UNIVERSITY HOUSTON

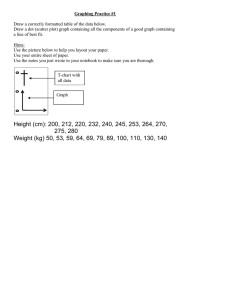

advertisement