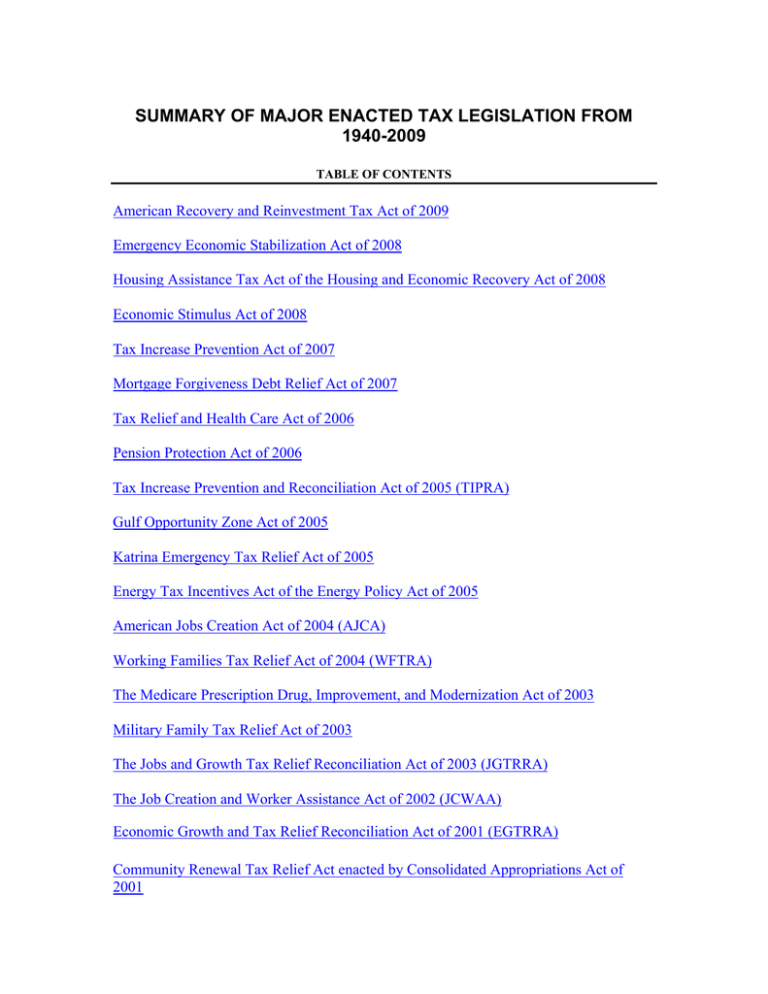

SUMMARY OF MAJOR ENACTED TAX LEGISLATION FROM 1940-2009

advertisement