How to input a VAT only invoice

advertisement

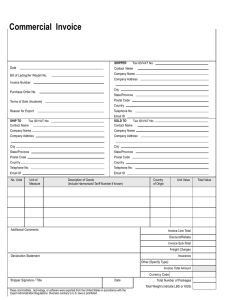

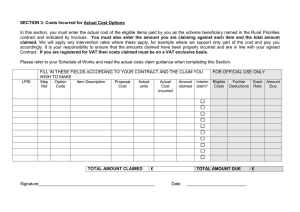

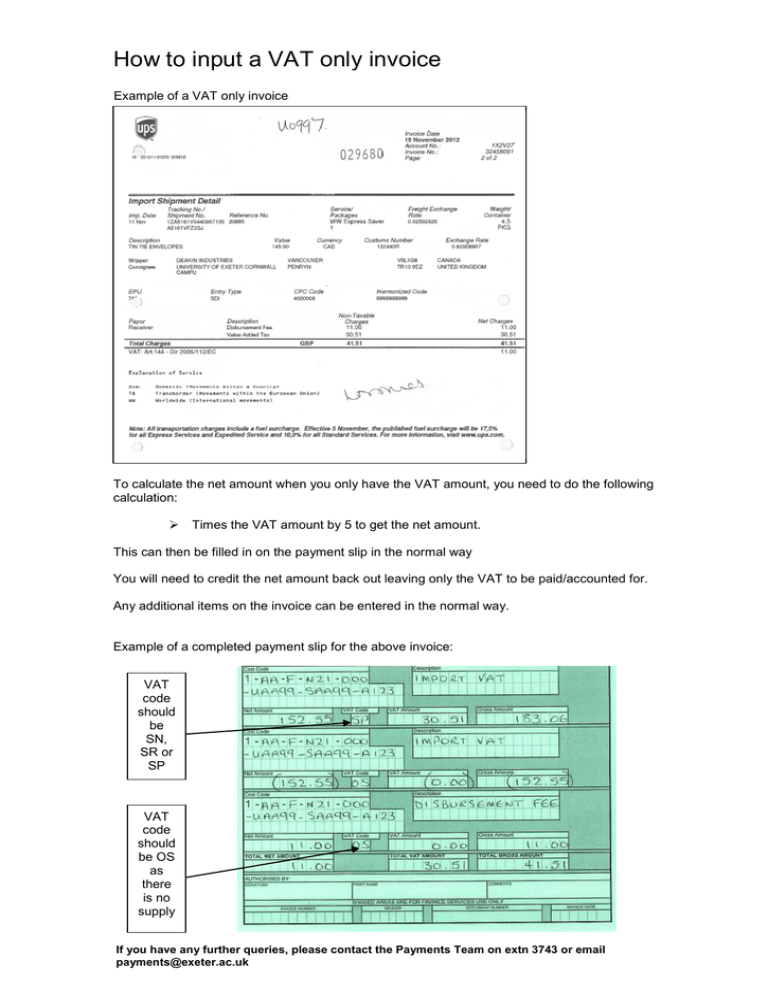

How to input a VAT only invoice Example of a VAT only invoice To calculate the net amount when you only have the VAT amount, you need to do the following calculation: Times the VAT amount by 5 to get the net amount. This can then be filled in on the payment slip in the normal way You will need to credit the net amount back out leaving only the VAT to be paid/accounted for. Any additional items on the invoice can be entered in the normal way. Example of a completed payment slip for the above invoice: VAT code should be SN, SR or SP VAT code should be OS as there is no supply If you have any further queries, please contact the Payments Team on extn 3743 or email payments@exeter.ac.uk