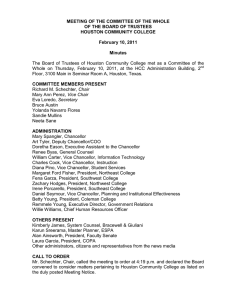

MEETING OF THE FINANCE SUB-COMMITTEE OF THE BOARD OF TRUSTEES HOUSTON COMMUNITY COLLEGE

advertisement

MEETING OF THE FINANCE SUB-COMMITTEE OF THE BOARD OF TRUSTEES HOUSTON COMMUNITY COLLEGE October 1, 2012 Minutes The Finance Sub-committee of the Board of Trustees of Houston Community College held a meeting on Monday, October 1, 2012 at the HCC Administration Building, 3100 Main, 2nd Floor, Seminar Room A, Houston, Texas. COMMITTEE MEMBERS PRESENT Richard Schechter Committee Chair Bruce A. Austin, Committee Member Sandie Mullins Yolanda Navarro Flores ADMINISTRATION Mary S. Spangler, Chancellor Art Tyler, Deputy Chancellor/COO Renee Byas, General Counsel William Carter, Vice Chancellor, Information Technology Diana Pino, Vice Chancellor, Student Success Margaret Ford Fisher, President, Northeast College William Harmon, President, Central College Virginia Parras for Zachary Hodges, President Northwest College Willie Williams, Jr., Chief Human Resource Officer OTHERS PRESENT Jarvis Hollingsworth, System Counsel, Bracewell & Giuliani Tod Bisch, President, Faculty Senate Natalie Ashby, Andrews Kurth LLP Tonya Fisher, Andrews Kurth LLP Tom Sage, Andrews Kurth LLP Clarence Grier, RBC Capital Markets Other administrators, citizens and representatives from the news media CALL TO ORDER Mr. Schechter, Chair called the meeting to order at 11:40 a.m. and declared the Committee convened to consider matters pertaining to Houston Community College as listed on the duly posted Meeting Notice. Houston Community College Finance Sub-committee – October 1, 2012 - Page 2 REVIEW FINANCING OPTIONS FOR HCC TO INCLUDE COMMERCIAL PAPER AND LINE OF CREDIT Dr. Tyler apprised that RBC Capital Markets, Financial Advisors and Andrews Kurth LLP, Bond Counsel were present to identify options for various opportunities for short-term financing by either obtaining commercial paper or line of credit to minimize the impact to taxpayers, should the bond pass. Motion – Mr. Austin moved and Mr. Schechter seconded. Dr. Tyler introduced Mr. Clarence Grier with RBC Capital Markets and Mr. Tom Sage with Andrews Kurth LLP. He noted that the presentation would include an overview of existing debt, bond election analysis, and financing options available to the college. Mr. Grier provided a background of existing debt; he apprised that the College currently has approximately $612 million in debt. Mr. Schechter inquired if there are assets that outweigh the current debt. Mr. Grier noted that the college’s assets do outweigh debt and that the AA+ rating was maintained. He informed that the college was able to secure lower rates due to the rating. Ms. Mullins inquired of bond rating since the original bond. Mr. Grier apprised that at least one increase has been received since the last bond measure. Dr. Tyler informed that the college was an AA; however, the college was able to increase its rating to AA+ even in the current market. (Mrs. Flores arrived at 11:47 a.m.) Mr. Austin inquired if the college is doing better. Dr. Tyler noted that the college is probably at a historical low regarding the interest rates. Overview of Financing Options – Existing Debt and Bond Election Mr. Grier informed that the market overview included 25 year bond revenue index and 20 year General Obligation (GO) Bond index. He asked the Board to consider the short-term rate. (Mr. Austin stepped out at 11:52 a.m.) Mr. Schechter recessed the meeting at 11:52 a.m. (Mr. Austin returned at 11:53 a.m.) Mr. Schechter reconvened the meeting at 11:53 a.m. Mr. Grier provided an overview of the existing Interest and Sinking (I&S) Debt and I&S debt with the bond. He noted that Mr. Sage would discuss the options regarding the bond election. Houston Community College Finance Sub-committee – October 1, 2012 - Page 3 Mr. Schechter apprised that the college would not immediately utilize all of the funding provided by the bond election. Mr. Grier informed that the effort would be to only draw down what is needed and thereby allow the college to only pay interest on the drawn funds. Mr. Schechter inquired of the time frame prior to realistically beginning construction. Dr. Tyler noted that there would probably need to be at least six months of lead time and approximately 1 year to 15 months before there will be a need to draw down funds. Mr. Grier apprised that RBC Capital Markets will work in conjunction with administration to review the short-term versus long-term. Mr. Sage informed that this will be something that will have to be managed. Overview of Financing Options – Upfront Delivery or Drawdown Mr. Sage noted that there are a number of options and provided an overview of (1) delivery of funds upfront and (2) allow for System to “drawdown” on funds as needed. He provided an overview of the interim financing that will not affect taxpayers at one time. Mr. Austin apprised that the Board must review the discussion of land purchases as well as design standard to review consistency in designs. He informed that an estimate should be reviewed regarding the land purchases. He noted that square footage was not discussed. Dr. Tyler apprised that square footage of some of the facilities was discussed such as Coleman College and Westside projects. He informed that there was not a discussion of the design for the projects. Dr. Tyler noted that there is an idea of how much land would need to be purchased. Mr. Sage apprised that the two interim financing models for consideration includes (1) establish commercial paper program and (2) secure drawdown bank line of credit. Mr. Grier informed that commercial paper should be considered only if for a specific project. He noted that the line of credit would be for multiple purpose usage. Dr. Tyler inquired of the ballpark figure for line of credit versus commercial paper. Mr. Grier noted that the bank line would be much more favorable; however, the more accurate figure would be provided prior to making purchases. He informed that interim financing would diminish going to the market multiple times. He noted that going to the market too often would signal an emergency; however, the interim financing provides an option of not having to go to the market numerous times for smaller issues. Mr. Sage noted that the recommendation presented for the Board to consider for interim financing solutions for the programs to include: (1) $125 million General Obligation Limited Tax; Tax-exempt Financing (subject to voter approval) (2) $50 million General Obligation Maintenance Tax; Tax-exempt Financing (non-voted) Houston Community College Finance Sub-committee – October 1, 2012 - Page 4 (3) $75 million Revenue Financing System Tax-exempt Financing (on first, second or third lien basis) Mr. Schechter apprised that the Finance Committee would schedule a follow up meeting in November 2012 to further review options available. Mr. Austin inquired if there is an institutional assessment available and noted that a trend analysis should be developed regarding the projected figures provided by the fields. He noted that the assessment should be done regarding investment term. Dr. Tyler apprised that the college could have the study completed. Mr. Austin noted that the study should be done internally. Ms. Mullins recommended completing the assessment externally. Mr. Schechter noted that the effort should possibly be done both internally and externally to provide the opportunity for comparison. ADJOURNMENT With no further business, the meeting adjourned at 12:43 p.m. Recorded, transcribed and submitted by: Sharon R. Wright, Manager, Board Services Minutes Approved: November 15, 2012