Distilling the reserve for uncertain tax positions: Lisa De Simone

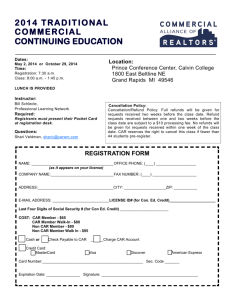

advertisement

Rev Account Stud (2014) 19:456–472 DOI 10.1007/s11142-013-9257-4 Distilling the reserve for uncertain tax positions: the revealing case of black liquor Lisa De Simone • John R. Robinson Bridget Stomberg • Published online: 1 October 2013 Springer Science+Business Media New York 2013 Abstract We examine the extent to which management discretion affects the reserve for unrecognized tax benefits. We analyze the financial statement disclosures of 19 paper companies that received a total of $6.4 billion in refundable excise taxes during 2009. All of these companies included the refunds in financial income, but 14 excluded all or part of the refunds from taxable income. Despite the magnitude and unprecedented nature of the exclusion, we find that only five of the excluding firms accrued a full reserve for an uncertain tax position, three firms accrued a partial reserve, and six firms did not accrue any reserve. This variation suggests managers enjoy wide latitude in applying the more likely than not standard for determining additions to the reserve. Our findings suggest that financial statement users should exercise caution when comparing tax reserves across companies. In addition, we find some evidence that income-increasing tax accrual decisions are related to characteristics generally associated with weak corporate governance. Keywords avoidance Uncertain tax positions FIN 48 Financial accounting Tax JEL Classification H25 M41 M48 L. De Simone Stanford Graduate School of Business, 655 Knight Way, Stanford, CA 94305, USA e-mail: LNDS@gsb.stanford.edu J. R. Robinson (&) University of Texas at Austin, 2100 Speedway, Austin, TX 78712-0211, USA e-mail: John.Robinson@mccombs.utexas.edu B. Stomberg University of Georgia, 255 Brooks Hall, Athens, GA 30602-6252, USA e-mail: Stomberg@uga.edu 123 Distilling the reserve for uncertain tax positions 457 1 Introduction Regulators and investors have long been interested in measuring the extent of corporate income tax avoidance and estimating the uncertain portion. Historically, however, the extent of uncertain tax avoidance was difficult to assess because firms were not required to make disclosures regarding the merits of income tax positions. The Financial Accounting Standards Board (FASB 2006) promulgated Accounting Standards Codification (ASC) Topic 740-10 (FIN 48) to address this lack of disclosure about uncertain tax avoidance as well as inconsistencies in accruing tax contingency reserves. FIN 48, effective in 2007, provides criteria for accruing and disclosing reserves for unrecognized tax benefits (UTB) arising from tax positions that managers deem to be uncertain. Our paper is the first to examine the comparability of FIN 48 accruals across firms. In doing so, we address the concern from the FIN 48 Post-Implementation Report (FAF 2012) that ‘‘judgments required to recognize and measure income tax uncertainties result in reporting information that is not comparable.’’ Complementary to concurrent work by Robinson and Schmidt (2012), who document inconsistencies in the clarity and completeness of FIN 48 disclosures, we explore whether management discretion in estimating accruals for UTBs weakens the comparability of FIN 48 reserves. We exploit an extraordinary setting in which a small group of firms in the same industry and during the same year entered into a unique and material transaction lacking direct legal authority as to the appropriate tax treatment. Although our research design sacrifices the breadth associated with large sample empirical studies, this near ceteris paribus setting allows us to better isolate the effect of management discretion on financial reporting under uncertainty. Understanding whether management discretion influences UTB accruals is important for several reasons. First, managers must exercise judgment to determine whether tax positions are uncertain, as well as the amount of uncertain tax benefits most likely to be sustained upon audit. Under FIN 48, a tax position is uncertain if management cannot conclude that the associated benefits are ‘‘more likely than not’’ to be sustained upon audit. If these judgments vary in consideration of a nearly identical transaction, then even a faithful application of a more likely than not standard will result in a wide range of reporting outcomes, potentially resulting in financial statements that reflect managerial incentives rather than the facts and circumstances of the transaction (Fields et al. 2001). Because the FASB uses a more likely than not standard to gauge uncertainty in many contexts other than taxes, our findings have implications for whether managers’ latitude to manipulate accruals allows them to disguise the nature of a transaction. Second, our evidence highlights the interplay between tax and financial reporting aggressiveness to help investors, regulators, and researchers better evaluate corporate tax avoidance. Our unique setting offers insights into whether firms that report aggressively for tax purposes also report aggressively for financial purposes (Frank et al. 2009) and allows us to empirically explore the conjecture that UTB accruals depend jointly on tax avoidance and financial reporting behaviors (De Waegenaer 2010; Hanlon and Heitzman 2010). Finally, the Internal Revenue 123 458 L. De Simone et al. Service (IRS) should be interested in understanding how latitude in management judgment affects the accuracy and completeness of the UTB reserve because this is the basis for recently required tax return disclosures. We identify 19 public companies that claimed a refundable excise tax credit for alternative fuel mixtures during 2009. The credit generated over $6.4 billion of total benefits for our sample firms, all of which increased reported financial income. The materiality and singular nature of these benefits necessitated disclosure of detailed information that reveals firms’ reporting choices. We examine these companies’ SEC filings to determine (1) the amount of refunds related to the alternative fuel mixture credit included in taxable income and, for firms excluding some or all of the refunds, (2) the amount of the UTB reserve established for this uncertain tax position. Because our setting allows us to hold constant potential sources of variation such as the nature of the transaction, industry, time, and economic environment, we posit that any variation in UTB reserves results from differences in management discretion. FIN 48 indicates that managers must evaluate any position not based on ‘‘clear and unambiguous tax law’’ before recognizing any corresponding benefit in the financial statements.1 Because no direct authority exists addressing the proper tax treatment of excise tax credit refunds, we conclude that excluding these amounts from taxable income is an uncertain tax position subject to FIN 48. This conclusion is supported by the wide variation we document in firms’ tax reporting of the refunds: five companies include the entire alternative fuel mixture credit refund in taxable income while the remaining 14 firms exclude all or part it. Therefore, we expect firms excluding the refunds from taxable income to reserve for some portion of the associated tax benefits, even if they do not reach identical conclusions about the amount of reserve to accrue. However, despite holding the economics of the transaction and the relevant legal authorities (nearly) constant, we document considerable variation in whether these 14 firms accrue a UTB reserve. Six firms establish a reserve for the entire tax benefit, five firms do not accrue any reserve, and three firms accrue a reserve for only a portion of the tax benefit.2 Because our setting controls for other potential sources of variation, we conclude management discretion is the source of the inconsistency in accruals for uncertain tax positions. We explore potential sources of variation in management discretion regarding the refunds. Firms had the option to receive the refund either as a credit against income taxes, a direct cash payment, or a mix of credit and cash. We find some evidence 1 Taxpayers often face ambiguity in applying the tax law even when engaging in routine transactions. For example, Congress permits an income tax credit for qualified research and development expenditures. Yet the precise definition of which expenditures qualify has been a matter of extensive litigation (for example, see Union Carbide Corp. v. Comm. (2nd CIR, 2012) 110 AFTR 2d 2012-5837 affm TC Memo 2009-050). Additionally, prior to the July 2006 temporary regulations governing intercompany service transactions, there were no prescribed methods to determine arm’s length transfer prices for services. Thus multinational entities faced tax law ambiguity when pricing routine intercompany service transactions. 2 We do not take any position on the proper income tax treatment of the credit refunds. Rather, we argue that there is an absence of legal authority for excluding the refunds. Also, note that the amount of the excise tax refund is not uncertain because all firms in our sample received IRS approval to quality for the credits. 123 Distilling the reserve for uncertain tax positions 459 that the form of payment influenced the tax treatment of the refunds: all of the firms that received the entire refund as a credit excluded the amount from taxable income, whereas only five of the 10 firms that received the refunds in cash excluded them from taxable income. We also find that firms excluding the refunds from taxable income have smaller net operating loss carryforwards. We explore potential sources of variation based on corporate governance, expecting firms with weak corporate governance in the form of strong, highly compensated CEOs to be associated with aggressive reporting. Consistent with expectations, firms that excluded the refunds from taxable income but did not establish a full reserve have, on average, lower levels of management and block ownership, greater analyst following, and more highly compensated, stronger CEOs than firms that did establish a full UTB reserve. This evidence is consistent with a positive association between weak corporate governance and aggressive financial reporting. Finally, despite our expectation that external auditors would require uniform application of the more likely than not standard for their clients, we document significant variation in UTB accruals among firms with the same financial statement auditor, surprisingly even among auditors working from the same office location. Overall, our findings suggest that UTB accruals do not comparably reflect uncertain tax avoidance across firms. This research provides a unique window for understanding and illustrating problems in applying an important accounting standard. We contribute to the growing literature on discretion in financial reporting and disclosure by offering direct evidence that the discretion afforded by FIN 48 allows managers to reach conflicting conclusions about the appropriate recognition of tax benefits, even when faced with a nearly identical set of facts and circumstances. We also provide evidence on the interaction between tax and financial reporting aggressiveness. Not all firms that reported aggressively for tax purposes also reported aggressively for financial reporting purposes. Therefore financial statement users must jointly consider tax and financial reporting incentives when evaluating the merits of a company’s tax disclosures. As with all small sample studies, we recognize the limitations of our analysis and urge readers to exercise caution when interpreting or generalizing our empirical results. 2 Background 2.1 Alternative fuel mixture credits The American Jobs Creation Act of 2004 created the alternative fuel mixture credit to encourage the development of alcohol and biodiesel fuels. This credit is a refundable excise tax credit equal to 50 cents per gallon of alternative fuel produced. Beginning in late 2008, paper companies recognized an opportunity to qualify for the credit by modifying a byproduct of paper pulp processing called black liquor. Firms began receiving IRS approvals for the refunds in early 2009, and by mid-2009 every company in the paper processing industry was receiving refunds. Because Congress has enacted very few refundable credits, no statutory or regulatory 123 460 L. De Simone et al. guidance exists to prescribe, or even address, the proper income tax treatment of refunded excise taxes. Therefore, although all 19 firms in our sample reported the refunds in financial income, the companies did not consistently include these amounts in taxable income. In the absence of direct guidance, the relevant legal authorities suggest that refunds should be included in taxable income.3 However, two arguments exist for excluding refunds from taxable income, both of which are subject to criticism. The first relies on treating the refundable tax credits as nontaxable ‘‘overpayments’’ in accordance with IRC Section 6401(b)(1). The second argument analogizes the credit to the earned income credit, another refundable credit the tax treatment of which has never been addressed by the IRS or the courts. Firms receiving refunds related to alternative fuel mixtures could interpret the absence of administrative authority regarding the earned income credit as evidence of an informal IRS policy excluding all refundable credits from taxable income. Given the absence of direct legal authority and the competing interpretations of existing statutes, we conclude that excluding refunds from taxable income is an uncertain tax position. 2.2 UTB as a measure of tax avoidance FIN 48 requires firms to (1) identify uncertain tax positions, (2) recognize tax benefits associated with only those positions that are more likely than not to be sustained upon audit, and (3) measure the benefit to be recognized in the financial statements as the ‘‘largest amount of tax benefit that is greater than 50 % likely of being realized upon ultimate settlement.’’ There can be uncertainty about whether a position is allowed or about the amount of the tax benefit derived from the position that the taxpayer will retain upon audit. A tax position can also be uncertain because the relevant tax law is ambiguous or undeveloped. Alternatively, the sustainability of a position may hinge on the unique facts and circumstances surrounding the transaction. When determining whether uncertain tax positions are more likely than not to be sustained, management must evaluate the technical merits of each position and assume the relevant taxing authority will audit each position with full knowledge of all pertinent information.4 The difference between the cash benefits generated from the tax return position and the amount recognized in the financial statements is the unrecognized tax benefit. If the position does not meet the more likely than not threshold, no benefit is recognized (i.e., none of the claimed tax benefit is reflected in financial income). Accounting researchers have begun to examine the merits of using the current year addition to UTB as a measure of uncertain or aggressive tax avoidance with mixed results (e.g., Cazier et al. 2010; Frischmann et al. 2008; Lisowsky and 3 IRC Section 61 states that taxpayers must include ‘‘income from all sources derived’’ in taxable income. Treasury Regulation Section 1.61-1(a) emphasizes that this presumption applies to all forms of income ‘‘unless excluded by law.’’ 4 FIN 48 permits management to consider a wide range of possible factors when assessing the probability that a position will be sustained, including tax opinions from outside advisors and widely understood administrative practices (ASC topic 740-10-25-7b). 123 Distilling the reserve for uncertain tax positions 461 Schmidt 2012). As with other empirical measures of tax avoidance derived from financial statements, the primary drawback of using components of the UTB to measure tax avoidance is that they are self-reported numbers subject to accounting choice and potential manipulation by management (Fields et al. 2001). Tax accruals are especially attractive for earnings management because of their discretionary nature and timing of calculation just prior to earnings announcements (Dhaliwal et al. 2004). Robinson and Schmidt (2012) examine the completeness and clarity of FIN 48 disclosures and find that, although larger firms have more complete disclosures, the disclosures lack clarity. Hence, given the role of management judgment in assessing the more likely than not threshold for UTBs, it remains to be seen whether UTBs consistently depict tax uncertainty. 3 Empirical method and results 3.1 Determining the magnitude of refunds We identify 19 public companies that disclosed receipt of alternative fuel mixture credit refunds during 2009 in their SEC filings.5 The IRS notified all firms in 2009 that their alternative fuel mixtures qualified for the credit and firms began submitting refund claims. To facilitate our analysis, we divide the sample firms into three groups. The Taxable Group consists of five firms that claimed the most conservative (certain) tax position and treated the refunds as taxable income. The Reserve Group consists of six firms that excluded the refunds from taxable income but accrued a full UTB reserve. This group took an aggressive (uncertain) tax reporting position but a conservative financial reporting position. Finally, the Benefit Group consists of eight firms that excluded the refunds from taxable income and recognized some or all of the tax benefits from the exclusion in their financial statements. This group took aggressive tax and financial reporting positions. We compare the information across these three groups to isolate the factors that contribute to reporting behavior but urge caution when generalizing from these small sample descriptive data. Column (1) of Table 1 presents the magnitude of the refunds, which was material for all 19 firms in our sample. Sample firms received over $6.4 billion in total refunds, ranging from a high of $2.1 billion (International Paper) to a low of $18 million (Wausau Paper). The financial statement benefit of these refunds was significant for companies in the struggling paper industry where, in 2008, 12 firms in our sample reported financial losses. Columns (2) and (3) of Table 1 present information on the materiality of the refunds. On average, refunds comprised over 88 % of the increase in pre-tax income from 2008 to 2009 and over 10 % of sales in 5 We identify 21 firms by searching the Edgar database for ‘‘alternative fuel mixture credit’’ and ‘‘black liquor,’’ and by examining public filings for firms in pulp paper SIC and NAICS industry codes. We exclude Appleton, an S corporation not subject to taxation, and Sappi, which reports using IFRS, thereby making it impossible to ascertain the tax status of the refunds. For Rock-Tenn and Buckeye Technology, two companies with fiscal years not ending on December 31, we estimate financial information over the 12 months ending on December 31, 2009, using quarterly and annual reports. 123 462 L. De Simone et al. 2009. Notably, six firms would have reported a pre-tax loss in 2009 if not for the alternative fuel mixture credit refunds. 3.2 Tax treatment of the refunds Column (4) of Table 1 presents the payment form and Column (5) presents the tax treatment of refunds for each firm. In SEC filings, all firms disclosed the payment form but not all firms explicitly disclosed the tax treatment. For firms that did not explicitly disclose the tax treatment of the refunds, we determine the tax treatment by examining tax footnote disclosures, particularly the effective tax rate reconciliation. We classify firms failing to disclose a reconciling item related to the alternative fuel mixture credit as having included the refunds in taxable income.6 Consistent with the absence of legal authorities and the uncertain nature of tax credit benefits, we find a wide disparity in the tax treatment of the refunds: five firms treated refunds as fully taxable while the remaining 14 firms excluded all or part of the refunds from taxable income. The form of payment influenced the tax treatment of refunds and reflects the apparent weakness of the legal arguments for excluding cash payments from taxable income. All firms that received at least some portion of the refunds as income tax credits excluded these amounts from taxable income. In contrast, only half of the firms that received refunds exclusively in cash excluded the amounts from taxable income. Moreover, every firm that elected to receive a mix of cash and credits initially opted to receive only cash payments but switched to credits during the year. Perhaps firms made this decision strategically to maximize the probability of retaining some portion of tax benefits upon IRS audit. Alternatively, the decision could be related to diminished liquidity needs. 3.3 Uncertain tax treatment for refunds Table 1 also presents information about the tax and financial statement benefits realized. Specifically, Column (6) presents the amount of credit excluded from taxable income for the 14 firms that did not treat the refunds as taxable. In Column (7), we calculate the Maximum federal tax benefit associated with excluding the refunds from taxable income as 35 % of the amount excluded. Column (8) reveals the amount of UTB addition firms accrued related to excluding the refunds. Eight of these 14 firms explicitly disclose the amount of UTB addition related to the exclusion of refunds, and two firms (Abitibibower and Glatfelter) state that ‘‘there is uncertainty’’ regarding the income tax status of the refunds. For the six firms that did not disclose the portion of the UTB addition related to the refunds, we estimate 6 Excluding the credits from taxable income would result in a permanent book-tax difference reducing the effective tax rate. Under Regulation S-X Rule 4-08(h)(2), reconciling items must be itemized if the item is ‘‘significant in appraising the trend of earnings’’ or if it exceeds 5 % of the amount computed by multiplying the income before tax by the applicable statutory federal income tax rate. Only Newpage Holding disclosed that it currently intends to include credits in gross income (Newpage 2009 10K filing, p. 81). 123 Refund amount (1) Refund/ sales (%) (2) Refund/ DPTI (%) (3) 18 Wausau Paper 7 2 4 18 10 17 28 102 224 a Cash Cash Cash Cash Cash T T T T T Tax treatment (5) 276 218 212 178 171 Abitibibowater Temple Inland Boise Kapstone Paper Clearwater Paper 14 28 11 6 6 6 66 178 90 65 76 128 Cash Mix Cash Mix Cash Cash 503 215 Rayonier 654 Smurfit Stone Container Domtar 2,063 International Paper 18 9 12 9 119 47 22 88 Credit Mix Cash Mix Benefit Group—firms excluding refunds and recognizing tax benefits 380 Meadwestvaco TF TF TF PT TF TF TF TF TF TF Full Reserve Group—firms excluding refunds and accruing a full UTB reserve 239 147 Graphic Packaging 304 Newpage Holding Verso Paper 344 Weyerhaeuser Form of refund (4) Magnitude and reporting of alternative fuel mixture credits Taxable Group—firms including refunds in taxable income Table 1 215.0 503.0 654.0 379.0 170.6 178.3 211.5 218.0 276.0 380.0 Excluded refund (6) 75.3 176.1 228.9 132.7 59.7 62.4 74.0 76.3 96.6 133.0 Maximum federal tax benefit (7) 15.0 162.0 0.0 0.0 59.7 62.4 74.0 76.3 96.6 133.0 N/A Refund UTB addition (8) 60.3 14.1 228.9 132.7 0.0 0.0 0.0 0.0 0.0 0.0 Tax benefit recognized (9) 80 8 100 100 0 0 0 0 0 0 Percent recognized (%) (10) Distilling the reserve for uncertain tax positions 463 123 123 127 108 76 Buckeye Technologies Glatfelter Rock-Tenn 3 9 18 8 Refund/ sales (%) (2) 40 174 50 164 Refund/ DPTI (%) (3) Credit Mix Mix Credit Form of refund (4) TF TF PT TF Tax treatment (5) 76.3 107.8 85.9 176.3 Excluded refund (6) 26.7 37.7 30.0 61.7 Maximum federal tax benefit (7) 0.0 10.6 0.0 0.0 Refund UTB addition (8) 26.7 27.1 30.0 61.7 Tax benefit recognized (9) 100 72 100 100 Percent recognized (%) (10) a Newpage Holding experienced a decrease in pre-tax income from 2008 to 2009. The absolute value of Newpage Holding’s credit as a percent of the change in pre-tax income is 126 % Refund amount is the alternative fuel mixture credit refund ($M) accrued during calendar 2009. Refund/sales is the ratio of refund to sales. Refund/DPTI is the ratio of refund to the change in pre-tax income from 2008 to 2009. In Column (4), Cash (Credit) indicates that all refunds were received in cash (income tax credits), and Mix indicates a mix between Cash and Credit. In Column (5) T (TF) indicates that refunds were included in (excluded from) taxable income, and PT indicates that a portion was included in taxable income and a portion excluded. Column (6) reports the estimated amount of refund excluded from taxable income. Maximum federal tax benefit is the excluded refund times the statutory tax rate of 35 %. Refund UTB addition was either explicitly disclosed or determined by comparing the 2009 UTB addition to the maximum tax benefit and UTB additions in prior years. Tax benefit recognized is the Maximum federal tax benefit less refund UTB addition, and Percentage recognized is the ratio of the tax benefit recognized to the maximum tax benefit 176 Refund amount (1) Packaging Corporation Table 1 continued 464 L. De Simone et al. Distilling the reserve for uncertain tax positions 465 the amount by comparing the 2009 UTB addition to the potential tax benefit of excluding the refunds and to prior year UTB additions.7 The wide disparity in the portion of tax benefits recognized in the financial statements is apparent in Table 1. Column (9) shows the tax benefit recognized in the financial statements as the difference between the tax savings from excluding the refunds from taxable income and the portion of the UTB addition related to the refund exclusion. Of the 14 firms that excluded the refunds from taxable income, five did not establish any UTB reserve and therefore recognized 100 % of the tax benefit claimed in their financial statements. On the opposite end of the spectrum, six firms fully reserved for the tax benefits related to excluding the refund and therefore recognized no financial statement benefits associated with the refund exclusion. The remaining three firms established partial reserves. This disparity exists despite holding constant the form of the payment and tax treatment. Smurfit Stone and MeadWestvaco both claimed cash refunds and excluded the amounts from taxable income. Yet Smurfit Stone did not accrue any reserve for the tax benefits while MeadWestvaco accrued a full reserve. The information presented in Table 1 reinforces four important conclusions. First, the variation in the tax treatment of the refunds is consistent with the conclusion that excluding these amounts from taxable income is an uncertain tax position. Second, the disparity between the tax benefits claimed and those recognized in the financial statements illustrates the wide latitude management has in applying the more likely than not standard in FIN 48. Third, the amount of tax benefits recognized in the financial statements is the joint result of tax and financial reporting decisions. Hence UTB reserves reflect both the uncertainty (riskiness) of the tax position and the extent to which managers are unwilling to vouch for the tax position by claiming the benefits for financial reporting purposes. Finally, not all firms that reported aggressively for tax purposes (i.e., excluded the refunds) also reported aggressively for financial purposes (i.e., recognized the uncertain tax benefits). 3.4 Analyses of firm characteristics Because we observe variation in firms’ tax and financial reporting of the refunds, we examine factors that could have influenced managers’ decisions. Table 2 illustrates that the primary differences in the financial characteristics between the three groups relate to cash flows and tax attributes. Firms in the Taxable Group were severely cash constrained, as evidenced by an average free cash outflow of $425 million in 2008 reported in Column (1).8 Alternative fuel mixture credit refunds represented a much larger portion of 2009 cash flows from operations for these firms (mean of 248 %) than other firms. Taxable Group firms also reported the highest average NOL carryforwards in 2008 (mean of $1,050 million) and increased reported NOL 7 For example, Packaging Corporation discloses in its effective tax rate reconciliation that $62 million of tax benefits were due to excluding credit refunds. However, the 2009 UTB addition was only $0.6 million, and this amount is comparable to the 2008 UTB addition of $1.4 million. Therefore we conclude that Packaging Corporation did not record any UTB addition for the credit refund in 2009. 8 We define free cash flows as cash flow from operations less capital expenditures. 123 466 Table 2 L. De Simone et al. Financial characteristics FCF 2008 (1) Refund/CFO (%) (2) NOLs 2008 (3) D NOLs (4) Taxable Group—firms including refunds in taxable income Weyerhaeuser Newpage Holding Verso Paper Graphic Packaging Wausau Paper Average -1,942 a 405 1,110 -105 691 2,906 243 -27 135 413 -1 1 150 1,524 -88 -51 16 -425 248 0 0 1,050 253 Full Reserve Group—firms excluding refunds and accruing a full UTB reserve Meadwestvaco 88 43 517 -63 Abitibibowater -606 600 1,471 434 Temple Inland -346 34 0 0 17 46 37 114 Boise Kapstone Paper 24 89 0 0 Clearwater Paper 21 76 0 1 -134 148 338 81 -37 Average Benefit Group—firms excluding refunds and recognizing tax benefits International Paper 1,667 44 762 Smurfit Stone Container -196 61 520 976 34 64 734 -192 5 Domtar Rayonier 1 70 13 Packaging Corporation 136 58 0 0 Buckeye Technologies 43 92 69 -2 1 66 96 -4 157 18 0 0 230 59 274 93 Glatfelter Rock-Tenn Average FCF is free cash flows, defined as cash flow from operations less capital expenditures. Refund/CFO is the ratio of refund to cash flow from operations, where refund is alternative fuel mixture credits ($M) accrued during calendar 2009. NOLs are net operating loss carryovers ($M and excluding foreign NOLs, except for Abitibibowater) reported for fiscal year 2008. DNOLs is the change in NOL carryovers from 2008 to 2009 a Weyerhaeuser reported negative cash from operations of $2.123 million in 2009. Absent the credits Weyerhaeuser would have reported negative $2.467 million of cash from operations carryforwards in 2009 despite including the refunds in taxable income. Thus the decision to treat the refunds as taxable was likely jointly motivated by both liquidity concerns and the ability to use an NOL carryover to absorb the additional taxable income. To assess possible determinants of the tax and financial reporting decisions, we also consider corporate governance and managerial incentives following Desai et al. (2007) and Cazier et al. (2010). Table 3 focuses on external monitoring and managerial incentive alignment. Blockholders and financial analysts can both serve as external monitors. Blockholdings represent total common stock held by 123 Distilling the reserve for uncertain tax positions Table 3 467 Corporate monitoring and incentives Block (%) (1) Analysts (2) CEO (%) (3) D&O Group (%) (4) Audit firm (5) Auditor city (6) KPMG Seattle Taxable Group—firms including refunds in taxable income Weyerhaeuser 29.9 18 0.1 2.6 Newpage Holding 96.7 0 1.6 3.5 PwC Dayton Verso Paper 69.8 3 0.9 2.8 Deloitte Memphis Graphic Packaging 91.8 1 0.2 19.4 E&Y Atlanta Wausau Paper 38.9 3 1.6 9.0 Deloitte Milwaukee 65.4 5.0 0.9 7.5 Average Full Reserve Group—firms excluding refunds and accruing a full UTB reserve Meadwestvaco 33.3 12 1.9 2.5 PwC Richmond Abitibibowater 45.5 0 0.9 2.1 PwC Montreal Temple Inland 10.0 13 0.0 8.1 E&Y Austin Boise 34.8 3 2.2 17.2 KPMG Boise E&Y Chicago KPMG Seattle Kapstone Paper Clearwater Paper Average 9.9 0 9.5 18.0 22.1 0 0.3 1.2 25.9 4.7 2.5 8.2 Benefit Group—firms excluding refunds and recognizing tax benefits International Paper 27.7 15 0.4 1.1 Deloitte Memphis 5.4 0 0.7 1.5 E&Y St. Louis Domtar 35.5 21 0.1 0.5 PwC Charlotte Rayonier 16.6 7 0.3 2.3 Deloitte Jacksonville Packaging Corporation 21.5 10 0.6 1.8 E&Y Chicago Buckeye Technologies 29.6 3 1.2 7.5 E&Y Memphis Glatfelter 26.2 2 1.3 2.9 Deloitte Philadelpia 6.4 5 0.8 7.3 E&Y Atlanta 7.9 0.7 3.1 Smurfit Stone Container Rock-Tenn Average 21.1 Block is total stock ownership by institutional investors owning 5 % or more of common stock. Analysts are the number of equity analysts listed on IBES. CEO and D&O Group represent stock ownership by the CEO and directors and officers, respectively. Ownership data collected from 2008 and 2009 proxy statements. Auditor information collected from 2008 and 2009 proxy statements institutional investors owning 5 % or more of common stock. The mean blockholdings varies across the sample, with Taxable firms having the highest average level of blockholdings (65 % of outstanding shares). Benefit Group firms and Reserve Group firms have similar average blockholdings of 21 and 26 % respectively, suggesting that aggressive tax reporting may be mitigated by high levels of institutional ownership. Financial analysts can influence financial reporting in two different ways. First, similar to blockholdings, analyst following can represent outside monitoring (Jensen and Meckling 1976; Healy and Palepu 2001). 123 468 L. De Simone et al. Second, analyst following has been used to represent external pressure to manage earnings (Lin and McNichols 1998; Michaely and Womack 1999). The average number of analysts is similar for Taxable and Reserve firms (5.0 and 4.7, respectively) but is markedly higher for Benefit firms (7.9). This pattern is consistent with the conjecture that pressure from analysts to meet earnings expectations results in more aggressive financial reporting. Columns (3) and (4) present information about the ownership of the CEO and the directors and officers, which also influences managerial discretion because errors in judgment can have serious wealth consequences for these individuals. In our sample, the average stock ownership levels for the CEO, directors, and officers are lowest for the firms recognizing credit tax benefits in their financial statements (Benefit Group). When ownership of the CEO, directors, and officers are aggregated, firms in the Benefit Group have an average of 3.8 % compared to 8.4 % for the Taxable Group and 10.7 % for the Reserve Group. This difference is consistent with Warfield et al. (1995) who report a positive association between managerial ownership and financial reporting quality. In Columns (5) and (6), we examine the role of the financial statement auditor in constraining management discretion. Although auditors are not responsible for determining whether their clients’ tax return positions are supported by substantial authority, they likely played an important role in management’s tax and financial reporting decisions regarding the alternative fuel mixture credit refunds. This is clear from Rock-Tenn’s response to an SEC inquiry about the uncertainty of the credit tax position. Management noted in a letter to the SEC dated March 3, 2010: Our conclusion to exclude [alternative fuel credit refunds] from taxable income … is supported by the opinion we received from our tax advisor, the review of this conclusion by our outside tax counsel and the concurrence of our external auditor. Despite the material amounts involved and the absence of legal precedent, we document inconsistency in both the tax and financial reporting decisions of the sample firms with the same Big 4 auditor. For example, Graphic Packaging and Smurfit Stone are both audited by E&Y, and both received cash refunds, yet while Graphic included the refunds in taxable income, Smurfit Stone did not. Each audit firm had at least one client that included refunds in taxable income and multiple clients that excluded these refunds. Moreover, every audit firm had at least two clients that excluded refunds despite receiving all or part of the refunds in cash. Regarding the financial reporting decision, auditors allowed managers significant latitude in determining whether the exclusion of refunds required the accrual of a UTB. We find the most consistent financial reporting decisions among firms audited by PwC and KPMG. Notably, none of the firms audited by KPMG recognized any tax benefits related to the refunds in their financial statements. This pattern corroborates anecdotal evidence suggesting that KPMG imposed more conservative financial reporting requirements due to recent tax shelter litigation.9 Of the three 9 We thank Ryan Wilson for helpful comments resulting from discussions with a tax department employee at one of the sample firms. 123 Distilling the reserve for uncertain tax positions Table 4 469 CEO compensation CEO also chairman? Total CEO compensation CEO bonus (1) 2008 (2) 2009 (4) 2009 (3) CEO/CFO (5) Taxable Group—firms including refunds in taxable income Weyerhaeuser No 4,877 4,871 0 3.37 Newpage Holding No 6,918 2,249 200 0.54 Verso Paper No 3,444 1,467 225 2.60 Graphic Packaging No 2,900 4,061 1,780 2.36 Wausau Paper Yes 2,526 4,751 1,161 3.83 1:4 4,133 3,480 673 2.54 Average Full Reserve Group—firms excluding refunds and accruing a full UTB reserve Meadwestvaco Yes 6,720 6,108 2,216 3.18 Abitibibowater Yes 3,365 1,095 0 1.85 Temple Inland No 1,905 5,616 1,401 2.32 Boise No 1,397 2,555 1,320 2.69 Kapstone Paper No 917 934 0 1.99 Clearwater Paper Yes 844 3,832 1,537 2.45 3:3 2,525 3,357 1,079 2.41 Average Benefit Group—firms excluding refunds and recognizing tax benefits International Paper No 5,866 12,164 2,727 4.95 Smurfit Stone Container Yes 5,693 5,614 2,079 10.02 Domtar Yes 5,396 4,665 1,944 2.99 Rayonier Yes 4,799 6,104 1,313 3.19 Packaging Corporation Yes 6,691 6,318 1,707 4.05 Buckeye Technologies Yes 1,369 1,366 235 3.19 Glatfelter Yes 2,135 4,196 952 4.01 Rock-Tenn Yes 8,049 11,010 1,472 4.76 7:1 5,000 6,430 1,554 4.64 Average Column (1) indicates whether the CEO and chairman of the board positions are combined. Total CEO Compensation is the amount paid to the CEO ($Thousands) for the fiscal year. CEO bonus includes cash bonus and other non-equity incentive compensation awarded to the CEO in 2009 ($ in Thousands). CEO/ CFO is the ratio of total compensation paid to the CEO to total compensation paid to the chief financial officer (CFO) in 2009. All data collected from 2008 and 2009 proxy statements companies audited by PwC that excluded refunds, only Domtar failed to accrue a UTB for the full tax benefit. Even then, Domtar recognized only $14 million of the $176 million tax benefits claimed. In contrast, firms audited by Deloitte that excluded the refunds (International Paper, Glatfelter, and Rayonier) recognized all or a substantial portion of the tax benefit in their financial statements. Finally, although two of E&Y’s clients (Temple Inland and Kapstone Paper) accrued a full UTB for excluded refunds, the other four clients recognized the maximum tax benefit from the exclusion. The most aggressive of these reporting decisions was Smurfit Stone, which recognized all of the tax benefits claimed ($229 million) 123 470 L. De Simone et al. despite receiving the refunds in cash. Indeed, Smurfit’s net tax benefits allowed the company to report an after-tax profit in 2009 rather than a pre-tax loss. Differences in CEO strength and compensation can also influence tax and financial reporting choices. Table 4 presents CEO characteristics taken from the 2008 and 2009 proxy statements. Although governance is a complex mix of incentives and monitoring (Brickley and Zimmerman 2010), combining the CEO position and board chairmanship is often portrayed as one indicator of ‘‘weak’’ governance (Jensen 1993). These positions are combined in seven of the eight Benefit Group firms as compared to three of the six Reserve Group firms and only one of the five Taxable Group firms. This pattern suggests that the CEO’s ability to influence the board is associated with less conservative financial reporting and perhaps less conservative tax reporting. Benefit firms also report the highest average CEO total compensation for both 2008 and 2009 and the highest average cash bonus in 2009. These relations hold if we deflate compensation by sales or assets to control for firm size, or if we calculate the mean after dropping firms with the highest amount from each group. Benefit firm CEOs also earn more than four times as much as their CFOs, and this multiple is almost twice as large for Benefit firms than for Reserve or Taxable firms. The systematic differences in executive compensation patterns for the Benefit firms are consistent with a positive relation between aggressive financial reporting and CEO incentives (e.g., Bergstresser and Philippon 2006). The similarity in compensation patterns for Reserve firms and Taxable firms does not indicate a relation between aggressive tax reporting and management incentives (Armstrong et al. 2012). 4 Conclusion We investigate whether a small group of firms in the same industry consistently applied the more likely than not standard of FIN 48 when confronted with a unique transaction of substantial economic magnitude. This powerful setting allows us to address the extent to which management discretion influences tax accruals while holding nearly constant the facts and relevant legal authority underlying the transaction. We identify 19 public paper companies that claimed the same refundable excise tax credit during 2009. In spite of the FASB’s specific intent that FIN 48 would improve transparency and comparability in reporting for uncertain tax positions, we find that the financial reporting of the refunds varies greatly among the firms in our sample. We conclude that FIN 48 provides managers with sufficient latitude to reach dramatically different conclusions regarding the uncertainty of a tax position and the subsequent accrual of the UTB. Firms recognizing a financial statement benefit related to excluding the refunds from taxable income have lower levels of institutional ownership, lower combined levels of CEO and directors and officer ownership, greater analyst following, and greater likelihood of having CEOs who are also chairman of the board. We also provide evidence that management compensation appears positively related to aggressive financial reporting but unrelated to aggressive tax reporting. Our evidence also suggests that not all firms are simultaneously aggressive for both tax 123 Distilling the reserve for uncertain tax positions 471 and financial reporting purposes. Of the 14 firms that took the uncertain (aggressive) position of excluding refunds from taxable income, only eight firms also reported aggressively for financial purposes by not accruing a reserve for the associated uncertainty. Finally, we demonstrate that Big 4 audit firms did not require their clients to take consistent positions regarding the UTB reserve, even in the same office. Thus it appears that external auditors do not constrain the latitude provided by FIN 48. Although limited to a small sample, this study suggests that the UTB reserve does not consistently reflect the extent of corporate income tax avoidance. Instead, managers appear to have sufficient latitude to apply their discretion to manipulate the reserve in a manner consistent with their incentives as constrained by the existing corporate governance structure. Acknowledgments We appreciate comments and helpful suggestions from an anonymous reviewer, Ben Ayers, Devan Mescall (discussant), Lillian Mills, D.J. Nanda, Ed Outslay, Sundaresh Ramnath, Jeri Seidman, Ryan Wilson (discussant), and Peter Wysocki as well as those made by participants in the AAA annual meeting, the ATA midyear meeting, and in accounting colloquiums at Michigan State University, the University of Texas at Austin, and the University of Miami. We also gratefully acknowledge research support provided by Red McCombs School of Business, the C. Aubrey Smith Professorship, and the Accounting Doctoral Scholars program. Robinson worked on this topic while serving as the academic fellow for the Division of Corporation Finance of the Securities and Exchange Commission, but all information presented here is available from public sources. The Securities and Exchange Commission as a matter of policy, disclaims responsibility for any private publication or statement by any of its employees. Therefore the views expressed in this paper are those of the authors and do not necessarily reflect the views of the commission or the other members of its staff of the commission. References Armstrong, C. S., Blouin, J. L., & Larcker, D. F. (2012). The incentives for tax planning. Journal of Accounting and Economics, 53, 391–411. Bergstresser, D., & Philippon, T. (2006). CEO incentives and earnings management. Journal of Financial Economics, 80, 511–529. Brickley, J., & Zimmerman, J. (2010). Corporate governance myths: Comments on Armstrong, Guay, and Weber. Journal of Accounting and Economics, 50, 235–245. Cazier, R., Rego, S., Tian, X., & Wilson, R. (2010). Early evidence on the determinants of unrecognized tax benefits. Working paper: University of Iowa. De Waegenaer, A., R. Sansing, and J.Wielhouwer. 2010. Financial accounting measures of tax reporting aggressiveness. Working paper, Tuck School of Business at Dartmouth. Desai, M., Dyck, A., & Zingales, L. (2007). Theft and taxes. Journal of Financial Economics, 84, 591–641. Dhaliwal, D., Gleason, C., & Mills, L. (2004). Last-chance earnings management: Using the tax expense to meet analysts’ forecasts. Contemporary Accounting Research, 21, 431–459. Fields, T. D., Lys, T. Z., & Vincent, L. (2001). Empirical research on accounting choice. Journal of Accounting and Economics, 31, 255–307. Financial Accounting Standards Board (FASB) (2006). Financial Interpretation No. 48 (FIN 48), Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109, Norwalk, CT. Frank, M. M., Lynch, L. J., & Rego, S. O. (2009). Tax reporting aggressiveness and its relation to aggressive financial reporting. The Accounting Review, 84, 467–496. Frischmann, P., Shevlin, T., & Wilson, R. (2008). Economic consequences of increasing the conformity in accounting for uncertain tax benefits. Journal of Accounting and Economics, 46, 261–278. Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50, 127–178. Healy, P., & Palepu, K. (2001). Information asymmetry, corporate disclosure, and the capital markets: a review of the empirical disclosure literature. Journal of Accounting and Economics, 31, 405–440. 123 472 L. De Simone et al. Jensen, M. (1993). The modern industrial revolution, exit, and the failure of internal control systems. Journal of Finance, 48, 831–880. Jensen, M., & Meckling, W. (1976). Theory of the firm: managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3, 305–360. Lin, H., & McNichols, M. (1998). Underwriting relationships, analysts’ earnings forecasts, and investment recommendations. Journal of Accounting and Economics, 25, 101–127. Lisowsky, P., L. Robinson, Schmidt, A. (2012). What Does FIN 48 Tell Us About Tax Shelters? Working paper. University of Illinois at Urbana-Champaign. Michaely, R., & Womack, K. (1999). Conflict of interest and the credibility of underwriter analyst recommendations. Review of Financial Studies Special, 12, 653–686. Robinson, L., Schmidt A. (2012). An examination of mandatory disclosure quality: Evidence from FIN 48. Working Paper. Warfield, T. D., Wild, J. J., & Wild, K. L. (1995). Managerial ownership, accounting choices, and informativeness of earnings. Journal of Accounting and Economics, 20(1), 61–91. 123