Law and Valuation

advertisement

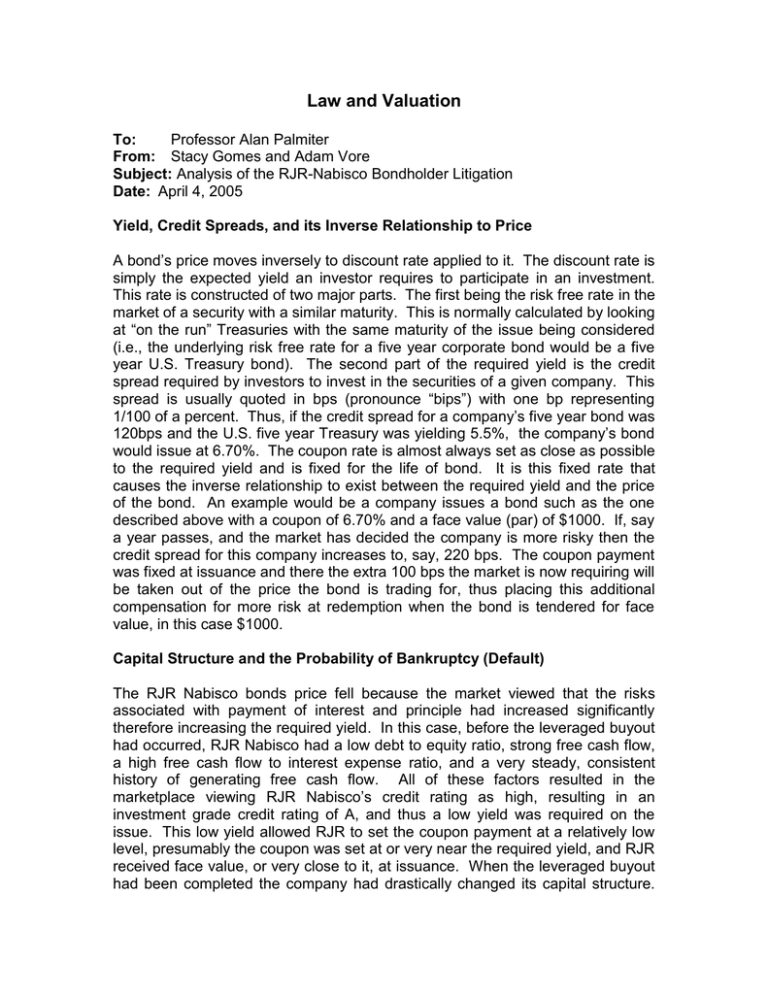

Law and Valuation To: Professor Alan Palmiter From: Stacy Gomes and Adam Vore Subject: Analysis of the RJR-Nabisco Bondholder Litigation Date: April 4, 2005 Yield, Credit Spreads, and its Inverse Relationship to Price A bond’s price moves inversely to discount rate applied to it. The discount rate is simply the expected yield an investor requires to participate in an investment. This rate is constructed of two major parts. The first being the risk free rate in the market of a security with a similar maturity. This is normally calculated by looking at “on the run” Treasuries with the same maturity of the issue being considered (i.e., the underlying risk free rate for a five year corporate bond would be a five year U.S. Treasury bond). The second part of the required yield is the credit spread required by investors to invest in the securities of a given company. This spread is usually quoted in bps (pronounce “bips”) with one bp representing 1/100 of a percent. Thus, if the credit spread for a company’s five year bond was 120bps and the U.S. five year Treasury was yielding 5.5%, the company’s bond would issue at 6.70%. The coupon rate is almost always set as close as possible to the required yield and is fixed for the life of bond. It is this fixed rate that causes the inverse relationship to exist between the required yield and the price of the bond. An example would be a company issues a bond such as the one described above with a coupon of 6.70% and a face value (par) of $1000. If, say a year passes, and the market has decided the company is more risky then the credit spread for this company increases to, say, 220 bps. The coupon payment was fixed at issuance and there the extra 100 bps the market is now requiring will be taken out of the price the bond is trading for, thus placing this additional compensation for more risk at redemption when the bond is tendered for face value, in this case $1000. Capital Structure and the Probability of Bankruptcy (Default) The RJR Nabisco bonds price fell because the market viewed that the risks associated with payment of interest and principle had increased significantly therefore increasing the required yield. In this case, before the leveraged buyout had occurred, RJR Nabisco had a low debt to equity ratio, strong free cash flow, a high free cash flow to interest expense ratio, and a very steady, consistent history of generating free cash flow. All of these factors resulted in the marketplace viewing RJR Nabisco’s credit rating as high, resulting in an investment grade credit rating of A, and thus a low yield was required on the issue. This low yield allowed RJR to set the coupon payment at a relatively low level, presumably the coupon was set at or very near the required yield, and RJR received face value, or very close to it, at issuance. When the leveraged buyout had been completed the company had drastically changed its capital structure. This new capital structure had dramatically increased the probability of default (or bankruptcy). (See Exhibit 1) This increase in default risk (and the accompanying blowing out of credit spreads) is part of a larger group of risks normally referred to as Event Risk. This increased risk was reflected in the company’s credit spread by a large increase. This large increase in its credit spread was exacerbated by the fact that the company had fallen from investment grade to junk status. It is important to note that most of the institutions that hold investment grade debt are required by either law or corporate governance not to hold junk bonds. This meant that when the RJR bonds fell to junk status most of the holders were required to sell by the end of the trading day. The junk bond traders are well aware of this fact and usually force the holders to sell at lower than expected market prices. The most recent example of this event was the downgrade of AT&T bonds to junk in the summer of 2004. Exhibit 1: Effects of Capital Structure on Bankruptcy Risk EPS $2.00 $1.00 Company X has a Capital Structure That Places the Company in Bankruptcy if Revenues Fall Below $100 Million Both Debt and Equity Onwers Worse Off Under New Capital Structure Company X has a Capital Structure that is 50% Debt and 50% Equity Level of Revenue Where the Company Would be Indifferent to Either Capital This Represents the Increased Level of Bankrupcy Risk Inccured by the Increased Leverage Revenue $500 Million $300 Million $100 Million $0.00 Company X Leverages Up its Capital Structure Which Allows for Higher EPS but It has a Higher Level of Minimum Revenue not Fall into Bankruptcy Bondholders Rights, the Indenture, and Event Risk Protective Covenants The court makes a correct distinction between bondholders and stockholders when discussing the applicability of fiduciary duties. Companies owe fiduciary duties, such as loyalty and care to stockholders because they are involved in managerial decisions and they are unable to put their demands into a contract. In contrast bondholders are sophisticated players in the market who are able to carefully analyze the provisions in their contract with companies as a check against potential abuse. The court also correctly noticed the difference between the contract in this case as opposed to basic adhesion or boilerplate contracts. Not only is the sophistication of Met Life and Jefferson Pilot highly significant, but originally, MetLife included protection provisions against LBOs in the contract and later waived them. Therefore, MetLife was fully aware of the possible ramifications of takeovers like the one in this case, but made a conscious decision to take out their protection mechanisms. This is perhaps one of the major reasons why the court refused to look at parol evidence. Also, courts in general typically do not like to get involved with provisions outside of the four corners of a contract unless the contract is ambiguous, one party had a clear disadvantage in bargaining power, or one of the major defenses apply, such as fraud or duress. In this case the contract was clear and the court was correct in stating that they should be concerned with the intent of the contract, but only to the extent that what they intended is evidenced by what is written in the contract. In addition to the basic parol evidence rules cited in the Restatement, there is much common law precedent to this court’s decision as well. In Sabetav. Sterling the NY Court of Appeals stated, “In other words, the implied covenant will only aid and further the explicit terms of the agreement and will never impose an obligation "'which would be inconsistent with other terms of the contractual relationship.” In addition to this provision there are an abundance of cases that state. Similarly the district court in this case stated, ”These plaintiffs do not invoke an implied covenant of good faith to protect a legitimate, mutually contemplated benefit of the indentures; rather, they seek to have this Court create an additional benefit for which they did not bargain.” The two plaintiffs in this case, Met Life and Jefferson-Pilot Insurance, were two large and active participants in the fixed income market. The insurance industry represents the heart of what is referred to as FIG (Financial Institutions Group) in the Debt Capital Markets, and represents the source of the largest volume in both acquisition and issuance. An expert level of understanding of fixed income (and the risks associated with it) is paramount in the insurance business. They must constantly assess how to invest unneeded premiums paid in, and when and how much capital will be needed to cover expected liabilities from claims. The courts found that because these investors were of the “expert level,” the court would not step in and rewrite the indenture. Further evidence of the plaintiffs’ expert level of sophistication in the Debt Capital Markets is the fact that Met Life has total assets of $88 billion with $49 billion located in the fixed income market and Jefferson-Pilot has total assets of $3 billion with 1.5 billion located in the fixed income market. The plaintiffs were aware of the risk and chose not to include any protection from event risk. The indenture should have contained event risk protective covenants. These covenants protect bondholders from a sudden decline in credit rating because a takeover related event has occurred. These events include recapitalization, a hostile takeover, the purchase of a large block of shares, or an excessively large dividend payout. A common form of an event risk protective covenant is the “poison put”. The “poison put” allows bondholders to force the company to buy back the bonds at par should a certain event take place (i.e., a leveraged buyout). This makes actually perpetrating the event so unattractive that the likelihood of the event actually occurring is very low, and should the event actually occur the bondholders are indemnified from any drop in their bond’s price because the company must buy them back at par. (The term “poison” is used because it effectively kills the deal. The right to sell at a predetermined price is called a “put” because you have the right to “put” or force to take at a certain price; thus the convention “poison put”) There are also “ super poison puts” which force the company to buy the bonds back at some multiple of par, usually 1.5x. It is interesting to note that company’s that employee anti takeover protection (even protection that is designed to protect the shareholders) do have a lower cost of debt, but evidence has shown that stockholders to value this anti takeover protection. The Evolution of the Indenture As a result of this case the indenture as grown from about five pages to fifty pages. Investors now require that every remotely possible event be spelled out and the protection that the company will provide explicitly detailed. The indenture will have hundreds of activities that the company can not engage in or they risk violating the indenture. The activities range from how much, if any, additional debt the company can raise to what sort of business opportunities the company can pursue. A whole list of financial ratios and what range they must stay within will be detailed in the indenture. All of this is done in an effort to lock in the risk level of the company so as to fairly compensate the bondholder for the level of risk they are taking. Often indenture now include “step up” clauses that protect bondholders if credit spreads widen even though the company is in complete compliance with the indenture. These “step up “clauses state that the coupon of the issue is increased, say 50 bps, for every level the company is downgraded. This is a further attempt by the bondholders to ensure that they are properly compensated for the level of risk they are incurring.