�� ࡱ � ... ���� F �����

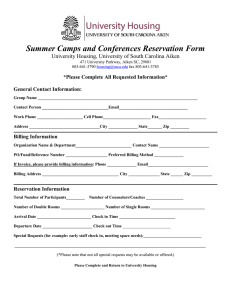

advertisement

�� ࡱ �

>

��

G

I

����

F

�����

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������� �

� �

�<

bjbjcTcT

4H

��

m

�

�

�

\

>

>

��

m

�

�

\

m

\

�

Z

�

q

�

�

m

�4

��

�

*

*

m

����

�

�

�

�

�

�

�

�

Z

\

\

c- �

! F

\

�

�

m

m

�

�

�

.

m

�

�

Z

�

�

m

�

$

�

\

�

�

�

�

m

�

\

�

�

:

,

"

�

�

����

F

,

K!

f

�

K!

�

•b����

0

�

�

�

�

�

\

�

�

�

�

�

�

�

�

�

����

����

����

����

����

����

����

���

�

����

����

����

����

����

����

����

����

����

K!

�

�

�

�

�

�

�

�

�

*

K!

�

\

m

-

(

�

�

�

3

:

FINANCIAL MANAGEMENT OF SERVICE

CENTERS

(Issued December 18, 1998)

I. PURPOSE

To establish Brandeis University's policies and procedures for the

financial management of service centers.

II. EFFECTIVE DATE

This policy is effective on July 1, 1999. The policy applies to

all costs incurred (or sponsored agreement budget periods

beginning) on or after that date.

III. DEFINITIONS

Service center

An activity that performs specific technical or administrative

services primarily for the internal operations of the University

and charges users for its services.

Auxiliary Enterprise

An activity that provided goods or services primarily to students,

faculty, staff and others for their own personal use, rather than

as a service to internal University operations. Examples of

auxiliary enterprises include residence halls, dining halls, and

bookstores. Auxiliary enterprises are not subject to this Policy

Statement.

Direct Operating Costs

All costs that can be specifically identified with a service

provided by a service center. These costs include the salaries,

wages and fringe benefits of University faculty and staff directly

involved in providing the service; materials and supplies;

purchased services; travel expenses; equipment rental; interest

associated with equipment acquisitions; etc. Note that for capital

expenses (equipment, software and furniture ~$500), the

depreciation should be charged as a direct expense, not the

acquisition cost.

Internal Service center Support Costs

All costs that can be identified to a service center, but are not

specific to a particular product or service offered by the center.

For example, the salary and fringe benefits of the service center

director are considered internal support costs.

Institutional Indirect Costs

The costs of administrative and supporting functions of the

University. Institutional indirect costs consist of general

administration and general expenses, such as executive management,

payroll, accounting and personnel administration; operations and

maintenance expenses, such as utilities, building maintenance and

custodial services; building depreciation and interest associated

with the financing of buildings; libraries; and special

administrative services provided to sponsored projects.

Unallowable Costs

Costs that can not be charged directly or indirectly to federallysponsored programs. These costs are specified in Circular A-21

issued by the U.S. Office of Management and Budget. Common

examples of unallowable costs include institutional advertising,

alcoholic beverages, bad debts, charitable contributions,

entertainment, fines and penalties, goods and services for

personal use, interest (except interest related to the purchase or

construction of buildings and equipment), selling and marketing

expenses. Please refer to the University's "Policy on Unallowable

Costs" for further information of these costs.

Applicable Credits

transactions that offset or reduce costs, such as purchase

discounts, rebates, allowances, refunds, etc. For purposes of

charging service center costs to federally-sponsored programs,

applicable credits also include any direct federal financing of

service center assets or operations (e.g., the direct funding of

service center equipment by a federal program).

Equipment

An item of tangible personal property having a useful life

exceeding one year and an acquisition cost of $500 or more.

Purchases under this amount are considered consumable supplies.

Billing Unit

The unit of service provided by a service center. Examples of

billing units include hours of service, tests performed, machine

time used, etc.

Billing Rate

The amount charged to a user for a unit of service. Billing rates

are usually computed by dividing the total annual costs of a

service by the total number of billing units expected to be

provided to users of the service for the year.

Surplus

The amount that the revenue generated by a service exceeds the

costs of providing the service during a fiscal year.

Deficit

The amount that the costs of providing a service exceed the

revenue generated by the service during a fiscal year.

IV. GENERAL POLICIES

All service centers are required to comply with the following:

To segregate costs in an account

Calculate rates annually

Charge rate for services as noted / defined below

Submit a copy of their semi-annual rate analysis to the Office of

Cost Analysis in the Controller's Office on (date) (or time after

rate defined)

Billing rates should be designed to recover the direct operating

costs of providing the services on an annual basis. For service

center with direct operating costs in excess of $100,000 annually,

the billing rates should also recover institutional indirect

costs. No costs other than the costs incurred in providing the

services should be included in the billing rates. The costs should

exclude unallowable costs and be net of applicable credits.

Billing rates should be computed annually at the start of each

University fiscal year. The rates should be based on the direct

operating costs of providing the services for the fiscal year just

ending and, where applicable, service center support costs and the

number of billing units for the fiscal year, or an estimate of the

costs and billing units of the new fiscal year.

The billing unit(s) should logically represent the type of service

provided.

The billing rate computation should be documented.

All users should be charged for the services they receive and be

charged at the same rates.

Separate accounts should be established in the University's

accounting system to record the actual direct operating costs of

the service center, internal service center overhead, revenues,

billings, collections, and surpluses or deficits. Documentation to

support the costs of the service center and records of units of

service should also be maintained.

The billing rates should be reviewed at least every six months and

adjusted where necessary.

Actual costs and revenues should be compared at the end of each

University fiscal year. Deficits or surpluses should be carried

forward as an adjustment to the billing rates of the following

year or the next succeeding year. Where feasible, the adjustments

may be made by increasing or decreasing the charges made to users

for the completed year, rather than through the �carry-forward�

adjustment process.

V. SERVICE CENTERS THAT PROVIDE MULTIPLE SERVICES

Where a service center provides different types of services to

users, separate billing rates should be established for each

service that represents a significant activity of the service

center. The costs, revenues, surpluses and deficits should also be

separately identified for each service. The surplus or deficit

related to each service should be carried forward as an adjustment

to the billing rate for that service in the following year or the

next succeeding year. The surplus from one service may be used to

offset the deficit from another service only if the mix of users

and level of services provided to each group of users is

approximately the same.

VI. COST ALLOCATION

Where separate billing rates are used for different services

provided by a service center, the costs related to each service

must be separately identified through a cost allocation process.

Cost allocations will also be needed where a cost partially

relates to the operations of a service center and partially to

other activities of a department or other organizational unit.

Depending on the specific circumstances involved, there may be

three categories of cost that need to be allocated: (a) costs that

are directly related to providing the services, such as the

salaries of staff performing multiple services, and (b) internal

service center support costs.

When cost allocations are necessary, they should be made on an

equitable basis that reflects the relative benefits each activity

receives from the cost. For example, if an individual provides

multiple services, an equitable distribution of his or her salary

among the services can usually be accomplished by using the

proportional amount of time the individual spends on each service.

Other cost allocation techniques may be used for internal service

center support costs, such as the proportional amount of direct

costs associated with each service, space utilized, etc. Questions

concerning appropriate cost allocation procedures should be

directed to the Office of Cost Analysis.

VII. EQUIPMENT PURCHASES

Expenditures for equipment purchases should not to be included in

the costs used to establish service center billing rates. The

costs should, however, include depreciation of the equipment.

A list of equipment used in service centers, with inventory

property control (tag) numbers, should be provided at the end of

each fiscal year to the Office of Cost Analysis. This information

is needed to assure that the equipment is excluded from the

depreciation portion of the University's indirect cost rates

charged to federally sponsored programs.

VIII. VARIABLE BILLING RATES

All users within the University should normally be charged the

same rates for a service center's services. If some users are not

charged for the services or are charged at reduced rates, the full

amount of revenue related to their use of the services must be

imputed in computing the service center's annual surplus or

deficit. This is necessary to avoid having some users pay higher

rates to make up for the reduced rates charged to other users.

This requirement does not apply to alternative pricing structures

related to the timeliness or quality of services. Pricing

structures based on time-of-day, volume discounts, turn-around

time, etc. are acceptable, provided that they have a sound

management basis and do not result in recovering more than the

costs of providing the services.

IX. SERVICES PROVIDED TO OUTSIDE PARTIES

If a service center provides services to individuals or

organizations outside of the University, the billing rates charged

to these users may be higher than the rates for internal

University users. Where applicable, sales tax must also be charged

to outside parties. Any amounts charged to outside parties in

excess of the regular internal University billing rates should be

excluded from the computation of a service center's surpluses and

deficits for purposes of making carry-forward adjustments to

future billing rates. Since revenue from outside parties may have

Unrelated Business Income Tax (UBIT) implications, the Office of

Cost Analysis should be consulted before arrangements for the

services are made.

X. TRANSFERS OF FUNDS OUT OF SERVICE CENTERS

It is normally not appropriate to transfer funds out of a service

center account to the University's general funds or other

accounts. If a transfer involves funds that have accumulated in a

service center account because of prior or current year surpluses,

an adjustment to user charges to compensate for the surpluses may

be necessary. The Office of Cost Analysis should be consulted

before the transfer is made.

XI. INVENTORY ACCOUNTS FOR PRODUCTS HELD FOR SALE

If a service center sells products and has a significant amount of

stock on hand, inventory records must be maintained. If the value

of the inventory is expected to exceed $50,000 at any point in the

year, a formal inventory account should be established. If the

inventory is not expected to exceed $50,000, internal inventory

records may be used in lieu of a formal account. A physical

inventory should be taken at least annually at the end of the

fiscal year and be reconciled to the inventory records. Inventory

valuations may be based on any generally recognized inventory

valuation method (e.g., first-in-first-out, last-in-first-out,

average cost, etc.).

XII. SUBSIDIZED SERVICE CENTERS

In some instances, the University, or a school or department, may

elect to subsidize the operations of a service center, either by

charging billing rates that are intended to be lower than costs or

by not making adjustments to future rates for a service center's

deficits. Service center deficits caused by intentional subsidies

cannot be carried forward as adjustments to future billing rates.

Since subsidies can result in a loss of funds to the University,

they should be provided only when there is a sound programmatic

reason and the reason is sufficiently documented.

XIII. RECORD RETENTION

Financial, statistical and other records related to the operations

of a service center must be retained for three years from the end

of the fiscal year to which the records relate. Records supporting

billing rate computations must be retained for three years from

the end of the fiscal year covered by the computations. For

example, if a billing rate computation covers the University

fiscal year ending June 30, 1999, the records supporting the

computation must be retained until June 30, 2002.

XIV. CONTACTS

If you have any questions about this policy, how to treat a

specific cost, or need information, please contact the Associate

Controller for Sponsored Programs at x6-4423, the Assistant

Controller of Cost Accounting at x6-4535, or the Internal Auditor

at x6-4516.

XV. TECHNICAL ASSISTANCE

The Office of Cost Analysis (x6-4535) is available to provide

technical assistance and advice on the financial management of

service centers. This assistance may be requested in connection

with the development of billing rates, cost allocation procedures,

equipment depreciation, record keeping, etc.

'

r

M

�

�

�

�

�

�

�

�

(

9

)

C

D

E

O

�

�

q

�

�

�

_

q

�

�

�

�

;

G

3

:

�

�

/

C

�

%! �# �# �#

) ��̸ۧ

�����������������������

������������q��

h�U 5 �CJ OJ PJ QJ \ �aJ

h G� 5 �CJ OJ PJ QJ \ �aJ

& h G� h G� 5 �CJ OJ PJ Q

J \ �aJ

h G� h G� CJ OJ PJ QJ aJ

& h G� h G� 6 �CJ OJ PJ Q

J ] �aJ

h�U 6 �CJ OJ PJ QJ aJ # h G� h G� 6 �CJ O

J PJ QJ aJ # h G� h G� 5 �CJ OJ PJ QJ aJ

,

)

D

E

Q

R

�

r

�

9

�

�

�

�

�

_

�

�

�

�

3

�d

E

�

�

�

�� [$ gd�U

�

�

�

�

�

�

�

�

�

d�

�

;

�

�

�

�

�

�

�

d�

�d

d�

�d [$ \$ gd G�

� gd G�

d�

�� gd G�

� a$ gd G�

�

�

�- [�# K% i&

) 0) �)

�

�

�

�

�

�

�

�

�

�

d�

�� gd�U

d�

�d �� [$ gd�U

&

F

d�

�d �d [$ \$ gd G�

$

>

'!

d�

�

�#

�

�

�

�

F

�

�

�

�

�

�

�

�

�

d�

�d

�d [$ \$ gd G�

d�

�

gd G�

&

F

d�

�d �d [$ \$ gd G�

)

) .) Q+ m+ �. �. �.

}1 �1 J3 K3 |3

6

6 46 u8 v8 �8 •: �: �: �;

�; �< �< �������������������������

h 0�

h G� h G� CJ OJ PJ QJ aJ

& h G� h G� 5 �CJ OJ PJ Q

J \ �aJ

h�U 5 �CJ OJ PJ QJ \ �aJ

�) Q+ o+ p+ �. �. �1

K3 ~3

6 66 v8 �8 �: �: �; �; �; �; �< �

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

gd G�

d�

�� gd G�

d�

�� gd�U

d�

� gd G�

d�

�d �� [$ gd�U

2 1�h :p 0� ��/

��=!�� "�� #�� $�� %�

�� ��

��

j

6

6

6

6

6

6

�

6

6

6

6

6

6

6

6

�

6

6

�

�

�

6

6

v

v

6

6

6

6

>

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

�

P

`

p

�

�

�

6

�

0

@

�

�

0

@

0

@

0

@

0

@

0

@

0

@

OJ PJ

6

P

P

P

P

P

P

QJ

6

`

`

`

`

`

`

_H

�

6

p

p

p

p

p

p

mH

�

�

�

�

�

�

nH

�

�

�

�

�

�

�

�

�

�

�

8

sH

�

v

6

6

6

6

6

6

6

6

�

v

�

v

�

v

�

v

v

6

6

6

6

6

6

6

6

6

6

6

6

6

�

6

h

H

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

�

6

2

�

�

�

�

�

�

�

�

X

tH

�

�

�

�

�

�

�

�

�

�

�

2

V

J

`��

~

J

6

6

v

6

6

6

6

6

6

6

6

6

6

�

(

0�

N o r m a l

d

��

CJ

_H

aJ mH

sH

D A ��� D

tH

F o n t

D e f a u l t

R i ��� R

P a r a g r a p h

0

T a b l e

N o r m a l

l 4�

a�

( k ��� (

0

N o

L i s t

�

4�

` ^`

� `

G� 0

N o r m a l

( W e b )

U �

4

d�

�d

�d [$ \$

CJ

OJ

PJ

QJ

^J

aJ

4

G� 0

H y p e r l i n k

>* ph � PK

! ��� �

xml���j�0 E����ж�r�(��ࡱIw},� �-j��4

t# bΙ{U���

[Content_Types].

��w�P� -

��T�U^h�d}㨫���)��*1P �'��

�^��W�� 0)��T�9< �l�#�� $yi} �� ; �~@��(���H��

��u�*

Dנz��/0�ǰ����

$��

X��3aZ�� ��,�D0 j~�3߶�b��~ i>� �� 3�\`�?�/� [� ��G�

�\•�!�-�Rk.�s�Ի�. .���a濭

?

�� PK

! �

��֧6

_rels/.rels���j�0

� ��}Q�� %v/��C/�} �(•h" � ��O�

� �����=������

�� ��C?�h�v=�•�Ʌ��% [xp��{۵_�Pѣ<�1 �H�0� ��O�R�Bd�

� �JE�4b$•��q_��� �6L�� R�7`�������0̞

O�•�,�E n7�Li�b��/�S���e��-е

����

�� PK

! ky� �

�

theme/theme/themeMa

nager.xml

�M

� @�}�w��7c�(Eb�ˮ�� C� AǠҟ����7�� ՛K

Y,�

�e�.���|,� ��H �,l�� ��x ɴ� �I�sQ}#Ր����֧ +�!�,�^�$

j=�GW���)�E�+&

8�

�� PK

! ����

P

theme/theme/theme1.xml

�YOo�6 � �w toc'v u��رM �n�-i���P�@�I} �� úa� �m�a[� 4��إ:l Я�GR��X^�6؊�>$

����-�����

!)O�^�r�C$�y@����-�/�yH*� �ࡱ)�ࡱ��ࡱ��UDb�`}"�q�ۋJ�ח

� �X^�)I`n�E� ��p) � ��li�V[]�1M<�� �� ��O�P��6r�=

���z�gb�I g�� u��S�e b���O����� �R�D۫

����qu

�g��Z����o~ٺlAp�lx�pT0�� �+[ } `j-�����zA� � �

2�F•���i�@�q�v�5֧\|��ʜ̭

N��le�X� ds��jcs�� ��7����f����

��W���+�Ն�7����`

� ��g�

Ș��J� ��j |��h(�K� �D-�� ��

dX� �iJ�؇(��x$(�

�:�� ;�˹!�

I_�T�� S

1�������?E� � ?������ ?ZBΪm���U/������?�~��� �xY����'���y5 �g&ࡱ/����ɋ�>��G �M�Ge��D��

� �� 3Vq%'#q� � ���$�8��K � ��)f�w 9:ĵ� �

x}r� x ��� �w�� �r�:\TZaG�*�y8I�j�bR��c|XŻ� ǿ�I

u3 KG�nD 1� N

IB �s�

��R��u��K>V�.E L+M2�#'�f��i

~�V�

�vl�{ u8��z� �H�

�*� ��:�( W� ☕

~ ��J��T�e\O*�tH G��HY�� }KN��P�*� ��˦ݾ-TѼ�9/#��A7�qZ

� �$*c?� � �qU ��n��w� N ��

%��O� �i�4

=3 ڗP��

����1�P�m

\\9� ���� ��� �Mؓ

�2a�D�]�;Yt�\ �?[x��

��g-���

eW�

�)6-r��C-S� j��

i�d �DЇA�Μ

���]�}Wr��|�]

IqbJ#x�꺃

6k���#��A�Sh��& ʌt(Q�% ��p%m��&]�caS l=�X���

����\P�1�Mh

�9� M��V�dDA��aV�B��[݈fJ�íP |8�

A� V^��f

�H��n���-�

�" �d>�z��n��NJ�

��>�ةb� ��&� ���2�� v����Ky ϼ���D:����,AGm��

\nz��i� Ù -� �.uχY C� 6�OMf��3o�r��$��5����N H�T[XF64

�T ,ќ���M0�E)`#�5�XY�`� ��;פ%�1�U�٥m;�R>QD

ք

�� ��D�cp�

U�'� �&LE�/p���m���%]�����8fi��r�S4�d

7y\�`�J�n�� ��I�

R� ��3U�~ 7 +��� ࡱ #��m�

q�BiD����

� ���i *�L6� 9��m�Y &�����i� ��HE��=(K&�N!V��.K�e�L

D�ĕ� {D

� ���v E ࡱde��NƟ�e�(�MN9ߜR�6 ����&3(��a����/D

��U�z�<�{ˊ�Y��ȳ ����V���)�9�Z[��4^n�• �5���!J� �?

��Q�3�eBo�C� � �� M

� ��m<�.�vp �� ���IY�f���Z�Y_p�[�=al�Y�}Nc͙

���ŋ4vfa��vl����'S ���A�8�|�*•u�{���%0ߟM0�7%��� �<�� �ҍ�

�� PK

!

ѐ��

'

theme/theme/_rels/themeManager.xml.rels��M

�0 ���w ooӺ �&݈Э� ��5

6?$Q��

�, .�a��i���� c2�1h� :�q��m��@R N��;d�`��o7� g�K(M&

$R(.1�r

'J��ЊT�8��V�"��AȻ�H�u}�� |�$�b {� �P����8 �g/]�QAs����(م#��L �[����

�� PK ! ��� �

[Content_Types].xmlPK

! �

��֧6

+

_rels/.relsPK ! ky� �

�

theme/theme/themeManage

r.xmlPK ! ����

P

�

theme/theme/theme1.xml

PK !

ѐ��

'

�

theme/theme/_rels/themeManager.xml.relsPK

]

�

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<a:clrMap

xmlns:a="http://schemas.openxmlformats.org/drawingml/2006/main"

bg1="lt1" tx1="dk1" bg2="lt2" tx2="dk2" accent1="accent1"

accent2="accent2" accent3="accent3" accent4="accent4"

accent5="accent5" accent6="accent6" hlink="hlink"

folHlink="folHlink"/>

�4

H

����

) �<

"

�

�) �<

!

#

�8

�

@ -�

��

� ��� �

�

�

�0

�(

�

�

�B

�

S

�-

�

�

�

�

��

p u r p o s e

v b r

t a D

�4

E

Q# �3 �4

)

0

�

�4

)

C

�

�

�4

3

(

)

q

r

�

�

/

/

E

E

�

�

'

'

�

�

�

�

!

! 0! 0! P# P# o# o# �& �&

�& �& }) }) �) �) J+ K+ ~+ ~+

.

. 6. 6. u0 v0

�0 �0 •2 �2 �2 �2 �3 �3 �3 �3 �3 �3 �4 �4

P#

?

�3

�

U\19�

h

� � � � � � � � �

�

YM� ��� � � � � � � � �

��

��� �

� ^�� `���CJ OJ QJ o(

��

�

�� ��� �

� ^�� `���CJ OJ QJ o(

o

�

�p ��� �

p ^�p `���CJ OJ QJ

o(

��

�

�@

��� �

@

^�@

`���CJ OJ QJ o(

��

�

�

��� �

^�

`���CJ OJ QJ o(

��

�

�� ���

�

� ^�� `���CJ OJ QJ o(

��

�

�� ��� �

� ^�� `���CJ OJ QJ o(

��

�

�� ��� �

� ^�� `���CJ OJ QJ o(

��

�

�P ��� �

P ^�P `���CJ

OJ QJ o(

��

�� ��� �

�

^�� `���CJ OJ QJ o(

��

�

��

��� �

� ^�� `���CJ OJ QJ o(

o

�

�p ��� �

p ^�p `���CJ OJ QJ o(

��

�

�@

��� �

@

^�@

`���CJ OJ QJ o(

��

�

�

��� �

^�

`���CJ OJ QJ o(

��

�

�� ���

�

� ^�� `���CJ OJ QJ o(

��

�

�� ��� �

� ^�� `���CJ OJ QJ o(

��

�

�� ��� �

� ^�� `���CJ OJ QJ o(

��

�

�P ��� �

P ^�P `���CJ

OJ QJ o(

��

�

YM

U\19

����������

��

�e�

�

�U

0� G� pO�

�4 �4

�@

�4 h

@ ��

U n k n o w

n ��

��

��

��

��

��

G-�

�*

�

�

T i m e s

N e w

R o m a n

5-�

�

S y m b o l

3.�

�*

�

�

A r i a l

7.�

� �{

@

�

C a l i b r i

?=�

�*

�

�

C o u r i e r

N e w

;

�

�

M a t h

�_

� �� B

"

q � ��

�

�,

�

h

_

W i n g d i n g s

A-�

C a m b r i a

��& ��&

�

�,

! �

� � � � ��20

2�

�

��

2

��

$P �

�

��

�4

�4

HX

���•���•���•���•���•���•���• G�

!

x

x

d e f a u l t

d e f a u l t

�Oh �� +'��0

l

�

�

�

(

��

�

�

����

�

�

�

�

4

@

L

T

default -

\

d

-

�

-

-

-

Normal.dotm Office

Word

@

�NZ

�,

default @

� F��� @

1

-

������

Microsoft

�

��

��՜.

��

+,�0

�

h

�

�

�

p

�

�

�

�

�

�

�

�

University

_

Brandeis

�4

-

-

Title

����&

'

(

)

*

+

,

.

/

0

1

2

3

4

5

����7

8

9

:

;

<

=

����?

@

A

B

C

D

E

��������H

������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

������������������R o o t

E n t r y

����

����

�

F

:g���� J

�

1 T a b l

e

!

"

#

$

����

����

%

W o r d D o c u m e n t

��������

S u m m a r y I n f o r m a t i o n

(

����

6

D o c u m e n t S u m m a r y I n f o r m a t i o n

8

������������

C o m p O b j

������������

y

������������

_!

4H

>

������������

���������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

����������������������������������������

� ��

����

�

F'

Microsoft Office Word 97-2003

Document

MSWordDoc

Word.Document.8 �9�q