Persistence of Innovation in Ireland Nola HewittDundas Queen’s University Belfast

advertisement

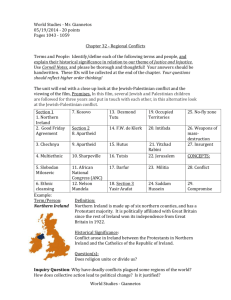

Persistence of Innovation in Ireland Nola Hewitt­Dundas Queen’s University Belfast InterTradeIreland Innovation Conference 9­10 June 2009, NUI Galway Key Questions 1. Has Ireland become an innovation­driven economy? 2. What are the factors that drive innovation in the organisation? 3. How does public support achieve its aim of increasing the number of R&D and innovation active businesses? Data Source – Irish Innovation Panel (IIP) Irish Innovation Panel (IIP) – plant level innovation activity over 15 years (soon to be 18 years) 5 (6) linked surveys Manufacturing (and since 2001) tradable service firms ≥10 employees Information on: innovation (product, process, organisational); R&D activity; functional flexibility in innovation; human capital formation; investments and financial performance; market profile; innovation and business strategy; technology adoption; innovation networks; government assistance; barriers to innovation Advantages – direct evidence & wealth of additional detail Policy Context 1991 to 2005 – priority of industrial policy has been promoting innovation and developing innovation capability, particularly among locally­owned firms Substantial public sector investment ­ EU driven ‘firms which possess and exploit technology are best positioned to take maximum advantage of shifts in the world economic environment. Without a strong technological capability Ireland’s industry is likely to be little more than a pawn on the battlefield of global competition’ (Government of Ireland, 1994, 59). “… Ireland by 2013 will be internationally renowned for the excellence of its research, and will be to the forefront in generating and using new knowledge for economic and social progress, within an innovation driven culture” (DETE, 2006, p.21) Trends in Ireland’s Innovation Performance 67.9% 62.8% Ireland and NI Compared Product Innovation – Foreign & Locally Owned Process Innovation – Foreign & Locally Owned What is driving plant’s innovation activity? I i = f0 KS ki + f1 RI i + f2 BAR i + f3 GOVT i + e i Findings: Critical Importance of in­house R&D activity 30% more likely to undertake product innovation 19% more likely to undertake process innovation Increases plant’s sales of new products by 11% Increases plant’s sales of new & imp. Products by 23% Suggest value of policy efforts to boost Business R&D Knowledge sourcing & Innovation Backward innovation linkages to suppliers or consultants – 11 to 12% more likely to undertake product or process innovation and c.8% greater sales from new or new & imp. products Other knowledge sources are less important Contrary to ‘open innovation’ innovation model Suggests that Ireland is driven by a relatively narrow range of external knowledge sources Is this attributable to low R&D and therefore low Abs. Cap? Concerning lack of relationship with Public knowledge sources? Resource base & Innovation Plant size important for process innovation – non­linear inverted U shape relationship Plant age unimportant Proportion of graduates unimportant (perhaps more important for exploitation than knowledge generation) Foreign Owned – 20% more likely to be product innovator 7.5% more sales from new products Access to Group R&D 17% more likely to be product innovator Public Sector Support & Innovation Increase of c.22% (30%) the probability that a plant will be a product (process) innovator Increase by c. 17% the sales that a plant obtains from new products ‘Barriers’ variables are largely insignificant suggesting a relatively conducive operating environment in Ireland Note lack of significance on skills or lack of finance (2005!) More significant is a lack of partners – 12­13% effect on innovation activity & 10­12% effect on innovation success Regulation reducing sales of new products by c.7% Suggests – policy to strengthen innovation partnerships and reduce regulation Understanding persistence of innovation Quantitative data ­ evidence of Creative Accumulation in technological capability – stronger product than process LO and SMEs – greater persistence but dominated by non­innovation activity sectors – all persistent except paper & printing and electrical & optical equipment Qualitative analysis – dominant role of strategic considerations and passive role of resource capabilities • A narrow capability based explanation of innovation persistence is inadequate and a more strategically aware systemic and contextual approach is necessary Back to the key questions… Qu1 Has Ireland become an innovation­driven economy? Limited evidence to support this. Declining Process innovation particularly in Foreign­owned and suggestions of move to more incremental development Qu 2 What are the factors driving innovation? + R&D capability ­ Lack of Innov. Partners + Backward linkages ­ Absence of Public + Government financial support partners effect + Foreign Owned ­ Regulation Policy Implications Qu 3 How does public support achieve its aim of increasing the number of R&D and innovation active businesses? Appropriateness of this target & recent initiatives e.g. Innovation Vouchers, CRCs, Applied Research Enhancement Programme, Technology Transfer Strengthening Initiative Challenge is building persistence of innovation activity Inadequacy of policy initiatives on internal capability and behavioural additionality. Need to account for strategic competencies and network participation Support for networking (current gap – private sector networks) and dealing with regulation Hewitt­Dundas, N and Roper, S (2008) Ireland’s Innovation Performance: 1991 to 2005, Quarterly Economic Commentary, ESRI, Summer 2008, pp. 46­68 Roper, S and Hewitt­Dundas, N (2008) Innovation persistence: Survey and case study evidence, Research Policy, 37, pp. 149­162