Innovation in China – some evidence from

advertisement

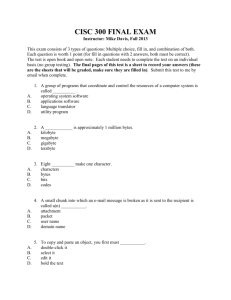

Innovation in China – some evidence from foreign R&D centres in Shanghai Seamus Grimes Department of Geography/ Centre for Innovation and Structural Change, National University of Ireland, Galway Debin Du Department of Urban and Regional Economics East China Normal University, Shanghai Decentralisation of R&D by ‘globalising’ corporations • MNCs becoming global corporations and decentralising activities (including some HQ and also R&D) outside home countries • Changing geography of market growth – emergence of China and India Centre for Innovation & Structural Change, CISC 1 Multinational firms, innovation and productivity Castellani and Zanfei (2006) • • • • • Increasing importance of asset seeking activities of MNCs – access to local knowledge Bridging initiatives – increasingly connect dispersed innovation systems Tensions within MNCs between international dispersion and concentration of innovative activities A shift in the literature from ‘transfer of MNC technology’ to the process of global knowledge creation and exchange MNCs need to combine internal networks of innovative subsidiaries with external network of collaboration with foreign firms and institutions Centre for Innovation & Structural Change, CISC Emerging countries • Large, emerging countries, with significant middle class markets, cheaper and well educated labour and stabilising political regimes (India, China, Brazil) no longer seen just as new markets for old products, but as significant locations requiring reconfigurations of the economic geography of MNC operations. • Not only do MNCs adapt products to local markets – local markets also provide ideas for new global products (Buckley, 2009). Centre for Innovation & Structural Change, CISC 2 Booz & Company Global Innovation 1000 (2008) Overseas expenditure by top corporate R&D spenders (2007) Top 80 US $80.1bn of $146bn Top 50 European $51.4bn of $117bn Top 43 Japanese $40bn of $71.6bn Centre for Innovation & Structural Change, CISC 3 Booz & Company Global Innovation 1000 (2008) Share of R&D facilities outside home markets of MNCs (2007) From 45% in 1975 to 66% in 2005 2004-2007 MNCs increased R&D sites by 6% and staff by 22% 83% of new sites in China and India 91% of additional staff in China and India 2007: China a net importer of $24.8bn R&D from top 1000 Centre for Innovation & Structural Change, CISC A new geography of knowledge? Dieter Ernst (2009) • Global centres of excellence in US, Japan and the EU • Advanced locations: Israel, Ireland, Taiwan and Korea • Catching-up locations: Beijing, Yangtze River Delta, Pearl River Delta, Bangalore, Chennai, Hyderabad and Delhi • New Frontier: lower-tier cities in China and India, plus Romania, Armenia, Bulgaria, Vietnam, etc Centre for Innovation & Structural Change, CISC 4 Global Innovation Networks (GINs) Ernst (2009) • ‘new frontier locations’: the main attraction – ample supply of low-cost, highly motivated, and trainable engineers and technicians, willing to work long hours at low pay in a highly-structured factory automation-type environment • Constraints: limited exposure to modern US style management systems Centre for Innovation & Structural Change, CISC GINs • Will improve access for MNCs to a limited pool of knowledge workers • Scarce talent in an ageing world • MNC innovation systems being opened to outsiders in a few select areas • Knowledge sharing the glue for GINs • A shift from IP barriers strategies to strategies seeking to externalise IP through GINs Centre for Innovation & Structural Change, CISC 5 Race for FDI: EU and China Oxelheim and Ghauri (2008) • An UNCTAD (2005) survey of global firms on the most attractive locations for R&D: – China (61.8%), US (41.2%), India (29.4%), UK (13.2%), France (8.8%), Germany (5.9%) – Ireland and Sweden (both 1.5%) • 2004: EU surpassed for first time by developing world ($233/$216bn) for FDI • 2005: China No 3 for FDI after US and UK – Data on FDI to China needs to be interpreted carefully Centre for Innovation & Structural Change, CISC Branstetter and Foley (2007) Facts and fallacies about US FDI in China NBER Working Paper 13470 • US affiliate activity in China is relatively modest and likely to remain modest for some time • • Small scale of activity partly because of focus on local market China = 2% of US affiliate sales (2004) • Carry out relatively little R&D which is quite dependent on supporting activity of parent • China’s exports of high technology goods quite dependent on imported components, technology and expertise It will be many years before China is a significant exporter of innovative goods and services • Centre for Innovation & Structural Change, CISC 6 US R&D in Asian DCs • R&D spending in Asian developing countries as a share of global research expenditure of foreign affiliates of US MNCs growing fast • Tripled from 3.4% in 1994 to 10% in 2002 Centre for Innovation & Structural Change, CISC A dynamic market with evidence of upgrading Brandt and Thun (2009) • • • • • • Battle between domestic and foreign firms for market Domestic firms meet the demand for lower cost products, but rising incomes and demand for better quality eroding this advantage Pressure on foreign firms to capture a larger share of growing middle market segments – accelerating the localisation of China operations Opportunities for domestic firms Entry at both ends of the market important for upgrading process in China Very different from conventional export-led model – domestic firms able to build capabilities and move into higher value-added segments of value chain Centre for Innovation & Structural Change, CISC 7 A global technology power in next 10-15 years, if…. Hu and Jefferson (2008) • If China succeeds in fortifying market institutions • Including its financial system • To allow more private resources to enter risky ventures • And a more rigorous enforcement of IPR • And continues to promote openness to foreign technology and investment • Then…. Centre for Innovation & Structural Change, CISC Gupta, A K and Wang, H (2009) Getting China and India Right • 172. ..even fifty years from now, it is a reasonable bet that 75 to 80 percent of the global demand for most products and services will be outside China. • 173: There is no reason that the established multinational should cede any of this market to an aspiring champion from China or India. Centre for Innovation & Structural Change, CISC 8 Challenges facing Chinese companies Buckley (2009) • Companies like Lenovo and TCL (TVs) take advantage of low purchasing power and inefficiencies of Chinese market • Offer cheap versions of electronic products – Chinese consumers cannot afford higher quality foreign products • Low profit margins – Chinese companies cannot afford necessary R&D expenditure to create new products and brand • Underdeveloped manufacturing and SCM skills • • Weak entrepreneurial and marketing skills So they acquire weaker brands at higher prices as best way forward Centre for Innovation & Structural Change, CISC China’s position as a major high tech exporter needs to be qualified (OECD, 2008) • Generally FIFs are less R&D intensive than domestic firms (not specific to China) • Pronounced differentials in some sectors contributed to a perception that technology transfer to China and related spillovers to the domestic economy have not met expectations • Lack of absorptive capacity of Chinese firms • Lack of IPR protection Centre for Innovation & Structural Change, CISC 9 The technology gap – a national challenge Zizhu chuangzin • Priority recently given to ‘indigenous innovation’ • What does it mean? • Zizhu chuangzin (independent innovation) – worries inside MNCs re definition – worries re drive to ‘absorb’ foreign technologies (Wilsdon and Keeley (2007) • Estimated that only 15% of the value of China’s electronic and IT exports is added in China • 50-70% of manufacturing costs of a Chinese PC represents license fees to Microsoft and Intel Centre for Innovation & Structural Change, CISC A domestic standards regime to better capture the economic value from technological progress techno-nationalism? • R&D investment in ICT sector both technology and demand driven • Domestic technical requirements and standards is why Motorola, Nokia, Microsoft and Ericsson were among the first to establish extensive R&D activity in China • China has become a major arena for global competition among MNCs Centre for Innovation & Structural Change, CISC 10 Chinese policy is technology-driven • Despite the development of a market economy, the role of the state in China is quite different to the West • A top-down policy • A strong focus on R&D as a driver of innovation and a neglect of the importance of markets and sophisticated customers • Hence the gap between domestic and foreign firms • Few spllovers from foreign firms in Shanghai related to a lack of trust and the absence of social capital • Corruption, IPR infringement undermine innovative behaviour Centre for Innovation & Structural Change, CISC Foreign R&D in China – some controversial issues (OECD, 2008) • • • • The number of foreign R&D organisations The type of R&D conducted Their importance in global R&D network Their impact on innovative capacity of Chinese industrial sector • 1990s: much of the earlier R&D was more show than substance and the result of government initiatives Centre for Innovation & Structural Change, CISC 11 The type of R&D performed (OECD, 2008) • ‘doing R&D in China often seen as a way of building a market or gaining favour with the government’ (Wilsdon and Keeley, 2007) • Market-seeking • Short-term adaption to market • Overall perception: most is development-focused rather than research Largely targeted at Chinese market Only a minority succeeding in integrating their R&D in China into their global R&D network Some selecting China as one of a few countries in global R&D • • • Centre for Innovation & Structural Change, CISC Foreign R&D in China Boutellier, Gassmann and Von Zedtwitz (2008) Various sources: 2000: 34 foreign R&D units 2002 82 2007 507 (Chinese Government figures say 750) 2nd only to US for foreign R&D labs But in 2007, the US was a net importer from top 1000 of $108.5bn compared with China’s $24.8bn Impressive growth of foreign R&D in China, but still relatively small Centre for Innovation & Structural Change, CISC 12 Rationale for offshoring R&D (OECD, 2008) • Initially MNCs shifted a significant part of their manufacturing to China because of low costs • Later they undertook related R&D activity • More recently, they located research and product development for the global market in China • Access to human resources a more important driver than market access, adaption of products to market or support of export-oriented manufacturing operations Centre for Innovation & Structural Change, CISC Foreign R&D in Shanghai MOST Survey 2006 + 2007 fieldwork • 2004: 6.77bn RMB (USD 0.99bn) • 22.6% of all FDI R&D in China • 2005: 75% of Business Expenditure in R&D (BERD) and 43% of total R&D expenditure in Shanghai • 2006: 9.7bn RMB (USD 1.42bn) Centre for Innovation & Structural Change, CISC 13 MOST Survey Shanghai 2006 • 156 R&D operations (123 centres) registered (Shanghai Bureau of Statistics) • 2 > 1bn RMB (USD 146.3m) • 10 > 100m RMB (USD 14.6m) • 14 50-100m RMB (USD 7.3m – USD14.6m) • 48 10-50m RMB (USD 1.46m – USD7.3m) • 53 < 10m RMB (USD 1.46m) Centre for Innovation & Structural Change, CISC MOST Survey Shanghai 2006 • • • • • • • 70% <100 42% <30 9 >500 4 >1000 GM Joint Venture Pan Asia 1,240 employees GE 1,200 13,397 employed = 15% of total Shanghai R&D labour force (11,007 scientists/engineers) Centre for Innovation & Structural Change, CISC 14 Plans to grow • • • • • • • AMD Shanghai to 400 EMC China to 500 Continental China 600 by 2011 Honeywell to 3,000 GlaxoSmithKline to 1,000 in 10 years SAP to 1,500 2/5 of all Shanghai R&D centres are Fortune 500 companies Centre for Innovation & Structural Change, CISC R&D centres by function MOST (2006) • Tactical: early stage R&D centres for local production and technical support – may evolve over time to more significant functions • Global/Regional Centres: 33 in Shanghai – in 7 cases they are the largest or only global R&D centre • Many MNCs have relocated Asia Pacific R&D from Singapore and Japan to Shanghai (Danisco, Dow) • Upgraded centres: SAP to SAP Research Institute Centre for Innovation & Structural Change, CISC 15 Centre for Innovation & Structural Change, CISC Conclusion • Despite the rapid growth in foreign R&D centres in China and Shanghai, many investments are modest • While there has been some outsourcing of tasks from HQ to Shanghai, and some contributions to global operations from Shanghai, the primary focus is on the local market and the Asia Pacific region • The Chinese market has shifted from the earlier competition (and monopoly) between MNCs with high margins and major contracts to a new competition for the rapidly expanding middle market of lower priced products and lower margins. Centre for Innovation & Structural Change, CISC 16 Conclusion • Many MNCs see China as a very significant market in the future and the arena where they must compete, not only with other MNCs, but with a growing number of Chinese companies. • Winning and maintaining market share in this new market will determine for some their ability to compete globally. • Thus R&D investment in China is part of growing with this new market. Centre for Innovation & Structural Change, CISC 17