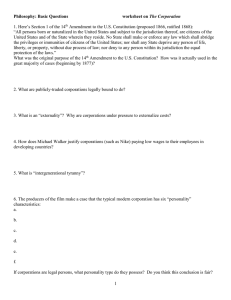

Corporations: Chapter 4 A Contemporary Approach Corporate Social Responsibility

advertisement

Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Yayoi Kasuma, Colour Dots (Tate Museum 2012) Module II – Corporations and Policy Chapter 4 Corporate Social Responsibility • Who does corporation serve? Bar exam Corporate practice • Private parties (property) • Stakeholders (social institution) • Classic answer: Dodge v. Ford Motor • Meaning of case • Other constituency statutes • Modern answer: corporate charity Law profession Citizen of world Corporations: A Contemporary Approach • Corporate law • Who should decide? • Role of directors and lawyers • Choices in takeover • Choices in offshore operations Chapter 4 Corporate Social Responsibility Slide 2 of 25 Purpose of corporation • Private property? • Social institution? Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 3 of 25 SALES (cars) 1910 1911 1912 1913 1914 1915 1916 18,664 34,466 68,544 168,304 248,307 264,351 472,350 (60% annual growth) Corporations: A Contemporary Approach PROFITS Ford Profits (1910-1916) $4,521,509 $6,275,031 $13,057,312 $25,046,767 $30,338,454 $24,641,423 $59,994,918 (45% annual growth) Chapter 4 Corporate Social Responsibility Slide 4 of 25 Henry Ford’s vision “My ambition is to employ still more men, to spread the benefits of this industrial system to the greatest possible number, to help them build up their lives and their homes. To do this we are putting the greatest share of the profits back in the business.” Henry Ford (interview with newspaper) Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 5 of 25 Henry Ford’s business plan • Product pricing • Semi-eleemosynary • Vertical integration Is he nuts? Would you have invested? Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Henry Ford Slide 6 of 25 Henry Ford’s financing plan Continue regular dividends – Since 1908 $1.2 million annually – 60% return on investors' original $2 million investment Discontinue special dividends – – – – – 1911 1912 1913 1914 1915 Corporations: A Contemporary Approach $1,000,000 $4,000,000 $10,000,000 $11,000,000 $15,000,000 Chapter 4 Corporate Social Responsibility Slide 7 of 25 Your advice … (as Ford Motor’s lawyer) Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 8 of 25 Michigan Sup Ct Dividend policy Vertical integration “A business corporation is organized and carried on primarily for the profit of the stockholders. The powers of the directors are to be employed for that end. The discretion of directors is to be exercised in the choice of means to attain that end, and does not extend to a change in the end itself, to the reduction of profits, or to the nondistribution of profits among stockholders in order to devote them to other purposes." "We are not, however, persuaded that we should interfere with the proposed expansion of the business of the Ford Motor Company. ... The judges are not business experts. It is recognized that plans must often be made for a long future, for expected competition, for a continuing as well as an immediately profitable venture. The experience of the Ford Motor Company is evidence of capable management of its affairs.” Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 9 of 25 Meaning of Dodge v. Ford Motor? Social institution (CSR) Property (SWM) anagnorisis (an-ag-NOR-uh-sis) noun The moment of recognition or discovery (in a play, etc.) Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 10 of 25 Modern non-shareholder constituency statutes Assume Ford has new plans • Drop workers' wages to $2 per day -- the market rate. • Raise the price of Ford cars by 20% -- the market will bear it. Can employees and customers complain under modern "other constituencies" statutes? Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 11 of 25 Pennsylvania Business Corporation Law § 1715. Exercise of powers generally (a) General rule.--In discharging the duties of their respective positions, the board of directors ... may in considering the best interests of the corporation, consider to the extent they deem appropriate: (1) The effects of any action upon any or all groups affected by such action, including shareholders, employees, suppliers, customers and creditors of the corporation, and upon communities in which offices or other establishments of the corporation are located. (2) The short-term and long-term interests of the corporation, including benefits that may accrue to the corporation from its long-term plans and the possibility that these interests may be best served by the continued independence of the corporation. (3) The resources, intent and conduct (past, stated and potential) of any person seeking to acquire control of the corporation. (4) All other pertinent factors. Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 12 of 25 ALI Principles of Corporate Governance § 2.01 The Objective and Conduct of the Corporation (a) Subject to the provisions of Subsection (b), a corporation should have as its objective the conduct of business activities with a view to enhancing corporate profit and shareholder gain. (b) Even if corporate profit and shareholder gain are not thereby enhanced, the corporation, in the conduct of its business: (1) Is obliged, to the same extent as a natural person, to act within the boundaries set by law; (2) May take into account ethical considerations that are reasonably regarded as appropriate to the responsible conduct of business; and (3) May devote a reasonable amount of resources to public welfare, humanitarian, educational, and philanthropic purposes. Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 13 of 25 Pop quiz (CSR) 1. CSR is: a. Preferring non-Sh constituencies at expense of Shs b. Greenwashing – that is, a publicity stunt c. Increased business social consciousness 3. In the case, Henry Ford argued that his plans/policies: a. Reflected that Shs already got enough b. Were designed to create a “new industrialism” c. Were permitted under corporate statutes 2. Dodge v Ford Motor establishes the principle of “shareholder primacy” in US corporate law. True or false? 4. Corporations: A Contemporary Approach The Michigan Supreme Court held that Ford Motor was not allowed to engage in charitable acts. True or false? Chapter 4 Corporate Social Responsibility Slide 14 of 24 5. The holding of Dodge v. Ford Motor is-a. Vertical integration was protected by BJR b. Changing the dividend policy requires Sh vote c. Minority Shs must receive dividends, if there are company profits 6. Modern “non-shareholder” constituency statutes require that boards of directors consider Shs and other nonSh constituencies. True or false? 7. A corporate board faced with a hostile takeover bid could choose to defend to protect “corporate culture.” True or false? 8. The ALI Principles of Corporate Governance a. Reflect the law in a majority of states b. Allow for corporate illegality when net profitable c. Are cited regularly, especially in Delaware. Answers: 1- C / 2-F / 3-B / 4-F / 5-A / 6-F / 7-T / 8-B Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 15 of 24 Corporate charity (1) Corporate power? (2) Proper under fiduciary duties? (3) What role for shareholders? Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 16 of 25 (1) Legal under corporate statute? MBCA § 3.02 GENERAL POWERS Unless its articles of incorporation provide otherwise, every corporation has perpetual duration and succession in its corporate name and has the same powers as an individual to do all things necessary or convenient to carry out its business and affairs, including without limitation power: (1) to sue and be sued, complain and defend in its corporate name; (2) to have a corporate seal, which may be altered at will, and to use it, or a facsimile of it, by impressing or affixing it or in any other manner reproducing it; (3) to make and amend bylaws, not inconsistent with its articles of incorporation or with the laws of this state, for managing the business and regulating the affairs of the corporation; (4) to purchase, receive, lease, or otherwise acquire, and own, hold, improve, use, and otherwise deal with, real or personal property, or any legal or equitable interest in property, wherever located; (5) to sell, convey, mortgage, pledge, lease, exchange, and otherwise dispose of all or any part of its property; (6) to purchase, receive, subscribe for, or otherwise acquire; own, hold, vote, use, sell, mortgage, lend, pledge, or otherwise dispose of; and deal in and with shares or other interests in, or obligations of, any other entity; (7) to make contracts and guarantees, incur liabilities, borrow money, issue its notes, bonds, and other obligations (which may be convertible into or include the option to purchase other securities of the corporation), and secure any of its obligations by mortgage or pledge of any of its property, franchises, or income; (8) to lend money, invest and reinvest its funds, and receive and hold real and personal property as security for repayment; (9) to be a promoter, partner, member, associate, or manager of any partnership, joint venture, trust, or other entity; (10) to conduct its business, locate offices, and exercise the powers granted by this Act within or without this state; (11) to elect directors and appoint officers, employees, and agents of the corporation, define their duties, fix their compensation, and lend them money and credit; (12) to pay pensions and establish pension plans, pension trusts, profit sharing plans, share bonus plans, share option plans, and benefit or incentive plans for any or all of its current or former directors, officers, employees, and agents; (13) to make donations for the public welfare or for charitable, scientific, or educational purposes; (14) to transact any lawful business that will aid governmental policy; (15) to make payments or donations, or do any other act, not inconsistent with law, that furthers the business and affairs of the corporation. Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 17 of 25 (1) Legal under tax law? Internal Revenue Code § 170. Charitable contributions and gifts (a) Allowance of deduction. (1) General rule. There shall be allowed as a deduction any charitable contribution payment of which is made within the taxable year. *** (b) Percentage limitations. *** (2) Corporations. In the case of a corporation-(A) In general. The total deductions under subsection (a) for any taxable year … shall not exceed 10 percent of the taxpayer's taxable income. Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 18 of 25 (1) Legal under corporate law (SWM)? Theodora Holding Corp. v. Henderson (Del. Ch. 1969) Theodora (Mrs. Henderson) Mr. Henderson Boys Camp -Alexander Dawson Foundation Theodora Holding Corp. Board $$ / stock Alexander Dawson, Inc. Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 19 of 25 The test to be applied ... on the validity of a [corporate] gift … is that of reasonableness, [for which the IRC] furnishes a useful guide. Contemporary courts recognize that unless corporations carry an increasing share of the burden of supporting charitable and educational causes that the business advantages now reposed in corporations by law may well prove to be unacceptable to … an aroused public. The contribution … "cost" … some fifteen cents per dollar of contribution, taking into consideration the federal tax provisions … William Marvel (1954-1982) … rehabilitation and education of deprived but deserving young people is peculiarly appropriate in an age when a large segment of youth is alienated even from parents who are not entirely satisfied with our present social and economic system. Theodora Holding Corp. v. Henderson (Del. Ch. 1969) Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 20 of 25 (2) Fiduciary duties? (pet charities …) Kahn v. Sullivan (Del. 1991) Shareholders $$ Board Occidental Petroleum Corporations: A Contemporary Approach Armand Hammer Museum Chapter 4 Corporate Social Responsibility Slide 21 of 25 Delaware Supreme Court (quoting Vice Chancellor): If the Court was a stockholder of Occidental it might vote for new directors, if it was on the Board it might vote for new management and if it was a member of the Special Committee it might vote against the Museum project. … gift to the Museum was within the range of reasonableness [Theodora Holdings] Justice Randy Holland … Occidental received an economic benefit in the form of good will from the charitable donation … Kahn v. Sullivan (Del. 1991) Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 22 of 25 (3) Role for shareholders? Would you put money in bank if your banker said he would choose and give up to 10% of your interest to charities of his choice? Why do shareholders tolerate that 1.8% of pretax corporate profits go to charities chosen by managers? Shouldn’t shareholders be able to vote on giving their money away? Prof. Victor Brudney Prof. Allan Ferrell Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 23 of 25 Group hypo - Corporate lawyers in CSR? (who do you want to be?) Morals of marketplace Duty of independence Justice Potter Stewart Chancellor Wm. Allen Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Lawyer interdependence Prof. Richard Painter Slide 24 of 25 ABA Model Rules of Professional Conduct Rule 2.1 Advisor In representing a client, a lawyer shall exercise independent professional judgment and render candid advice. In rendering advice, a lawyer may refer not only to law but to other considerations such as moral, economic, social and political factors, that may be relevant to the client’s situation. Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 25 of 25 Foreign Corrupt Practices Act Securities Exchange Act § 13(b)(2)(A): Public companies must keep books and records that “accurately and fairly reflect the transactions and dispositions of the assets of the issuer.” FCPA: Public companies cannot pay foreign government officials to induce action or non-action in their official capacity for the purpose of obtaining or retaining business (with an exception for bribes to “expedite or secure performance of routine government action”). Violations can result in civil penalties and criminal prosecution. Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 26 of 25 Group Hypo You represent Exogen Corporation as outside counsel. The company has a “situation.” OSHA is thinking of banning one of the chemicals used in the company’s manufacturing process – Durasol. The company, at the same time, is exploring moving its manufacturing to Ruranesia. The world is flat. The company knows occupational health regulation is lax in Ruranesia, and government regulators are poorly paid and often corrupt. The proposal before the board is to move the company’s manufacturing to Ruranesia ASAP. The board asks your opinion about this plan. In your groups, please consider and answer two questions: (1) What kind of lawyer are you? (2) What is your advice to the board on the plan? Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 27 of 25 Exogen Group responses Lawyering style • Morals of marketplace 6 • Independence 3 • Interdependence 8 Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 28 of 25 Advice to Board Advice to Board (continued) • • Use of Durosal – – – – – – – – • Consider alternative / protection 6 Investigatex effects further (industry) 4 Stop using chemical (in US) 3 Stop using chemical (even Indo) 1 Wait (delay) until OSHA bans 2 Work with OSHA (even tax) 5 Get OSHA to prohibit! 2 Move to Ruranesia fast 1 Potential downside – – – – – Tort/products liability in US Effect on company reputation Effect on SH value (if use) Effect on SH value (if move) Consider harm to Indo workers Corporations: A Contemporary Approach 3 8 2 3 4 FCPA concerns – – – – – • Corporate/individual liability Put in US manager / training Violation costs more than savings Bribery hurts reputation Bribery is unethical 5 1 1 3 1 Bottom line – – – – – – Chapter 4 Corporate Social Responsibility Discontinue + CSR ad campaign Board chooses which option Consider the long run Continued use is unethical Lobbying OSHA unethical Our law firm’s role in illegality? 2 4 3 1 1 1 Slide 29 of 25 The end Corporations: A Contemporary Approach Chapter 4 Corporate Social Responsibility Slide 30 of 25