A Model of Optimum Tariff in Vehicle Fleet Insurance

advertisement

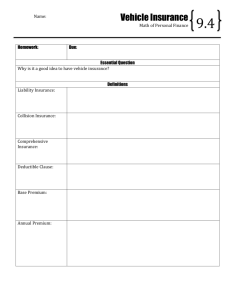

A Model of Optimum Tariff in Vehicle Fleet Insurance K. Boukhetala and F.Belhia and R.Salmi Statistics and Probability Department Bp, 32, El-Alia, USTHB, Bab-Ezzouar, Alger Algeria. Summary: An approach about tariff in vehicle fleet insurance has been proposing, where we develop a non-linear mathematical model with constraints. The solution of the problem is an optimum cut rates for each class of risk. The model has been implementing on computer. Key words: Fleet insurance, Vehicle risk, Cut rate, Optimisation, Simulation. 1 Introduction The individual seeks often to protect of hazardous risk phenomena of his environment. A potential risk may be transferring to insurance company for cover, versus payment of premium. The calculus of this premium is an essential element at the insurer and requires actuarial techniques. In [RSST98], we find general principles to determinate a good premium. For the case of vehicle risk, an approach of the determination of an optimal premium, by using linear programming has given in [B01]. Recently, [NB04] show an asymptotic result concerning an estimator of extreme risk premium by using the adjusted premium principle given by [W96]. In this paper, we propose an optimal approach to determine cut rates of premium, by class of risk, in a vehicle fleet assurance. For a commercial reason, the reduction is an important parameter in the portfolio management strategy of company. We suggest a non-linear programming model with constraints to determine optimal cut rates. 2 Factors and classes of risk The most signification factors of risk, considered by this problem are type of vehicle, traffic area, and usage and vehicle power. Each factor is a set of codes. A risk class is a combination of these factors. For instance, the class 00103 concerns vehicles for business use, of power from 7 to 10 horses and moving inside a determined area. The set of risk classes has been generating by applying trees method, as for instance the CART method. 1312 3 Premium of risk Formally, a risk premium may be considering as a non-negative random variable X with distribution function FX. We associate to X a finite quantity ∏( X ) , called “the premium of risk”. The determination of ∏( X ) needs a particular treatment and represents a reference point for commercial premiums calculus. Different principles of risk premium are given. A calculation of a good premium requires some proprieties of ∏( X ) . Let X, Y, Z be three arbitrary risks, the following proprieties are suggested, for a practice reason of the definition of risk premium principle (see [RSST98] ) . P1) P2) P3) P4) P5) P6) ∀α ≥ 0, ∏ ( α ) = α ∀α ≥ 0, ∏ ( α X) = α ∏ (X) ∏ (X+Y) ≤ ∏ (X) + ∏ (Y) ∀α ≥ 0, ∏ ( α +X) = α + ∏ (X) X ≤ st Y then ∏ (X) ≤ ∏ (Y) ("st" order stochastic) If for all a ∈ [0,1], and for all ∏ (X) = ∏ (Y) ⇒ ∏ ( a FX + (1-a) FZ) = ∏ ( a FY + (1-a) FZ). Each property admits a convenient interpretation. On the basic of these proprieties, principles of risk premium are defined by: A1) Principle of the expected value: ∀ α ≥ 0 , ∏ (X) = (1+ α ) E(X), (E(X)< ∞ ), A2) Principle of variance: ∏ (X) = E(X) + a Var (X), A3) Principle of the deviation: ∏ (X) = E(X) + a Var(X), A4) Principle of modified variance: Var ( X ) ⎧ , if E ( X ) > 0 ⎪ E(X ) + a E(X ) ∏( X ) = ⎨ ⎪0 if E ( X ) = 0 ⎩ A5) Principle of the exponential: log E ( e aX ) a A6) Principle of adjusted premium: This principle concerns the case of extreme risk X (see [RSST98]). [W96] suggests the following principle. ∏ (X) = ∏ (X) = ∞ ∫ u (1 − F X ( x )) 1 p dx , 1313 Where p≥1 is a parameter of distortion and u is a value, appropriately determined ˆ ) in practice. For the case of this principle, an estimator's family (∏ , asympu n n∈N totically normal has given in [NB04]. The following character of risk one or the other among of this principle may be chosen. As it is about the vehicle risk, we use expected value principle. 4 Modelling Given SK the damage cost (random yearly cost) associate to kth class of risk. The insurance supposed knowing the expectancy: E ( S k ) , ∀ k = 1 , 2 ,... K , that can be calculated from damage historic. This, permits to determinate the net premium π k , given by π k = E S k , ∀ k = 1, 2 ,..., K . ( ) For a reason of commercial security, the insurer consider the premium ( ) π 'k = 1 +α k π k , ∀ k = 1, 2 ,..., K , where α k is a loading parameter of net premium, which is, generally, fixed by the insurer according to his tariff strategy. Given N the total number of vehicles, separated into K classes. The insurer gets N commercial premiums of a global value estimated to K ∑π k =1 surer yields part ' k . Let c k be the cut rate relative to the kth class of risk. The in- c k π k' of his premiums and conserve the other part (1- c k ) π . Then, the total value of conserved premium becomes: ' k ∑ (1 − c )π K k ' k , k =1 K with a total cost of damage: ∑S k =1 k To determine these cut rates, the company has to consider at least the quantity: ⎡ ( ) 2 ⎛⎜ 1 − c π ' − S ⎞⎟ ⎤ k k k ∑ ⎠ ⎥⎦ ⎣ k =1 ⎝ Z= E ⎢ K (1) 1314 4.1 The problem Hypothesis We consider the following assumptions: H1) the portfolio is controlled for annual period, H2) each class I k , k = 1,2,… ,K, including nk vehicles (N = ∑ K n k =1 k ) H3) in any class, risks insured are homogeneous and independents. H4) for each class k of risk, the cost of damage Sk, is a non-negative random variable. H5) the cut rates c k are unknown variables to determine. 4.2 Formulation of objective’s function Let Yik be the cost of damage of ith vehicle associated to the kth class of risk. The global cost damage relative to class k is, Sk nk = ∑Y ik i =1 Given: j any damage of the vehicle i. Ui , the total yearly number of damages of vehicle i. Yijk is the random cost of jth damage relative to the vehicle i of the kth class of risk (j = 1,2,…,Ui). Then, the total cost of damages is Ui Yi k = ∑ Yi j k , for k = 1,2,…,K and i = 1,2,… ,nk j =1 Let Nsk be the random variable "number of damages of the kth class n Nsk = k ∑ U ik . i =1 Then Sk = nk U i =1 j =1 i ∑ ∑ Yi j k = N s k ∑ Yl k l =1 We admit also the following consideration: Y1 k ,..., Y N sk ,k are (i.i.d.), with : E (Yl k ) = E (Y k ) ∀ k = 1,2,…, K and l = 1,2,…, Nsk. Y1 k ,..., Y N sk ,k are independents from the variable Nsk ∀ k = 1,2,…,K. 1315 An explicit calculation of (1) gives the following objective function, to minimize: K Z= ∑ c 2 2 ′ k πk + ⎛ ∑ c π' ⎜⎜⎝ E' ( N ) K 2 k =1 k k sk k =1 Where ψ k = π 'k + E ( N sk 2 ⎞ E ⎛⎜ Y k ⎞⎟ − π ' k ⎟⎟ + ⎝ ⎠ ⎠ K ∑ψ k =1 ) E ( Y ) + var( N ) ⎛⎜⎝E ( Y ) ⎞⎟⎠ + var⎛⎜⎝ Y 2 2 2 sk k k k ⎞⎟ E ⎠ k (N ) sk 4.3 Constraints 4.3.1 Constraint in relation to the technical equilibrium For the insurance company, the ratio τ 1 = S , is an essential index to measure the π technical equilibrium. The quantities S and π represents, respectively, total cost of damages and total of the acquired premiums. In practice, a good tariff must verified, τ 1 ≅ 1 . Then, we have: K ∑ Sk ≤ τ1 . k =1 ∑ (1 K k =1 Let K ∑ k =1 (S k − ck ) π' − (1 − c k k )τ 1 π k' ) ≤ 0. Thus, the first constraint must be: K τ1 ∑ k =1 c k π k′ + K Nsk k =1 l =1 ∑∑ K Yl k − τ1 ∑ π 'k ≤ 0. k =1 4.3.2 Constraint in relation to the total cut rate: For more justice towards the customer, the insurer applies, class by class, a reduction rule. The average balanced rate must not exceed a given percentage ( τ 2 ) (the maximum, fixed by the company, being 50%). 1316 We have: K ∑ ck π 'k ∑ τ2. ≤ k =1 K π 'k k =1 Hence, the second constraint will be: K ∑c ′ - τ2 kπ k k =1 K ∑π′ k ≤ 0 k =1 4.3.3 Constraints in relation to the cut rate of class In every class, the cut rate must be restrained between 0 and a proportion ξ k fixed by the expert of the company. According to this condition, we consider K constraints: ∀ k = 1,2,..., K 0 ≤ ξk < 1 , 0 ≤ ck ≤ ξ k 4.4 Mathematical model From 4.2 and 4.3, we have to resolve, the following program: K Min (Z = c1 ,c2 ,...,cK ∑ c 2 2 ′ k πk + K ⎛ ck π 'k ⎜⎜ E' ⎝ k =1 ∑ 2 k =1 (N) sk ⎞ E ⎛⎜ Y k ⎞⎟ − π ' k ⎟⎟ + ⎝ ⎠ ⎠ Under constraints K τ1 ∑ckπ k′ + k =1 K ∑c k=1 K N sk k =1 l =1 ∑∑ ′ kπ k − τ 2 c k − ξ k ≤ 0, K Yk − τ 1 ∑ π 'k ≤ 0 0 ≤ τ1 < 1 k =1 K ∑π ′ k ≤ 0 0 ≤ τ2 <1 k =1 0 ≤ ξ k < 1 ∀ k = 1,2,..., K (2) K ∑ψ ) k=1 k 1317 5 Comment The proposed model is a tool of a decision help, concerning the fixation of the cut rates in vehicle fleet insurance. The stochastic form of model needs the calculation of the tow first moments of the random variables Nsk and Yk; respectively, the particular case of Poisson and log-normal laws is taken into consideration. The model is implemented on computer, as interactive package, where the user has the choice to estimate the parameters of the model, by using the statistical database of the insurer, or by simulation as is showing by the fig.1, that represents the simulation module of calculus of cut rates. Risk class Vehicle Individual Total Expected Expected number premium premium number cost of damages Optimal cut rates Fig1. Simulation module of calculus of optimal cut rates 1318 References [RSST98] Rolski, T., Schmidt, H., Schmidt, V., Teugels, J.: Stochastic Process for Insurance and Finance. John Wiley & Sons edition (1998). [B01] Boukhetala, K. : A linear Programming Model for an optimal basic premium in car insurance. Bulletin of the International Statistical Institute, Vol. III , pp. 469-470 (2001). [NB04] Necir, A.,Boukhetala, K.: Estimating the risk-adjusted premium for the largest claims reinsurance covers. COMPSTAT'04, Proc. in Computational Statistics, Physica- Verlag, Heidelberg, New York, pp 1577- 1584 (2004). [W96] Wang S.: Premium calculation by Transforming the Layer Premium Density, ASTIN Bulletin, 26, 71–92 (1996).