Critical Employment Law Definition - Employee versus Independent Contractor EUCLID MANAGERS

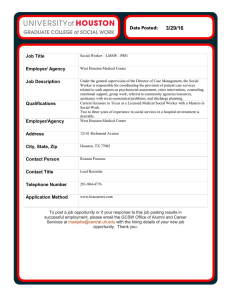

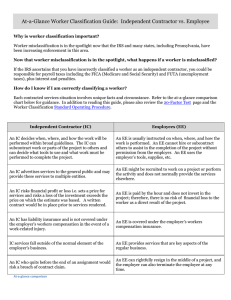

advertisement

EUCLID MANAGERS® has served the independent agent since 1976, offering a portfolio of group health, professional liability, individual life, health, disability, annuity and long-term care products. We proudly represent many fine carriers including Group Products: UnitedHealthcare of Illinois Delta Dental of Illinois MetLife Concierge Services: LifeLock HealthiestYou Individual Products: American General Life Companies AXA/Equitable Banner Life Delta Dental of Illinois Genworth Financial Insurance Co. Guarantee Trust Life John Hancock Life Lincoln National Life MetLife Principal Financial Prudential Financial Transamerica UnitedHealthOne West Coast Life Contact Information 234 Spring Lake Drive Itasca, Illinois 60143 Phone: (630) 238-1900 Outside Chicagoland: (800) 345-7868 Fax: (630) 773-8790 Visit us at: www.euclidmanagers.com Critical Employment Law Definition - Employee versus Independent Contractor Brokers have played – and continue to play – a critical role in assisting employers with employee benefits. For many small employers, their health insurance broker is, for all intents and purposes, the client’s human resources guru. With the implementation of the Affordable Care Act, ACA, human resources and employment law issues are more important than they’ve ever been. Now, a misunderstanding of just who is an employee, can have serious continued on page 2 A letter from Karen Knippen Just who is – and isn’t – an employee is one of the most critical issues since eligibility for coverage under a benefit plan is triggered by employment status. We can alert employers to the factors they should consider in making a determination of employment status and why it’s important. Then we can encourage them to seek out appropriate legal guidance. Sincerely yours, Karen Knippen, RHU, REBC, CLTC Senior Vice President EUCLID MANAGERS® has been serving the independent agent since 1976 with a portfolio of group health, professional liability and individual life and health, annuity and long-term care products. We proudly represent UnitedHealthcare, Delta Dental of Illinois, MetLife and Humana Individual. We encourage your feedback and suggestions. Please call your EUCLID MANAGERS® Marketing Representative or Marcy Graefen at (630) 238-2915 for more information. Outside Chicagoland, call (800) 345-7868. Website: www.euclidmanagers.com repercussions. This is especially true if the employer would be an “applicable large employer” (ALE) with 50 or more full-time equivalents but for the fact that several workers are classified as independent contractors rather than employees. This issue of Reflections reviews factors to consider when an employer is determining whether a worker is an employee or an independent contractor. Common Law Employee According to the Internal Revenue Service, “under common-law rules, anyone who performs services for an employer is an employee if the employer can control what will be done and how it will be done.” Employers need to assess whether a worker is an employee or an independent contractor in order to comply with many employment laws including the ACA. Determining which individuals providing services to an employer are employees is determined by the facts and circumstances of the situation. The degree of control and independence is determined by looking at three (3) main categories: 1. 2. 3. Behavioral Financial Type of relationship. Employers have to look at the entire relationship. Merely having a contract with an individual that states someone is an independent contractor isn’t sufficient. Further complicating matters are additional categories of workers. These include statutory employees and statutory nonemployees. A statutory employee requires that certain independent contractors be treated as employees by statute – statutory employees – for certain employment tax purposes. Statutory employees are often sales related. Statutory non-employees are licensed real estate agents and some other direct sellers, among others. Many employers have heard of the 20 factor test to determine whether a worker is an independent -2- Reflections contractor or an employee. While a review of the 20 factors is helpful, a worker still may be an employee after passing this test. The 20 factors identified by the IRS are as follows: 1. Instructions: If the person for whom the services are performed has the right to require compliance with instructions, this indicates employee status. 2. Training: Worker training (e.g., by requiring attendance at training sessions) indicates that the person for whom services are performed wants the services performed in a particular manner (which indicates employee status). 3. Integration: Integration of the worker’s services into the business operations of the person for whom services are performed is an indication of employee status. 4. Services rendered personally: If the services are required to be performed personally, this is an indication that the person for whom services are performed is interested in the methods used to accomplish the work (which indicates employee status). 5. Hiring, supervision, and paying assistants: If the person for whom services are performed hires, supervises or pays assistants, this generally indicates employee status. However, if the worker hires and supervises others under a contract pursuant to which the worker agrees to provide material and labor and is only responsible for the result, this indicates independent contractor status. 6. Continuing relationship: A continuing relationship between the worker and the person for whom the services are performed indicates employee status. 7. Set hours of work: The establishment of set hours for the worker indicates employee status. 8. Full time required: If the worker must devote substantially full time to the business of the person for whom services are performed, this indicates employee status. An independent contractor is free to work when and for whom he or she chooses. 9. Doing work on employer’s premises: If the work is performed on the premises of the person for whom the services are performed, this indicates employee status, especially if the work could be done elsewhere. 10. Order or sequence test: If a worker must perform services in the order or sequence set by the person for whom services are performed, that shows the worker is not free to follow his or her own pattern of work, and indicates employee status. 11. Oral or written reports: A requirement that the worker submit regular reports indicates employee status. 12. Payment by the hour, week, or month: Payment by the hour, week, or month generally points to employment status; payment by the job or a commission indicates independent contractor status. 13. Payment of business and/or traveling expenses. If the person for whom the services are performed pays expenses, this indicates employee status. An employer, to control expenses, generally retains the right to direct the worker. 14. Furnishing tools and materials: The provision of significant tools and materials to the worker indicates employee status. 15. Significant investment: Investment in facilities used by the worker indicates independent contractor status. 16. Realization of profit or loss: A worker who can realize a profit or suffer a loss as a result of the services (in addition to profit or loss ordinarily realized by employees) is generally an independent contractor. 17. Working for more than one firm at a time: If a worker performs more than de minimis services for multiple firms at the same time, that generally indicates independent contractor status. 18. Making service available to the general public: If a worker makes his or her services available to the public on a regular and consistent basis that indicates independent contractor status. 19. Right to discharge: The right to discharge a worker is a factor indicating that the worker is an employee. 20. Right to terminate: If a worker has the right to terminate the relationship with the person for whom services are performed at any time he or she wishes without incurring liability that indicates employee status. Conclusion There are benefits to employers for the use of independent contractors. Employers don’t have to pay employment taxes or provide benefits for bona fide independent contractors. Independent contractors exist because there are services that employers need that may not be directly related to their business – yet the work still has to be done. The ACA’s employer responsibility rules make it ever more critical that employers correctly classify workers. First, as mentioned previously, not counting workers when making the assessment of “applicable large employer status” can result in an employer assuming they aren’t subject to the employer responsibility requirements, when they, indeed, should be. And, for those employers who are ALEs, not offering workers coverage assuming they’re independent contractors could wind up with the employer being subject to penalties for not offering coverage. Some employers may believe that ignoring this issue is a prudent course. But, the IRS and federal Department of Labor are stepping up audits on employee status. And, they’ve enlisted the aid of state agencies to ferret out misclassified workers. Employers should conduct a thorough review of workers to determine classification status while there is still time to make needed changes. Ignorance of who is an employee – and who isn’t – has always carried risk and the ACA has only increased the cost of error. Reflections -3- A service publication for brokers from Euclid Managers®, proudly representing UnitedHealthcare of Illinois, Delta Dental of Illinois, MetLife and UnitedHealthOne. HealthiestYou and Lifelock available through Euclid Managers Concierge Services. Visit us online www.euclidmanagers.com. Legislative Review is published by Euclid Managers®, 234 Spring Lake Drive., Itasca, IL 60143. For more information, contact your Marketing Representative or Marcy Graefen at (630) 238-2915 or marcy@euclidmanagers.com. Outside Chicagoland: (800) 345-7868, Fax (877) 444-2250. © Permission to quote with credit to source. Critical Employment Law Definition - Employee versus Independent Contractor Inside: Presorted First-Class Mail U.S. Postage PAID Addison, IL 60101 Permit No. 210