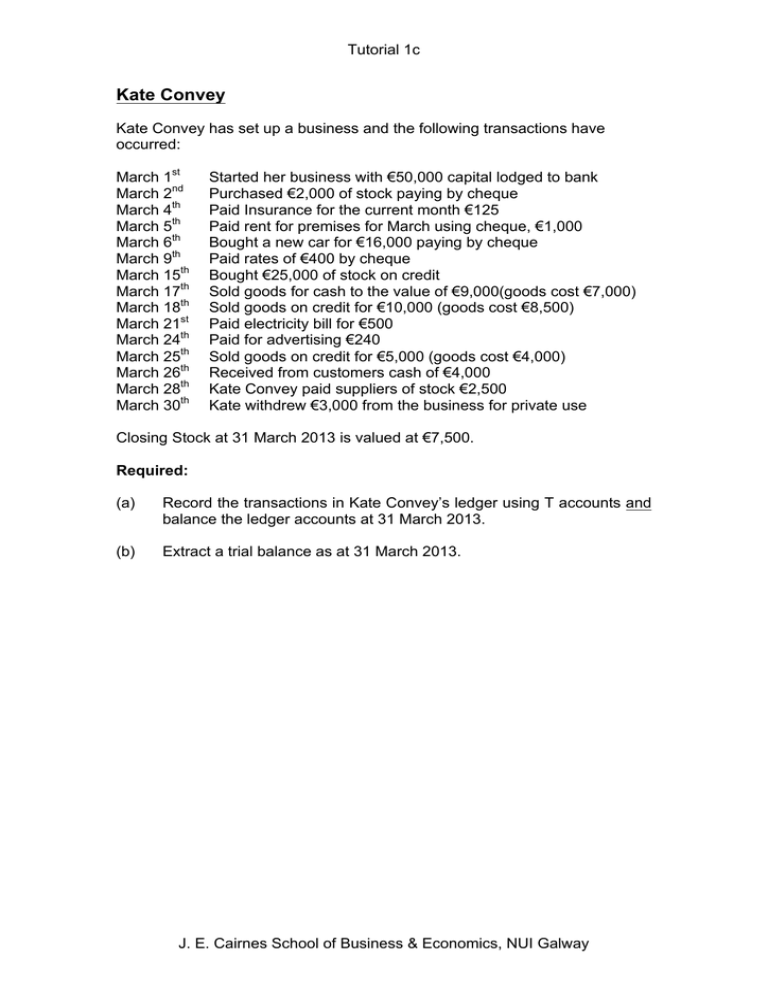

Kate Convey

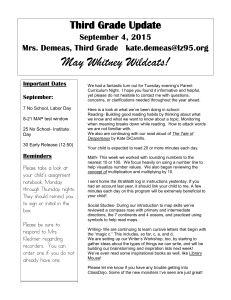

advertisement

Tutorial 1c Kate Convey Kate Convey has set up a business and the following transactions have occurred: March 1st March 2nd March 4th March 5th March 6th March 9th March 15th March 17th March 18th March 21st March 24th March 25th March 26th March 28th March 30th Started her business with €50,000 capital lodged to bank Purchased €2,000 of stock paying by cheque Paid Insurance for the current month €125 Paid rent for premises for March using cheque, €1,000 Bought a new car for €16,000 paying by cheque Paid rates of €400 by cheque Bought €25,000 of stock on credit Sold goods for cash to the value of €9,000(goods cost €7,000) Sold goods on credit for €10,000 (goods cost €8,500) Paid electricity bill for €500 Paid for advertising €240 Sold goods on credit for €5,000 (goods cost €4,000) Received from customers cash of €4,000 Kate Convey paid suppliers of stock €2,500 Kate withdrew €3,000 from the business for private use Closing Stock at 31 March 2013 is valued at €7,500. Required: (a) Record the transactions in Kate Convey’s ledger using T accounts and balance the ledger accounts at 31 March 2013. (b) Extract a trial balance as at 31 March 2013. J. E. Cairnes School of Business & Economics, NUI Galway