Resolving Residential Mortgage Distress: Time to Modify? WP/14/226 Jochen R. Andritzky

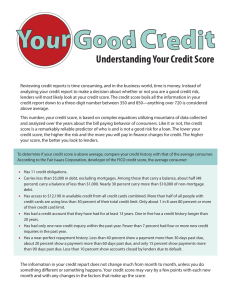

advertisement