S chro oders s

advertisement

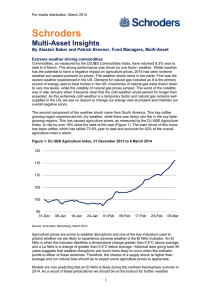

For media distrib bution. November 2013 Schro oders s Multi-As sset In nsights By Aymeric Forest F and d Matthias s Scheiber, Fund Managers, M Multi-Asse et Eme erging marrket debt: is there mo ore pain to come? The domestic en nvironment fo or most eme rging markett bonds rema ains challengging due to slow s wth and rising g inflation, po osing a challlenge to central banks (figure1). Emeerging marke ets grow suffe ered a broad d sell-off overr the summe er on concern ns that the Fe ederal Reserrve (Fed) wo ould begiin to taper qu uantitative ea asing. Econo omies with la arge and grow wing twin (fisscal and currrent acco ount) deficitss came under most presssure due to th heir vulnerab bility to a reduuction in liqu uidity. If the ese economies are unab ble to borrow as much mo oney from foreigners, connsumption, inve estment or go overnment sp pending (or a all three) must adjust dow wnwards. Onnce that adju ustment beco omes sufficie ently large, it represents a risk to finan ncial stabilityy. While the decisio on by the Fed to delay ta apering bought emerging markets som me breathing g mentals when n tapering be ecomes immiinent. Countrries spacce, we expecct focus again on fundam with twin deficitss should be using u this tim me to repair th heir economiies. Of the ‘frragile five’ a, South Afric ca, Turkey a nd Brazil), all but Turkey have growinng twin deficits (Indonesia, India ating quarterr on quarter. that are deteriora d our rating ffor emerging market dolla ar debt, whilee maintaining g our We have furtherr downgraded e ma arket local de ebt. Howeverr, we upgrad ed our outloo ok overrall negative outlook for emerging for P Polish local currency c bonds based on n close links to t the eurozo one and fallinng inflation in n the regio on. Figu ure 1: G-Track kers for developed G9 verrsus emergin ng debt marke ets Deve eloped: US, UK, Eurozone, Japan, Canada, Au ustralia, New Ze ealand, Norway and Sweden (G GDP weighted). Sourcce: Schroders, Thomson T Datas stream, 31 Octo ober 2013. 1 For media distrib bution. November 2013 Flig ght to qualiity: is Euro ope the nex xt safe have en? Polittical posturin ng in the US leading up to o, and during g, the govern nment shutdoown saw ‘saffe asse et’ flows movve from US trreasuries to German bun nds and UK gilts. g A key feeature of ‘saffe asse ets’ is liquiditty. We subtra act the yield on governme ent bonds fro om governm ent-guarante eed agen ncy bonds off the same maturity m to ca alculate the liquidity prem mium investorrs are willing to pay to hold the sovereign s bo ond (figure 2))1. The bonds s have the sa ame credit rissk but when nd for safe ha aven assets the governm ment bond yie eld falls and the liquidity there is a deman mium rises. The T liquidity premium for bunds and gilts g fell once e an agreemeent over the debt prem ceiling was reached. The pre emium for gillts fell more precipitously p y, possibly duue to better wth prospects. Meanwhile e credit risk iin the US rem mains elevatted as the maarket recogn nises grow that its fiscal diffficulties were e not fully ressolved in Octtober (figure 3). ure 2: Liquid dity premium m for treasu uries, Figu trea asuries, gilts s gilts s and bunds s um for Figure 3: Crredit premiu and bunds Sourcce: Schroders, Bloomberg, Barrclays Point, No ovember 2013 We are in a low w volatility y regime – ffor now We monitor the volatility v of various econo omic and fina ancial aggreg gates to idenntify signs of st a backdro op of relatively low volatility, although the stress stresss. Our indiccators sugges rankkings of policcy-related uncertainty me easures are slightly s elevated due to thhe lingering impa act from the US governm ment shutdow wn and lifting of the debt ceiling c at thee eleventh ho our. There are a num mber of factorrs that could lead to a pic ck up in volattility. Until theere is a more e overnment fu nding, the un ncertainty fro om October ccould return in conccrete resolution to US go the ffirst quarter of o 2014 even n if it would a appear in neither party’s interest i in ann election yea ar. Mea anwhile, the timing t and ex xtent of Fed tapering rem mains a conc cern. Elsewheere, the Euro opean stresss test and As sset Quality R Review (AQR R) could prov ve significantt for the euro ozone in 2014. While the review is se et to end in October O next year, news fflow before th hen coulld spur market volatility. 1 We e construct bond d curves for eac ch issuer from liq quid bonds in th he same currenc cy and comparee yields at a consiistent maturity (five ( years). 2 For media distrib bution. November 2013 Amo ong the funda amental indic cators we tra ack, there is low stress from earningss revisions. In n the US tthe latest US S earnings se eason has be een relatively y benign, while in Europee and Japan earn nings release es have been n equally bal anced. In ag ggregate the volatility of oour earning mea asures are att historical lows. The envvironment forr earnings should remain supportive iff the econ nomic recove ery continues s. The area w where there has been a marginal pickk-up in stress is in ecconomic surp prises (such as purchasin ng managers s’ indices and the Philadeelphia Federral Inde ex) driven by an improvem ment in the b business env vironment. For further info ormation ple ease contactt the Schrod ders PR team m: Este elle Bibby, Se enior PR Manager, Europ pean Institutional +44 (0)20 7658 3431/ estelle e.bibby@sch hroders.com Cha arlotte Banks, PR Manage er, UK Interm mediary +44 (0)20 7658 2589/ 2 charlo otte.banks@sschroders.co om Geo orgina Roberrtson, PR Ma anager, Intern national +44 (0)20 7658 6168/ georgina.robertson n@schroders s.com Kath hryn Sutton, PR Executiv ve, Internatio onal +44 (0)20 7658 5765/ kathry yn.sutton@scchroders.com m Important Inforrmation: The views and opinions o conttained herein n are those of o Multi-Asset Investmentt and may no ot nece essarily repre esent views expressed o or reflected in n other Schro oders commuunications, strattegies or funds. For press and prrofessional in nvestors and d advisors on nly. This docu ument is not suitable for retail clients. Thiss document iss intended to o be for infor mation purpo oses only an nd it is not inttended as prom motional matterial in any respect. r The material is not n intended as an offer oor solicitation n for the p purchase or sale of any financial f inst rument. The material is not n intended to provide, and a shou uld not be re elied on for, accounting, a le egal or tax advice, or inve estment recoommendations. Inforrmation here ein is believed to be reliab ble but Schro oder Investm ment Manageement Ltd (Sch hroders) doe es not warran nt its completteness or acc curacy. No re esponsibilityy can be acce epted for erro ors of fact orr opinion. Thiis does not exclude e or restrict any duuty or liability that Schroders has to o its custome ers under the e Financial Services S and Markets Actt 2000 (as ame ended from tiime to time) or any otherr regulatory system. s Schroders has exxpressed its own view ws and opinio ons in this do ocument and d these may change. c Reliance shouldd not be place ed on th he views and d information n in the docu ment when taking t individ dual investmeent and/or strattegic decisio ons. Issu ued by Schro oder Investme ent Managem ment Limited d, 31 Gresham Street, Loondon EC2V 7QA A. Registratio on No 18932 220 England . Authorised d and regulatted by the Finnancial Cond duct Auth hority. For yo our security, communica tions may be e taped or monitored. 3