Document 14867605

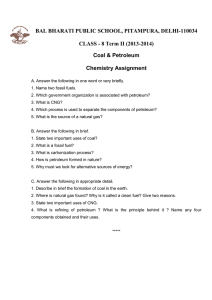

advertisement