Depending on what enters in the data vector {z(t)}, θ can include the whole parameter vector

of the stochastic volatility model (1)-(4) or only part of it. For example, if {z(t)} contains only QV and IV

(and possibly lags of them) then we will not be able to estimate the parameters controlling the drift α(t).

This is because the estimation in this case is based only on the continuous and discontinuous components

of the quadratic variation QV and the drift term does not participate in the latter.

12

Remark 3. The conditions for the consistency and asymptotic normality of θf are well known (see e.g.

Newey and McFadden (1994) and Wooldridge (1994)) and therefore are omitted here.

Remark 4. In the case when TV participates in the (feasible) data vector, the quality of ẑ(t) as a

proxy for z(t) depends on how good TV is in disentangling price jumps. This, in turn, depends crucially

on the activity of the price jumps. Intuitively, if the price contains many small jumps, then it will be

harder to separate these small jumps from the continuous price movements. The activity of the price

jumps is indexed with the Blumenthal-Getoor index given in (22). The index is in the interval [0, 2]. In

intuitive terms, the index measures the smallest power for which the sum of the absolute jumps raised

to it is still finite. As seen from the definition of the index, it concerns the behavior of the very small

jumps. For finite activity jump processes this index is 0. Another example is the α-(tempered) stable

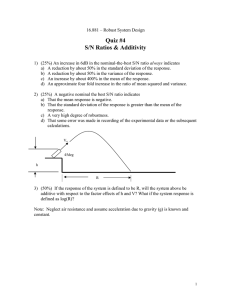

process, where the Blumenthal-Getoor index coincides with the α parameter of the process. In Figure 1

I plot simulated trajectories of jump processes with different values of the Blumenthal-Getoor index and

a simulated trajectory of Brownian motion. As seen from the figure, for higher values of the BlumenthalGetoor index the trajectories of the jump processes look very similar to the trajectory of the Brownian

motion. Therefore, intuitively, the index is measuring how close the jumps are to a continuous process.

Remark 5. Assumption 3 is needed only when TV is included in the data vector ẑ(t). Further, it

could be weakened for the consistency result in Theorem 2. Assumption 3 coincides with the condition

in Barndorff-Nielsen et al. (2006) under which the asymptotic distribution of TV (as δ → 0) is unaffected

by the presence of price jumps. This is not a coincidence of course. Under the condition T δ → 0, which is

imposed in part b of Theorem

2, we need supδ δ −1 E (T Vδ (t) − IV (t))2 < K for some constant K so that

√

the error θ̂f − θ̂nf is op (1/ T ). Note also that Assumption 3 rules out infinite variation price jumps. The

Monte Carlo analysis in Todorov (2006b) shows that for practical applications this assumption is relevant.

Remark 6. Assumption 4 puts integrability conditions on the components of the stochastic volatility

model. It is used for proving uniform integrability of powers of RV and TV. The conditions involving the

continuous variance factors, V c (t), are well known (see e.g., Feller (1951)). Under these conditions V c (t) is

strictly positive and stationary. The conditions in Assumption 4 involving the jumps in the price and the

variance guarantee that all moments of the price and variance jumps are finite. These conditions involve

only the behavior of the big (price or variance) jumps (unlike the Blumenthal-Getoor index which measures

the behavior of the Lévy measure for the small jumps). The integrability condition for the powers of the

function g(·) is necessary for the discontinuous variance factor V j (t) to have all its moments finite (see

Rajput and Rosiński (1989)). This condition is automatically satisfied when g(·) is a sum of exponentials

(with negative exponents) which is the case for CARMA kernels with distinctive negative autoregressive

roots that are used in the empirical part.

Remark 7. Assumptions 5-7 are related with the moment conditions m(·, ·) used in the GMM estimation. They are satisfied if for example m(·, ·) is polynomial in z, which is the case for the estimators in

Sections 4 and 6.

The asymptotic properties of the feasible estimator θ̂f are analyzed in the next Theorem.

Theorem 2 (Consistency and asymptotic normality of θ̂f )

(a) Suppose Assumptions 1-5 hold. Then for T → ∞ and δ → 0 we have

p

θ̂f → θ0 .

(b) Suppose Assumptions 1-7 hold. Then if T → ∞, δ → 0 and T δ → 0 we have

´

√ ³

d

T θ̂f − θ0 → N (0, Avar(θ̂nf )).

13

(23)

(24)

Note that for the consistency of θ̂f we do not need a condition for the relative speed at which T → ∞

and δ → 0. For the asymptotic normality result, however, we need such a condition.

This is so because in

√

this case the error θ̂f − θ̂nf has to satisfy a stronger condition, i.e. to be op (1/ T ). Theorem 2 shows that

for this it suffices to have T δ → 0, i.e. the number of intraday observations should increase slightly faster

than the number of the days in the sample increase.

The proof of Theorem 2 can be found in Todorov (2006b).

4

Selection of the Model under the Physical Measure

4.1

High-Frequency Data and Initial Data Analysis

I estimate different model specifications (all falling in the general stochastic volatility model (1)-(4)) using

high-frequency data on the S&P 500 index futures contract. The data covers the period January 2, 1990,

to November 29, 2002. There are 80 five-minute return observations in each day covering the day trading

session from 9:30am till 4:15pm.

For each of the days in the sample I calculate RV and TV, using the high-frequency returns over that

day and using equations (18) and (19)20 . Figure 2 plots the returns over the day as well as TV and

JV=RV-TV. The last variable is a measure of the sum of squared jumps over the day. As seen from the

TV series, integrated variance has spikes and this is suggestive of the presence of jumps in the stochastic

variance σ 2 (t) (the spot variance of the continuous price component). Another interesting observation from

Figure 2 is that most of the days in which TV is high are days in which JV is high as well. This suggests

that jumps in σ 2 (t) are linked with the price jumps.

I continue the initial data analysis by investigating the persistence in IV and the squared daily price

jumps. The two panels of Figure 3 show the first 100 autocorrelations of TV and JV respectively. As seen

from the Figure, IV and the sum of squared price jumps differ significantly in their persistence. On one

hand, IV is a very persistent process. On the other hand, the squared jumps over the day show almost no

persistence. Therefore, even if there is time-variation in the price jumps, it should be such that it yields

almost no persistence when looking at the squared jumps over the days.

4.2

Model Selection

In this Subsection I estimate several specifications of the stochastic volatility (hereafter abbreviated as SV)

model (1)-(4) and select one of them to be used in the subsequent analysis of the variance risk premium.

Below I specify each of the candidate models. In each of them I keep the price jumps since we saw in the

previous Subsection that the data suggests nontrivial price jump contribution. To save space I do not report

estimation results for SV models without a price jump component in them since they are overwhelmingly

rejected. I classify the models according to the driving factor of the stochastic variance σ 2 (t), that is,

whether the stochastic variance is determined by diffusion processes only, or is determined by jumps only,

or contains both types of processes. For convenience here and to avoid unnecessary repetition I state in

each of the cases only the stochastic variance specification (the equation for the evolution of the price is

always the same and is given by (1)).

4.2.1

Model Specifications

Diffusive SV Model

In this model the stochastic volatility has only a continuous component (i.e. V j (t) = 0). This model is

nested in the affine jump-diffusion models of Duffie, Pan, and Singleton (2000). Here I look at up to two

20

On the days on which RVδ (t) > T Vδ (t), I replace the value of T Vδ (t) with that of RVδ (t), i.e. I compute T Vδ (t) ∧ RVδ (t).

This is a finite sample correction, since QV (t) ≥ IV (t) always, and guarantees that the estimate for the squared price jumps

is always nonnegative.

14

factors, i.e., the stochastic variance specification is

V (t) = V c (t) = V1c (t) + V2c (t),

q

c

c

dVi (t) = κi (θi − Vi (t))dt + σiv Vic (t)dBi (t),

(25)

i = 1, 2.

(26)

To avoid identification

problems in the estimation I make the following re-parametrization. I set θ = θ1 +θ2

q

θi

and σi = σiv 2κ

for i = 1, 2. σi2 is the variance of Vic (t). Therefore, the stochastic variance parameters

i

I estimate are θ and κi , σi for i = 1, 2. The nonnegativity and stationarity restrictions in Assumption 4

imply

θ > 0, κ1 > 0, κ2 > 0, σ1 + σ2 < θ.

I estimate both a one and a two-factor model.

Jump-Driven SV Model

In this model the stochastic variance is driven only by positive jumps, i.e. V c (t) = 0. This model falls

into the class of the jump-driven stochastic volatility models of Todorov (2006a). Here I use the following

specification for the moving average function g(·) in equation (4)

Z t Z

V (t) = V j (t) =

g(t − s)k(x)µ(ds, dx),

(27)

−∞

g(u) =

Rn

0

b0 + ρ1 ρ1 u b0 + ρ2 ρ2 u

e +

e ,

ρ1 − ρ2

ρ2 − ρ1

u ≥ 0.

(28)

The expression in (28) is of a (normalized) CARMA(2,1) kernel (see Brockwell (2001b) for details). The

reason I work with it here is that it induces the same type of autocorrelation function for the stochastic

variance σ 2 (t) as that implied by a two-factor affine jump-diffusion model. Thus, the models in the different

classes here are given a fair comparison. To ensure nonnegativity of the kernel as well as to guarantee

(weak) stationarity of the stochastic variance I impose the following parameter restrictions (see Todorov

and Tauchen (2006))

b0 ≥ − max{ρ1 , ρ2 } > 0.

I look also at a CARMA(1,0) kernel, which is the analogue of the one-factor Diffusive SV model. The

CARMA(1,0) kernel is a restriction of the CARMA(2,1) kernel. The restriction is b0 = − min{ρ1 , ρ2 }.

Jump-Diffusive SV Model

This model has both a diffusive and a jump component in the variance

V (t) = V c (t) + V j (t),

V c (t) = V1c (t),

q

c

c

dV1 (t) = κ1 (θ1 − V1 (t))dt + σ1v V1c (t)dB1 (t),

Z t Z

j

V (t) =

g(t − s)k(x)µ(ds, dx),

−∞

Rn

0

g(u) = eρ1 u ,

u ≥ 0.

(29)

(30)

(31)

(32)

This variance specification generates the same autocorrelation structure for σ 2 (t) as that implied by the

CARMA(2,1)-jump-driven SV model and the two-factor affine jump-diffusion model. To avoid

R identifica1

tion problems in the estimation, the model is re-parameterized as follows. I set θ = θ1 − ρ1 R2 k(x)G(dx)

0

q

θ

2

and σ1 = σ1v 2κ1 . θ is the mean of the stochastic variance and σ1 is the variance of the diffusive variance

component V c (t). In other words, as for the Diffusive SV model, I do not estimate separately the means

15

of the different variance components (note that in the Jump-Driven SV model this problem is automatically avoided since in it we have a single factor). The nonnegativity and stationarity of σ 2 (t) implies the

following conditions on the parameters which are imposed in the estimation

κ1 > 0,

θ > 0,

4.2.2

ρ1 < 0,

σ1 < θ.

Details on the estimation

Turning to the estimation of the different model specifications, I use a GMM-type estimator and apply the

general result in Theorem 2. In all estimated models I do not specify the Lévy processes in the price and

the variance. Instead, I treat as parameters only cumulants which are needed for calculating the moment

conditions in the GMM. In particular, I estimate

Z

Z

Z

Z

Z

2

2

4

k(x)G(dx),

k (x)G(dx) and

h2 (x)k(x)G(dx).

h (x)G(dx),

h (x)G(dx),

Rn

0

Rn

0

Rn

0

Rn

0

Rn

0

R

As mentioned above, in the case of the Jump-Diffusive SV model I do not estimate Rn k(x)G(dx) separately

0

to avoid identification problems. Also, in the case of the Diffusive SV model, since the variance does not

contain jumps, the last three quantities above are obviously not estimated. Further, in the estimation of

the models I impose the following constraint on the cumulants

sZ

Z

Z

0≤

Rn

0

h2 (x)k(x)G(dx) ≤

Rn

0

h4 (x)G(dx)

Rn

0

k 2 (x)G(dx).

This constraint guarantees that there exists a two-dimensional Lévy process (for the jumps in the price

and the variance) with cumulants equal to the estimated ones.

Turning to the moment conditions in the GMM, for the estimation of all the models specified above, I

match the following statistics

1. Mean, Variance and Autocorrelation of IV

2. Mean and Variance of QV

3. Mean of Realized Fourth Variation (hereafter FV), which is defined below

For the autocorrelation of IV I use lags 1, 3 and 6 as well as the average autocorrelation for lags 11 − 20,

21 − 30 and 31 − 40. The averaging of the higher order autocorrelations is done since these autocorrelations

are estimated with less precision. Altogether I end up with 11 moment conditions. I make the following

additional observations regarding the estimation.

• I use Theorem 2 and substitute in the estimation the unobservable IV with TV. In addition, I make

use of the following CLT result. Under the assumptions of Theorem 2, as shown in Barndorff-Nielsen

et al. (2005) and Barndorff-Nielsen et al. (2006), we have

√ Z t+1

µ

¶

Z t+1

A

law

−1/2

2

δ

T Vδ (t) −

σ (u)du −→ 3

σ 2 (u)dW (u),

(33)

µ

t

2/3 t

where W is a Wiener process defined on an extension of the probability space and is independent of

the futures log-price process f . The constant A is given by

A = µ34/3 − 5µ62/3 + 2µ22/3 µ24/3 + 2µ42/3 µ4/3 ,

16

where µa is defined after equation (19). Based on this result we have the following approximation

r µZ

¶

t+1

K

4

T Vδ (t) ≈ IV (t) +

σ (u)du ²t ,

(34)

M

t

where K =

A

µ62/3

≈ 3.0613 and (²t ) is i.i.d. sequence and ²t ∼ N (0, 1). Similar approximation for RV,

for the case of no price jumps, is used in Andersen, Bollerslev, and Meddahi (2005) for the purposes

of constructing volatility forecasts. Note that ²t is independent of IV (t) and is i.i.d. (with mean 0).

This means that, using the asymptotic refinement in equation (34), the mean and autocovariance

of TV are approximated by the mean and the autocovariance of IV. For the approximation of the

variance of TV, in addition to the variance of IV, we have a term of order O(δ) reflecting the effect

of ²t

µZ t+1

¶

K

4

Var (T Vδ ) ≈ Var (IV (t)) +

E

σ (u)du .

(35)

M

t

I use the approximation in equation (35) in the estimation. That is, the sample variance of TV is

matched to the expression in

³R (35). Under´the conditions of Theorem 2, there is no asymptotic effect

t+1

K

from adding the term M E t σ 4 (u)du to the variance of IV, i.e. Theorem 2 continues to hold.

This approximation can be viewed as a small sample correction (i.e. for a finite number of intraday

observations)21 (see Todorov (2006b)). Finally, for the moments of IV I use Theorem 1 in Todorov

(2006a).

• In the estimation the unobservable QV is replaced by RV, using Theorem 2. Similar to IV, I make a

small sample correction to the variance of QV. I match the sample variance of RV to an approximation

of the variance of RV, which is derived using Theorem 1 22 . This approximation can be written as

a sum of the variance of QV and an additional O(δ) term. Under the conditions of Theorem 2 the

correction has no asymptotic effect.

• FV is a particular case of realized power variation. It is defined for a day t as

F Vδ (t) =

M

X

rδ4 (t + (i − 1)δ).

(36)

i=1

p

R

It can be shown that for ∀t F Vδ (t) → Rn g 4 (x)G(dx) as δ → 0 (see Woerner (2006) and Jacod

0

(2006a)). Thus, FV is a measure of the sum of the price jumps raised to the power four over the

day. I use here F V to completely identify the second order moments of the jumps in the price

and the variance. To calculate the mean of FV I use equation (16) in Theorem 1. This is a high

order approximation. The error of the approximation is of magnitude O(δ 3/2 ), and is coming from

the “leverage effect” associated with the link between the diffusive variance factor and the diffusive

price innovation. This error will be zero for the Jump-Driven SV model and the Jump-Diffusive SV

model, provided that in the latter model the continuous innovations in the price and the variance are

independent. I neglect this error in this estimation23 .

• For calculating the optimal weighting matrix for the GMM-type estimator I use a Parzen kernel with

a lag-length of 80.

21

In the estimation it does not have

effect. For example for the parameter estimates of the Jump-Diffusive

³R a very significant

´

t+1

K

model Var (IV (t)) ≈ 1.14 and M

E t σ 4 (u)du ≈ 0.08.

22

The error of approximating the true variance of RV is of magnitude O(δ 1/2 ) and is induced by the “leverage effect” coming

from the link between the diffusive component of the stochastic variance and the diffusive price innovations. In the case of

the Jump-Driven SV models this error is zero.

23

Note that the effect of this error is not covered by Theorem 2. However, numerical experiments suggest that for practical

purposes the error is negligible.

17

• The estimation is performed using the MCMC approach of Chernozhukov and Hong (2003) of treating

the Laplace transform of the objective function as an unnormalized likelihood function and applying

MCMC to the pseudo posterior. The point estimates are the resulting mode of the pseudo posterior.

4.2.3

Estimation results

The estimation results are reported in Tables 1-3. Below I summarize the key findings from the estimation.

• One-factor type stochastic volatility models cannot match the autocorrelation in IV (respectively

TV). This claim holds true regardless of the specification of the stochastic variance σ 2 (t) as a sum

of diffusions or purely jump-driven. Both one-factor type models estimated here produce very bad

fit as can be seen by their corresponding J-statistics24 reported in the first columns of Tables 1 and

2 respectively. On the other hand, inclusion of an additional variance factor significantly improves

the fit. A two-factor type SV model can match the autocorrelation in IV (respectively TV). Figure 4

plots the fit to the autocorrelation of TV, implied by the parameter estimates for the Jump-Diffusive

SV Model (29)-(32) (an almost identical autocorrelation structure is implied by the model estimates

for the CARMA(2,1) jump-driven SV model). As seen from the Figure, the autocorrelation of TV

is well matched for lags until forty (in the estimation I matched the autocorrelation of TV until

lag forty). After lag forty the model-implied autocorrelation slightly underestimates the empirically

observed one. However, it is still well within the 95% confidence interval.

• The Diffusive SV Models, estimated here, produce very bad fit to the data as seen from the results

in Table 1. The reason for this is that the square-root processes could not generate enough variance

in IV to match the empirically observed one. On the other hand, models which contain jumps in

the stochastic variance σ 2 (t) can naturally generate enough variance in IV. These models with jumps

in σ 2 (t) provide good fit to the data, as seen from the estimation results in Tables 2 and 3. This

observation is in line with the findings in Eraker, Johannes, and Polson (2003), where lower frequency

stock market data is used and in Broadie, Chernov, and Johannes (2006), where options data is used.

• The estimation results for the models containing jumps in the variance (given in Tables 2 and 3) show

that

there is a relationship between the jumps in the variance and the jumps in the price. That is,

R

h2 (x)k(x)G(dx) is statistically different from zero25 . This finding rejects independence between

Rn

0

the jumps in the price and the variance. It is also in line with the observation made at the beginning

of the current Section regarding the positive link between the JV and TV series. It should be noted

that perfect linear dependence between the price jumps and the variance jumps or perfect linear

dependence between the squared price jumps and the variance jumps can be shown to be rejected;

see the analysis in Todorov (2006b). Another popular in the literature dependence structure, where

the jumps in the price and the variance are compound Poisson, arrive always together and have

independent normally and exponentially respectively distributed jump sizes, can be also rejected. As

already discussed in Section 2 here I do not model parametrically the link between the jumps in the

variance and the jumps in the price. Therefore, the results in the paper are not driven by a (possibly

misspecified) parametric model for the jumps.

The estimated two-factor type models are nonnested. To compare them formally we can use a model

selection criteria (MSC) as proposed in Andrews (1999), Andrews and Lu (2001) and Hong et al. (2003)

among others. The MSC can be written as

M SC = J − s(#moments − #parameters) × kT ,

24

The J-statistic is the GMM test for overidentifyingR restrictions.

Note that under the null hypothesis the parameter Rn h2 (x)k(x)G(dx) is on the boundary of the parameter space. In this

0

case the asymptotic distribution (under the null) is truncated normal (see Andrews (2002)); as a result the 5% significance

critical value is 1.65.

25

18

where J is the test of overindentifying restrictions for the model, s(·) is an increasing function and kT is a

sequence satisfying kT → ∞ and kT = o(T ). This model selection criteria is consistent, i.e. asymptotically

we choose the model with the best fit to the moment conditions, which is most parsimonious26 . In the

case here, all models are estimated with the same number of conditions. The Jump-Driven and the JumpDiffusive SV models have the same number of parameters, which exceeds the number of parameters of the

Diffusive SV model with one. Therefore, the difference in MSC of the Jump-Driven and Jump-Diffusive

SV models is coming only from the difference in their J-statistics. When comparing these two models

with the Diffusive SV model, a small correction to the difference of the corresponding J-statistics should

be made to account for the fact that the Diffusive SV model is more parsimonious. However, given the

high value of the J-statistic for the Diffusive SV model, this correction for parsimony cannot change our

conclusions about the inferior performance of this model. Thus, the two best performing models are the

CARMA(2,1) jump-driven SV model (parameter estimates reported in the second column of Table 2) and

the Jump-Diffusive SV Model (parameter estimates reported in Table 3). The two models produce an

almost identical fit to the moments used in the estimation.

In the subsequent analysis I decide to work with the Jump-Diffusive SV Model for the following reason.

As already discussed in Section 2, the “leverage effect” in the models analyzed here can be captured by

dependence in the diffusive and/or jump innovations in the price and the variance. The CARMA(2,1)

jump-driven SV model can put too much “burden” on the jump specification, since it is only through the

link between the jumps in the price and the variance that this effect can be generated in this model. In

contrast, the Jump-Diffusive SV Model is more flexible in that regard as it can allow for “leverage” coming

from dependence between the diffusive innovations in the price and the variance. Thus, for the subsequent

analysis of the variance risk premium, I work with the Jump-Diffusive SV Model. Following Tauchen

(1985), in Table 4 I report the t-statistics associated with each of the moments used in the estimation.

The results in Table 4 suggest that the Jump-Diffusive Volatility Model has no problem with fitting any

of the moments used in the estimation27 .

I finish the present Section with a short comment on the parameter estimates of the Jump-Diffusive

Model. In line with many other studies in the literature (Andersen, Benzoni, and Lund (2002), Alizadeh,

Brandt, and Diebold (2002), Chernov, Gallant, Ghysels, and Tauchen (2003)) here I find one of the variance

factors to be slowly mean reverting, having a half-life of approximately twenty (business) days, while the

other one to be quickly mean reverting with a half-life of approximately half a day. Perhaps not surprisingly

the quickly mean-reverting factor is the jump component of the variance, while the slowly mean-reverting

variance factor is the continuous component of the variance.

5

Initial Analysis of the Variance Risk Premium

In this Section I start the analysis of the variance risk premium, using the selected model for the futures

price. The variance risk premium is formally defined as the wedge between (conditional) expectation of the

future quadratic variation under the risk-neutral and the physical measure. Thus, the daily-standardized

risk premium for the time-variation in the quadratic variation over the next a days is

V Ra (t) =

¢ 1 ¡

¢

1 Q¡

E [f, f ](t,t+a] |Ft − EP [f, f ](t,t+a] |Ft ,

a

a

(37)

where EQ (·) denotes expectation under the risk-neutral measure, known also as equivalent martingale

measure. In case a superscript is not put on the expectation operator, the expectation is always assumed

26

If none of the compared models can fit asymptotically the moment conditions, i.e. for none of the compared models

kT

m0 (θ0 ) = 0 (m0 (θ) = E(m(z(t), θ))), then for the consistency of the MSC criteria we need also √

→ ∞.

T

27

However, these t-statistics should be interpreted carefully. In particular, if a moment condition fails, then in general this

affects the consistency of the whole parameter vector. This, in turn, leads to inconsistency even of correct moments. The

diagnostic tests are used here just as one more device of checking if the model has difficulty in matching the moments used in

the estimation.

19

to be under the physical measure.

The variance risk premium reflects the compensation demanded by investors for two features of the

price process. The first is the time-variation in the variance of the continuous price component σ 2 (t). The

second feature, compensation for which is reflected in the variance risk premium, is the presence of price

jumps. In this Section I construct a measure for the variance risk premium, using VIX index data and the

selected Jump-Diffusive SV model, and analyze the dynamics of the variance risk premium. The empirical

findings in this Section are used as an important guidance for constructing prices of diffusive and jump

risk, which is done in the next Section.

5.1

Variance Risk Premium Measure and Its Properties