Working Families Tax Relief Act

advertisement

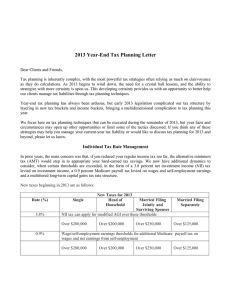

2004 Tax Acts New Rules New Opportunities ©2004, CCH INCORPORATED A WoltersKluwer Company Two New Tax Acts • Working Families Tax Relief Act of 2004 Signed into law by President Bush on October 4, 2004 • American Jobs Creation Act of 2004 Signed into law by President Bush on October 22, 2004 2 Working Families Tax Relief Act • $146 billion in tax savings over the next 10 years • $132 billion in tax savings for individuals • $14 billion in tax savings for businesses 3 What’s Behind the Act? • Accelerated tax cuts for individuals were set to expire • Many business tax breaks had expired on 12/31/2003 • Technical tax corrections needed 4 American Jobs Creation Act • Revenue neutral • $145 billion in tax cuts offset by $50 billion saved by repealing the extraterritorial income exclusion and $95 billion in increased taxes/penalties/user fees 5 What’s Behind the Act? • Resolves a trade dispute with the European Union. After the World Trade Organization ruled that an export break— the extraterritorial income exclusion—was illegal, the European Union retaliated by imposing increasing tariffs on U.S. goods • Aids domestic manufacturers • Discourages businesses from moving abroad 6 Hundreds of Changes • Almost 450 tax code changes • Dozens of major changes effective immediately or on 1/1/2005 7 Important Changes for Individuals and Families • • • • • 10% tax bracket expanded and adjusted for inflation $1,000 child tax credit continued Marriage penalty relief New deductions for sales tax and attorneys’ fees Revised definitions of “dependent” and “head of household” 8 Major Changes for Businesses • • • • • New manufacturers’ deduction Extension of expired or expiring tax benefits New credits and new deductions New rules for Code Sec. 179 expensing and depreciation Limitation on deduction for entertainment expenses for certain employees 9 Important Changes for Corporations • IRS’s authority to issue consolidated return regulations affirmed • Definition of “brother-sister controlled group” modified • Limitation on importation and transfer of built-in losses • Expanded disallowance of deduction for interest on corporate debt • Recognition of gain on distribution to foreign corporation in liquidation of holding company • “Nonqualified preferred stock” definition clarified 10 Major Changes for International Transactions • Extraterritorial income exclusion repealed • Foreign personal holding and foreign investment company rules repealed • Foreign corporations exempted from personal holding company rules • Foreign tax credit modified • Subpart F income modified • Deduction for foreign earnings reinvested in U.S. 11 Big Changes for the Alternative Minimum Tax on Individuals • Increased AMT exemption amounts have been extended to tax years beginning in 2005 • Taxpayers’ ability to use all nonrefundable personal credits to offset their AMT liability has been extended two years • Limitation on foreign tax credit repealed 12 What Will You Do to Take Advantage of the New Tax Breaks? Thank You! 14