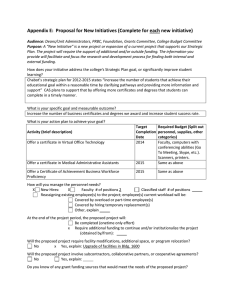

Building an E-Commerce Trust Infrastructure. I.Executive Summary

advertisement