Preemption and Forecast Accuracy: A Structural Approach ∗ Job Market Paper

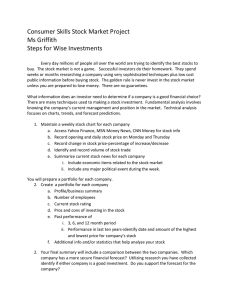

advertisement

Preemption and Forecast Accuracy:

A Structural Approach∗

Job Market Paper

[Download the most recent version]

Fanny Camara†

January 26, 2016

Abstract

This paper examines how competition affects information provided by experts. I estimate a

timing game played by financial analysts who produce earning forecasts. Over time, both the

exogenous information available to the market and the information privately observed by each

analyst become more precise. In choosing when to release their forecasts, analysts weigh whether

to wait for more precise information in order to forecast more accurately, or to preempt their

competitors by reducing the informational advantage enjoyed by rivals who have yet to issue

their forecasts. I assess the informational value of professional forecasters. I find that financial

analysts produce 40% of the information on future earnings made available to investors during the

forecasting period. I perform a counterfactual experiment with fixed forecast dates to quantify

the extent to which preemption affects forecast delay and forecast accuracy. Preemption reduces

forecast delays substantially: without preemption, the average analyst would disclose her forecast

eight days after the date observed in the data. Because earlier forecasts use less information,

preemption diminishes the average forecast accuracy by 24%.

Keywords: Structural Estimation, Preemption, Timing Game, Earning Forecasts, Information

Economics

JEL: C18, C57, D83, D84, G14, L15

∗

I am deeply indebted to Margaret K. Kyle, Marco Ottaviani , and Jesse M. Shapiro for their invaluable

guidance and support. I am also grateful to Christian Hellwig, Andrew Foster, John Friedman, Augustin

Landier, Laura Lasio, Ernest Liu, Christopher Malloy, Mathias Reynaert, and Paul Scott for insightful comments. Finally this paper has benefitted from discussions with seminar audiences at Bocconi, Mines ParisTech,

and Brown. Errors and opinions are mine.

†

Toulouse School of Economics, 21 allée de Brienne, 31015 Toulouse Cedex 6, France; fanny.camara@tse-fr.eu.

1

1

Introduction

Experts play an important role in markets with information problems. For example,

consumers may rely on expert assessments of the quality of a new car, firms may base their

investment decisions on the forecasts of macroeconomic variables produced by central

banks, and investors may adjust their portfolios in response to the forecasts of financial

analysts. However, strategic interactions between competing experts can affect the quality

of the information they provide to the market, and distort market outcomes as a result.

This paper examines the distortions that may result from mis-timing the release of

information in the presence of competition. Specifically, I study financial analysts who

issue forecasts on the earnings of public companies. These analysts are experts, who invest

significant effort to acquire information about the companies they follow. If experts are

rewarded for the informational content of their forecasts, the timing of the forecast release

is a critical decision for the analyst. By waiting, she acquires more precise information

and forecasts more accurately. However, forecasts already issued by her rivals become

public information, thereby reducing her own information advantage.

This paper is the first to develop a methodology to quantify the distortions generated

by strategic interactions between competing experts. I use this methodology to estimate

the extent to which preemption affects the delay and the accuracy of quarterly Earning Per Share (EPS) issued by sell-side analysts (analysts employed by brokerage firms).

Amid growing regulatory efforts to curb concentration in the brokerage industry (Regulation of National Market System (2005) in the US, Markets in Financial Instruments

Directive (2007) in the EU), this work can help determine the optimal level of competition

needed to ensure the efficient functioning and the liquidity of capital markets. In addition, this paper is the first to develop a structural method to quantify the contribution

of professional forecasters to the information available to the market.

When experts cannot choose the timing of their forecasts, economic theory suggests

that having more experts forecasting a given outcome improves forecast accuracy for two

reasons. First, as the number of experts who collect conditionally independent signals

increases, their aggregated information becomes more precise. Second, the theoretical

literature on persuasion suggests that competition disciplines experts to report their

2

private information truthfully either by confronting experts with misaligned preferences

(Gentzkow and Kamenica, 2011; Krishna and Morgan, 1999; Milgrom and Roberts, 1986)

or by increasing the amount of feedbacks that the market receives about the state of the

world (Gentzkow and Shapiro, 2006; Camara and Dupuis, 2015).

In contrast, competition among experts has ambiguous effects on accuracy when experts are free to time their forecasts. On the one hand, tougher competition implies that

a higher number of experts collect and process information. On the other hand, when the

payoff of each expert is tied to the relative informational content of her forecast, strategic

interactions between analysts results in sub-optimal forecast timing. The mechanism is

the following: Each disclosed forecast becomes public information. The expert who issues

an early forecast reduces the informational advantage that her competitors, who have not

yet released their forecasts, have on the market. Experts anticipate that earlier forecasts

reduce the value of their private information and react by issuing their predictions before

the time they would have chosen in the absence of competitors.

Assessing the impact of strategic interactions between analysts on forecast accuracy

constitutes an empirical question of particular relevance for earning forecasts since economic efficiency depends crucially on their accuracy. First, analysts play an important

role in reducing the asymmetry of information between insiders and outsiders which, to

the extent that inside trading hurts investors’ confidence in securities markets (Ausubel,

1990), stimulates investment. Second, since earning forecasts are used as inputs by credit

rating agencies to rate firms’ debts (Fong et al., 2014), accurate earning forecasts increase

the reliability of credit ratings and have positive spillover effects on financial stability. Finally, sell-side analysts lower the cost for investors of acquiring information and, therefore,

improve the liquidity of securities markets (Groysberg et al., 2007).

In this paper, I quantify the informational loss in earning forecasts that preemption

generates. To do so, I generalize the game studied by Guttman (2010) to N players

to model the timing decisions of sell-side financial analysts who forecast the quarterly

Earning Per Share (EPS) of public companies. Motivated by the works of Irvine et al.

(2007) which provides empirical evidence that brokerage firms give early access to research

to clients who generate significant commission revenues – a practice called tipping – and

Cowen et al. (2003) which documents that research firms who employ financial analysts

3

sell research as a stand-alone product, I assume that analysts indirectly capture the

benefits of the information that they produce by selling their forecasts to their private

clients before disclosing them to the market. The willingness-to-pay of the client for the

analyst’s information corresponds to the trading gain that he can make by exploiting

his informational advantage over the market. Exogenous public information about the

future realization of the EPS – which can take the form of financial reports issued by

the company – arrives continuously over the forecasting period. At the beginning of the

game, the analyst receives a signal whose precision depends on her initial ability. As time

goes by, she accumulates more private information at a rate determined by her learning

ability. The time when the informational advantage of the analyst over the market reaches

its maximum increases with the magnitude of her learning ability relative to her initial

ability.

When a unique analyst covers the stock, she maximizes her payoff by issuing her

forecast when the precision of her private information relative to the public information

reaches its maximum. Hereafter, I refer to this level of precision (and the corresponding timing) as the unconstrained optimal. When multiple analysts cover the stock, the

equilibrium timing profile is such that each analyst chooses the date that maximizes the

relative precision of her private information under the constraint that no later analyst

finds it profitable to deviate from the equilibrium timing by undercutting previous forecasters. Unlike the dynamic timing game studied by Fudenberg and Tirole (1985), this

game features players who receive one-shot payoffs that depend only on the history of the

game before their moves and not on the actions of players who move after them. This

implies that players have no incentive to influence the timing of subsequent movers. As

a result, I define preemption not as a deviation from a precommitment equilibrium but

as a deviation from the unconstrained optimum. More specifically, the analyst is said to

preempt her competitors when she chooses to issue her forecast at a time when the accuracy of the public information is lower than the level that maximizes her informational

advantage over the market. It is worth noting that, besides preemption, competition reduces forecast delays for a purely mechanical reason: each disclosed forecast increases the

precision of the public information and thus decreases the time each subsequent analyst

has to wait to reach the point when her informational advantage is maximized.

4

At equilibrium, analysts with similar ratios of initial to learning ability which command similar optimal unconstrained timing, tend to engage in a preemption which results

in clustered forecasts. The intuition is the following. Consider a scenario with two analysts, in which the informational advantage of analyst A (she) is maximized for a public

precision yA , while the informational advantage of analyst B (he) is maximized when the

public information reaches the level of precision yB . Denote by f A (yA ), the precision of

the private information of analyst A that corresponds to the public information yA . Define similarly f B (yB ) for analyst B. Assume that the abilities of both analysts are similar

so that the difference between yA and yB is small with yA < yB , and yB < yA + f A (yA ).

Assume further that the difference between yA and yB is small enough that analyst B

is better off by timing his forecast right before yA rather waiting for analyst A to issue

her forecast in yA . If analyst B believes that analyst A will release her forecast when

the public signal reaches the precision yA , he has incentives to undercut analyst A and

issues his forecast in yA − . Analyst A anticipates that she will be preempted by B if she

waits until the public precision reaches the level yA to issue her forecast. She reacts by

releasing her forecast at an even earlier date when the public precision, y ∗ , is such that B

is indifferent between undercutting A and forecasting immediately after her at a level of

public precision y ∗ + f A (y ∗ ). As a result of the preemption race between both analysts,

A forecasts before her optimal unconstrained timing and the two forecasts are clustered

in time (B forecasts immediately after A). At equilibrium, analysts who differ enough in

terms of initial to learning ability ratios issue unclustered forecasts at their unconstrained

optimal levels of public precision. The multiple players version of the timing game does

not admit a unique equilibrium. However all the equilibria of the game have the property

that analysts who issue unclustered forecasts do it when the precision of the public signal

reaches their unconstrained optimal level. This feature of the game, that is invariant

across equilibria, is at the core of the identification strategy.

I estimate the structural parameters that govern the arrival process of public information as well as the initial and learning abilities of the analysts. This allows me to

assess the informational value of financial analysts – which the contribution of financial

analysts to the accuracy of investors’ expectations about future earnings – and the level

of heterogeneity in the precision of analysts’ private information. Finally I quantify the

5

extent to which preemption affects accuracy and forecast delay. To do so, I perform a

counterfactual experiment in which the forecasts’ dates are fixed so as to maximize the

relative precision of each forecast under the constraint that no analyst issues her forecast

before the public signal reaches her unconstrained optimal precision.

I estimate that analysts produce 40% of the information available to investors which

supports the widespread perception that analysts are major market information intermediaries (Bradshaw, 2011). I find that preemption creates sizable informational losses:

the accuracy of the average forecast in the counterfactual scenario without preemption

is 24% larger than the estimated accuracy of the actual average forecast. In terms forecast errors, the loss in accuracy caused by preemption translates into an average absolute

forecast error that 18% larger than the one that would occur in the absence of preemptive

incentives. In terms of forecast timing, I estimate that preemption reduces the average

forecast delay by 8 days, bringing the average forecast delay to 2 days after the report of

the EPS of the previous quarter. I find that, at the beginning of the forecasting period,

the higher number of disclosed forecasts in the actual data swamps the negative effect on

accuracy of the sub-optimal timing so that preemption actually increases the amount of

information produced by analysts and disclosed to investors during the first week of the

forecasting period. However after this period, preemption reduces the accuracy of the

information made available to the market. The overall effect of preemption on welfare is

ambiguous and depends on how much investors value access to information at the very

beginning of the forecasting period.

While the literature on EPS forecasts is large and has explored the questions of herding (Gleason and Lee, 2003; Hong et al., 2000), forecast bias (Hong and Kacperczyk, 2010;

Hong and Kubik, 2003; Lim, 2001), forecast accuracy (Fang and Yasuda, 2004; Mikhail

et al., 1997), and the market reaction to earning forecasts (Park and Stice, 2000; Stickel,

1992), I focus on timing which has received much less attention.

The existing empirical literature on timing has mostly focused on the informativeness

of early forecasts versus late forecasts, the informational content being measured by the

stock price response to the forecasts (Cooper et al., 2001) or a combination of accuracy,

price response, and boldness of revisions (Keskek et al., 2014). More closely related to

this paper, Kim et al. (2011) explores the determinants of the timing of forecast revisions.

6

They find that the characteristics that predict later revisions also predict lower forecast

errors. Their reduced-form approach does not enable them to distinguish whether late

forecasters outperform early forecasters because they receive better private information

later in the forecasting period or whether they simply benefit from the information revealed by previously issued forecasts.

Gul and Lundholm (1995) were the firsts to study a game of forecast timing. The

authors develop a model that rationalizes the clustering (in value) of the forecasts issued

by two experts. Since the informational environment that they consider does not include

exogenous information, after the first expert issues her forecast, the second expert has no

further incentives to wait and releases her forecast immediately. This feature makes the

model unfit to rationalize the forecasting behavior of financial analysts who typically wait

for more exogenous public information even when they are the last forecasters. Guttman

(2010) considers a richer informational environment in which exogenous information arrives continuously during the forecasting period. He further assumes that experts time

their forecasts so as to maximize the market value of their private information. These

two features make the timing game that he studies better tailored to financial analysts.

This paper also contributes to the literature on structural estimation of timing games.

To the best of my knowledge, only two papers quantify the efficiency loss arising from

competition when timing is endogenous. Schmidt-Dengler (2006) estimates the effects of

both preemption and business stealing on the timing of MRI adoption by hospitals and

find that competition affects adoption times mostly through business stealing. Takahashi

(2013) estimates a dynamic exit game played by movie theaters. He finds that strategic

interactions cause theaters to delay exit by 2.7 years relative to the profit-maximizing

date. While these papers have focused on traditional questions in industrial organization

(namely technology adoption and exit), this work constitutes the first attempt to estimate

an equilibrium timing model to recover the informational cost of preemption in a financial

setting.

The remainder of the paper is organized as follows: Section 2 provides some background on sell-side analysts and relevant regulations. Section 3 describes the data. Section 4 presents reduced-form evidence on the effects of competition on timing and accuracy. Section 5 explains the model used for timing decisions. Section 6 reports the

7

details of estimation and identification. Section 7 presents the results of the structural

estimation. Section 8 concludes.

2

Background on Sell-Side Analysts and Regulatory

Context

The job of a sell-side analyst consists in providing investment reports about publicly

listed companies to retail and institutional investors (for example pension plans or mutual funds). Investment reports typically include a review of the firm’s business model,

short-term earning forecasts, projections of stock price, and “buy”, “sell”, or “hold”

recommendations. In order to produce those reports, analysts study the companies’ financial and operating data, assess firms’ competitive environments, and gather additional

insights on future performance through meetings with firm management1 and discussions

with traders and sales staff who provide them with information on trading volumes and

planned future purchases. For the specific task of producing earning forecasts, analysts

build financial models to predict future revenues and costs that use as inputs the information that they have gathered.

Securities firms who employ sell-side analysts generate revenue by underwriting public

offerings, charging trading commissions, and selling research as a stand-alone product

(Cowen et al., 2003). Trading commissions usually take the form of fees charged by

brokerage houses to handle trades and to provide clients with investment advice based on

the research produced by sell-side analysts. In addition, securities companies commonly

practice “tipping”. Tipping consists in providing select institutional clients with access

to investment reports before their public disclosure. Institutional clients compensate the

company indirectly through trading commissions.

Since the early 2000s, the introduction of regulatory measures to tackle the issue

of conflict of interests and promote competition has changed substantially the relative

importance of those sources of research funding. The implementation of the Sarbanes1

Since 2000, the Fair Disclosure Regulation prohibits firms from privately communicating value-

relevant information to analysts which may have reduced the analysts’ ability to collect private information from firm management

8

Oxley Act of 2002 has weaken the linkage between underwriting activities and research

by mandating securities firms to build a Chinese Wall between their investment banking

and research departments and by precluding firms from tying analysts’ compensations

to specific investment banking transactions. In an effort to promote competition in the

market for brokerage services, the UK’s Financial Services Authority issued new guidelines (CP176) in 2003 prescribing the unbundling of research and execution commissions.

Similar regulations have later been adopted by the US where the Securities and Exchange

Commission (SEC) implemented the Regulation of National Market System (NMS) in

2005 and by the EU which adopted the concept of best execution as part of the Markets in

Financial Instruments Directive (MiFID) in 2007. These regulatory changes have limited

the extent to which brokerage houses can rely on underwriting and bundled trading commissions to finance their research activities and have increased the relative importance of

tipping or direct sales of investment reports as sources of research funding.

3

3.1

Data and Descriptive Statistics

Data Sources

I use data on quarterly forecasts of Earning Per Share (EPS) of publicly listed U.S.

companies from the Institutional Brokers’ Estimate System (I/B/E/S) detail history

dataset. The dataset contains the value of the forecasts, the date and time at which each

forecast is issued, the identity of the financial analyst who issues the forecast, the identity

of the brokerage house for which the analyst works, the realization of the EPS, and the

date at which the realization of the EPS is announced publicly. I use data on stock prices

and stock returns from the Center for Research in Security Prices (CRSP) database.

3.2

Sample Definition

In line with the previous literature on EPS forecasts, I focus on forecasts issued for typical

fiscal quarters i.e. quarters ending in March, June, September, and December. These

represent more than 85% of the forecasts. I exclude forecasts released before the beginning

of the fiscal quarters, forecasts released after the end of the fiscal quarter, as well as all

9

forecasts pertaining to stock-quarter whose previous quarterly EPS is announced with a

delay of more than 90 days. I select forecasts issued from the beginning of 2010 through

the end of 2014.2 After all exclusions, the sample contains a total of 392,846 quarterly

EPS forecasts for 3,412 stocks issued by US companies. The companies are distributed

across 371 industries as defined by the Standard Industrial Classification code (SIC).

3.3

Brokerage Houses

The data contain EPS forecasts issued by analysts working for 333 brokerage houses

(summarized in Table A3). In a typical quarter, the average brokerage house employs 12

analysts and covers 94 stocks from companies distributed across 34 industries. I measure

the size of a brokerage house by the number of analysts employed. Bigger brokerage

houses offer higher compensations and positions that are perceived as more prestigious.

Following the literature and notably Hong and Kacperczyk (2010), I use the size of the

brokerage house for which the analyst works as a measure of her career success. An

analyst employed by a big brokerage house will hereafter be referred to as high status

analyst. I define a big brokerage house as a house whose size is above the 90th percentile

of brokerage house size distribution i.e. a house which employs at least 33 analysts. On

average, a big brokerage house employs 54 analysts and covers 449 companies distributed

over 144 industries. Big brokerage houses issue about 51% (201,452) of the quarterly

forecasts in the sample. In a given quarter, 47% of the analysts in the sample work

for big brokerage houses. The typical company covered by a big brokerage house has a

bigger market capitalization ($11.6 million) than those covered by a smaller brokerage

house ($7.3 million).

2

I focus on recent data to avoid the issue of selective ex-post deletion of inaccurate forecasts docu-

mented by (Ljungqvist et al., 2009). As evidenced by the reaction of Thomson Financial, which issued

in 2007 a confidential guidance to select clients regarding the integrity of its I/B/E/S historical detail

recommendations database, the publication of this influential paper has disciplined the Thomson to

produce more reliable data since then.

10

3.4

Analysts

The data contain the quarterly EPS forecasts of 4,262 sell-side analysts (Table A5). On

average, the Experience of the analyst, measured as the number of years passed since

she has entered the database, is 7 years. Her average Tenure, measured by the time she

has spent working for the same brokerage house, is close to 3.5 years. I use the term

Stock Experience to refer to the number of years the analyst has covered a specific stock.

The typical forecaster has a stock-specific experience of nearly 4 years. I measure the

industry-specific experience, referred to as Industry Experience, as the number of years

the analyst has covered the industry. The typical analyst has followed the same industry

for almost 5 years. Roughly half of the analysts are classified as high status, as explained

in Section 3.3. During a given quarter, the typical forecaster covers 11 stocks distributed

over 5 industries. In the following, I will use the term Stock Workload to refer to the

number of stocks that an analyst covers during a quarter and Industry Workload to refer

to the number of industries that the analyst covers.

3.5

Stocks

Table A4 summarizes the key statistics for stock coverage, market capitalization, return

volatility, number of recommendations, and dispersion of the recommendations. The average firm in the sample has a market capitalization of $5.8 million and is covered by 8

analysts. Bigger companies are covered by more analysts: those above the 90th percentile

of the market capitalization distribution are covered by an average of 17 analysts. To

measure the level of interest investors attribute to different companies, I collect the number of recommendations issued by analysts on each stock (# of Recommendations). The

recommendations are translated by I/B/E/S into a five-point scale from 1 (= strong buy)

to 5 (= strong sell). I compute the standard deviation of the recommendations received

by each stock (Recommendation Dispersion) to measure the degree of disagreement between analysts about the future earnings of the companies. For each stock-quarter pair,

I define the variable Volatility as the average daily variance of the stock returns over the

year that ends at the beginning of the quarter.

11

3.6

Forecast Timing

34 days

1. First day

57 days

2. EPS

of fiscal quarter pre-announcement

3. Analyst’s

4. Last day of

forecasts

fiscal quarter

Forecasting Period

Figure 1: Fiscal Quarter

Table A6 presents the descriptive statistics for the forecast delays. A fiscal quarter

lasts 91 days. The realization of the EPS marks the end of the forecasting period and is

announced with an average delay of about 34 days. For each company, the variable EPS

Report Delay measures the average report delay of the EPS over the period 1984-2010. I

use this variable to capture the commitment of each company to transparent and efficient

financial reporting. Since analysts usually wait for the report of the EPS of the previous

quarter – the EPS pre-announcement – to issue their forecasts, I define the forecasting

period as the time span between the date of the EPS pre-announcement and the end of

the fiscal quarter.

Following the announcement of the EPS pre-announcement, the average analyst waits

5 days before issuing her forecast. Half of the forecasts are issued within 1 day after the

announcement of the previous quarters’ EPS but 10% of the forecasts are issued more

than 13 days after this date.

Analysts seldom revise their forecasts. In 84% of the cases, the analyst issues a unique

forecast that she never revises during the forecast period. When the analyst does decide

to revise her forecast, she does so only once in more than 85% of the cases.

4

4.1

Reduced-Form Evidence

Forecast Delay

In this section, I explore the relationship between competition and forecast delay. I

use the stock coverage which is the number of analysts who cover the stock during a

12

given quarter as a measure of competition. I show that, after controlling for stock and

analyst characteristics, analysts issue their forecasts earlier on stocks which receive larger

coverage. The empirical result that analysts react to tougher competition by timing their

forecasts earlier supports the conjecture that competition creates preemption incentives.

Figure 9 plots the relationship between forecast delay and stock coverage.

In order to identify the determinants of forecast delay, I estimate a continuous time

proportional Cox model to fit the hazard rate that a forecast is issued at a given day

during the forecasting period3 . I denote by λt,i,s,q,y the hazard rate that the forecast on

stock s in quarter q of year y is issued at time t by analyst i. I allow the hazard rate to

depend on analyst characteristics, Wi,s,q,y , and stock characteristics, Zs,q,y :

λt,i,s,q,y = λ0 (t) exp(βj + βq + βy + β0 Coverage + βW Wi,s,q,y , βW + βZ Zs,q,y )

(4.1)

The vector of analyst characteristics, W , contains the various measures of the analyst’s

experience, the status of the analyst, and her workload. The vector of stock characteristics, Z, includes the market capitalization, the volatility of past returns, the EPS report

delay, the number of recommendations, and the dispersion in recommendations. I add

quarter dummies, βq , to account for the fact that estimates for the last quarter of the year

are likely to be followed more closely by investors. I add industry dummies βj , to capture

the difference in forecast delays between industries perceived as more or less attractive

to investors. I also include year dummies, βy . λ0 (t) is the baseline hazard function.

Results

Table 1 displays the results of the cox proportional hazard regression. Table A1 shows

the predicted CDF of the forecast delay and the shifts in the predicted CDF induced by

an increase of one standard deviation of the various explanatory variables. The model

predicts that the typical analyst issues her forecast by the end of the first day of the

forecasting period with a probability of 62%. By the end of the first month following

the EPS pre-announcement, the typical analyst has issued her forecast with a predicted

probability of 92%. The most interesting result concerns the impact of coverage on

forecast delay: the model predicts that increasing the stock coverage by one standard

deviation (7 analysts) increases the probability that each analyst discloses her forecast

3

The choice of a continuous-time model is motivated by the high frequency of the forecast data.

13

by the end of the first day following the EPS pre-announcement by 3.3%.

The total and the stock specific experiences, the status of the analyst, as well as the

two measures of workloads have significant impacts on forecast delays. Analysts who

have followed a stock for a longer period as well as analysts working for bigger brokerage

houses issue their forecasts earlier. An analyst with a stock experience one standard

deviation larger than the average is 2.8% more likely to issue her forecast by the end of

the first day of the forecasting period and a high status analyst is 2.8% more likely to

issue her forecast on the first day than her low status counterpart. More surprisingly,

analysts with longer total experience issue their forecasts later. However the magnitude

of this effect is small: a one standard deviation increase in the total experience translates

into a modest .01% decrease in the probability of a first day forecast. Analysts who follow

more stocks and more industries during the quarter disclose their forecasts earlier. This

can reflect the fact that more competent analysts are assigned more stocks to cover.

Stocks issued by companies with larger market capitalization, stocks that receive more

recommendations, and stocks for which analysts issue less divergent recommendations

receive later earning forecasts. All those characteristics correlate with less uncertainty

regarding the realization of the future EPS. Their estimated negative impacts on timeliness is consistent with the idea that analysts maximize the value of their forecasts for

investors by prioritizing stocks for which public information is scarce.

4.2

Forecast Accuracy

In this section, I investigate how competition affects forecast accuracy. More specifically,

I assess the extent to which the analyst learns from the information disclosed in previously

issued forecasts by estimating the impact of the order of the forecast on its precision. I

also evaluate how competitive pressure affects the quality of the information produced

by analysts, beyond what analysts can learn from observing the disclosed forecasts of

their opponents, by estimating the impact of stock coverage on forecast accuracy after

controlling for forecast order.

I measure forecast accuracy by using the inverse of the absolute forecast errors. As

shown in table A2, forecasts are positively biased. This finding is consistent with the rich

14

Table 1: Determinants of Forecast Delay

Dependent Variable: Hazard rate of forecast release

a

Coef.

Std. Err.

Experience

-.0020∗∗∗

.0006

.0005

Stock Experience

.0127∗∗∗

.0008

.0000

Industry Experience

-.0001

.0008

.9147

High Status Analysts

.0508∗∗∗

.0049

.0000

Stock Workload

.0108∗∗∗

.0007

.0000

Industry Workload

.0054∗∗∗

.0014

.0002

Market Capitalization

-.0007∗∗∗

.0002

.0003

Volatility

3.844

2.432

.1140

EPS Report Delay

.0044∗∗∗

.0004

.0000

# of Recommendations

-.0054∗∗∗

.0006

.0000

Recommendation Dispersion

.0244∗∗∗

.0092

.0082

Coverage

.0048∗∗∗

.0007

5.18e-11

Quarter Fixed Effects

Yes

Year Fixed Effects

Yes

Industry Fixed Effects

Yes

Nbr of Obs

201,843

∗

p < .1,

a

∗∗

p < .05,

∗∗∗

p < .01

clustered at stock level

15

P. Value

literature on earning forecasts’ bias which documents that analysts issue overly optimistic

forecasts partly because of self-selection (McNichols and O’Brien, 1997) – analysts are

more likely to cover stocks they are enthusiastic about – and partly because of incentives

to please managers (Francis and Philbrick, 1993), to secure equity underwriting deals

(Lin and McNichols, 1998), and to generate trading commissions. Since I want to uncover

the determinants of the precision of the information produced by analysts and not the

determinants of their biases, I use centered forecast errors to measure accuracy. To do

so, I estimate the determinants of the bias and I subtract the predicted bias from the

forecast error for every stock-analyst pair. Table A2 shows the summary statistics for

the uncentered and centered absolute forecast errors.

The average centered absolute forecast error is about .11, while the median forecast

error is much smaller, .048, which reflects the fact that the distribution of forecast error is

very skewed to the right. Figure 10 shows the relation between forecast error and forecast

delay broken down by order. For given forecast delays, forecasts released first are noisier

than forecasts released by following analysts.

I use the following model to the estimate the effect of coverage, order, and forecast

delay on the absolute forecast error of analyst i, on stock s, issued in quarter q of year y:

F Ei,s,q,y = αj +αq +αy +α1 Coverage+α2 Order Index+α3 Delay+αW Wi,s,q,y +αZ Zs,q,y +i,s,q,y

(4.2)

Where: αj is the industry fixed effect; αq is the quarter fixed effect; αy is the year

fixed effect; W is the vector of analyst characteristics; and Z is the vector of stock

characteristics. Delay is the number of days after the EPS pre-announcement.

The variable Order Index is constructed in the following way. I sort the analysts who

cover a given stock by forecasting time from the earliest analyst to the latest one4 . The

rank tends to be lower on stocks covered by less analysts creating a downward bias for

the estimate of the effect of forecast order for stocks covered by few analysts. In order

to construct a measure of forecast order that is robust to variation in stock coverage, I

divide the rank by the total number of forecasts issued on the stock, using the following

formula:

4

When more than one forecast are issued at the same time, I assign them the same rank

16

Order Indexi,s,q,y = 100

Ranki,s,q,y − 1

Coverages,q,y − 1

Results

Results are displayed in Table 2. I find that the order of the forecast has a positive

impact on forecast accuracy: an increase of the magnitude of one standard deviation (=

30) in the order index decreases the forecast error by .004 which is about 4% of the mean

absolute forecast error. This constitutes empirical evidence that analysts do incorporate

in their forecasts the information disclosed through previously issued forecasts. However,

after controlling for the order, the forecast delay itself has no significant effect on the

precision of the forecasts. Since the timing of the forecast is endogenous, it is difficult

to interpret this result. The insignificant impact of forecast delay may suggest that

the amount of exogenous information that analysts receive over the forecasting period

is modest. Alternatively, it may reflect the fact that analysts who receive more precise

private information at the beginning of the forecasting period issue their forecasts earlier.

I find that the impact of coverage on forecast accuracy is negative: each additional analyst

covering the stock increases the absolute forecast error by a quantity corresponding to

1.3% of the mean absolute forecast error. This result is consistent with the idea that

competition produces accuracy loss, possibly through suboptimal timing.

Among analyst characteristics, only the status of the analyst has a significant effect

on the accuracy of the forecast. As intuition suggests, analysts who hold prestigious

positions in big brokerage houses deliver more accurate forecasts.

Among stock characteristics, the volatility of stock returns and the market capitalization are found to increase forecast errors. This means that earnings are harder to predict

for highly volatile stocks and for stocks issued by bigger companies. Analysts are found

to issue more accurate forecasts for the earnings of companies that report their EPS later,

confirming the earlier conjecture that companies that disclose their EPS late have less

volatile earnings.

17

Table 2: Determinants of Forecast Accuracy

Dependent Variable: Centered Absolute Forecast Error (×103 )

a

Coef.

Std. Err.

Experience

.066

.182

.716

Stock Experience

.006

.152

.970

Industry Experience

-.053

.182

.770

High Status

-1.575∗∗

.666

.018

Stock Workload

-.017

.152

.910

Industry Workload

.124

263.637

.637

Share of High Status Analysts

1.956

12.267

.873

Market Capitalization

.249∗

.136

.066

Returns Volatility

38.028∗∗∗

6.707

.000

EPS Report Delay

-.865∗∗

.398

.030

# of Recommendations

-.364

.384

.343

Recommendation Dispersion

9.851

9.082

.278

Order Index

-.162∗∗∗

.030

.000

Coverage

1.601∗∗

.659

.015

Delay

.131

.088

.134

Intercept

115.951∗∗∗

38.963

.003

Quarter Fixed Effects

Yes

Year Fixed Effects

Yes

Industry Fixed Effects

Yes

Nbr of Obs

286,469

∗

P. Value

p < .1, ∗∗ p < .05, ∗∗∗ p < .01

Note: The variable Share of High Status Analysts measures the percentage of high status analysts who cover the stock.

a

clustered at stock level

18

4.3

Discussion

The reduced form approach provides evidence that coverage correlates negatively with

forecast delay and forecast accuracy. Both findings suggest that competition might create preemptive incentives. However this reduced-form approach does not permit to make

causal inferences. Since analysts have discretion to choose which stocks they follow, the

negative correlation between coverage and accuracy may reflect the fact that analysts

are more likely to cover companies which provide less public information on their future earnings. This selection pattern would be consistent with analysts maximizing the

market value of their private information. Similarly the relationship between coverage

and forecast delay may merely reflect the fact that analysts prefer to cover companies

that release public information earlier during the fiscal quarter. Moreover, this approach

does not allow to identify what share of the accuracy loss can be imputed to less precise

exogenous public information at the time of the forecasts’ releases and to less precise

private information contained in the forecasts.

In order to quantify the distortion in timing and accuracy caused by preemption, I

build a structural approach that uses the equilibrium conditions of a timing game that I

present in section 5 to recover the parameters that govern the public learning as well as

the accuracy of the analysts’ private information.

5

5.1

Model

Setup

Consider a stock covered by n analysts in a continuous time framework. Each analyst

has to issue her forecast of the future realization of the EPS, x, at some time, t, during

the forecasting period, [0, T ]. The EPS, Π, is a random variable which follows a common

knowledge distribution N (µ0 , σ0 ). At the end of the forecasting period, the company

reports the realization of its EPS, π.

19

5.2

5.2.1

Information Structure

Exogenous Public Information

During the forecasting period, investors and analysts receive some exogenous public information on the company’s future earnings. This information can take the form of reports

of disclosures of accounting information, or announcements of any events that affect the

future performance of the company such as a merger, a technological breakthrough made

by the company, the appointment of a new CEO, or the results of clinical trials for a

pharmaceutical firm. Over time, the market receives a continuous stream of exogenous

public signals so that the precision of the exogenous public information, denoted f˜(t), increases in a differentiable manner: for all t1 < t2 , f˜(t1 ) < f˜(t2 ). Formally, the cumulative

exogenous public signal at instant t is represented by:

st = π + t

with t ∼ N (0,

1

)

f˜(t)

In practice analysts never wait until the last day of the forecasting period to issue their

forecasts. To guarantee that the model predicts realistic outcomes, I assume that the

precision of the exogenous public signal becomes arbitrarily large at the end of the forecasting period which suppresses all incentives for analysts to issue their forecasts at the

very end of the fiscal quarter.

lim f˜(t) = +∞

t→T

5.2.2

Private Information

At the beginning of the forecasting period, analyst i receives a private signal whose

precision is determined by her initial ability, αi . As time progresses, the accuracy of the

analyst’s private information increases as she builds on publicly released information to

refine her forecast. At instant t, the cumulative private signal of analyst i is represented

by:

sit = π + i

with it ∼ N (0,

1

) and yt = f (t)

f i (yt )

it is independent of the realization of the EPS, π. Moreover, analysts receive conditionally

independent signals: for all i 6= j, it ⊥ jt . The function f i (yt ) captures the precision

of the private information that analyst i has accumulated when the precision of the

20

public information (f (t)) reaches yt . f (t) corresponds to the sum of the precision of the

exogenous public information, f˜(t), and the precision of the private information disclosed

through the forecasts issued by t. Formally:

X

f (t) = f˜(t)+

f i (f (ti )) where ti denotes the time at which analyst i issues her forecast

i | ti <t

I use the following functional form for f i ():

f i (yt ) = αi + β i log(yt ) with yt = f (t)

β i captures the learning ability of the analyst. Positive values of β reflect the fact

that professional analysts are able to draw predictions from the public information that

are more precise than the investors’ beliefs about the future realization of the earning. I

assume that the marginal cost of converting public information into additional private is

increasing, which translates into a concave relationship between private and public precision. This assumption captures the fact that when there is little remaining uncertainty

about the future earning, the analyst finds it more difficult to improve on the public

signal5 .

5.3

Forecast

Analyst i issues a forecast equals to her posterior after observing the public signal st and

her private signal sit :

xit = wti sit + (1 − wti ) st

(5.1)

The weight, wti , that she allocates to her private signal is an increasing function of the

relative precision of her private information:

wti =

5.4

1/f (t)

1/f (t) + 1/f i (yt )

and yt = f (t)

Analyst Payoff

Guttman (2010) shows that when the analyst sells her forecasts to a single investor

6

before disclosing it publicly, her payoff is an increasing function of the precision of her

5

6

The computing power needed to process big data might be prohibitively large

which can be regarded as represented a group of investors not large enough for their trading decisions

to affect the price of the stock

21

private information relative to the public information:

U i (t) = log(

f i (t) + f (t)

)

f (t)

(5.2)

This result hinges on the following assumptions. The initial and the learning abilities

of the analyst are common knowledge. The market contains a continuum of investors

with a CARA utility function. Each investor decides how to allocate her initial wealth

between a safe asset with zero returns and a risky asset which corresponds to the stock of

the firm. Each investor is small enough that her trade does not affect the market price.

The supply of the stock is exogenous and constant. The willingness-to-pay for observing

the analyst’s forecast ahead of the market corresponds to the amount that equalizes her

expected utility if she remains uninformed to her expected utility if she acquires the

analyst’s information. The extra profit that the investor can make by using the forecast

of the analyst is determined by the relative informational content of the forecast. Since

the analyst is a monopolist on her private information, she extracts the entire the surplus

of her client.

5.5

5.5.1

Equilibrium Timing

Single-Analyst Case

The analyst issues her forecast at the time t that maximizes the relative precision of her

forecast. Since f (.) is invertible, for the analyst, choosing the optimal time is equivalent

to choosing the optimal precision of the public information at which to issue her forecast.

From now on, I refer to the precision of the public signal at which the analyst chooses to

issue her forecast when she is the only analyst who covers the stock as her unconstrained

optimum which I denote by yuc . yuc is such that:

i

yuc

= arg max U i (y) with U i (y) = log(

y≥0

f i (y) + y

)

y

It follows that:

i

= max{0, exp(1 −

yuc

22

αi

)}

βi

(5.3)

Since the payoff function is single-peaked, the unconstrained optimum is always

unique. Figure 2 shows the precision of the public signal at which the analyst chooses to

issue her forecast in the single-analyst case.

U

1

yuc

f (t)

Figure 2: Unconstrained Optimum

5.5.2

Two-Analyst Case

When an analyst issues her forecast, the precision of the public signal increases in a

discrete way. The size of the jump corresponds to the precision of her private signal. At

time t, the precision of the public information, denoted f (t), corresponds to the sum of

the precision of the exogenous public information and the informational content of the

forecasts – i.e. the precision of the private information of the analyst at the time she

issues her forecast – issued by t. Formally:

f (t) = f˜(t) +

X

f i [f (ti )]

i=1,2|ti ≤t

By increasing the precision of the public signal through her forecast, the analyst reduces the informational value of her opponent’s signal. The dependence of one analyst’s

payoff on the timing of the other analyst’s forecast generates a strategic interaction between competing analysts.

Intuitively, when analysts differ enough in terms of initial and learning abilities, each of

them forecasts at her unconstrained optimum. However, when analysts are more similar,

23

their unconstrained optima are also similar. In this case, they engage in a preemption

race and cluster their forecasts in time.

To see this, assume that the unconstrained optimal timings of analysts 1 and 2 are t1 <

1

2

1

2

1

).

| < f 1 (yuc

− yuc

such that |yuc

< yuc

t2 , with corresponding optimal public precisions yuc

1

If analyst 1 forecasts at t1 the public precision increases by a quantity f 1 (yuc

). It follows

that analyst 2 cannot reach her unconstrained optimal payoff by forecasting after analyst

1

1

1

2

1

1

)], analyst 2 finds it profitable to

+ f 1 (yuc

) > U 2 [yuc

. If U 2 (yuc

) > yuc

+ f 1 (yuc

1 since yuc

preempt analyst 1 by forecasting right before t1 . In turn, analyst 1 prefers to forecast right

before analyst 2 as long as t is such that U 1 (f˜(t)) > U 1 {f˜(t) + f 2 [f˜(t)]}. Both analysts

preempt each other until the precision of the public signal is such that one analyst becomes

indifferent between undercutting her opponent and forecasting immediately after her.

In the following, I present a more formal argument. First, it is useful to introduce the

concept of indifference interval. Denote J ≡ f 2 [f (τ1 )] the precision of the private signal

of analyst 2 when the public signal reaches a precision equal to f (τ1 ). Assume that J

is such that analyst 1 is indifferent between forecasting when the precision of the public

signal is f (τ1 ) and forecasting when the precision is f (τ1 ) + J:

f (τ1 ) is such that U 1 [f (τ1 )] = U 1 [f (τ1 ) + J]

(5.4)

If 5.4 holds, analyst 1 is said to admit an indifference interval of lower end f (τ1 ) and

length J. Since U 1 (.) is single-peaked and f 2 (.) is increasing, the indifference interval is

unique. The indifference interval exists as long as, at the beginning of the forecasting

period, analyst 1 is better off by forecasting immediately after analyst 2 rather than

forecasting first:

U 1 [f (0)] < U 1 {f (0) + f 2 [f (0)]}

(5.5)

Figure 3 shows an example of indifference interval.

Using the concept of subgame perfect equilibrium, Guttman (2010) shows that the

equilibrium timing is the following:

• At the very beginning of the forecasting period, if both analysts are better off

24

U

J ≡ f 2 (f (τ1 ))

f (τ1 )

f (t)

f (τ1 ) + J

Figure 3: Indifference Interval

issuing their forecasts immediately rather than waiting for their opponent to issue

her forecast and quickly follow suit, then both analysts forecast at time 0. Formally,

if U i [f (0)] ≥ U i {f (0) + f −i [f (0)]} for all i ∈ {1, 2}, then t1 = t2 = 0.

• If U i [f (0)] < U i {f (0) + f −i [f (0)]} for analyst i and U −i [f (0)] ≥ U −i {f (0) +

f i [f (0)]}, analyst −i forecasts at time 0 and analyst i forecasts immediately afi

i

ter if f (0) + f −i [f (0)] > yuc

and forecasts at tiuc = f −1 (yuc

) otherwise.

• If U i [f (0)] < U i {f (0) + f −i [f (0)]} for both analysts, the analyst with the smallest

lower end of indifference interval (f (τi ) < f (τ−i )) forecasts first. She forecasts at a

time t = min{τ−i , tiuc }.

– If the first analyst forecasts at τ−i , her competitor forecasts immediately after.

– If the first analyst chooses her unconstrained optimal time tiuc , then her competitor also chooses his unconstrained optimal time whenever it is feasible i.e.

−i

i

i

whenever yuc

≥ yuc

+ f i (yuc

) otherwise he forecasts immediately after analyst

i.

When one analyst forecasts immediately after the other, the equilibrium is said to be

clustered in timing. Otherwise the equilibrium is said to be unclustered. In an unclustered

equilibrium, both analysts always issue their forecasts at their unconstrained optima.

Figure 4 shows an example of unclustered equilibrium where analyst 1 (blue) forecasts

25

1

2

first at yuc

while analyst 2 (red) forecasts second at yuc

. Figure 5 shows an example of

clustered equilibrium where analyst 1 (blue) forecasts first at f (τ2 ) and analyst 2 (red)

forecasts immediately after the first analyst.

U

1

)

f 1 (yuc

1

yuc

2

yuc

f (t)

Figure 4: Two Analysts, Unclustered Equilibrium

U

f 1 [f (τ2 )]

f (t)

1

2

f (τ2 ) yuc

yuc

Figure 5: Two Analysts, Clustered Equilibrium

5.5.3

n-Analyst Case

When more than two analysts compete, it is no longer possible to derive a closed-form

solution for the equilibrium and the game generally admits multiple equilibria. Depending

on the degree of heterogeneity in analysts’ abilities, the game can present a non-clustering

equilibrium pattern, a combination of clusters of several forecasts separated in time with

26

other clusters of forecasts or with single non-clustered forecasts, or a fully clustered

pattern in which all forecasts are issued at the same time. In the following, I present the

algorithm that I use to find the equilibria of the game for an arbitrary number n (n > 2)

of analysts.

The precision of public signal increases exogenously over time as well as endogenously

after each forecast. At any instant t, the precision of the public signal depends on the

history of forecasts issued before t. I denote by ti the timing chosen by analyst i. The

precision of the public signal at t is:

X

f (t) = f˜(t) +

f i (f (ti ))

i | ti <t

I introduce the concept of a k-degree indifference interval with respect to an ordered

sequence of forecasts by k analysts. I denote by τSi k the lower end of a k-degree interval

for analyst i with respect to the ordered sequence of forecasts Sk = {s1 , s2 , ..., sk }, where

sk is the identity of the analyst who is the k th to forecast in the sequence. The jump

in precision after the sequence of forecasts Sk corresponds to the sum of the precisions

of the private signals disclosed in the successive forecasts. I define the upper end of the

indifference interval, denoted τ iSk , as follows:

τ iSk

=

k

X

f sl (f sl−1 (τSi k )) with f s0 (τSi k ) = f˜(τSi k )

l=1

τSi k

is such that analyst i is indifferent between being the first to forecast in τSi k and

forecasting right after the sequence of forecasts described in Sk .

τSi k

is such that U i (f (τSi k )) = U i (f (τSi k ) + τSi k )

To find the set of subgame perfect equilibria of the game, I consider all possible orders

of moves (= n!). For a given order of moves M = {m1 , m2 , ..., mn } where mk is the identity

of the analyst who is the k th to forecast, I derive a timing profile σ̃ = (y m1 , ..., y mn ) such

that no analyst would find it profitable to forecast before her prescribed timing. This

timing profile is such that analysts issue their forecasts no later than when the precision

of the public signal reaches the lower ends of the indifference intervals of the following

analysts.

27

After analyst mn−1 forecasts in y mn−1 , the last analyst, mn , chooses to forecast at the

public precision y mn such that:

mn

, y mn−1 + f mn−1 (y mn−1 )}

y mn = min{yuc

For any integer k such that 1 ≤ k < n, after the forecast of analyst mk−1 in y mk−1 ,

analyst mk chooses the public precision y mk such that:

mk

mk

= {mk , mk+1 , ..., ml }

, {f (τSmml k )}nl=k+1 } with Sm

y mk = min{yuc

l

ml

The timing profile σ̃ constitutes a subgame perfect equilibrium if there is no profitable

right-deviation. A right-deviation for analyst mk consists in forecasting after y mk . When

the timing profile commands that analyst mk forecasts at or after her unconstrained opmk

, she cannot find it profitable to delay her forecast. When the timing

timal timing yuc

profile commands that she forecasts before her unconstrained optimum, she has no incentives to delay her forecast if and only if she cannot gain by forecasting immediately

after tmk = f −1 (y mk ) when other analysts follow the timing strategies prescribed by σ̃.

When y mk = τSmml k , there is no profitable right-deviation for analyst mK , whenever:

ml

U mk (y mk ) ≥ U mk (y mk + τ mml k+1 )

Sml

The off-equilibrium beliefs and the corresponding strategies off the equilibrium path

are the following: If analyst mk has not issued her forecast when the precision of the

public signal reaches y > y mk , her competitors who have not yet issued their forecasts

believe that she is going to forecast immediately. As long as y + f mk (y) < y mk+1 , analyst

mk+1 waits until the precision of the public information approaches y mk+1 . As soon as

y + f mk (y) ≥ y mk+1 , analyst mk+1 responds by forecasting immediately and following

analysts ({ml }nl=k+2 ) quickly follow suit by forecasting in the order prescribed by the

equilibrium strategy. If analyst mn−1 issues her forecast at a precision of the public

mn

signal y < y mn−1 analyst mn issues her forecast in max{yuc

, y + f mn−1 (y)}. For all

k 6= n − 1, if analyst mk deviates by issuing her forecast before her prescribed timing,

the precision of the public signal at which her competitors issue their forecasts is left

unaffected.

28

6

Estimation: Description and Identification

6.1

Notation

A period refers to a given quarter in a given year. I observe S stocks and N analysts.

I use the subscript s ∈ {1, .., S} for all variables that differ across period-stock pairs,

the subscript i ∈ {1, ..., N } for variables that differ across analysts, and the subscript

q ∈ {1, ..., Q} to index variables that differ across periods. The variable ns,q denotes the

number of analysts who cover the stock s in period q. For each stock, s, Qs is the number

of quarters for which I observe at least one forecast. T corresponds to the time span

between the beginning and the end of the forecasting period. ti,s,q denotes the time at

which analyst i issues her forecast on stock s at period q. If the forecast is issued during

a time cluster, I index the forecasting time by c (= tci,s,q ), otherwise the forecast receives

the index uc (= tuc

i,s,q ).

6.2

Specification

Precision of the Public Signal

I impose the following functional form on the precision of the exogenous public signal:

1

1

t

+Γ

f˜s,q (t) = +

κ exp(σ0 )

T −t

I accommodate stock heterogeneity by allowing the parameters σ0 , which corresponds to

the variance of the EPS, and Γ, which captures the arrival rate of exogenous public information, to vary across stocks. Specifically, I allow σ0 to be stock and period specific and

I parametrize Γ as an exponential function of Zs,q . Choosing an exponential formulation

guarantees that the predicted precision of exogenous public information takes on positive

values.

0

Γ(Zs,q ; γ) = exp(Zs,q γ)

∈ [0, +∞)

Precision of the Private Signal

f i (yi,s,q ) = α(Wi,s,q ; δ) + β(Wi,s,q ; η) log(κ yi,s,q )

29

I allow the precision of the private signal to be analyst and stock specific by using the

following functional forms for α and β:

0

α(Wi,s,q ; δ) = exp(Wi,s,q δ)

0

β(Wi,s,q ; η) = exp(Wi,s,q η)

∈ [0, +∞)

∈ [0, +∞)

Moreover, I introduce the scaling parameter, κ, to allow the model to fit forecast

errors of a wider range of magnitudes. The optimal unconstrained public precision at

which the analyst issues her forecast becomes:

i,s,q

yuc

=

6.3

α(Wi,s,q ; δ)

1

exp(1 −

)

κ

β(Wi,s,q ; η)

Identification

I aim to recover the parameters that govern the public learning (Γ), which I define as the

precision of public information that the market would accumulate over time in the absence

of financial analysts, the initial precision of the exogenous public information (σ0 ), and

the analysts’ initial (α) and learning (β) abilities using data on EPS realizations (π), EPS

forecasts (x), and forecast timing t.

The intuition behind the identification of the parameters of the model is the following:

The accuracy of both the public signal and the private signal received by the analyst at

the time she issues her forecast jointly determine the magnitude of her forecast error. The

public learning does not affect the equilibrium precision of public information at which

analysts issue their forecasts but it affects the calendar time of the forecasts releases: the

model predicts that analysts issue their forecasts earlier when they cover companies that

release more precise exogenous information about their performances so that the uncertainty surrounding their future earnings is resolved faster. It follows that the variation

across stocks in the calendar time of the forecast releases identifies the parameters that

govern the precision of the exogenous public information (f˜). Since I observe a time

series of EPS for each stock, I can infer the initial precision of the public signal from

30

the empirical variance of the EPS. Once σ0 is recovered, the public learning, Γ, can be

obtained by inverting f˜.

For a given precision of exogenous public information, the precision of the analyst’s

private information can be recovered from the accuracy of her forecast. In turn, the

precision of the private information of the analyst depends on both the precision of her

initial signal, α, and her learning ability, β. I use the variation across analysts in forecast

release time to separately identify the two dimensions of analysts’ abilities. To see this,

notice that, even though the timing game admits multiple equilibria, a common feature

of all the equilibria of the game is that analysts who issue unclustered forecasts always

do so when the precision of the public signal reaches their unconstrained optima. From

the optimality condition 5.3, I can derive a one-to-one relationship between the precision

of the public information at the time of the forecast and the two dimensions of analysts’

abilities, α and β.

6.4

Estimation Algorithm

I use the time series of EPS realizations for each stock to compute the nonparametric

estimate of the variance of the EPS for stock s in period q, σ̂0s,q , which corresponds to

the empirical counterpart of σ0s,q .

Pq

σ̂0s,q

=

q 0 =0

(πs,q0 − π̄s,q )2

nq

The starting period 0 corresponds to the first quarter of 1984, the first year for which

EPS data are available in the I/B/E/S database. π̄s,q is the empirical mean of the EPS

of stock s computed over the period ranging from 0 to q. nq is the number of quarters

from 0 to q.

Let δ0 be the initial guess of values of the vector of parameters δ of the initial ability,

α. Given δ0 , the algorithm generates a sequence of estimates of {θk = (ηk , γk ) : k ≥ 1}

where the k-stage estimates correspond to the values of θ that maximize the likelihood

of observing the vector of forecast values, x, and forecast times, t, given the realization

of the EPS π:

31

θk = arg max L(x | t , π; θk , δk−1 )

(6.1)

θ

L(x | t, π; θk , δk−1 ) =

Qs ns,q

S Y

Y

Y

s=1 q=1 i=1

1

p

φ[(xi,s,q − πs,q )/σ(ti,s,q | θk , δk−1 )]

σ(ti,s,q | θk , δk−1 )

with

σ(ti,s,q | θk , δk−1 ) =

1

fθk (ti,s,q ) + fθik (yi,s,q )

with yi,s,q = fθk (ti,s,q )

and

fθk (ti,s,q ) =

1

1

ti,s,q

+ s + Γ(Zq,s |γk )

+

κ σ̂0

Ts,q − ti,s,q

X

fθlk (fθk (tl ))

l | tl <ti,s,q

fθik (yi,s,q ) = α(Wi,s,q ; δk−1 ) + β(Wi,s,q ; ηk ) log(κyi,s,q )

The parameters {δk : k ≥ 1} are obtained recursively as:

δk = ψ(tuc ; θk )

(6.2)

ψ(.) is derived from the optimality condition 5.3:

ψ(tuc ; θk ) = arg min

δ

X

−1

[tuc

i,s,q − fθk (

tuc

1

exp(1 − α(Wi,s,q ; δ)/β(Wi,s,q ; ηk ))]2

κ

The two steps, 6.1 and 6.2, are repeated until the algorithm reaches convergence.

Formally the stopping criterium is: |δk − δk−1 | < , with very small (.0001).

The estimator ϑ̂ ≡ (θ̂, δ̂) is consistent. Its asymptotic distribution is:

√

M (ϑ̂ − ϑ0 ) ∼ N (0, Avar(ϑ̂))

Where

M=

Qs ns,q

S Y

Y

Y

ms,q,i

s=1 q=1 i=1

With asymptotic variance:

M

1 X

Avar(ϑ̂) =

M m=1

Where

∂g(xm , πm ; ϑ̂)

ϑ0

!−1

M

1 X

g(xm , πm ; ϑ̂)g(xm , πm ; ϑ̂)0

M m=1

ψ(tuc

m ; θ̂)

!

M

1 X ∂g(xm , πm ; ϑ̂)

M m=1

ϑ0

g(xm , πm ; ϑ̂) =

L(xm | πm ; θ̂, δ̂)

50

For implementation, I bootstrap the data 50 times to get {θ̂b }50

b=1 , {δ̂b }b=1 , and

{σ̂0,b }50

b=1 , and I calculate their standard errors.

32

!−1

6.5

Data Selection and Scaling

The model assumes that analysts issue a unique forecast during the fiscal quarter. This

assumption is consistent with the empirical observation that analysts who issue quarterly

earning forecasts seldom revise their forecasts (84% of the observed forecasts are never

revised). I estimate the parameters of the model on a selected subsample of the data that

excludes stocks for which at least one analyst has revised her forecast.

After all exclusions, the data contain 70,770 forecasts issued by 3,430 analysts on

2,224 stocks. Table A8 summarizes the characteristics of the stocks and the analysts

that compose the subsample used for the structural estimation. In the structural sample,

stocks are issued by smaller companies (the average market capitalization is 2.2 in the

subsample compared with 5.7 in the full sample), they consequently receive less recommendations (6 versus 7 on average) and are covered by fewer analysts (6 versus 8 on

average). The selected sample also features analysts who tend to be less experienced,

to cover less stocks and to be slightly less likely to work for big brokerage houses. For

numerical reasons7 , I exclude very late forecasts, i.e. forecasts issued less than two weeks

before the end of the quarter, which represent less than 1% of the sample.

The variance of the centered forecast errors is 0.0149 which corresponds to an average

precision of the forecast equal to 67. To achieve better numerical performance, I fix the

scale of the model, κ, to

1

20

in order to let the upper bound of range of the optimal

unconstrained public precision be close enough to the nonparametric estimate of the

variance.

The variable time, t, is continuous and corresponds to the number of minutes since the

date of the EPS pre-announcement. The length of the forecasting period, T , corresponds

to the number of minutes between the EPS pre-announcement and the end of the fiscal

quarter. Table 3 shows the summary statistics for both variables. I consider that the

analyst issues an unclustered forecast, if no other analyst issues a forecast during the day

of her forecast release. According to this definition, 33% of the observed forecasts are

unclustered.

7

For forecasts issued at the very end of the forecasting period, the ratio

t

T −t

which for scaling reasons affects the performance of the estimation algorithm.

33

takes very large values,

Table 3: Length of Forecasting Period and Forecast Delay (structural sample)

Variable

Obs

Mean

Std. Dev.

P25

P50

P75

P90

P95

Length of the forecasting period (in days)

70,770

56.824

11.783

53

59

65

69

71

# days since EPS pre-announcement

70,770

2.159

4.073

1

1

2

5

9

7

Results

7.1

Precision of initial belief on EPS

At the beginning of the forecasting period, analysts and investors share common beliefs

about the future realization of the EPS. Their common best initial prediction of the EPS

corresponds to the historical mean of the company earnings. The precision of their initial

belief is determined by the historical variance of the EPS. Table A9 shows the summary

statistics for the estimates of the variance of the EPS, σ̂0s,q .

As shown in Table 4, the variance of the EPS is smaller for bigger companies, probably

because bigger companies are more likely to be long-established with profits that vary

less over time than those of younger companies. The variance is also smaller for stocks

that receive more recommendations, which seems to indicate that analysts make safe bets

by recommending stocks of companies for which there is little uncertainty regarding the

future profitabilities. I also find that companies that report their EPS later in the fiscal

quarter have earnings that are more stable over time; those companies might choose to

report late precisely because investors can infer their EPS before the official report with

a high level of accuracy. As expected, the volatility of the stock returns is positively

correlated with the volatility of the EPS.

7.2

Exogenous Public Information

There are two sources of public information in the model. The first is purely exogenous:

over time the market learns about the future earning of the company. The exogenous

public information can take the form of the disclosure of sales revenues, the regulatory

approval of a drug for a pharmaceutical company, or a patent for an important tech34

Table 4: Determinants of EPS variance

Dependent Variable: σ̂0s,q

Variable

Coef.

Std. Err.

Market Capitalization

-.0329∗∗∗

.0117

Volatility (×103 )

.0746∗∗∗

.0089

EPS Report Delay

-.0103∗∗∗

.0010

# of Recommendations

-.0096∗∗∗

.0021

Recommendation Dispersion

.0111

.0372

Last Quarter

.0427

.0275

Time Trend

.0067

.0091

Intercept

.6680∗∗∗

.0554

Nbr of Obs

70,770

∗

p < .1,

a

∗∗

p < .05,

∗∗∗

a

p < .01

clustered at stock level

nological breakthrough. The second source of information is the disclosed forecasts of

analysts.

Table 5 shows the estimates of the parameters, γ, which measure the impacts of

various stock characteristics on the public learning. I find that exogenous information on

the future earnings of companies with highly volatile returns, large market capitalization,

companies which report their EPS late, as well as last quarter earnings exhibits a lower

arrival rate. This result is consistent with the reduced-form evidence presented earlier

showing that returns volatility and market capitalization are negatively associated with

forecast accuracy. Regarding the magnitude of the effects, a one-percent increase in

market capitalization decreases the arrival rate of exogenous information by .7%, and a

one-percent increase in returns volatility decreases the arrival rate by 1.4%. None of the

other potential determinants of the arrival rate of exogenous information appears to have

a significant effect on Γ.

From the estimated parameters γ̂, I derive the estimated value of the public learning,

0

Γ̂ = exp(Zs,q γ). The marginal effect of each passing minute on the precision of the

35

Table 5: Determinants of the public learning

Dependent Variable: Γ

Z

Raw Parameter: γ̂

Marginal Effect

Elasticity

(at mean)

(at mean)

SE

P Value

Market Capitalization (× 107 )

-1.8077

-380.3998

-0.6524

0.8872

0.0416

Volatility (× 103 )

-1.7051

-358.7915

-1.3159

0.4197

0.0000

EPS Report Delay

-0.0604

-12.7122

-1.9855

0.0339

0.0745

# of Recommendations

-0.0134

-2.8184

-0.1057

0.0266

0.6142

0.2500

52.6045

0.2119

0.2979

0.4013

-0.6609

-139.0815

0.2595

0.0109

Time Trend

0.0776

16.3350

0.0761

0.3075

Intercept

8.3137

0.8999

0.0000

Recommendation Variance

Last Fiscal Quarter

0.1358

exogenous information is given by:

f˜0 (t) = Γ

T

(T − t)2

Table A9 reports the summary statistics of Γ̂. At the median value of Γ̂, the precision

of the exogenous public information is estimated to increase by 2.5 from the first to the

second day of the forecasting period, and by 3.6 from the 10th to the 11th day of the

forecasting period. The arrival rate of exogenous information varies considerably across

stocks: from the first to the second day of the forecasting period, the precision of the

exogenous information on stocks in the 10th percentile of the distribution increases by