ROADMAP FOR THE EVOLUTION OF DTT – A bright future for TV

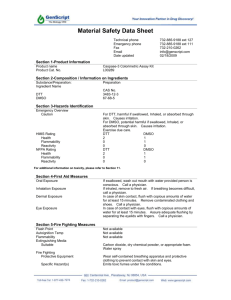

advertisement