Making Ireland Grow Again

advertisement

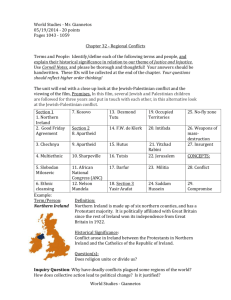

Making Ireland Grow Again: Characterising, Measuring, Coordinating, and Fostering Innovation Capabilities at the Enterprise, Sector and National Levels June 9, 2010 Michael Best Professor Emeritus University of Massachusetts Fellow, Judge Business School, University of Cambridge Visited plants in : • • • • • • • • • Greater London* Germany Slovenia* Cyprus* Massachusetts/NH* Italy Jamaica* Canada Colombia • • • • • • • • Northern Ireland* Malaysia* Indonesia Honduras* India* Moldova* Estonia Albania * Conducted enterprise/cluster modernization analysis Where does Ireland fit in the global economy? • Past: “IDA model” • Future aspirations: smart economy, knowledge economy, innovation hub… • Assessment from Capabilities Perspective Ireland’s Strategic Assessment: (what the IDA saw and acted on) • The triumph of neo-liberalism and the opening of global markets (EU, Eastern Europe, ex-USSR, China, India, Brazil) Inter-determinant with: • Emergence of high-tech ‘industrial districts’ in US (3000 companies in MA, Silicon Valley, Austin) serially ‘spawning’ new sectors Evolution of Industrial Structure PS 5 Knowledge intensive (systems integration) information, communication, instruments future PS 3,4 Complex-assembly intensive (flow) auto, consumer electronics PS 2 Material-intensive (flow) steel, plastic food processing present (Principle of production) PS 1 Low technology, labour intensive (interchangeability) apparel, toys, furniture M.Best, NCA West Pole: Diffusion of Irish Model • 13 countries grown 7% annually for 25 years (www.growthcommission.org) • Manufacturing exports of 4 tigers increased from $5 billion in 1962 to $715 billion in 2004 • New ‘growth machine’ Government Strategy: transition to high tech economy • • • • • Smart economy Knowledge economy International innovation hub Innovation hub for Europe Green economy High-tech Job Growth Aspirations: High Estimate • 215,000 by 2020to match SV’s 15% of labor force “Were Ireland to achieve levels of employment in high-tech firms comparable with Silicon Valley, the numbers would increase substantially. More realistically, Ireland might aspire to be a leader in Europe and aim to have 15% of employment concentrated in high-tech firms. This would result in almost 346,000 people being employed in high-tech firms by 2020 – a net increase of 215,000 jobs over the period.” Innovation Ireland, Innovation Task Force, p. 88 Low Estimate: Best in Europe • 117,000 by 2020 to match highest concentration in Europe “At regional level, the leading region for hightech employment [in EU-27] was Berkshire, Buckinghamshire and Oxfordshire (UK), with high-tech sectors accounting for 10.7 % of total employment. A region such as this may provide a more realistic short-term model for Ireland. Were Ireland to increase its share of employment in high-technology firms from the current level to 10.7%, this would see employment in high-tech firms increase from approximately 131,000 in 2008 to 248,000 in 2020, a net increase of 117,000. Is there room at the top? • Where are the drivers of growth and innovation to achieve the targets? • Issue: low Gross Expenditure on R&D (GERD) to GNP in Ireland. • Why? Lack of fast-growing mid-size to large firms with new product development (NPD) and technology management (TM) capabilities and any evidence-based analysis of how to develop them in the Ireland context. High-tech definition • “Owns proprietary technology or proprietary IP that contributes to a significant portion of the company’s operating revenues or devotes a significant proportion of its operating revenues to R&D of technology. Using other companies technology or IP in a unique way does not qualify” Deloitte Technology Fast 500 eligibility criteria. Indicators of New Technology Development R&D Intensity Patent intensity Ireland 1.2 2 Massachusetts 5.3 14 Finland 3.4 9 R&D intensity = R&D to GSP/GDP, 2003 Patent intensity = USPTO patents awarded GSP/GDP, av erage of 1999, 2001, 2003 Source: The John Adams Innovation Institute Table R&D EU Scoreboard Companies and Employment Impact, 2008 ** Companies Population million R&D Investment Emillion Employees % of LF* Finland Sweden Netherlands Denmark Belgium Spain Ireland Greece 58 70 53 47 30 21 12 4 5.3 9.2 16.4 5.5 10.7 45.3 4.4 11.2 6787 6952 9703 3418 2558 1471 532 53 534,814 834,151 1,003,566 310,776 570,200 485,379 60,602 6,281 25 23 15 14 13 2.8 3.4 0.13 Non EU*** Switz. Taiwan 38 41 7.6 23.1 17468 5125 950,875 562,611 32 6.1 * Percentage of labor force derived by assuming labor force equal to 40% of a country's population. ** The EU Industrial R&D Investment Scoreboard is a compilation of the top 1000 European headquartered companies by R&D investment. *** The EU Industrial R&D Investment Scoreboard has a separate scorecard for the top 1000 non-EU companies. Table Irish Companies in Top 1000 EU R&D Investment Scorecard R&D Investment No Company Rank Employees Market Capitalisation 2008 2008 Change 08/07 €m # €m % 531.72 60,602 10,725 -41.0 ICB Sector NACE Sector Code 2008 Ireland 1 Elan 80 Pharmaceuticals (4577) 227.92 1,683 2,574 -30.1 2 Kerry 118 Food producers (357) 147.46 22,312 3,184 -10.6 3 Bank of Ireland 247 Banks (835) 56.00 15,868 2,248 -66.1 4 SkillSoft 322 Software (9537) 35.86 1,124 588 5 Trinity Biotech 638 Health care equipment & services (453) 11.49 757 6 AGI Therapeutics 640 Pharmaceuticals (4577) 11.47 9 7 -89.4 7 Glanbia 688 Food producers (357) 10.13 3,400 742 -46.3 8 Norkom 773 Software (9537) 7.78 304 99 -22.6 9 Kingspan 799 Construction & materials (235) 7.10 6,692 958 -23.6 10 Greencore 823 Food producers (357) 6.74 8,066 282 -34.7 11 Datalex 903 Computer services (9533) 5.40 164 19 -33.3 12 Trintech 997 Software (9537) 4.37 223 25 12.9 Source: The 2009 EU Industrial R&D Investment Scorecard, European Commission. Table Danish Companies in Top 1000 EU R&D Investment Scorecard No Company Rank ICB Sector NACE Sector Code Denmark R&D Investment Employees Market Capitalisation 2008 2008 2008 €m # €m % 3,418.24 310,776 82,302 -19.7 Change 08/07 1 Novo Nordisk 27 Pharmaceuticals (4577) 994.94 26,069 22,453 -4.6 2 Lundbeck 68 Pharmaceuticals (4577) 300.07 5,208 2,889 -18.4 3 Vestas Wind Systems 81 Alternative energy (58) 223.00 17,924 11,022 -32.3 4 Genmab 94 Biotechnology (4573) 191.16 565 1,314 -37.3 5 Danfoss 108 Industrial machinery (2757) 159.35 27,386 6 DONG Energy 113 Oil & gas producers (53) 154.65 5,347 7 Grundfos 117 Industrial machinery (2757) 149.12 17,482 8 Novozymes 134 Biotechnology (4573) 133.69 4,993 3,397 -10.4 9 Danisco 171 Food producers (357) 96.61 8,986 1,673 -28.8 10 Danske Bank 192 Banks (835) 79.81 23,755 11,900 -19.1 11 GN Store Nord 212 Telecommunications equipment (9578) 71.35 4,786 721 -9.8 12 Bang & Olufsen 214 Leisure goods (374) 71.20 2,541 278 -23.7 13 William Demant 221 Health care equipment & services (453) 66.91 5,383 2,672 8.7 14 Coloplast 262 Health care equipment & services (453) 51.86 7,420 2,195 8.1 15 Topotarget 282 Biotechnology (4573) 46.51 109 81 -48.4 16 ALK-Abello 289 Pharmaceuticals (4577) 43.94 1,454 514 -40.8 17 LEGO 291 Leisure goods (374) 43.26 5,388 18 Simcorp 296 Software (9537) 41.45 949 619 -4.3 19 NKT 304 Electrical components & equipment (2733) 38.91 8,610 724 -35.9 20 FLSmidth 316 Construction & materials (235) 36.01 11,509 1,812 -45.9 21 Lifecycle Pharma 324 Biotechnology (4573) 35.43 102 72 -56.7 22 NeuroSearch 325 Biotechnology (4573) 35.40 242 274 -50.5 23 Auriga Industries 343 Chemicals (135) 32.29 1,904 247 -49.0 24 Santaris Pharma 357 Biotechnology (4573) 29.61 100 25 Rockwool International 370 Construction & materials (235) 28.22 8,689 1,400 -22.1 26 LM Glasfiber 398 Chemicals (135) 25.02 6,241 27 Dako 431 Biotechnology (4573) 22.01 1,048 28 Symphogen 451 Biotechnology (4573) 20.62 87 29 Thrane & Thrane 455 Telecommunications equipment (9578) 20.55 693 119 -42.1 30 Terma 463 Aerospace & defence (271) 20.06 1,183 31 Post Danmark 488 Industrial transportation (277) 18.41 20,021 32 TDC 512 Fixed line telecommunications (653) 16.93 16,193 4,999 -35.5 33 Schouw 576 General industrials (272) 14.20 3,743 377 -50.9 34 Pharmexa (now Affitech) 578 Biotechnology (4573) 14.17 74 22 -18.9 35 Carlsberg 600 Beverages (353) 12.90 45,505 7,952 -19.7 36 Zealand Pharma 647 Pharmaceuticals (4577) 11.10 68 37 KMD 649 Computer services (9533) 11.03 3,027 38 Sondagsavisen 804 Media (555) 7.00 1,187 39 Maconomy 833 Software (9537) 6.53 224 19 40 Bavarian Nordic 844 Biotechnology (4573) 6.32 270 307 42.8 41 Dantherm 853 Industrial machinery (2757) 6.12 2,303 30 -73.9 42 Exiqon 879 Biotechnology (4573) 5.78 216 60 43 Dansk Landbrugs Grovvareselskab 913 Food producers (357) 5.26 4,556 44 Ambu 917 Health care equipment & services (453) 5.23 1,397 132 36.3 45 Topdanmark 945 Nonlife insurance (853) 4.97 2,467 1,730 -1.8 46 Solar 967 Electrical components & equipment (2733) 4.70 3,010 201 47 Glunz & Jensen 976 Computer hardware (9572) 4.58 362 6 88 -45.8 -57.9 OECD Main Science and Technology Indicators (STI Scoreboard 2009) R&D expenditure of foreign affiliates as a percentage of R&D expenditures of enterprises 1986 Australia Austria Belgium Canada Czech Republic Finland France Germany Greece Hungary Iceland Ireland Italy Japan Netherlands Norway Poland Portugal Slovak Republic Spain Sweden Turkey United Kingdom United States 61.57 1993 1995 31.11 1997 34.64 22.09 13.25 1999 41.79 31.77 29.75 32.01 27.40 14.92 15.87 6.51 17.09 16.06 3.75 21.79 17.17 3.61 65.34 17.84 4.52 66.25 66.22 65.33 63.77 0.86 1.37 1.29 20.57 3.93 21.52 17.98 6.61 39.65 14.72 0.83 26.80 20.71 12.10 29.16 13.28 35.72 18.65 14.84 32.80 10.93 32.83 36.38 7.29 31.16 13.05 2001 2003 2005 2007 53.47 59.37 33.91 54.72 57.13 31.88 46.63 13.99 22.58 26.74 56.83 34.05 51.48 16.12 23.49 27.78 66.50 73.21 66.65 70.30 25.20 5.12 72.37 4.56 30.76 18.97 30.99 40.65 72.11 26.28 4.27 27.13 25.38 9.31 24.62 22.41 26.22 44.70 27.84 30.38 34.03 23.94 26.22 42.26 30.46 30.70 23.12 37.47 42.81 13.10 44.55 14.85 39.13 13.75 37.52 14.78 29.64 45.26 14.25 21.54 24.77 65.23 32.95 3.39 19.62 19.62 26.21 35.48 Business R&D: OECD Science, Technology and Industry Scoreboard 2009 Table. Irish Companies in Business Week's Fast Growing 500: 2000-2003 Company Name Sector CPL RESOURCES Management Services (employment agency) Construction & Real Estate MERCURY HOLDINGS DCC KINGSPAN GROUP IT Services (distribution) Construction & Real Estate Sales 2003 (€ Mil.) Sales Change Jobs Created 2000-2003 2000-2003 % Employees 2003 52 156 1,166 1,406 310 104 1,581 2,500 2,198 18 712 3,768 784 18 653 3,102 408 (707 website) 75 438 3,438 (error) 600 website UNIPHAR GROUP Biotech & Life Sciences (wholesale) ELECTRICAL & PUMP SERVICES Industrial Services 40 33 75 195 FLI INTERNATIONAL Management Services (environmental services) IT Services (enterprise compliance; reg) 15 104 52 98 10 192 45 95 QUMAS BusinessWeek and Europe's Entrepreneurs for Growth, a Brussels organization that represents more than 2,000 entrepreneurs, have teamed up for the second year in a row to sh Business Week October 25, 2004 Is Ireland a high-tech economy? • • • • • • • Yes, affiliates of high tech companies Yes, higher education skill formation No, GER&D/GDP No, R&D activities of affiliates No, sector transition or creation No, new technology development No, establishment of distinctive regional technological capabilities (knowledge base that attracts R&D FDI activity). Concern: Ireland’s lost decade • Expansion of debt masquerading as wealth creation • Limited expansion of innovative enterprises with NPD and TM capabilities • Limited TBED leadership capability • Non-focus on design and innovation engineering: plant by plant, sector by sector North Pole: variants • Silicon Valley • Greater Boston/Route 128 • Nordic Model North Pole: organizational characteristics • Open-system business model • Subtle coordination of government, industry, science (education) • New Sector Development capability • Organization principle of systems integration • System engineering skills (vs. design, process and concurrent engineering associated with mass prod.) Figure 1. Competing Business Models The Old Vertical Computer Industry - Circa 1980 The New Horizontal Computer Industry - Circa 1995 Sales and distribution Sales and distribution Application software Application software Operating systems Computer Operating systems Disk drives Computer Chips CMs Retail Stores Superstores Word Word Perfect DOS and Windows Compaq Seagate Dell OS/2 Intel Architecture Selectron SCI I-net Lotus SAP UNIX Linux Mac Packard Bell Quantum Mail Order Dealers HP IBM Western Digital Maxtor Motorola Flextronics Etc Jabil RISC Celestica Chips Printers IBM Source: HP Epson DEC Sperry Wang Univa c Adaptation from Only the Paranoid Survive by Andrew Grove, 1996. Used by permission of Doubleday, a division of Random House, Inc. M. Best, NCA Forenel (forestry/eng./electronics Forest industry: wood; paper, board, pulp 170,000 employees in Finland •Forestry •Construction •Furniture •Packaging •Machinery and equipment •Chemical industry •Automation and IT •Printing •Energy •Research and education •Business services Source: Kuusisto, OECD MA: New Sector Creation (distinctive dynamic regional capability) • Minicomputers • Data Storage Systems (‘file cabinets of IT) • Medical devices (US output grew 9 times in 25 years to 2004; regionally specialized) • Network Switching Equipment • Mutual fund industry (asset management) • Biotech • Business software tools • Robotics • Advanced materials/nanotech • Renewable energies vTHREAD Techno-Historical Regional Economic Analysis Database • Cluster characterization and regional capability audit tools • 50,000+ company profiles and 4 million product entries • Historical 1990-2005 • Finely granulated technology taxonomy • Company data supplied by CorpTech vTHREAD tools • • • • • • • • Fast growing firm query Technology audit (major categories) Enterprise location quotient Visualization and discovery tools Cluster query and mapping Cluster analysis: drill down loc. & tech. Cluster dynamics: industry churn analysis FDI as indicator of regional competitive advantage (foreign direct investment) Cluster growth with scale: example Medical devices in Massachusetts: (7000 employed in 1990 to 28,000 in 2003 plus 3K to 20K of non-MED company growth) Fast-Growing, Big Medical Device Companies: Employment Fast-Growing, Medium-Sized Medical Device Companies Based on Employee Level Fast-Growing Non-Medical Device Companies With Medical Device Product Offerings Foreign-Headquartered Medical Device Companies with Massachusetts Divisions or Facilities Inward Investment in MA • 69 of 200 largest employers are headquartered out of state (IBM, HP, Microsoft, J&J, Cisco major employers) • 8-10 % of 3000+ High Tech business units are foreign headquartered • R&D/gross state product = 5.4%, higher than any other state or country in Europe Source: Massachusetts Innovation Index 2009, page 41. Source: http://www.usmm.org/ww2.html NSD: WW II-MIT Legacy • Microwave • Digital computer • Guidance systems • Internet • Radiation lab (Raytheon) • Lincoln lab (DEC; 50+) • Instrumentation-Draper (SAGE; 55) • BBN, ARPA funded • MITRE (systems eng.) • ESC, Hanscom AF: 200+ C4I systems Triangular Relations (subtle coordination) and New Sector Development with Oomph • Government (mission-driven R&D…) • Industry (production capabilities/engineering skills) • Science/education/skill formation (open fundamental research, regional knowledge base, curriculum for sector ramp-up) Company-level capabilities and associated engineering-skill metrics • Production: material transformation activities (alignment of hundreds); product and process engineering associated with WCM • New product development: concept, materials, production planning, process engineering, pilot, ramp-up, scale performance; design and concurrent engineering • Technology management (beyond assimilation): applied research, development research, technology sourcing networks; systems engineering • Technology management (leadership): technologyintegration teams; dip-down for basic research; innovation engineering Central Message • Subtle coordination across government, industry, and university is integral to New Sector Development • Cluster evolution, increasing differentiation and technological transformation are all part of a single, long-term developmental process. • Government role of market creation and sector development is often obscured “Golden Semicircle” • 1968: 690 “science-based” companies along “Golden Semicircle” (Lieberman 1968) Success factors: “uniqueness of each company’s technology…and availability of government contracts during its crucial early years” (Roberts) • 1973: 1212 high tech companies • 1985: 3000 high tech companies TBED policymaking and market creation instruments • Mission-driven R&D funding via triangular relations (FFRDCs) • Pricing to reflect market externalities (carbon tax; congestion charge) • Government purchasing in early stages of market development (semiconductor, computer…) • Peer reviewed, proof-of-concept, new technology, small company funding (SBIRs) • Bank regulation for long-term finance of industry Intractable sectors to economic mandarinates • Energy • Urban transportation • Food • Depletable resources Market Creation: the case of the absentee government • Market for energy: ROI v Nolan County, Texas (or Denmark) • Market for urban transportation: Dublin v. Copenhagen or Amsterdam Energy: democratic versus exclusive products Renewable Energies wind energy, hydropower, photovoltaics , etc. in per cent 80 traditional biomass 70 coal 60 oil, gas 50 40 30 20 10 nuclear power 0 1860 1880 1900 1920 1940 1960 1980 Year 2000 2020 2040 2060 2080 2100 Market creation for renewable energy • Natural resources plus smart grid • Super grid leadership • Gov’t power to convene: World leaders in fundamental and related technologies • Establish troika (3-way) innovation model • Internalize the externalities to include fostering indigenous innovation engineering and business development Facing the Inconvenient Truths: Towards a Sustainable Model of Economic Governance • Extend the social partnership to account for social infrastructures of consumption. Example: Nordic model of urban transportation • Focus technology research, assimilation and development on clean technologies. Example: Texas and renewable energy Dubliners visit Copenhagen Cargo bike: SUV alternative Bridge over harbour Cities and Innovation: SBA study of 4000 in manufacturing • 45% took place in 1 of 4 cities: NY, SF, Boston, LA • 96% took place in metropolitan areas • Boston and SF have rates of 9 per 100,000; rest of country 1.75 • Only 14 cities have innovation rates greater than the national average Texas: $10 billion clean energy project with huge employment Clearwater, Nolan County, Texas: from oil to renewables with scale • Today, Nolan County (pop: 18K) produces more wind power than UK, France and CA on 3 large wind farms. Wind West • T Boone Pickens 4 year plan: 4000 MW, 2700 turbines across 200,000 acres—150 miles across Panhandle (1 million homes) • Master scheme: Army of wind farms North to South Great Plains and West to CA solar energy corridor Cuchulainn’s energy Where is Cuchulainn? Dundalk’s alternative energy: no hulk Lessons for Rapid Growth (2) • Driver is business enterprise with NPD and TM capabilities • Role of business enterprise is to develop capabilities (cumulatively and mutually) • Business competitive advantage is about the development of distinctive capabilities • Regional competitive advantage is about the development of clusters of enterprises which mutually advance distinctive capabilities