PARAG PATHAK HARVARD UNIVERSITY

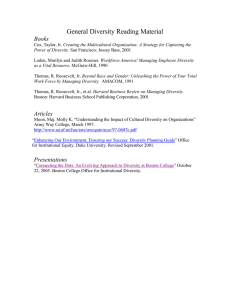

advertisement

PARAG PATHAK http://www.fas.harvard.edu/~ppathak ppathak@fas.harvard.edu HARVARD UNIVERSITY CGOLDIN@HARVARD.EDU Placement Director: Claudia Goldin Graduate Student Coordinator: Nicole Tateosian NATATEOS@FAS.HARVARD.EDU 617-495-3934 617-495-8927 Home Contact Information 221 Norfolk Street, #2 Cambridge, MA 02139 Home phone number: (617) 864 6211 Office Contact Information 420E Baker Library, Harvard Business School Boston, MA 02163 Cell phone number: (857) 928 3704 Personal Information: DOB: 06/08/1980, Gender: M, Citizenship: USA Undergraduate Studies: A.B., Applied Mathematics, Harvard University, Summa cum laude, 2002 Phi Beta Kappa, Thomas T. Hoopes Thesis Prize Graduate Studies: S.M., Applied Mathematics, Harvard University, 2002 Ph.D. Candidate, Business Economics, Harvard University, 2003 to present Thesis Title: “Essays on Market Design” Expected Completion Date: June 2007 Thesis Committee and References: Professor Alvin E. Roth (primary advisor) 441 Baker Library, Harvard Business School (617) 495 5447, Al_Roth@harvard.edu Professor Gary Chamberlain Littauer 123, Harvard University (617) 495 1869, gary_chamberlain@harvard.edu Professor Drew Fudenberg Littauer 310, Harvard University (617) 496 5895, dfudenberg@harvard.edu Professor Ariel Pakes Littauer 117, Harvard University (617) 495 5320, ariel@ariel.fas.harvard.edu Teaching and Research Fields: Primary fields: Microeconomic Theory, Public Economics, Applied Econometrics Secondary fields: Market Design, Industrial Organization, Finance, Experimental Economics Teaching Experience: Spring 2004 Game Theory (graduate), Harvard, Professor Attila Ambrus Fall 2004 International Trade (graduate), Harvard, Professor Elhanan Helpman Spring 2005 Continuous Time Finance (graduate), Harvard, Professor Robert Merton Fall 2005 Econometric Methods (graduate), Harvard, Professor Gary Chamberlain Research Experience and Other Employment: 4/02-9/02 Research Assistant, Prof. Paul Milgrom (Stanford) Putting Auction Theory to Work 6/02-9/02 US Department of Justice, Antitrust, Economic Analysis Group 9/02-6/03 Visiting student, Chateaubriand Fellow, IDEI, Toulouse Professional Activities Seminars: International Monetary Fund (Annual Research Conference), November 5, 2004 Conference on Market Design Stanford University, December 5, 2004 AEA Meetings, Market Design Session, Philadelphia, January 7, 2005 Banque de France (Paris) February 5, 2005 Stanford University (lecture to Market Design graduate course), May 26, 2005 Hebrew University Summer School on Market Design, July 11, 2005 Yahoo! Market Design Group, July 14, 2006 Conference co-organizer: Mindich Conference on ``Designing Choice’’ at Harvard, April 6-7, 2006 Honors, Scholarships, and Fellowships: 2003-2006 National Science Foundation Graduate Fellowship 2003-2005 Paul and Daisy Soros Fellowship for New Americans 2005 Spencer Foundation Dissertation Fellowship 2005 Lincoln Institute for Land Economics Fellowship 2005 George Dively Award for Outstanding Pre-Dissertation Research 2006 John R. Meyer Dissertation Fellowship 2006 State Farm Companies Doctoral Dissertation Award 2006 Q-Group Research Grant: “Short Sales Constraints” 2006 GIC Award for Excellence in Teaching Economics Publications: “Short Interest, Institutional Ownership and Stock Returns” (with Paul Asquith and Jay Ritter), Journal of Financial Economics, 78, pp. 243-276, 2005. “The New York City High School Match’’ (with Atila Abdulkadiroğlu and Alvin Roth), American Economic Review, Papers and Proceedings, pp. 364-367, 2005. “The Boston Public School Match’’ (with Atila Abdulkadiroglu, Alvin Roth, and Tayfun Sönmez), American Economic Review, Papers and Proceedings, pp. 368-371, 2005. “The Dynamics of Open Source Contributors’’ (with Josh Lerner and Jean Tirole), American Economic Review, Papers and Proceedings, pp. 114-118, 2006. Research Papers: “Lotteries in Student Assignment” (Job Market Paper) Public school choice plans across the United States use lotteries to make assignments. Motivated by design issues in the New York City High School match, this paper compares lotteries in the allocation of school seats. The first mechanism, random serial dictatorship, is based on a single lottery: it selects an ordering from a given distribution and assigns the first student her top choice, the second student his top choice among available schools, and so on. The second mechanism, top trading cycles with random priority, is based on lotteries for each school: it selects an ordering from a given distribution and sets that order as the priority for the first school, selects another ordering from the same distribution and sets it as the priority for the second school, and so on. Then the mechanism finds an assignment in the induced market with these priorities using top trading cycles, where cycles form when each student points to the school she desires the most among available schools and each student points to the student in the market who receives the highest priority at that school. This paper shows that a random serial dictatorship is equivalent to top trading cycles with random priority. “Incentives and Stability in Large Two-Sided Matching Markets” (with Fuhito Kojima) The paper analyzes the scope for manipulation in many-to-one matching markets (college admission problems) under the student optimal stable mechanism when the number of participants is large and the length of the preference list is bounded. Under a mild independence assumption on the distribution of preferences for students, the fraction of colleges that have incentives to misrepresent their preferences approaches zero as the market becomes large. We show that truthful reporting is an approximate equilibrium under the student optimal stable mechanism in large markets that are sufficiently thick, a condition that allows for certain types of heterogeneity in the distribution of student preferences. “Leveling the Playing Field: Sincere and Sophisticated Players in the Boston Mechanism” (with Tayfun Sönmez) Empirical and experimental evidence suggests different levels of sophistication among families in the Boston Public School (BPS) student assignment plan. In this paper, we analyze the Nash equilibria of the preference revelation game induced by the Boston mechanism when there are two types of players. Sincere players are restricted to report their true preferences, while sophisticated players play a best response. The set of Nash equilibrium outcomes is characterized in terms of the set of stable matchings of an economy with a modified priority structure, where sincere students lose their priority to sophisticated students. While there are multiple equilibrium outcomes, a sincere student receives the same assignment in all equilibria. Finally, the assignment of any sophisticated student under the Pareto-dominant Nash equilibrium of the Boston mechanism is weakly preferred to her assignment under the student-optimal stable mechanism, which was recently adopted by BPS for use in 2006. “Strategy-proofness versus Efficiency in Matching with Indifferences: Redesigning the NYC High School Match’’ (with Atila Abdulkadiroğlu and Alvin Roth) The design of the New York City (NYC) High School match involved tradeoffs between incentives and efficiency, because some schools are strategic players that rank students in order of preferences, while others order them into big priority classes. Therefore it is desirable for a matching mechanism to produce stable matchings (to avoid giving the strategic players incentives to circumvent the match), but it is also necessary to use tie-breaking for schools whose capacity is sufficient to accommodate some but not all students of a given priority. We analyze a model that encompasses one-sided and two-sided matching models, and study the set of stable matchings as well as the set of student-optimal matchings. Our main result is that a student-proposing deferred acceptance mechanism that breaks indifferences the same way at every school’s preference relation is not dominated by any other strategy-proof mechanism. That is, from the point of view of students, any mechanism that Pareto dominates a fixed tie breaking deferred acceptance algorithm cannot be strategyproof. Finally, using data from the recent redesign of the NYC High School match, we document that the extent of potential efficiency loss is substantial, about 10% of assigned students could have improved their assignment in a (non strategy-proof) student optimal mechanism, if the same student preferences would have been revealed. “Changing the Boston School Choice Mechanism: Strategyproofness as Equal Access” (with Atila Abdulkadiroğlu, Alvin Roth, and Tayfun Sönmez) In July 2005 the Boston School Committee voted to replace the existing Boston school choice mechanism with a deferred acceptance mechanism that simplifies the strategic choices facing parents. This paper presents the empirical case against the previous Boston mechanism, a priority matching mechanism, and the case in favor of the change to a strategy-proof mechanism. We present evidence both of sophisticated strategic behavior among some parents, and of unsophisticated strategic behavior by others. We find evidence that some parents pay close attention to the capacity constraints of different schools, while others appear not to. In particular, we identify a certain kind of mistake that can be observed in the data without knowing the true preferences of a family. Families that make this mistake are disproportionately unassigned, and in many cases they would have been assigned but for the mistake. This interaction between sophisticated and unsophisticated players identifies a new rationale for strategy-proof mechanisms based on fairness, and was a critical argument in Boston’s decision to change the mechanism. “Cooperation over Finite Horizons: Theory and Experiments” (with Attila Ambrus) This paper proposes a theory of cooperation over finite horizons, focusing on public good contribution games, that implies the broadly documented feature of decreasing cooperation over time. The central assumption is that there are two types of players: those who only care about their own material payoffs, and those who reciprocate others’ contributions. The main result is that if reciprocity functions satisfy some regularity conditions, then generically there is a unique perfect equilibrium, in which contributions are decreasing. In this equilibrium, selfish players contribute to induce subsequent contributions by reciprocal players, and this incentive diminishes as the end of the play approaches. The model explains the puzzling restart effect and is consistent with various other empirical findings. In one-shot games, the model predicts no contributions. We also report the results of a series of experiments, using a probabilistic continuation design in which after each round, the game is restarted with low probability. The results support the implications of our model that the restart effect is present even with experienced players, whereas, in one-shot games, contributions disappear with experience. We show that experienced players correctly foresee the pattern of contributions, suggesting that the declining pattern comes from equilibrium play. We also identify the presence of conditional reciprocity among experienced players, and document that selfish players (identified exogenously) stop contributing earlier than reciprocal players, as implied by the model. “Speculative Attacks and Risk Management” (with Jean Tirole) The paper builds a simple, micro-founded model of exchange rate management, speculative attacks, and exchange rate determination. The country may defend a peg in an attempt to signal a strong currency and thereby boost the government's future re-election prospects or attract foreign capital. The paper relates the size of the speculative attack and government's defense strategy to the market's prior beliefs about the strength of the currency, the ability of foreign speculators to short sell the currency, domestic politics, and initial debt composition. Speculative activities can exhibit strategic complementarity or substitutability. Finally, features of original sin covary with the maintenance of pegs, as letting residents hedge the currency or incentivizing them to lengthen their debt maturity structure is an admission that the currency is overvalued and undoes the signal sent by defending the currency. Research Paper(s) in Progress Lotteries in the Transfers Problem: Designing an Appeals Process in NYC The Demand for High School in New York City (with Atila Abdulkadiroğlu) The Equity Lending Market (with Paul Asquith and Andrea Au) The Demand for Housing in Greater Boston