The Great Electric Car Debate: Is Widespread Plug-In Hybrid Electric

Erwin 1

The Great Electric Car Debate: Is Widespread Plug-In Hybrid Electric

Vehicle Adoption Plausible in American Society?

Brodie D. Erwin

1. 0 Introduction

Since at least the 1970s, Americans have known that reliance on gasoline is a risky proposition. The utilization of oil as the primary energy source for transportation raises a wide range of policy concerns including: peak oil fears, climate change, and national security.

1

With these concerns becoming more prevalent in recent years, our leaders have finally begun to push for the development and adoption of alternative sources of transportation energy.

2

Interestingly enough, one of the first automotive fuels, electricity, is once again worthy of consideration.

The very first electric car was developed in 1839 by Robert Anderson in Scotland.

Anderson’s electric car was thought to be the future of the automobile business because “you

[couldn’t] get people to sit over an explosion.” 3

The lack of a battery that could store power eventually led to the triumph of the gasoline-powered internal combustion engine over electric engines. However, the technology now exists to power passenger cars with electricity over ever

1 Joshua P. Fershee, Struggling Past Oil: The Infrastructure Impediments to Adopting Next

Generation Transportation Fuel Sources, 40 Cumb. L. Rev. 87, 88 (2010).

2 President Barack H. Obama, Address to Joint Session of Congress (Feb. 24, 2009),

(transcript available at http://www.nytimes.com/2009/02/24/us/politics/24obamatext.html) (“We have known for decades that our survival depends on finding new sources of energy. Yet we import more oil today than ever before.”).

3 Fershee, supra note 1 at 99, (citing Vincent Curcio, Chrysler: The Life and Times of an

Automotive Genius, 138 (2000)).

Erwin 2 increasing distances.

4

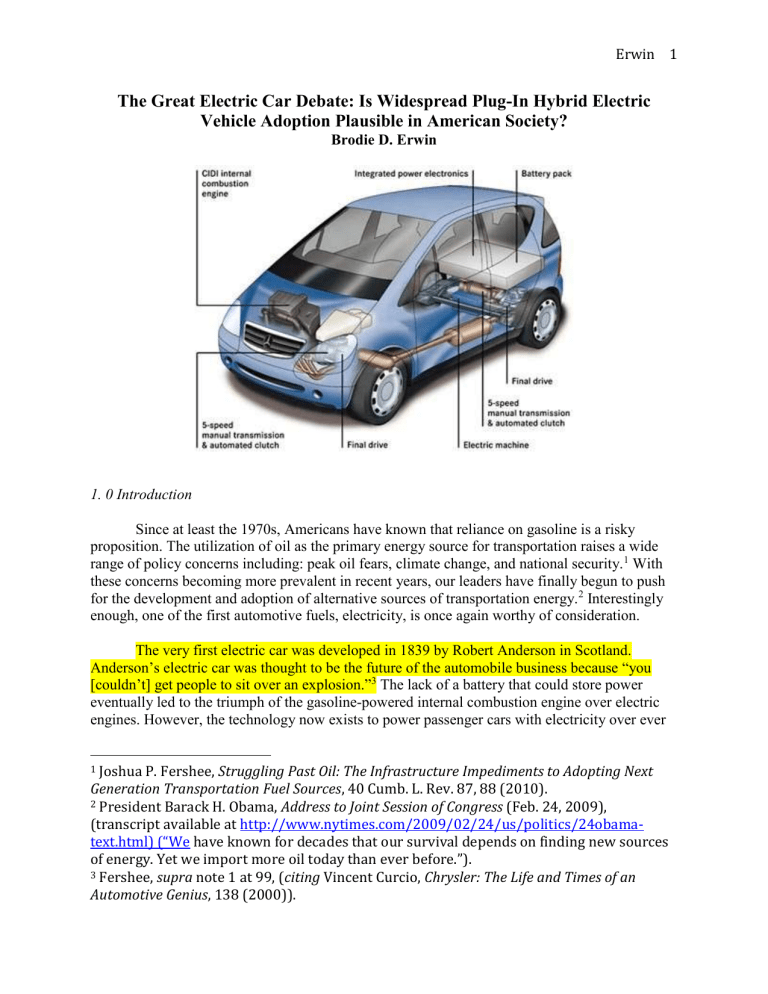

This break through in technology has prompted many critics of oil dependency to argue that plug-in hybrid electric vehicles (PHEVs) are the solution to the environmental problems that motorized transportation causes. However, electric vehicles have been plagued by a laundry list of limitations that experts point to as obstacles to widespread penetration of PHEVs into the marketplace.

5

This paper seeks to determine whether a widespread adoption of PHEVs as the primary car for American drivers is plausible in the United States.

2.0 The Positive Side of PHEVs as a Transportation Source

Beginning in 2010 several PHEVs were introduced to the market. First, Chevrolet rolled out the Volt, a PHEV capable of up to forty miles of travel on a pure electrical charge. Next,

Tesla introduced the Roadster, a two-seat all electric sports car that was capable of traveling 200 miles on a single charge.

6 Lastly, Nissan introduced the all-electric five-seat Leaf that is capable of traveling 106 miles before it must be recharged.

7

It is easy to identify the obvious positive aspects that these PHEVs will have over internal combustion engine vehicles (ICEVs). PHEVs are far more energy efficient. Electric motors convert seventy-five percent of the chemical energy from their batteries to power their wheels while ICEVs only convert twenty percent of the energy stored in gasoline.

8

PHEVs emit no tailpipe pollutants when run in full electric mode. This will greatly reduce smog, carbon dioxide, and other emissions that contribute to the destruction of our Ozone. Electric motors are also quieter and offer smoother and stronger acceleration while requiring less maintenance than

ICEVs.

9

Most importantly, while PHEVs cost more to initially purchase than conventional vehicles, their operating costs are significantly lower than ICEVs. PHEVs, like the Volt cost about three cents a mile to fuel, while a comparable vehicle in a Toyota Corolla would cost about thirteen cents a mile. The roughly $1.20 that it takes to run the Volt over forty miles is considerably less than the $5.20 it takes to power the Corolla over the same distance.

10 Additionally, more than seventy-five percent of the nation commutes forty miles a day or less to work, thus PHEVs like the Volt or the Leaf are more than capable of meeting consumers’ basic driving needs on pure electric charges.

4 In 1996, General Motors introduced the EVI a plug-in electric two-seat car that had a range of up to 80 miles. Today, the newly released Nissan Leaf has a range of up 106 miles.

See generally http://www.fueleconomy.gov/feg/evsbs.shtml.

5 Id.

6 Danielle Changala, Paul Foley, The Legal Regime of Plug-In Hybrid Electric Vehicle

Adoption: A Vermont Case Study, 32 Energy L.J. 99, 101-104 (2011).

7 Id.

8 fueleconomy.gov, supra note 4

9 Id.

10 based on reported 29 mile per gallon average rate of 2011 Toyota Corolla and the current average price of unleaded gas at $3.69.

Erwin 3

2.1 Diagram of the Chevrolet Volt’s Hybrid Driving System

Another positive in the argument for wide-scale adoption of PHEVs is that there is already tremendous physical infrastructure in place in the electricity sector that is available to virtually every American. Other alternative fuel sources, such as ethanol and hydrogen face significant infrastructure hurdles related to providing widespread access to their fuel source.

However, with PHEVs, consumers are only a “plugin” away from accessing an almost endless supply of fuel.

This is not to say that if electricity were to become the primary transportation fuel source, major changes would not be needed. Proponents simply argue that the backbone infrastructure is already available, and that the increase in electricity demand caused by adding the transportation sector to its list of consumers could be met from electricity generated from cleaner resources such as wind and solar power.

11

Currently, one of the major criticisms of using wind and solar power for electricity generation is that neither are “on” all the time. That is that wind is not always blowing and the sun is not always shining.

12

Since electricity, unlike gasoline or natural gas, cannot be stored in large quantities the use of these cleaner sources usually poses a significant problem.

To remedy this problem, widespread implementation of electric power storage technology is needed. The batteries found in PHEVs could provide a means by which this electric power storage could be achieved.

13

Each PHEV would draw electricity up to a full charge, and if the grid needed additional electricity during these times, consumers could sell small amounts of power back to the grid from their plugged-in car. Proponents continue to advocate by arguing that PHEVs would become even more cost effective if electric companies would provide compensation for storing energy and improving the overall reliability to the grid.

14

Proponents of PHEVS, point to these benefits as evidence that widespread use of electric vehicles should no longer be considered theoretical.

11 Fershee, supra note 1 at 102.

12 Id.

13 Changala & Foley, supra note 6 at 109.

14 Id.

2.2 Diagram of the home charging station for the Nissan

Erwin 4

LEAF

However, building an electric car is not the hard part, what is difficult is designing an electric car that will provide acceptable performance in terms of: range, ease of recharging, safety, and passenger comfort.

15

3.0 The Obstacles for PHEVs as a Transportation Source

A 1998 study by the U.S. General Accounting Office, listed five major barriers to near term introduction of PHEVs. The barriers were: limitations of current battery technology, gaps in the required infrastructure, uncertain safety, uncertain market potential, and high initial purchase price.

16 While some of these barriers, like battery technology, have been greatly diminished over the last ten years many still present considerable obstacles for widespread adoption of PHEVs.

PHEV battery technology has progressed light years from 1998. In 1998, batteries had a typical range of eighty miles, acceleration power that was less than a ICEV, and a maximum operating life of 500 to 2,000 charges. Id . However, today’s PHEV batteries have a range of up to 200 miles, an acceleration power of zero to sixty miles-per-hour in less than nine seconds

(comparable to most ICEVs), and have a much better charging lifespan.

17

Additionally, many of the safety concerns surrounding PHEVs have been put to rest.

Aside from the recent headlines detailing the dangers of overcharging Chevrolet Volts,

15 C. Kenneth Orski, The Great Electric Car Debate, 30 Urb. Law. 525, 526 (1998).

16 Id. at 526-527.

17 Bobbie A. Flower, Electric Vehicles: A Breath of Fresh Air for the Next Millennium, 15 Pace

Envtl. L. Rev. 329, 365 (1997). See also http://idealab.talkingpointsmemo.com/2011/11/stanford-seeks-to-boost-clean-energywith-new-super-long-lasting-battery-electrode.php

.

Erwin 5 consumers are finding that PHEVs are just as safe (if not more so) than ICEVs.

18

As electric engines have become more powerful, PHEVs have been able to grow larger in size (and are even available in some SUV models). The larger size of PHEVs has rendered moot the argument that their crash test statistics are poor in comparison to conventional cars.

19

However, the two major hurdles to widespread PHEVs still continue to be concerns about gaps in the required infrastructure and uncertain market potential.

While a power source is readily available in the U.S. electric grid to charge PHEVs at home, most major components of PHEV service support are not in place. This includes commercial fleet charging stations, public charging stations, battery recycling facilities, and emergency road service.

20

There is no question that the lack of a long-range quick charging battery impacts the ability of PHEVs to replace ICEVs immediately. Current battery technology limits PHEVs to a cruising range between 90-150 miles, while most gasoline cars have a cruising range in the area of 350-450 miles.

21

Additionally, PHEVs take up to eight hours to reach a full battery charge.

22

With these limitations there is no readily available solution for drivers needing to travel long distances without having to build in lengthy refueling stops.

Companies are in the process of developing numerous ideas to solve this obvious problem. The idea of converting normal gas stations into “charging stations” has been circulated.

23

PHEV drivers would pull in and “exchange” their depleted battery for a fully charged one. The idea is that consumers are already familiar with the “swapping” of fuel containers because of the way the propane gas tank industry runs.

24

Businesses, like Blue Rhino

Propane, have refilling stations at local grocery stores and gas stations. Consumers bring their empty propane tanks to these stores and switch them out for a pre-filled full tank. Familiarity with this type of process would help ease consumer concerns about a new way of “refueling,” as long as the charging stations maintained high-quality exchanges.

25

A scenario, more realistic than the “propane model,” is already being developed by

Nissan. Their concept revolves around having high- powered public charging stations installed at gas stations, malls, and similar public locations, all while having the stations be detectable by onboard navigation systems.

26

These stations would use a three-phase, 50 kW “fast charger” to

18 see generally http://gm-volt.com/2011/04/18/garage-fire-ignites-controversey-overthe-chevrolet-volt/

19 Fershee, supra note 1 at 102.

20 Orski, supra note 15 at 525.

21 Fershee,supra note 1 at 103.

22 Changala & Foley, supra note 6 at 102-103.

23 Fershee, supra note 1 at 104-105.

24 Id.

25 Kevin Demarrais, Summer Cookouts Take Big Hit, N.J. Record, May 20, 2009 at B1

(discussing how Blue Rhino and Amerigas have been criticized recently for only filling their tanks with fifteen pounds of propane, two pounds less than in prior years. For consumers to back exchanging electric car batteries at “propane exchange” style stores the batteries would have to be comparable.)

26 Changala & Foley, supra note 6 at 103-104.

Erwin 6 provide an eighty percent charge in only thirty minutes. However, these charges are projected to cost around $45,000 each.

27

Still, Nissan is hoping to alleviate “range anxiety” by working on this plan for public charging stations in combination with the government and the private sector.

3.1 Concept Drawing Depicting Public Charging Stations at a Best Buy

Regardless of how a refueling system ends up being structured, it is clear that a national network of charging stations is needed before PHEVs experience widespread adoption over conventional gas powered vehicles. This network would go along way in filling the gaps that critics believe are present in the infrastructure needed to support PHEVs as a primary transportation source.

As previously stated, uncertain market potential and the high initial purchase price of

PHEVs are also major barriers to their widespread adoption. It is true that PHEVs have a high purchase price. The Volt costs around $40,000 and the Leaf costs $33,000. Critics argue that these high sticker prices are keeping large numbers of drivers from being able to afford these cars. However, there are number of government incentives that greatly lower the price of a

PHEV.

28

A $7,500 tax credit is offered to purchasers of PHEVs by the federal government through the 2009 American Recovery and Reinvestment Act (ARRA). That tax credit brings the cost of the Volt to around $32,500 and the cost of the Leaf to around $25,280, completely comparable with similar new ICEVs.

29

Many states also provide additional incentives for purchasers of PHEVs that further increase the discount buyers will receive.

30

27 Id. see also Nissan LEAF, Electric Car, Nissan USA, http://nissanusa.com/leaf-electriccar/details.jsp#/details (last visited November 28, 2011).

28 Id.

29 Id.

30 Id. (stating that California and Georgia offer an additional $5,000 tax credit, Colorado offers up to $6,000 additional , and Oregon offers and additional $1,500) see also Hybrid and Plug-in Incentives and Rebates: Region by Region, http://www.hybridcars.com/localincentives/region-by-region.html

(last visited December 1, 2011).

Erwin 7

The high purchase price is not the only limitation to the PHEVs market potential. Critics also argue that PHEVs (like the Volt) that aren’t fully electric, only become cost efficient when the vehicle is driven around forty miles a day. This works well in some states, because half our nation’s vehicles are driven less than twenty miles per day. 31

However, in more rural states the number of miles traveled per day increases drastically. Thus, a round trip commute that exceeds

40 miles would necessitate driving on more than just the vehicle’s electric motor and the savings of the electric engine would not be sufficient enough to overcome the high price tag associated with the car.

32

Still in “all-electric” cars like the Leaf or the Tessla Roadster one would think that this argument would become moot.

The last caveat in the argument about the uncertain market potential of PHEVs deals with the consumption of electricity itself. There is a growing concern that if PHEVs experienced widespread adoption, they would only be charged during times of peak demand when consumers arrived home from work. This is considered a time of “peak” electric use, because as people arrive home they turn on their lights, air conditioners, and other electronics.

33

The charging of

PHEVs at times of “peak” energy demand would increase the costs of electricity for all consumers regardless of whether they owned a PHEV. Thus, this argument becomes a disincentive for consumers looking to keep their electricity costs down. However, if PHEVs were charged at night, when no other electricity was in use, there would be little effect on “peak” electric demand. Thus, proponents argue that that “time-of-day” rates could be instituted to encourage overnight charging of the vehicles.

34

In the face of these critiques, the question becomes: “how do we successfully encourage widespread adoption of PHEVs?”

4.0 How Do We Make it Work?

In working to see the widespread adoption of PHEVs come to fruition, the majority of proponents advocate letting PHEVs become competitive in the market by removing subsidies to the fossil fuel industry.

35

The federal government currently provides a much as $14 billion of direct fossil fuel subsidies annually.

36

Some critics estimate that the true cost of oil for the

United States is more than $100 a barrel, almost twice that of the recent prices that consumers complain about.

37

[with oil now at $100 – what’s the equation today?] Subsidies for fossil fuels allow the oil industry to keep the pump price at an artificially low rate that the electric car industry cannot compete with. PHEV proponents argue that the removal of the subsidies that mask the direct cost of oil will return us to a truly competitive market in which consumers will decide for themselves which fuel source, gas or electricity, is the most cost effective.

38

PHEV

31 Id. at 108

32 Id.

33 Id. at 110.

34 Id.

35 Daniel Ramish, Government Regulatory Initiatives Encouraging the Development and Sale of Gas/Electric Hybrid Vehicles:Transforming Hybrids from a Curiosity to an Industry

Standard, 30 Wm. & Mary Envtl. L. & Pol’y Rev. 231, 249-250 (2005).

36 Id.

37 Id. citing Justin Blum, Supply Fears Drive Oil’s Price Higher, Wash. Post, March 4, 2005.

38 Id.

Erwin 8 advocates also suggest that the government funds that had been previously tied up in fossil fuel subsidies should then be redirected to research and development of hybrid technologies.

39

Some scholars also advocate discouraging fossil fuel consumption by going a step further and enforcing a harsh tax on gas.

40

These scholars say that a tax should be based on a percentage of the sales prices, as done with other sales tax, with a floor tax.

41 Portions of these additional revenues would then be set aside for state or local projects to pursue alternative, non-oil-based transportation fuel options. This setting aside of tax revenues would be similar to how the federal government funded the creation of the National Highway System in the 1950’s by increasing the tax on gasoline.

42

However, the enforcement of a tax (that directly funds hybrid development) would detract from the argument that PHEVs could win out over conventional gas powered vehicles if the market place was truly competitive. A gasoline tax would amount to a similar unfair advantage for PHEVs that the oil industry enjoys in the form of government subsidies.

In the end it will take more than government funding. It will take manufacturers producing a quality, cost effective vehicle and a swing in public opinion where individuals are willing to sacrifice some level of comfort in the name of protecting the environment.

5.0 Conclusion

While a number of arguments against PHEVs have been presented, it is quite clear that the biggest barriers blocking widespread adoption of PHEVs are the lack of a long lasting battery or a nationwide network of charging stations that make it practical for drivers to operate PHEVs on long distance trips. An argument can be made that consumers will be willing to pay the high sticker price for PHEVs in the name of protecting the environment as long as they don’t have to sacrifice safety and comfort. However, until a viable solution is formed that answers the PHEVs’ distance problem we will fail to see any successful penetration of PHEVs into the national market. In the end, the consumer will be the ultimate judge of when PHEV technology is ready to compete with the gasoline engine.

39 Id.

40 Id.

41 Fershee, supra note 1 at 117.

42 Fred Bosselman, Energy, Economics, and the Environment: Cases and Materials, 1070-73

(Foundation Press 2010) (2000).

PHEV vs

ICEV

Initial cost

Purchase price

Tax rebate

Operating cost

Resale (15 years)

PHEV

35,000

10,000

14,161

1,924

TOTALS 41,085

Assumptions

ICEV

NPV @ 5%

ICEV

15,000

40,433

1,443

56,877 gets 30 mpg / 12,000 mi/yr

Gas costs $3.50 and rises 10%/year upkeep of $500/yr rises 10%/yr insurance starts $400 +5%/year resale of $3000

PHEV gets 100/mpg / 12,000 mi/yr

1

2

5

6

9

10

13

14

15 5,316 1,427

PHEV Fuel Upkeep

1

2

3

Electric costs rise 5%/year upkeep of $300/year rises 10%/yr insurance starts $300 +5%/year resale of $4000

ICEV Fuel Upkeep

1,400

1,540

3 1,694

4 1,863

2,050

2,255

7 2,480

8 2,728

3,001

3,301

11 3,631

12 3,994

4,394

4,833

420

441

463

0

0

0

500

550

605

666

732

805

886

974

1,072

1,179

1,297

0

0

0

Insurance NPV

400

420

1,714

1,778

Total

441

463

486

511

536

563

591

621

652

684

718

754

792

1,844

2,325

2,418

2,515

2,617

2,723

2,835

2,951

3,074

3,202

3,336

3,477

Insurance NPV

300

315

331

3,624

40,433

686

686

686

Erwin 9

8

9

10

11

4

5

6

7

12

13

14

15

486

511

536

563

591

621

652

684

718

754

792

832

300

330

363

399

439

483

531

585

643

707

778

856

Total

347

365

383

402

422

443

465

489

513

539

566

594

933

944

957

969

983

997

1,012

1,028

1,044

1,061

1,079

1,097

14,161

Erwin 10