As the industry leader, it is our responsibility to set a good example.

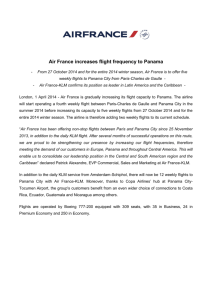

advertisement