Distribution of Federal Tax Change by Cash Income Percentile, 2013

advertisement

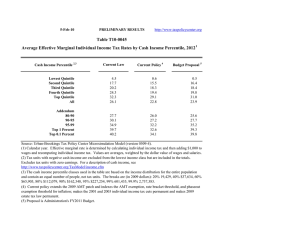

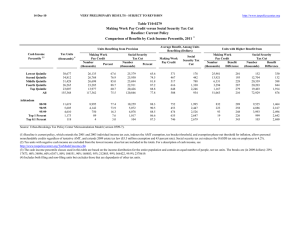

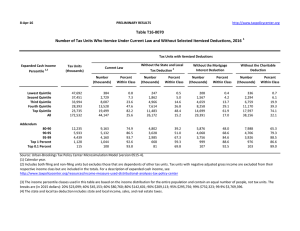

8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0057 Administration's FY2012 Budget Proposals Administration's Baseline Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile, 2013 1 Summary Table Percent of Tax Units4 Cash Income Percentile 2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After‐Tax Income 5 Share of Total Federal Tax Change Average Federal Tax Change ($) Average Federal Tax Rate Change (% Points) 6 Under the Proposal 34.1 78.6 93.3 98.7 99.3 76.5 0.9 0.7 0.3 0.1 0.1 0.5 1.8 2.6 2.5 3.3 3.0 2.9 2.8 8.7 12.6 22.9 52.9 100.0 ‐195 ‐681 ‐1,081 ‐2,343 ‐6,175 ‐1,735 ‐1.7 ‐2.3 ‐2.0 ‐2.6 ‐2.1 ‐2.2 3.5 10.0 16.5 19.6 27.4 22.2 99.4 99.4 99.4 98.6 96.2 0.1 0.0 0.1 0.9 3.1 4.0 4.0 3.6 1.0 0.4 18.4 12.8 15.9 5.8 1.1 ‐4,269 ‐6,040 ‐9,367 ‐13,296 ‐24,313 ‐3.0 ‐3.0 ‐2.6 ‐0.7 ‐0.3 22.2 23.5 26.0 34.2 38.1 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Number of AMT Taxpayers (millions). Baseline: 21.2 Proposal: 3.9 (1) Calendar year. Baseline is current law. Proposal would a) index the parameters of the AMT to inflation after 2011 and allow non‐refundable credits against tentative AMT; b) extend parts of the 2001 and 2003 tax cuts, including marriage penalty relief, the 10, 15, 25, 28 and a portion of the 33 percent brackets, and the 0%/15% rate structure on capital gains and qualified dividends for taxpayers in those brackets; c) set the threshold for the 36 percent bracket at $200,000 (single), $250,000 (married), or $225,000 (head of household), indexed for inflation after 2009, less the standard deduction and one personal exemption (two if married); d) set the thresholds for PEP and Pease at $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; e) extend the $1,000 child tax credit, $3,000 (not indexed) refundability threshold, and allow against the AMT; f) extend the maximum credit amount for the child and dependent care tax credit; g) increase the phase‐out range and eliminate the 60‐month limit on the deductibility of student loan interest payments; and h) set the estate tax at its 2009 level ($3.5M exemption, 45% rate). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $19,829, 40% $38,180, 60% $66,963, 80% $114,669, 90% $167,030, 95% $236,580, 99% $643,739, 99.9% $2,961,299. (4) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (5) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0057 Administration's FY2012 Budget Proposals Administration's Baseline Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile, 2013 1 Detail Table Percent of Tax Units 4 Cash Income Percentile 2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After‐Tax 5 Income Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate Change (% Points) 6 Under the Proposal 34.1 78.6 93.3 98.7 99.3 76.5 0.9 0.7 0.3 0.1 0.1 0.5 1.8 2.6 2.5 3.3 3.0 2.9 2.8 8.7 12.6 22.9 52.9 100.0 ‐195 ‐681 ‐1,081 ‐2,343 ‐6,175 ‐1,735 ‐32.8 ‐18.7 ‐10.9 ‐11.6 ‐7.1 ‐9.0 ‐0.2 ‐0.5 ‐0.2 ‐0.5 1.4 0.0 0.6 3.8 10.1 17.2 68.3 100.0 ‐1.7 ‐2.3 ‐2.0 ‐2.6 ‐2.1 ‐2.2 3.5 10.0 16.5 19.6 27.4 22.2 99.4 99.4 99.4 98.6 96.2 0.1 0.0 0.1 0.9 3.1 4.0 4.0 3.6 1.0 0.4 18.4 12.8 15.9 5.8 1.1 ‐4,269 ‐6,040 ‐9,367 ‐13,296 ‐24,313 ‐11.9 ‐11.2 ‐8.9 ‐1.9 ‐0.7 ‐0.4 ‐0.3 0.0 2.1 1.2 13.5 10.0 16.0 28.9 14.9 ‐3.0 ‐3.0 ‐2.6 ‐0.7 ‐0.3 22.2 23.5 26.0 34.2 38.1 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2013 1 Tax Units4 Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average After‐ 5 Tax Income (Dollars) Average Federal Tax Rate6 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total Number (thousands) Percent of Total 40,401 35,545 32,339 27,031 23,705 159,683 25.3 22.3 20.3 16.9 14.9 100.0 11,561 29,518 53,265 91,335 295,351 79,379 595 3,645 9,879 20,194 87,191 19,349 10,966 25,873 43,386 71,140 208,160 60,030 5.1 12.4 18.6 22.1 29.5 24.4 3.7 8.3 13.6 19.5 55.2 100.0 4.6 9.6 14.6 20.1 51.5 100.0 0.8 4.2 10.3 17.7 66.9 100.0 11,940 5,860 4,707 1,197 122 7.5 3.7 3.0 0.8 0.1 142,598 204,431 366,652 1,983,475 9,019,082 35,989 53,985 104,716 691,470 3,459,139 106,609 150,446 261,936 1,292,005 5,559,943 25.2 26.4 28.6 34.9 38.4 13.4 9.5 13.6 18.7 8.7 13.3 9.2 12.9 16.1 7.1 13.9 10.2 16.0 26.8 13.6 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Number of AMT Taxpayers (millions). Baseline: 21.2 Proposal: 3.9 (1) Calendar year. Baseline is current law. Proposal would a) index the parameters of the AMT to inflation after 2011 and allow non‐refundable credits against tentative AMT; b) extend parts of the 2001 and 2003 tax cuts, including marriage penalty relief, the 10, 15, 25, 28 and a portion of the 33 percent brackets, and the 0%/15% rate structure on capital gains and qualified dividends for taxpayers in those brackets; c) set the threshold for the 36 percent bracket at $200,000 (single), $250,000 (married), or $225,000 (head of household), indexed for inflation after 2009, less the standard deduction and one personal exemption (two if married); d) set the thresholds for PEP and Pease at $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; e) extend the $1,000 child tax credit, $3,000 (not indexed) refundability threshold, and allow against the AMT; f) extend the maximum credit amount for the child and dependent care tax credit; g) increase the phase‐out range and eliminate the 60‐month limit on the deductibility of student loan interest payments; and h) set the estate tax at its 2009 level ($3.5M exemption, 45% rate). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $19,829, 40% $38,180, 60% $66,963, 80% $114,669, 90% $167,030, 95% $236,580, 99% $643,739, 99.9% $2,961,299. (4) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (5) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0057 Administration's FY2012 Budget Proposals Administration's Baseline Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table Percent of Tax Units 4 Cash Income Percentile 2,3 With Tax Increase With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent Change in After‐Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 33.0 70.2 88.0 98.2 99.0 76.5 0.6 1.1 0.4 0.1 0.1 0.5 3.1 2.9 2.6 3.1 2.9 2.9 3.9 8.3 11.6 21.0 55.1 100.0 ‐325 ‐701 ‐1,004 ‐1,909 ‐5,033 ‐1,735 ‐133.0 ‐24.1 ‐12.4 ‐11.2 ‐6.9 ‐9.0 ‐0.4 ‐0.5 ‐0.3 ‐0.4 1.6 0.0 ‐0.1 2.6 8.1 16.5 72.9 100.0 ‐3.0 ‐2.6 ‐2.1 ‐2.4 ‐2.0 ‐2.2 ‐0.7 8.3 15.1 19.1 27.2 22.2 99.0 99.1 99.1 98.3 96.3 0.1 0.0 0.1 0.9 3.0 3.5 3.7 3.6 1.2 0.5 17.3 13.1 17.4 7.2 1.4 ‐3,143 ‐4,768 ‐8,063 ‐13,851 ‐26,239 ‐10.4 ‐10.4 ‐9.1 ‐2.3 ‐0.9 ‐0.2 ‐0.2 0.0 2.0 1.3 14.8 11.2 17.1 29.9 15.4 ‐2.6 ‐2.7 ‐2.6 ‐0.8 ‐0.3 22.4 23.6 25.7 33.8 37.7 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes 1 by Cash Income Percentile Adjusted for Family Size, 2013 Tax Units4 Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average After‐ Tax Income5 (Dollars) Average Federal Tax Rate6 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 33,459 32,885 31,869 30,496 30,312 159,683 21.0 20.6 20.0 19.1 19.0 100.0 10,833 26,816 47,152 79,522 248,646 79,379 245 2,915 8,127 17,082 72,639 19,349 10,589 23,901 39,025 62,440 176,007 60,030 2.3 10.9 17.2 21.5 29.2 24.4 2.9 7.0 11.9 19.1 59.5 100.0 3.7 8.2 13.0 19.9 55.7 100.0 0.3 3.1 8.4 16.9 71.3 100.0 15,281 7,600 5,988 1,444 144 9.6 4.8 3.8 0.9 0.1 121,325 174,872 311,732 1,722,207 7,944,556 30,288 46,022 88,212 596,149 3,020,072 91,037 128,850 223,520 1,126,059 4,924,484 25.0 26.3 28.3 34.6 38.0 14.6 10.5 14.7 19.6 9.0 14.5 10.2 14.0 17.0 7.4 15.0 11.3 17.1 27.9 14.1 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Number of AMT Taxpayers (millions). Baseline: 21.2 Proposal: 3.9 (1) Calendar year. Baseline is current law. Proposal would a) index the parameters of the AMT to inflation after 2011 and allow non‐refundable credits against tentative AMT; b) extend parts of the 2001 and 2003 tax cuts, including marriage penalty relief, the 10, 15, 25, 28 and a portion of the 33 percent brackets, and the 0%/15% rate structure on capital gains and qualified dividends for taxpayers in those brackets; c) set the threshold for the 36 percent bracket at $200,000 (single), $250,000 (married), or $225,000 (head of household), indexed for inflation after 2009, less the standard deduction and one personal exemption (two if married); d) set the thresholds for PEP and Pease at $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; e) extend the $1,000 child tax credit, $3,000 (not indexed) refundability threshold, and allow against the AMT; f) extend the maximum credit amount for the child and dependent care tax credit; g) increase the phase‐out range and eliminate the 60‐month limit on the deductibility of student loan interest payments; and h) set the estate tax at its 2009 level ($3.5M exemption, 45% rate). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,627, 40% $25,365, 60% $42,896, 80% $70,063, 90% $101,583, 95% $145,293, 99% $386,366, 99.9% $1,826,435. (4) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (5) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0057 Administration's FY2012 Budget Proposals Administration's Baseline Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table ‐ Single Tax Units Percent of Tax Units 4 Cash Income Percentile 2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After‐Tax 5 Income Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate Change (% Points) 6 Under the Proposal 18.7 57.8 87.3 98.0 98.6 66.0 1.1 1.1 0.4 0.1 0.1 0.6 0.9 1.3 1.5 1.9 3.9 2.6 1.9 6.0 9.8 16.2 66.2 100.0 ‐65 ‐236 ‐423 ‐861 ‐4,323 ‐897 ‐11.0 ‐10.1 ‐6.7 ‐6.7 ‐9.0 ‐8.3 0.0 ‐0.1 0.2 0.4 ‐0.4 0.0 1.4 4.8 12.3 20.5 60.8 100.0 ‐0.8 ‐1.2 ‐1.2 ‐1.5 ‐2.7 ‐2.0 6.5 10.3 16.8 21.1 27.4 21.8 98.6 98.4 98.7 98.8 95.9 0.0 0.1 0.1 0.5 3.4 3.1 3.7 5.1 3.7 2.1 16.2 12.2 22.5 15.3 3.5 ‐1,981 ‐3,299 ‐7,838 ‐26,868 ‐68,833 ‐8.7 ‐9.7 ‐12.7 ‐6.2 ‐2.9 ‐0.1 ‐0.2 ‐0.7 0.5 0.6 15.4 10.4 14.1 20.9 10.5 ‐2.3 ‐2.7 ‐3.6 ‐2.3 ‐1.2 23.9 24.8 25.1 35.2 40.6 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2013 1 Tax Units4 Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average After‐ 5 Tax Income (Dollars) Average Federal Tax Rate6 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total Number (thousands) Percent of Total 18,053 16,001 14,578 11,876 9,681 70,516 25.6 22.7 20.7 16.8 13.7 100.0 8,179 20,442 35,077 57,277 159,815 45,439 595 2,343 6,318 12,918 48,112 10,784 7,585 18,100 28,759 44,358 111,703 34,655 7.3 11.5 18.0 22.6 30.1 23.7 4.6 10.2 16.0 21.2 48.3 100.0 5.6 11.9 17.2 21.6 44.3 100.0 1.4 4.9 12.1 20.2 61.3 100.0 5,163 2,344 1,814 360 32 7.3 3.3 2.6 0.5 0.1 87,005 124,519 215,516 1,152,428 5,673,795 22,810 34,135 61,928 432,085 2,369,274 64,196 90,384 153,588 720,343 3,304,521 26.2 27.4 28.7 37.5 41.8 14.0 9.1 12.2 13.0 5.7 13.6 8.7 11.4 10.6 4.3 15.5 10.5 14.8 20.5 9.9 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). (1) Calendar year. Baseline is current law. Proposal would a) index the parameters of the AMT to inflation after 2011 and allow non‐refundable credits against tentative AMT; b) extend parts of the 2001 and 2003 tax cuts, including marriage penalty relief, the 10, 15, 25, 28 and a portion of the 33 percent brackets, and the 0%/15% rate structure on capital gains and qualified dividends for taxpayers in those brackets; c) set the threshold for the 36 percent bracket at $200,000 (single), $250,000 (married), or $225,000 (head of household), indexed for inflation after 2009, less the standard deduction and one personal exemption (two if married); d) set the thresholds for PEP and Pease at $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; e) extend the $1,000 child tax credit, $3,000 (not indexed) refundability threshold, and allow against the AMT; f) extend the maximum credit amount for the child and dependent care tax credit; g) increase the phase‐out range and eliminate the 60‐month limit on the deductibility of student loan interest payments; and h) set the estate tax at its 2009 level ($3.5M exemption, 45% rate). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,627, 40% $25,365, 60% $42,896, 80% $70,063, 90% $101,583, 95% $145,293, 99% $386,366, 99.9% $1,826,435. (4) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (5) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0057 Administration's FY2012 Budget Proposals Administration's Baseline Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table ‐ Married Tax Units Filing Jointly Percent of Tax Units 4 Cash Income Percentile 2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After‐Tax 5 Income Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate Change (% Points) 6 Under the Proposal 34.3 73.3 84.5 98.2 99.3 84.8 0.1 1.4 0.5 0.1 0.1 0.4 4.2 3.8 3.1 3.6 2.6 2.9 2.2 5.8 10.0 23.3 58.6 100.0 ‐572 ‐1,165 ‐1,563 ‐2,763 ‐5,571 ‐2,911 ‐121.4 ‐30.7 ‐15.9 ‐13.6 ‐6.5 ‐8.6 ‐0.2 ‐0.4 ‐0.4 ‐0.8 1.8 0.0 0.0 1.2 5.0 14.0 79.8 100.0 ‐4.0 ‐3.4 ‐2.6 ‐2.8 ‐1.9 ‐2.2 ‐0.7 7.7 13.6 18.0 27.1 23.3 99.3 99.5 99.3 98.4 97.0 0.1 0.0 0.1 0.6 2.4 3.6 3.7 3.3 0.8 0.3 19.7 15.2 18.3 5.5 0.8 ‐3,911 ‐5,544 ‐8,369 ‐9,618 ‐14,269 ‐11.2 ‐10.7 ‐8.3 ‐1.5 ‐0.5 ‐0.4 ‐0.3 0.1 2.5 1.4 14.6 12.0 19.1 34.0 17.2 ‐2.7 ‐2.8 ‐2.3 ‐0.5 ‐0.2 21.8 23.2 25.9 33.4 37.1 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2013 1 Tax Units4 Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average After‐ 5 Tax Income (Dollars) Average Federal Tax Rate6 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total Number (thousands) Percent of Total 7,024 8,856 11,443 15,130 18,854 61,567 11.4 14.4 18.6 24.6 30.6 100.0 14,231 34,357 60,965 97,772 297,727 132,758 471 3,797 9,858 20,334 86,213 33,874 13,759 30,560 51,108 77,438 211,515 98,884 3.3 11.1 16.2 20.8 29.0 25.5 1.2 3.7 8.5 18.1 68.7 100.0 1.6 4.5 9.6 19.3 65.5 100.0 0.2 1.6 5.4 14.8 77.9 100.0 9,003 4,921 3,909 1,021 104 14.6 8.0 6.4 1.7 0.2 142,540 200,289 359,028 1,900,519 8,491,806 34,912 52,061 101,369 644,948 3,163,991 107,628 148,228 257,658 1,255,571 5,327,816 24.5 26.0 28.2 33.9 37.3 15.7 12.1 17.2 23.8 10.8 15.9 12.0 16.5 21.1 9.1 15.1 12.3 19.0 31.6 15.8 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). (1) Calendar year. Baseline is current law. Proposal would a) index the parameters of the AMT to inflation after 2011 and allow non‐refundable credits against tentative AMT; b) extend parts of the 2001 and 2003 tax cuts, including marriage penalty relief, the 10, 15, 25, 28 and a portion of the 33 percent brackets, and the 0%/15% rate structure on capital gains and qualified dividends for taxpayers in those brackets; c) set the threshold for the 36 percent bracket at $200,000 (single), $250,000 (married), or $225,000 (head of household), indexed for inflation after 2009, less the standard deduction and one personal exemption (two if married); d) set the thresholds for PEP and Pease at $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; e) extend the $1,000 child tax credit, $3,000 (not indexed) refundability threshold, and allow against the AMT; f) extend the maximum credit amount for the child and dependent care tax credit; g) increase the phase‐out range and eliminate the 60‐month limit on the deductibility of student loan interest payments; and h) set the estate tax at its 2009 level ($3.5M exemption, 45% rate). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,627, 40% $25,365, 60% $42,896, 80% $70,063, 90% $101,583, 95% $145,293, 99% $386,366, 99.9% $1,826,435. (4) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (5) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0057 Administration's FY2012 Budget Proposals Administration's Baseline Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table ‐ Head of Household Tax Units Percent of Tax Units 4 Cash Income Percentile 2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After‐Tax 5 Income Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate Change (% Points) 6 Under the Proposal 63.1 91.2 96.4 99.4 99.0 84.4 0.1 0.7 0.1 0.0 0.0 0.3 4.8 4.0 3.3 2.9 2.4 3.4 18.4 28.2 23.5 16.7 13.2 100.0 ‐695 ‐1,136 ‐1,393 ‐1,796 ‐3,181 ‐1,224 91.3 ‐37.7 ‐15.0 ‐10.3 ‐6.2 ‐17.0 ‐4.5 ‐3.2 0.7 2.3 4.7 0.0 ‐7.9 9.5 27.3 30.0 41.0 100.0 ‐5.0 ‐3.6 ‐2.7 ‐2.3 ‐1.7 ‐2.8 ‐10.5 5.9 15.4 19.9 25.8 13.9 99.0 98.7 99.6 99.3 96.8 0.0 0.0 0.0 0.5 2.9 2.7 3.0 2.4 1.0 0.6 6.0 2.9 3.1 1.1 0.2 ‐2,295 ‐3,609 ‐5,209 ‐10,135 ‐25,816 ‐7.9 ‐8.6 ‐6.9 ‐2.0 ‐0.9 1.4 0.6 0.9 1.8 0.9 14.4 6.3 8.6 11.7 5.4 ‐2.0 ‐2.2 ‐1.8 ‐0.7 ‐0.3 23.1 23.8 24.4 33.7 37.6 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2013 1 Tax Units4 Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average After‐ 5 Tax Income (Dollars) Average Federal Tax Rate6 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total Number (thousands) Percent of Total 8,120 7,619 5,177 2,860 1,273 25,098 32.4 30.4 20.6 11.4 5.1 100.0 13,842 31,582 51,476 78,894 187,085 43,104 ‐761 3,013 9,310 17,511 51,472 7,200 14,604 28,569 42,166 61,383 135,613 35,904 ‐5.5 9.5 18.1 22.2 27.5 16.7 10.4 22.2 24.6 20.9 22.0 100.0 13.2 24.2 24.2 19.5 19.2 100.0 ‐3.4 12.7 26.7 27.7 36.3 100.0 808 249 182 35 3 3.2 1.0 0.7 0.1 0.0 115,728 161,060 289,763 1,499,445 7,613,791 29,008 41,867 75,977 515,758 2,885,610 86,719 119,193 213,786 983,687 4,728,181 25.1 26.0 26.2 34.4 37.9 8.7 3.7 4.9 4.8 2.0 7.8 3.3 4.3 3.8 1.5 13.0 5.8 7.6 9.9 4.6 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). (1) Calendar year. Baseline is current law. Proposal would a) index the parameters of the AMT to inflation after 2011 and allow non‐refundable credits against tentative AMT; b) extend parts of the 2001 and 2003 tax cuts, including marriage penalty relief, the 10, 15, 25, 28 and a portion of the 33 percent brackets, and the 0%/15% rate structure on capital gains and qualified dividends for taxpayers in those brackets; c) set the threshold for the 36 percent bracket at $200,000 (single), $250,000 (married), or $225,000 (head of household), indexed for inflation after 2009, less the standard deduction and one personal exemption (two if married); d) set the thresholds for PEP and Pease at $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; e) extend the $1,000 child tax credit, $3,000 (not indexed) refundability threshold, and allow against the AMT; f) extend the maximum credit amount for the child and dependent care tax credit; g) increase the phase‐out range and eliminate the 60‐month limit on the deductibility of student loan interest payments; and h) set the estate tax at its 2009 level ($3.5M exemption, 45% rate). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,627, 40% $25,365, 60% $42,896, 80% $70,063, 90% $101,583, 95% $145,293, 99% $386,366, 99.9% $1,826,435. (4) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (5) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0057 Administration's FY2012 Budget Proposals Administration's Baseline Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table ‐ Tax Units with Children Percent of Tax Units 4 Cash Income Percentile 2,3 With Tax Increase With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent Change in After‐Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 69.1 95.9 98.8 99.8 99.8 92.2 0.1 0.4 0.1 0.0 0.1 0.1 5.9 5.1 4.0 4.5 2.7 3.6 7.2 12.7 15.7 26.6 37.7 100.0 ‐939 ‐1,643 ‐2,066 ‐3,663 ‐6,120 ‐2,736 101.7 ‐44.2 ‐17.3 ‐14.9 ‐6.2 ‐11.2 ‐1.0 ‐1.2 ‐0.7 ‐0.8 3.7 0.0 ‐1.8 2.0 9.4 19.0 71.2 100.0 ‐6.3 ‐4.6 ‐3.2 ‐3.5 ‐1.9 ‐2.8 ‐12.4 5.8 15.5 19.7 28.2 21.8 99.9 99.9 99.6 98.9 97.4 0.0 0.0 0.1 0.7 2.3 3.9 4.1 2.8 0.6 0.2 15.0 10.3 10.0 2.5 0.3 ‐4,668 ‐6,933 ‐8,393 ‐8,782 ‐9,866 ‐11.1 ‐10.9 ‐6.7 ‐1.1 ‐0.2 0.0 0.0 0.8 2.9 1.5 15.1 10.5 17.4 28.1 13.6 ‐2.9 ‐3.0 ‐2.0 ‐0.4 ‐0.1 23.1 24.2 27.4 35.4 38.2 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes 1 by Cash Income Percentile Adjusted for Family Size, 2013 Tax Units4 Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average After‐ Tax Income5 (Dollars) Average Federal Tax Rate6 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total Number (thousands) Percent of Total 10,404 10,419 10,279 9,803 8,309 49,348 21.1 21.1 20.8 19.9 16.8 100.0 15,026 35,671 63,686 106,014 325,807 99,630 ‐923 3,718 11,927 24,525 98,129 24,497 15,950 31,954 51,759 81,489 227,678 75,133 ‐6.1 10.4 18.7 23.1 30.1 24.6 3.2 7.6 13.3 21.1 55.1 100.0 4.5 9.0 14.4 21.6 51.0 100.0 ‐0.8 3.2 10.1 19.9 67.5 100.0 4,326 1,997 1,604 382 36 8.8 4.1 3.3 0.8 0.1 162,746 233,966 425,182 2,235,730 10,656,644 42,254 63,477 124,945 799,619 4,079,568 120,492 170,490 300,238 1,436,111 6,577,076 26.0 27.1 29.4 35.8 38.3 14.3 9.5 13.9 17.4 7.8 14.1 9.2 13.0 14.8 6.4 15.1 10.5 16.6 25.3 12.1 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would a) index the parameters of the AMT to inflation after 2011 and allow non‐refundable credits against tentative AMT; b) extend parts of the 2001 and 2003 tax cuts, including marriage penalty relief, the 10, 15, 25, 28 and a portion of the 33 percent brackets, and the 0%/15% rate structure on capital gains and qualified dividends for taxpayers in those brackets; c) set the threshold for the 36 percent bracket at $200,000 (single), $250,000 (married), or $225,000 (head of household), indexed for inflation after 2009, less the standard deduction and one personal exemption (two if married); d) set the thresholds for PEP and Pease at $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; e) extend the $1,000 child tax credit, $3,000 (not indexed) refundability threshold, and allow against the AMT; f) extend the maximum credit amount for the child and dependent care tax credit; g) increase the phase‐out range and eliminate the 60‐month limit on the deductibility of student loan interest payments; and h) set the estate tax at its 2009 level ($3.5M exemption, 45% rate). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,627, 40% $25,365, 60% $42,896, 80% $70,063, 90% $101,583, 95% $145,293, 99% $386,366, 99.9% $1,826,435. (4) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (5) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0057 Administration's FY2012 Budget Proposals Administration's Baseline Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table ‐ Elderly Tax Units Percent of Tax Units 4 Cash Income Percentile 2,3 With Tax Increase With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent Change in After‐Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 6.3 29.6 55.6 94.8 97.8 54.8 0.0 0.3 0.7 0.1 0.3 0.3 0.4 0.7 1.0 2.4 4.1 2.9 0.4 2.3 4.4 14.8 78.0 100.0 ‐39 ‐153 ‐399 ‐1,498 ‐7,764 ‐1,806 ‐13.3 ‐14.8 ‐14.0 ‐15.8 ‐10.0 ‐10.8 0.0 ‐0.1 ‐0.1 ‐0.6 0.8 0.0 0.3 1.6 3.3 9.6 85.1 100.0 ‐0.4 ‐0.7 ‐1.0 ‐2.1 ‐2.9 ‐2.3 2.4 3.8 5.9 11.0 25.9 19.0 97.4 98.1 98.6 96.9 95.1 0.3 0.1 0.2 1.2 4.6 4.2 4.4 5.9 2.6 1.3 16.5 13.7 28.7 19.1 4.4 ‐3,714 ‐5,517 ‐11,972 ‐26,463 ‐56,367 ‐17.5 ‐15.5 ‐15.6 ‐4.6 ‐2.0 ‐0.8 ‐0.5 ‐1.1 3.1 2.3 9.5 9.1 18.8 47.8 25.6 ‐3.4 ‐3.5 ‐4.3 ‐1.7 ‐0.8 15.9 18.8 23.0 34.3 38.5 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes 1 by Cash Income Percentile Adjusted for Family Size, 2013 Tax Units4 Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average After‐ Tax Income5 (Dollars) Average Federal Tax Rate6 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total Number (thousands) Percent of Total 5,313 8,515 6,190 5,603 5,686 31,333 17.0 27.2 19.8 17.9 18.2 100.0 10,822 22,986 41,540 72,670 269,484 78,111 294 1,033 2,857 9,505 77,552 16,681 10,528 21,953 38,682 63,165 191,932 61,431 2.7 4.5 6.9 13.1 28.8 21.4 2.4 8.0 10.5 16.6 62.6 100.0 2.9 9.7 12.4 18.4 56.7 100.0 0.3 1.7 3.4 10.2 84.4 100.0 2,520 1,400 1,357 409 44 8.0 4.5 4.3 1.3 0.1 109,880 159,960 281,390 1,589,526 7,053,610 21,198 35,637 76,668 571,645 2,770,657 88,682 124,323 204,722 1,017,880 4,282,954 19.3 22.3 27.3 36.0 39.3 11.3 9.2 15.6 26.5 12.7 11.6 9.0 14.4 21.6 9.8 10.2 9.5 19.9 44.7 23.3 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would a) index the parameters of the AMT to inflation after 2011 and allow non‐refundable credits against tentative AMT; b) extend parts of the 2001 and 2003 tax cuts, including marriage penalty relief, the 10, 15, 25, 28 and a portion of the 33 percent brackets, and the 0%/15% rate structure on capital gains and qualified dividends for taxpayers in those brackets; c) set the threshold for the 36 percent bracket at $200,000 (single), $250,000 (married), or $225,000 (head of household), indexed for inflation after 2009, less the standard deduction and one personal exemption (two if married); d) set the thresholds for PEP and Pease at $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; e) extend the $1,000 child tax credit, $3,000 (not indexed) refundability threshold, and allow against the AMT; f) extend the maximum credit amount for the child and dependent care tax credit; g) increase the phase‐out range and eliminate the 60‐month limit on the deductibility of student loan interest payments; and h) set the estate tax at its 2009 level ($3.5M exemption, 45% rate). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,627, 40% $25,365, 60% $42,896, 80% $70,063, 90% $101,583, 95% $145,293, 99% $386,366, 99.9% $1,826,435. (4) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (5) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.