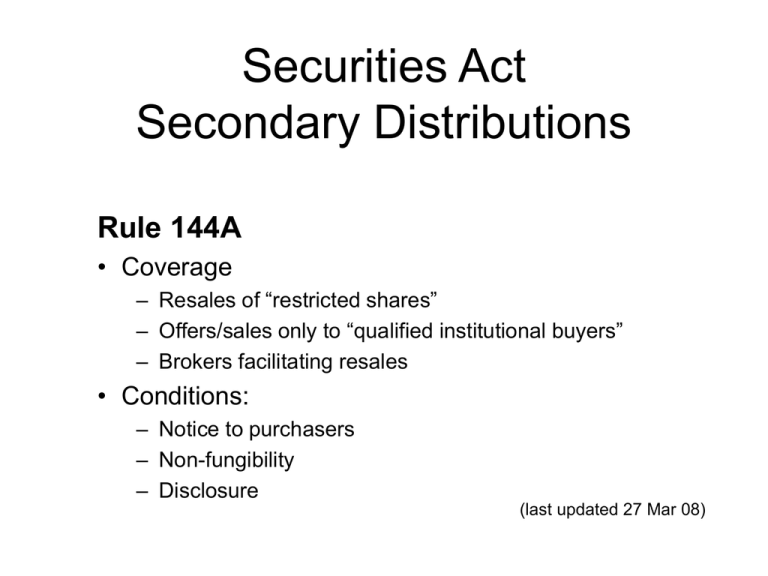

Securities Act Secondary Distributions Rule 144A • Coverage

advertisement

Securities Act

Secondary Distributions

Rule 144A

• Coverage

– Resales of “restricted shares”

– Offers/sales only to “qualified institutional buyers”

– Brokers facilitating resales

• Conditions:

– Notice to purchasers

– Non-fungibility

– Disclosure

(last updated 27 Mar 08)

Practitioner’s Query

Certain "Offered Warrants" (among other

securities) are registered on an S-3 "for

resale" by Selling Holders. Selling Holder

"A" resells Offered Warrants to Selling

Holder "B“ – a possibility not mentioned in

the prospectus.

Selling Holder "B" is part of control group.

Hence, these are control securities in B's

hands even though resale restrictions were

supposedly "cleansed" by the resale

registration.

Is current registration useless if B resells?

Must transfer agent place a restrictive

legend upon the warrant certificates

delivered to B?

Am I missing something here? Or is it possible

that the resale registration also covers the

resale by B?

Patrick Daugherty

seclawyer@aol.com

Patrick Daugherty

partner Foley & Lardner {}

Best Lawyers in America

America's Leading Business Lawyers

("top of the class for capital raising”)

What is a “Rule 144A offering” ….

Institutional

Investor

Broker

Institutional

Broker

Investor

Institutional

Broker

Investor

Institutional

Investor

Broker

Institutional

Investor

Trading market

Firm-commitment

underwriting

Best-efforts

underwriting

Underwriter

Underwriter

Purchaser

Restricted

securities

Issuer

§ 4 Exempted transactions

The provisions of section 5 shall not

apply to-(1) transactions by any person other than

an issuer, underwriter, or dealer.

(2) transactions by an issuer not

involving any public offering.

§ 2(a)(11) Definitions

The term "underwriter" means any

person who has purchased from an

issuer with a view to, or offers or sells for

an issuer in connection with, the

distribution of any security … As used in

this paragraph the term "issuer"

shall include, in addition to an issuer,

any [control person].

Rule 144A

(b) Sales by persons other than issuers or

dealers.

Any person, other than the issuer or a dealer,

who offers or sells securities in compliance

with the conditions set forth in paragraph (d) of

this section shall be deemed not to be

engaged in a distribution of such securities

and therefore not to be an underwriter of such

securities …

(c) Sales by Dealers.

Any dealer who offers or sells securities in

compliance with the conditions set forth in

paragraph (d) of this section shall be deemed

not to be a participant in a distribution of such

securities within the meaning of section

4(3)(C) of the Act and not to be an underwriter

…, and such securities shall be deemed not to

have been offered to the public within the

meaning of section 4(3)(A) of the Act [statute].

Rule 144A

(d) Conditions to be met.

(1)

(2)

(3)

(4)

securities offered/sold only to QIB or

reasonably believed to be QIB

seller (and broker) take reasonable steps

to ensure that purchaser aware relying on

Rule 144A

securities not of same class as securities

listed on US stock exchange or Nasdaq

for non-reporting issuer, exempt foreign

issuer, or foreign government, Rule 144A

holders and prospective purchasers can

obtain from issuer, upon request:

–

“very brief” statement about issuer

and business

–

issuer's most recent balance sheet,

P&L and retained earnings

statements for last 2 fiscal years

Some hypotheticals …

(4 hypotheticals and thought problem)

Hypotheticals #1-4

Island Tours wants to raise additional

capital to expand its operations

internationally to provide tours in

Aruba and the Maldives.

Island Tours’ common stock has

traded on Nasdaq since its IPO

three years ago. Skipper, the CEO

of Island Tours, does not want to

expose the company (or himself) to

potential § 11 liability from the

offering.

Hypothetical #1

Island Tours proposes to sell $50

million of a new class of

preferred stock to about ten

large mutual funds. Island Tours

cold calls 100 mutual funds

(assume that these are QIBs) as

potential purchasers and

provides each mutual fund with

some basic information on Island

Tours and three years worth of

audited financials.

Can Island Tours offer and sell to

the mutual funds under Rule

144A?

Hypothetical #2

Island Tours hires Goldbucks

Brothers to act as its selling

agent. Through Goldbucks

Brothers, Island Tours sells $50

million of a new class of

preferred shares to ten

sell

accredited purchasers under

Rule 506.

Lovey, one of the accredited

purchasers, bought $1 million in Accredited Accredited

Lovey

the offering. Two days after the

investor

investor

offering, Lovey cold calls Fidelity

(a qualified institutional buyer)

Reg D

and Fidelity agrees to purchase

Not current

all of her preferred shares in

’34 Act

Island Tours

Island Tours. Is this okay?

filing

Hypothetical #3

Lovey sells to Fidelity three months

after she purchases the

securities from Island Tours.

Fidelity in turn sells the securities to

Vanguard (also a QIB) the next

week.

What if Fidelity sells the securities

Accredited

to the Professor, an academic

with a net worth of $900,000, the investor

next day in a transaction (without

involving a broker)?

Accredited

investor

Lovey

Reg D

Island Tours

Hypothetical #4

Instead of a preferred stock

offering, Island Tours places $10

million of its common stock with

ten accredited investors

(including Lovey). The offering

is exempt under Rule 506.

Lovey wants to sell $1 million of the

common stock she purchased in

the Rule 506 offering to Fidelity

(a QIB) under Rule 144A?

??

Nasdaq

Accredited

investor

Accredited

investor

Lovey

Reg D

Island Tours

Thought problem …

Compare the following …

Ten years ago Fraud-By-Mail (FBM)

placed $5 million common shares

under Rule 505. FBM is a small

non-reporting company with an

active policy of not disclosing any

information to the market or to

broker-dealers.

Last month International Business

Machines (IBM) places $5 million

common shares under Rule 505.

IBM is a large reporting company,

with an active NYSE following.

Which shares are liquid? Does this

make sense?