24-Mar-09 PRELIMINARY RESULTS Less than 10 10-20

advertisement

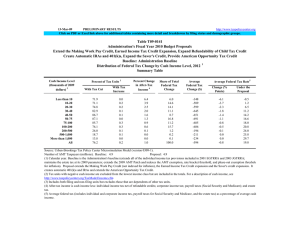

24-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0182 Reinstate the Top Two Rates, Limit Value of Itemized Deductions, Tax Capital Gains and Qualified Dividends at 20 Percent for High Income Tax Payers Baseline: Administration Baseline Small Business Tax Units Distribution of Federal Tax Change by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units With Tax Increase 3 Number (thousands) Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 19.8 1,248.7 633.4 394.1 2,298.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 40.5 87.9 95.4 6.4 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.6 -2.7 -5.5 -1.8 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 6.3 15.0 78.6 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 4 1,390 14,219 129,820 1,896 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.8 7.3 12.5 5.7 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 -0.1 -0.1 -0.3 -0.3 -1.0 -0.7 0.2 2.3 0.0 Under the Proposal 0.1 0.2 0.6 1.0 1.2 4.4 5.5 18.1 18.9 11.8 38.1 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.5 2.0 3.8 1.4 Under the Proposal 7.3 3.9 9.4 13.0 14.7 16.8 18.1 20.8 25.1 28.9 34.3 25.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,706 3,615 3,107 2,626 2,192 5,024 4,212 7,615 3,084 721 413 35,970 7.5 10.1 8.6 7.3 6.1 14.0 11.7 21.2 8.6 2.0 1.2 100.0 Average Income (Dollars) 6,021 15,596 26,267 36,691 47,453 65,978 91,824 145,500 310,919 721,142 3,423,770 140,128 Average Federal Tax Burden (Dollars) 437 606 2,464 4,762 6,968 11,057 16,577 30,254 76,555 194,112 1,042,995 33,505 Average AfterTax Income 4 (Dollars) 5,585 14,990 23,804 31,929 40,485 54,921 75,248 115,246 234,364 527,029 2,380,775 106,623 Average Federal Tax Rate 5 7.3 3.9 9.4 13.0 14.7 16.8 18.1 20.8 24.6 26.9 30.5 23.9 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.3 1.1 1.6 1.9 2.1 6.6 7.7 22.0 19.0 10.3 28.1 100.0 0.4 1.4 1.9 2.2 2.3 7.2 8.3 22.9 18.9 9.9 25.6 100.0 0.1 0.2 0.6 1.0 1.3 4.6 5.8 19.1 19.6 11.6 35.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Note: Includes all tax units reporting a net gain or loss on Schedules C, E, or F. (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). The proposal reinstates the top two individual income tax rates to 36 and 39.6 percent, limits the tax rate at which itemized deductions reduce tax liability to 28 percent, and imposes a 20 percent rate on capital gains and qualified dividends for tax units with AGI above $200,000 ($250,000 for couples). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.