24-Jun-09 PRELIMINARY RESULTS

advertisement

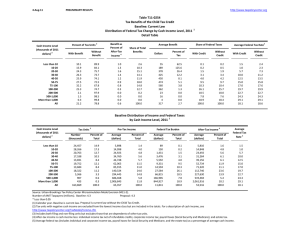

24-Jun-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0340 Medical Expense Deduction Floor Raised to 10 Percent of AGI Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2009 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 0.0 0.0 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 With Tax Increase 0.0 0.8 2.5 4.6 6.8 10.0 10.1 7.7 4.5 3.3 2.7 4.9 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Share of Total Federal Tax Change 0.0 0.5 1.6 3.1 4.9 19.3 20.5 35.9 9.4 1.7 3.0 100.0 Average Federal Tax Change ($) 0 0 1 4 7 17 26 36 34 36 137 12 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal -2.2 0.3 5.9 10.6 13.3 15.3 17.5 20.2 23.3 24.5 27.1 18.2 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-2). Number of AMT Taxpayers (millions). Baseline: 3.968 Proposal: 3.945 (1) Calendar year. Baseline is current law, proposal is to raise the floor for deducting medical expenses to 10% of AGI. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 24-Jun-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0340 Medical Expense Deduction Floor Raised to 10 Percent of AGI Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2009 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.8 2.5 4.6 6.8 10.0 10.1 7.7 4.5 3.3 2.7 4.9 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Share of Total Federal Tax Change 0.0 0.5 1.6 3.1 4.9 19.3 20.5 35.9 9.4 1.7 3.0 100.0 Average Federal Tax Change Dollars 0 0 1 4 7 17 26 36 34 36 137 12 Percent 0.0 0.8 0.1 0.1 0.1 0.2 0.2 0.1 0.1 0.0 0.0 0.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal -0.1 0.1 1.6 3.1 4.0 10.5 11.5 27.4 18.2 7.8 16.0 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 18,691 24,650 20,270 15,408 12,353 20,535 14,202 18,105 5,002 866 390 151,485 Percent of Total 12.3 16.3 13.4 10.2 8.2 13.6 9.4 12.0 3.3 0.6 0.3 100.0 Average Income (Dollars) 5,781 14,983 24,690 34,732 44,661 61,775 86,078 138,753 290,117 680,751 2,803,165 67,151 Average Federal Tax Burden (Dollars) -126 44 1,451 3,669 5,928 9,425 15,019 28,047 67,473 166,487 758,744 12,230 Average AfterTax Income 4 (Dollars) 5,907 14,939 23,239 31,062 38,733 52,350 71,059 110,707 222,644 514,265 2,044,421 54,922 Average Federal Tax Rate 5 -2.2 0.3 5.9 10.6 13.3 15.3 17.5 20.2 23.3 24.5 27.1 18.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.1 3.6 4.9 5.3 5.4 12.5 12.0 24.7 14.3 5.8 10.7 100.0 1.3 4.4 5.7 5.8 5.8 12.9 12.1 24.1 13.4 5.4 9.6 100.0 -0.1 0.1 1.6 3.1 4.0 10.5 11.5 27.4 18.2 7.8 16.0 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-2). Number of AMT Taxpayers (millions). Baseline: 3.968 Proposal: 3.945 (1) Calendar year. Baseline is current law, proposal is to raise the floor for deducting medical expenses to 10% of AGI. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal -2.2 0.3 5.9 10.6 13.3 15.3 17.5 20.2 23.3 24.5 27.1 18.2 24-Jun-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0340 Medical Expense Deduction Floor Raised to 10 Percent of AGI Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2009 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.0 1.3 3.6 5.9 8.3 9.1 9.4 9.7 6.5 6.9 3.6 4.1 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 -0.1 0.0 0.0 0.0 0.0 0.0 Share of Total Federal Tax Change 0.0 1.7 4.1 6.5 9.9 26.5 21.6 19.5 7.0 1.5 1.7 100.0 Average Federal Tax Change Dollars 0 1 2 5 9 19 34 38 57 67 178 8 Percent 0.0 0.1 0.1 0.1 0.1 0.2 0.2 0.1 0.1 0.0 0.0 0.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal 0.4 2.7 6.5 8.5 9.6 18.8 13.3 17.3 9.5 4.3 9.2 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 13,152 15,090 10,542 7,266 5,673 7,204 3,303 2,664 637 115 51 66,239 19.9 22.8 15.9 11.0 8.6 10.9 5.0 4.0 1.0 0.2 0.1 100.0 Average Income (Dollars) 5,692 14,806 24,568 34,753 44,620 60,914 85,491 134,746 292,731 682,877 2,766,656 38,368 Average Federal Tax Burden (Dollars) 128 822 2,836 5,423 7,817 12,050 18,612 30,007 68,769 172,341 835,983 6,989 Average AfterTax Income 4 (Dollars) 5,564 13,984 21,732 29,330 36,802 48,864 66,879 104,739 223,962 510,536 1,930,673 31,379 Average Federal Tax Rate 5 2.3 5.6 11.5 15.6 17.5 19.8 21.8 22.3 23.5 25.2 30.2 18.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 3.0 8.8 10.2 9.9 10.0 17.3 11.1 14.1 7.3 3.1 5.6 100.0 3.5 10.2 11.0 10.3 10.0 16.9 10.6 13.4 6.9 2.8 4.8 100.0 0.4 2.7 6.5 8.5 9.6 18.8 13.3 17.3 9.5 4.3 9.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-2). (1) Calendar year. Baseline is current law, proposal is to raise the floor for deducting medical expenses to 10% of AGI. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 2.3 5.6 11.6 15.6 17.5 19.8 21.8 22.3 23.5 25.3 30.2 18.2 24-Jun-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0340 Medical Expense Deduction Floor Raised to 10 Percent of AGI Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2009 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.4 3.0 5.0 11.5 11.0 7.5 4.2 2.7 2.6 6.6 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Share of Total Federal Tax Change 0.0 0.0 0.3 0.7 1.5 14.4 20.3 46.0 11.3 1.8 3.7 100.0 Average Federal Tax Change Dollars 0 0 1 2 4 17 24 36 31 29 133 19 Percent 0.0 0.0 0.9 0.1 0.1 0.2 0.2 0.1 0.1 0.0 0.0 0.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal 0.0 -0.2 0.0 0.5 1.1 5.9 10.2 32.0 22.4 9.4 18.5 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,391 4,212 4,769 4,200 4,021 9,995 9,502 14,657 4,201 722 323 59,366 4.0 7.1 8.0 7.1 6.8 16.8 16.0 24.7 7.1 1.2 0.5 100.0 Average Income (Dollars) 5,172 15,527 24,849 34,951 44,825 62,707 86,519 139,929 289,872 680,719 2,741,179 111,151 Average Federal Tax Burden (Dollars) -156 -462 93 1,477 3,478 7,400 13,611 27,637 67,472 165,454 727,692 21,329 Average AfterTax Income 4 (Dollars) 5,328 15,989 24,756 33,474 41,347 55,307 72,908 112,292 222,399 515,265 2,013,487 89,823 Average Federal Tax Rate 5 -3.0 -3.0 0.4 4.2 7.8 11.8 15.7 19.8 23.3 24.3 26.6 19.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.2 1.0 1.8 2.2 2.7 9.5 12.5 31.1 18.5 7.5 13.4 100.0 0.2 1.3 2.2 2.6 3.1 10.4 13.0 30.9 17.5 7.0 12.2 100.0 0.0 -0.2 0.0 0.5 1.1 5.8 10.2 32.0 22.4 9.4 18.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-2). (1) Calendar year. Baseline is current law, proposal is to raise the floor for deducting medical expenses to 10% of AGI. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal -3.0 -3.0 0.4 4.2 7.8 11.8 15.8 19.8 23.3 24.3 26.6 19.2 24-Jun-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0340 Medical Expense Deduction Floor Raised to 10 Percent of AGI Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2009 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.0 1.0 3.6 6.3 7.5 6.4 4.6 2.3 3.9 3.3 2.8 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Share of Total Federal Tax Change 0.0 0.0 2.7 10.6 17.7 35.2 19.7 10.4 1.2 1.4 1.1 100.0 Average Federal Tax Change Dollars 0 0 1 3 7 12 16 15 9 73 122 4 Percent 0.0 0.0 -0.1 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal -4.4 -11.5 -2.5 9.9 14.3 31.5 21.2 21.7 8.8 3.7 7.2 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,963 5,047 4,611 3,533 2,320 2,862 1,158 655 122 19 8 23,363 12.7 21.6 19.7 15.1 9.9 12.3 5.0 2.8 0.5 0.1 0.0 100.0 Average Income (Dollars) 6,673 15,028 24,801 34,391 44,563 60,643 84,653 129,635 287,210 664,816 2,693,182 36,821 Average Federal Tax Burden (Dollars) -1,263 -1,966 -465 2,406 5,308 9,457 15,686 28,526 62,320 164,706 738,273 3,677 Average AfterTax Income 4 (Dollars) 7,935 16,993 25,266 31,985 39,255 51,186 68,967 101,109 224,890 500,111 1,954,909 33,145 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -18.9 -13.1 -1.9 7.0 11.9 15.6 18.5 22.0 21.7 24.8 27.4 10.0 2.3 8.8 13.3 14.1 12.0 20.2 11.4 9.9 4.1 1.5 2.6 100.0 3.0 11.1 15.0 14.6 11.8 18.9 10.3 8.6 3.5 1.2 2.1 100.0 -4.4 -11.6 -2.5 9.9 14.3 31.5 21.2 21.7 8.8 3.7 7.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-2). (1) Calendar year. Baseline is current law, proposal is to raise the floor for deducting medical expenses to 10% of AGI. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal -18.9 -13.1 -1.9 7.0 11.9 15.6 18.6 22.0 21.7 24.8 27.4 10.0 24-Jun-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0340 Medical Expense Deduction Floor Raised to 10 Percent of AGI Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2009 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.5 3.3 5.4 8.1 7.4 5.3 2.3 1.1 2.0 4.0 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Share of Total Federal Tax Change 0.0 0.0 0.4 2.3 4.7 17.2 20.8 42.0 7.6 1.3 3.8 100.0 Average Federal Tax Change Dollars 0 0 0 2 6 12 17 23 15 16 116 10 Percent 0.0 0.0 0.0 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal -0.7 -2.2 -1.1 0.9 2.2 7.9 11.4 32.8 22.7 9.2 16.8 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 3,537 5,872 5,662 4,749 3,935 6,902 5,990 8,648 2,386 385 157 48,399 7.3 12.1 11.7 9.8 8.1 14.3 12.4 17.9 4.9 0.8 0.3 100.0 Average Income (Dollars) 6,332 15,226 24,911 34,605 44,672 62,286 86,360 139,724 288,487 677,932 2,789,597 85,231 Average Federal Tax Burden (Dollars) -1,535 -2,724 -1,455 1,408 4,174 8,392 13,892 27,786 69,792 174,520 783,587 15,134 Average AfterTax Income 4 (Dollars) 7,866 17,949 26,366 33,197 40,498 53,893 72,468 111,938 218,695 503,411 2,006,011 70,097 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -24.2 -17.9 -5.8 4.1 9.3 13.5 16.1 19.9 24.2 25.7 28.1 17.8 0.5 2.2 3.4 4.0 4.3 10.4 12.5 29.3 16.7 6.3 10.6 100.0 0.8 3.1 4.4 4.7 4.7 11.0 12.8 28.5 15.4 5.7 9.3 100.0 -0.7 -2.2 -1.1 0.9 2.2 7.9 11.4 32.8 22.7 9.2 16.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-2). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law, proposal is to raise the floor for deducting medical expenses to 10% of AGI. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal -24.2 -17.9 -5.8 4.1 9.4 13.5 16.1 19.9 24.2 25.8 28.1 17.8 24-Jun-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0340 Medical Expense Deduction Floor Raised to 10 Percent of AGI Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2009 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.1 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.4 4.5 12.1 20.0 27.7 22.9 13.6 8.0 4.5 9.1 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.1 -0.1 0.0 0.0 -0.1 Share of Total Federal Tax Change 0.0 0.0 0.1 0.9 2.9 18.5 21.4 38.3 13.5 2.0 2.3 100.0 Average Federal Tax Change Dollars 0 0 0 3 11 33 75 110 108 83 186 27 Percent 0.0 0.0 0.0 0.2 0.5 0.7 0.8 0.5 0.2 0.1 0.0 0.3 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.0 -0.1 0.0 Under the Proposal -0.1 0.2 1.0 1.1 1.6 7.9 8.3 22.0 20.7 11.0 26.2 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.1 0.0 0.0 0.0 0.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,678 6,623 4,325 2,573 1,985 4,292 2,173 2,639 954 187 95 28,567 9.4 23.2 15.1 9.0 7.0 15.0 7.6 9.2 3.3 0.7 0.3 100.0 Average Income (Dollars) 6,433 14,921 24,432 34,692 44,821 61,376 85,782 139,139 291,469 679,583 2,749,752 65,824 Average Federal Tax Burden (Dollars) -55 79 604 1,167 2,163 4,778 9,912 21,770 57,036 154,173 727,752 9,178 Average AfterTax Income 4 (Dollars) 6,487 14,842 23,828 33,525 42,658 56,598 75,870 117,369 234,433 525,409 2,022,000 56,646 Average Federal Tax Rate 5 -0.9 0.5 2.5 3.4 4.8 7.8 11.6 15.7 19.6 22.7 26.5 13.9 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.9 5.3 5.6 4.8 4.7 14.0 9.9 19.5 14.8 6.8 13.9 100.0 1.1 6.1 6.4 5.3 5.2 15.0 10.2 19.1 13.8 6.1 11.8 100.0 -0.1 0.2 1.0 1.2 1.6 7.8 8.2 21.9 20.8 11.0 26.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-2). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law, proposal is to raise the floor for deducting medical expenses to 10% of AGI. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal -0.9 0.5 2.5 3.4 4.9 7.8 11.6 15.7 19.6 22.7 26.5 14.0