Consumer Pull vs Technology Push:

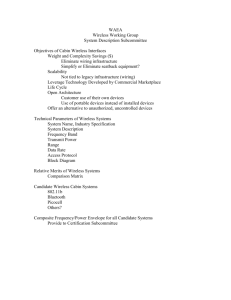

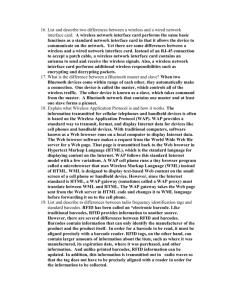

advertisement

Consumer Pull vs Technology Push: Can the Wireless Industry Strike The Balance? D. Wood, G. Maddy & A. Drinkwater Abstract Mobile commerce was predicted as being a multi billion dollar industry, facilitating a mobile Internet, and providing the wireless industry with endless business opportunities. However the reality is that despite the high mobile phone penetration throughout many countries, mcommerce has not taken off as was anticipated. This can be attributed to a number of factors, such as the lack of industry standards, the lack of technological integration throughout the world, and inadequate consumer research and marketing of mobile applications, resulting in poor usability amongst users. Current technologies are assessed in this paper to determine their likelihood of a continued presence in the wireless marketplace, and the potential of future technologies such as 3G and Bluetooth is evaluated. The paper concludes that we are likely to see a more 'consumer-pull' oriented approach to designing mcommerce devices and applications if they are to succeed, rather than the hitherto unsuccessful 'technology-push' approach, and predicts that we will not see global integration of mobile technologies for many years to come. Introduction Consider the following scenario, the year is 2005, you are on a business trip in another country, while walking down to the high street you hear the distinctive beep from your jacket pocket. On removing the device you see that your companies stock price is plummeting. From the street you access your personal finances and favourite on-line stock-trading site. As the other pedestrians continue their journeys around you, you start selling your stocks to reduce your exposure. Then you use the device to purchase an airline ticket to get you back to the company?s headquarters. Then using the same device you inform your partner of the change in plans, before locating the nearest bar for a well-needed drink before your flight. Although this scenario currently seems very whimsical, this is the reality many of the large telecommunications companies are spending billions of pounds to achieve. The motivation of this investment is the rapid growth in the number of mobile phone customers. This paper explores global activity in this area and evaluates whether the evolving technologies can effectively meet customer needs and desires and make the mcommerce promise become a reality. Current Market Mcommerce is defined as the ability to deliver services and transactions to customers when and where ever they are. It is achieved by using the growth in mobile phone usage as a portal and platform for service delivery. It promises to be a multi-billion pound industry, providing endless business opportunities for the wireless industry (IEE Audio Magazine, December 2000). The infrastructure for such a wireless web is already starting to be constructed, although the progress varies across the world. Total mobile commerce revenues are expected to reach $600 million in the US, $1.7 billion in Europe and $3.5 billion in Japan by the year 2003 (Jupiter Communications). Worldwide Penetration of Handheld Devices Through 2005 (millions) (Source: Data Monitor) In the US, 95 million people use mobile phones - only 34 per percent of the population. Most countries in Europe have over 50 per percent penetration of mobile phones, within Finland, the most phone-crazed nation in the world, the possible services would represent a huge market. Finnish wireless subscribers can already use their phones to send text messages to friends, pay bills and get traffic reports simply by inputting the correct numbers. In Japan, teenagers use the Internet-connected iModePhone, which has attracted over 10 Million users and has secured Asia the position as the world leader in mobile usage (see below). The figures below highlight the diverse mobile ownership percentages around the world. World wide Phone Penetration (Source: American Scientific, October 2000) However these figures may appear misleading. The public?s perception of and use of mcommerce devices has varied throughout the world - indeed their first experiences of mcommerce have not always been favourable. Mcommerce initially was marketed as a mobile internet, but this is not what was received. Consumers are frustrated with slow transmission speeds, difficult user interfaces and high costs. In addition, poor network coverage, mainly text information, poor navigation, small screen, requirements for dial up, digits only keypad (resulting in security only coping with PIN numbers), and no standard in user interface have alienated many users from the current mcommerce environment. As many as one in five mobile users in the US stop using mcommerce after a few attempts, it was revealed in a study by The Boston Consulting Group (BCG). Although, in contrast, about 88% of current or potential customers did believe that in the next three years, the mobile phone will go everywhere with them. 80% expect to be using a wireless device in their daily lives to shop, catch the news, and send and receive e-mail. It has been reported that in Europe, however, Short Message Service (SMS) has proved incredibly popular, rather than the predicted shopping services and now copes with over five billion messages per month. In addition, it has been forecast that the annual growth in numbers of messaging subscribers is about 100% over the next four years. (Mobile Messaging and Internet Applications Conference July 2000). Uptake of Wireless Data Applications, 2000-05 (millions) (Source: allNetDevices) Further evidence that messaging is a significant mobile activity is found in the above statistics from allNetDevices on Uptake of Wireless Data Applications, 2000-2005 (millions), where messaging is highlighted as the most popular wireless data application. So we can see that currently there seems to be a rather fragmented global mcommerce market, with little integration of technologies or perceived use. The wireless industry are taking steps to provide technologies and devices that more closely meet the public?s needs, whilst reaching some kind of industry standard. We shall now take a look at the 2 main technologies of the current environment and predict whether they will continue to provide a service in the marketplace. By examining the apparent successes or failings of these technologies we can predict what issues evolving wireless technologies and applications will address, and how the wireless industry should market future mcommerce services in the global environment. Wireless Application Protocol (WAP) Wireless Application Protocol is currently a dominant Internet platform for mobile devices. At present it works on the GSM network, but development is under way to migrate it to the UMTS, Universal Mobile Telecommunications System which will guarantee improved data transmission rates throughout this progression. WAP uses WML (Wireless Markup Language) as a basis for its web pages. The pages filtered through WML, before they can be displayed on WAP phones. Transcoders and format converters are required to convert Web content to wireless Web content (see diagram below). Current WAP Communication Links (Source: wapforum.org October 2000) It has been universally agreed that WAP phones have low usability. Indeed, following a UK field study undertaken by Nielsen, 70% of the participants said they would not be using WAP in a year. Nielsen reports that general shopping services are unlikely to survive in the mobile environment; instead mobile services must target users with immediate, context-directed content, such as highly goal-driven services and entertainment-focused services, including SMS. The great popularity of SMS can be attributed to the fact that it is a personalized and targeted service, and is often context-dependent in terms of both time and space. The messages are kept short and are therefore fast to read. Even though messaging is primarily carried out on low usability WAP or mobile phones, the usefulness of the service closely matches the needs and satisfaction levels of the target population - mainly 13-26 year olds. The WAP Forum, however, claims that around 8 million people worldwide are using WAP technology, while the Danish research firm Strand Consult praised WAP technology and attributed the bad press to the poor usability due to the small screens on phones. (BBC online 4/01/01 'Why WAP is not woeful'.) Despite WAP unpopularity at the moment, it will not disappear in the near future as the investment in this technology and its development has been enormous. The WAP Forum has been established as the wireless industry's association to develop worldwide standards leading to interoperability, as it is considered that this is essential for WAP's deployment. The Forum is working closely with the W3C (World Wide Web Consortium) to ensure that in the future developments in HTML and HTTP will provide for the needs of mobile devices using the WAP framework. WAP Handset Share of All Handset Sales, 2000-06 (%) (Source: Allied Business Intelligence) The new specifications for WAP 2.0 include migration of WAP from WML to xHTML, resulting in developer's creating single applications for multiple devices. It is viewed that WAP is continuously evolving (see chart above) and should not be discounted as a major technology in the future mobile market, with mobile chat and Bluetooth expected imminently.(Wap Forum December 2000) Despite the initial negative reception of WAP phones onto the market, the continuous investment and development being input, in line with feedback from mobile customers, would suggest that the WAP industry may well produce products which compliment the market place in the future. iMode In contrast to the experience of WAP, the iMode product in Japan appears to have been more of a success. As at December 2000, the number of iMode subscribers was increasing by 50,000 per day (eurotechnology.com). The popularity of iMode cannot be attributed to any one asset but seems to be resulting from an extremely favourable user experience. Typical iMode screen display iMode Phones allow users to: Send e-mails Transfer funds between bank accounts Book plane tickets Find the nearest hotel or restaurant Play interactive games Check their horoscope Download melodies. (Source: eurotechnology.com) There are at this time three main facets of the iMode system which should be discussed: fast communication links; extensive information content; a cheap billing system. Firstly, iMode is classed as a 'packet-switched' system resulting in the user seeing the system as always on (as long as he is within reach of the iMode signal). This provides fast access to the system through the iMode menu with the chosen data being downloaded immediately. Download speed is currently 9.6 kbit/sec which is acceptable for basic iMode information. The second feature worth considering is the extensive site content available to the iMode user - it is estimated that 600 official and many more unofficial sites are already accessible. The reason for this almost definitely lies in the fact that iMode is based on cHTML (compact HTML) which is an extension of HTML designed for mobile screens (see iMode screen above). The similarity of the languages has allowed easy development of internet pages, involving the consumer in the technology and resulting in the freedom of information notion which has been so successful in the explosion of the fixed wire Internet. Thirdly, the cost of using the iMode system in Japan is to the consumer's advantage because (after basic subscription fees) they are charged for the amount of data download. Thereafter, for a limited time this information may be accessed with no further cost. As the below graph shows the popularity of the iMode system has not wavered in Japan. Subscribers to Japan's iMode Mobile Internet & Mcommerce Service (Millions) (Source: eurotechnology.com) In addition, according to a worldwide authority on Internet commerce, Japan has a $400 million head start over the US and Europe in the mcommerce race. This could be due to the massive figure of 30 million wireless subscribers with Internet-enabled handsets in Japan, compared with only 6 million in the US and in Europe in the year 2000. This positions Japan's iMode as a world leader in the market with their leading position likely to continue for several years. The following figure shows what a leading force Asia is predicted to be in the field of mcommerce use, based in the number of handheld devices owned: It is evident that the US can not currently compete with Japanese technology due to lack of standardisation and unfavourable pricing structure. However an important development reported in (allNetDevices December 2000) states that NTT DoCoMo has recently bought a 16% stake in AT&T Wireless in America which may well begin the upward trend in popularity of wireless devices in the USA. AT&T have already agreed to license iMode and add a GSM 'layer' to their existing wireless system. This development will open up the mobile commerce market to the Americans, as GSM has proved successful through most of Europe and the rest of the world. The Future of Handheld Devices Currently the most popular devices that are Internet enabled are mobile phones, but this will probably change in the future. The new handheld devices are restrained at the moment by the slow speeds of wireless data transmissions, which average to about 10 kilobits per second - less than one-fifth the data rate of a typical PC modem over a fixed telephone line. These slow speeds have been acceptable for sending text messages but become frustrating when trying to surf the web. Companies at the high end of the market, including Nokia, Ericsson and Motorola are now beginning to develop the new variants of mobile phones using 3G. 3G Mobile or not... 3G mobile phones are 3rd Generation, following on from the 1st Generation of analogue mobiles, and 2nd Generation digital phones. 3rd Generation phones will also be digital, but will provide significantly enhanced data capabilities, allowing for multimedia operation, where users access voice and data transmissions simultaneously. The 2G system deployed in Europe was GSM, the 3G system will be UMTS, but note that recent enhancements to the data capabilities of GSM (GPRS and EDGE) will span the gap between the two systems, and are being described as 2.5G. The table below summarizes the increase capabilities with each generation. A Generation's Evolution 1980's 1999 2000 2001 1G 9.6 Kbit/s 2G 19.2 Kbit/s 2.5G 64-144 Kbit/s 3G 384 Kbit/s - 2 Mbit/s Voice Voice Voice Voice mcommerce SMS SMS SMS Internet Access Text Email E-mail E-mail Document transfer Web browsing (infancy) Web browsing Low/high quality video mcommerce (Source Mobile Commerce Presentation by Stephanie Perrin @ UMTS 2000 Conference) Mobile operators in the UK, and more recently in Germany, have paid phenomenal sums for the right to use the radio spectrum allocated to 3G systems, although they are still undecided what exactly the consumer will want to access on these next-generation networks. This major investment can be attributed to necessity - as mobile operators they must be able to deploy 3G systems, given the predictions for the growth of this market. The numbers of users of mobile phones is expected to grow significantly, but with increased data capabilities mobiles will increasingly be used for emerging and new applications such as internet access, information services, and video calls, music downloads greatly increasing the volume of traffic on the radio interface. 3G will be available in the USA and Japan before it is available in Europe. The cdma2000 system is expected to be deployed in the US and Japan mid-2001, while UMTS is not expected to be available in Europe until mid-2002. One realistic possibility of 3G is that the phones themselves will not necessarily be smaller than 2G phones, due to their additional capabilities: keyboards; mice for data input; touch sensitive screens and styluses or use voice recognition software. The intention is to deploy 3G gradually into the marketplace, resulting in the first phones available expected to be mixed-mode, allowing for GSM operation as well as UMTS. So we can see that there will not be an immediate global embracing of 3G technology, but rather a gradually evolution towards this. The table below attempts to predict the gradual launch of 3G technologies into the marketplace. 3G Timescales Scheduled Date 2000 2001 2001 Summer 2001 Start 2001 2002 2002/3 2004 3G licenses awarded 3G trials and integration 3G launched in Japan by NTT DoCoMo Trial 3G services available in Europe Deployment of basis 3G terminals Launch of 3G services, adoption of 3G 3G specific applications, advanced 3G terminals 3G to reach critical mass (Source: Malachy Murphy: "SMS, WAP and iMode") To accommodate new 3G services larger screens will be provided, and marketing images envisage touch screens similar to those used in PDAs at present. These screens have proven to be more flexible and configurable than a keypad. This is an example of user experience dictating the design technology. Most will have microphones and earpieces which are separate from the rest of the body of the device. This will allow the user to speak and listen through the device while viewing the screen simultaneously. To eliminate the need for wires, prototypes of these headsets are using the new technology of Bluetooth. This technological breakthrough introduces to the marketplace data transmission between two Bluetooth enabled devices without the use of wires. Ultimately, progress within this field will allow users to conduct transactions without cash, checks or credit cards. It has been suggested by an analyst from Goldman and Sachs, however, that 3G may never happen, despite the massive investment in 3G licenses and equipment by companies. He believes that 2G and 2.5G technologies may meet the need of the consumer of mcommerce. (Dow Jones December 2000). Bluetooth Named after a 10th Century Viking king, the Bluetooth wireless technologies are an open specification for enabling low-cost, personal connections for a variety of small devices, from mobile computers to mobile phones to MP3 Players. This technology provides a radio-based transmission of data and voice, using the globally available 2.4 GHz frequency range. The most outstanding attribute of Bluetooth is that it enables rapid, automatic, and ad-hoc wireless connections, even when devices are not within line of sight: Data/Voice Access Points (Source: Implementing Bluetooth Solutions by Dieter Kossessa @ UMTS 2000 Conference) Bluetooth devices are able to transfer data at rates of up to 1Mbps over a distance of 100 meters. A mobile PC, can for example, seamlessly transfer files and update an e-mail inbox by coming into range with a data access point that is tied to a corporate network or the internet. Data on a PDA could likewise be refreshed and updated when a Bluetooth enabled PDA and mobile phones are linked. A mobile PC could even access the Internet from any location by using a mobile phone as a modern without requiring cables to connect the devices. Bluetooth's objective is to create a universal standard for the air interface and software, to ensure the interoperability between devices from different manufacturers. The first commercial products to include Bluetooth technology are expected to be available in the year 2000. It is predicted that 79 percent of digital handsets and more than 200 million PCs will incorporate Bluetooth Technology by 2002. The beauty of the creation of Bluetooth is that it is a world wide specification developed by a section of the industry through the participation in the Bluetooth Special Interest Group (SIG). Formed in 1998 by five companies, Ericsson, IBM, Intel, Nokia and Toshiba and since then over 2000 companies have joined the SIG. Each member company receives a royalty free patent license from other member companies to implement the Bluetooth specification in its products. In addition, member companies receive access to Bluetooth technical specifications and intensive training seminars such as the Bluetooth Developers Conferences. Interoperability will be vital to the success of Bluetooth; this is self-managed by the SIG members through a qualification process. Successful completion of the qualification process allows the manufacturer to license their product thus giving the customer confidence in the products. Qualification involves conformance and interoperability testing completed by a certified Bluetooth Test Facility authorized by the SIG. This shows that the wireless industry are collaborating to establish worldwide standards leading to decrease in costs and a more consistent user experience. There is concern that the 2.4 GHz band used by BlueTooth technology will become congested with wireless data in the future, with demand possibly exceeding supply by April 2000 (MCI Worldcom November 2000). It has been suggested that a solution to this problem would be move the BlueTooth spectrum to the 5 GHz range. However, it is considered that there traffic issues will be resolved before BlueTooth enabled devices are launched in 2001. Conclusion In conclusion, therefore, it will not be for many years that we should expect to see a global technology embracing the mobile commercial world, instead current and evolving technologies should be optimized to achieve consumer satisfaction, which in turn will lead to increased mobile revenues for industry. 2G, 2.5G and WAP will continue to play a role in the wireless industry as we move towards 3G and Bluetooth enabled technology. Rather than the previously ?technology-push? driven force behind mcommerce, it looks likely that for mcommerce to rival ecommerce in its spending power and reach, consumers will have to begin to demand certain technologies to suit their needs ? a ?consumer-pull? approach. This requires consumers in general to be well informed about what technology is available, which they will then tend to customize and personalize to suit. It seems apparent that mcommerce has been poorly marketed in the past, with little consideration given to customer needs and desires. Any company who wishes to be successful in mcommerce should adopt a user-centred approach to product design, incorporating detailed task analysis, continually monitoring how consumers are using their products, in order to optimize user satisfaction and hence achieve mobile commercial success. This is the lesson that WAP has surely taught us: that even if the technology is good, it must be usable, low cost, fast and secure and not exist merely to exploit a current technology, but rather provide a relevant, desired service to the public over a suitable device, be it a phone, a PDA or other handheld devices. If the wireless industry can unite in achieving this through collaboration, investment and effective product design, then perhaps we will begin to see the mcommerce market take off in 5 years time as was hoped. One factor which has not been mentioned previously but is of great importance in any discussion on the future of mobile communicators is the health issue. The results of a May ?99 Mori poll have shown that 43% of regular mobile users are worried about health effects - this follows on from a 1998 cellular industry sponsored survey which revealed that almost one in five mobile owners had reduced their usage over health fears. Until there is concrete evidence about the potential risks of mobile usage, it would be impossible to predict whether mobile communicators will continue to survive in any capacity - perhaps this the ultimate user-centred area of product development that the wireless industry should be addressing to ensure the future success of their products. References 'The Internet in Your Hands' American Scientific,October 2000 'mcommerce' IEE Audio Magazine, December 2000 'The Future is Here. Or is it?', American Scientific, October 2000 'US mcommerce Solutions Market will Grow 1000 per cent by 2005; Datamonitor Report Forecasts Growth from $90m in 2000 to $1.2bn in 2005, Ultimately will Catch up with Europe', New York Business Wire, August 16, 2000 WAP Field Study Findings, Jakob Nielsen?s Alert Box, Dec 10 2000 'Why WAP is not Woeful', BBC online, 4 Jan 2001 http://www.epaynews.com/statistics/mcommstats.html - allNetDevices, Jupiter Communications, Allied Business Intelligence Murphy, Malachy: 'SMS, WAP & iMode', Dec 2000 'Mcommerce Experiences Growing Pains', Office.com, June 2000 Boston Consulting Group Mobile Messaging and Internet Applications Conference, July 2000 http://www.Actconferences.com Wireless Application Protocol Forum Ltd, Wapforum.org, 1999-2000 iMode http://www.eurotechnology.com Imodenews http://www.japon.net 'This Changes Everything December', allNetDevices, Dec 2000 Dow Jones, mcommercetimes, Dec 2000 MCI Worldcom, Nov 2000 http://www.mcommercetimes.com/Technology/49