Application Architecture Overview www.castek.com Insure

advertisement

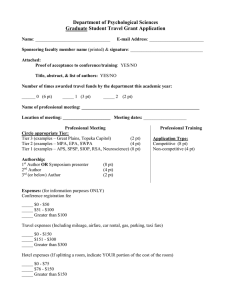

Application Architecture Overview Insure3 a Flexible Approach to Core Processing Systems for Property & Casualty Insurers www.castek.com Insure3 Claims – Application Architecture © Castek Software Inc. 2006. All rights reserved worldwide. This document contains information proprietary to Castek Software Inc. which shall not be disclosed to third parties nor reproduced in whole or in part for any purpose whatsoever, without the prior written permission of Castek Software Inc. © Castek Inc. 2003 ii Insure3 Claims – Application Architecture Table of Contents Introduction .................................................................................................................... 1 Architecture Tier Details.................................................................................................... 3 Presentation / Desktop Tier ..................................................................................... 4 User Services Tier .................................................................................................. 4 Business Services Tier ............................................................................................ 5 Enterprise Integration Tier ...................................................................................... 7 Data Services Tier ................................................................................................ 10 Supporting Technologies ................................................................................................. 11 iii Insure3 Claims – Application Architecture INTRODUCTION Insure3 Claims is a module in Castek’s Insure3 Suite of core business processing systems for Property & Casualty insurers. The functional scope of Insure3 Claims is to support insurers’ in performing the core business activities across the full claims lifecycle, from first notice through assignment, adjudication, settlement and recoveries. Insure3 Claims also addresses the non-functional requirements associated with enterprise-scale, mission critical applications: performance, scalability, reliability, operability and maintainability. These goals drive the use of a layered architecture and best practice design patterns for application development. The Insure3 Claims system is architected as a thin-client, service-based, Java 2 Enterprise Edition (J2EE) application. This drives a partitioning of the application into four basic logical tiers, which can be physically deployed on one or more computers, plus an Enterprise Integration tier to represent interaction with other existing systems and external service providers. The diagram below depicts these tiers and the interactions between them: Presentation Desktop Tier User Services Tier Business Services Tier Data Services Tier Enterprise Integration Tier Presentation / Desktop Tier The desktop tier represents the user’s computer and their visual interface into the Insure3 Claims system. In the Insure3 Claims application this tier runs on the physical computer that the end user is using. A Web Browser presents the user interface and allows the end user to interact with the application. 1 Insure3 Claims – Application Architecture User Services Tier The user services tier represents the user’s processing model, in other words, the way in which they perceive their interaction with the system. This tier responds to user actions and manipulates the objects in the User Interface (UI) domain model. User actions are mapped to service requests that can be satisfied by the Business Services tier, and the corresponding responses are reflected back in the UI model. Finally, this tier is responsible for rendering the user interface pages that are displayed in the presentation tier. In the Insure3 Claims application this tier resides in the Web Server and Web Container that responds to HTTP posts sent from the Presentation tier. Business Services Tier The business services tier represents the application’s processing model. This tier responds to triggered business transactions, manipulating the objects in the Business domain model. In the Insure3 Claims application this tier resides in the Application Server and the EJB Container that receives service requests from the User Services tier. Additionally, Insure3 Claims exposes XML Web Services on top of the Business Services components which facilitate integration with other applications. Data Services Tier The data services tier represents the model of persistent information maintained by the application. This tier responds to requests for data and manipulates the columns and rows in the relational database tables which hold persistent data for Insure3 Claims. In the Insure3 Claims application this tier is supported by the relational database (RDBMS) server which responds to data requests from the Business Services tier. Enterprise Integration Tier The enterprise integration tier represents the focal point for interactions between Insure3 Claims and other enterprise systems. For the purposes of this document these systems could be an insurer’s legacy or existing systems, external application or information service providers, or other modules of the Insure3 suite. XML Web Services are used as a standard mechanism to facilitate easier integration through well defined interfaces. 2 Insure3 Claims – Application Architecture ARCHITECTURE TIER DETAILS This section provides additional detail on each of the tiers in the Insure3 Claims application: its role, key responsibilities, interactions, design approach and supporting technologies. The diagram below depicts the key pieces within each tier that will be discussed in this section. The numbered arrows indicate the sequence of flow in processing a user request originating at the thin client user interface in the web browser. Presentation / Desktop Tier User Services Tier (Web Server) Business Services Tier (App Server) 2 / 10 Web Browser HTTP(S) 1 / 15 Application Servlet 11 W 3/9 Flow Manager Desktop Objects 12 HTTP(S) 14 6a Business Event 4/8 SOAP (XML) JSP E B S E R V I C E 5 Business Service Component (Session EJB) SOAP (XML) 13 Business Object Component (Entity EJB) Business Object Component (Entity EJB) 6b 6c Enterprise Integration Tier Existing System External Service Data Services Tier (Database Server) W E B 7 S E R V I C JDBC/ SQL-J E 3 Insure3 Claims – Application Architecture Presentation / Desktop Tier The desktop for the Insure3 Claims, in its “out-of-the-box” configuration, is any electronic device that is capable of hosting Microsoft Internet Explorer 5.5 (or later). The only two requirements for supporting Insure3 Claims thin client presentation are the ability render HTML and to execute JavaScript. Scripting is used on the presentation later for proactive field editing, creating dialog boxes, and other lightweight activities which improve the efficiency and responsiveness of the user experience. This limited use of JavaScript has no adverse effect on the bandwidth requirements of the Insure3 Claims application. User Services Tier The User Services tier for the Insure3 Claims requires a Web Server that is capable of hosting a Web Container, or delegating to a separate Web Container, that is compatible with the J2EE 1.2 standards for Java Servlet 2.2 and JavaServer Pages (JSP) 1.1. A servlet acts as the “Front Controller”, representing the Claims application on the User Services Tier. Front Controller is a J2EE Design Pattern that ensures all UI interactions with an application enter through a single “front door”. This allow the servlet to act as a controller for the application, delegating responsibilities to the appropriate object to meet a user’s goals and then directing them to the next page in the application flow. For more information about the Front Controller design pattern please refer to http://java.sun.com/blueprints/patterns/FrontController.html. The controller is one part of a standard presentation design pattern called Model-View-Controller, usually abbreviated as MVC. MVC segregates the program logic related to creating the presentation (View) from the object model itself (Model) and the application control logic (Controller). In the Insure3 Claims application the Application servlet, Flow Manager and Business Events represent the controller, the Desktop Objects represent the Model, and the JSPs represent the View. For more information about the Model-View-Controller design pattern please refer to http://java.sun.com/blueprints/patterns/MVC.html. Desktop objects form the User’s object model. The intent was to create a set of interacting objects that represent the items used in day-to-day Claims Processing work. The concept of a desktop was chosen as a metaphor to help derive the proper set of objects with responsibilities useful in handling claims. Having an object model that reflects the user’s perspective of claims handling activities supports the user centered design objective of making personnel efficient and effective in their use of the system. Insure3 Claims’ User Services tier was created to be a part of a serviceoriented architecture. This service focus influenced the decisions to make the Desktop objects stateful, and to assign them responsibility for knowing transactional boundaries. As an example, when taking a First Notice Of Loss 4 Insure3 Claims – Application Architecture (FNOL), all of the data available regarding an incident is captured. This information is held in the Desktop until the ‘Submit FNOL’ action is taken. Once a Desktop object has reached a transactional boundary, it must forward a request to the Business Services tier. This communication is made via an XML message. The Desktop object model is aware of the user’s HTTP Session that controls its lifecycle. If the HTTP Session times out, the desktop is able to stream its state into XML format and send this data to a persistent cache. When the user logs back on to the system, the cache is searched for desktop state information; if saved state information is located, the desktop will restore itself to its previous state and the user can continue their work, without losing any data. Business Services Tier The Business Services tier for the Insure3 Claims executes on an Application Server that is capable of hosting an EJB Container compatible with the J2EE 1.2 standard for Enterprise JavaBeans 1.1. The EJBs in Insure3 Claims are separated into two business categories: Business Services and Business Objects. Business Services are large-grained services representing business process areas that are supported within Insure3 Claims such as FNOL and Adjudication. A Web Service typically fronts a Business Service component allowing easy integration with disparate technologies and platforms. Each Business Service is implemented as a Stateless Session Bean which acts as a façade, delegating work to one or more underlying Business Objects. For more information about the Session Façade design pattern please refer to http://java.sun.com/blueprints/patterns/SessionFacade.html. Business Objects represent the core business domain concepts or physical entities that make up the Claims processing world, such as Claim File, Incident, Claim, Reserve and Payment. These objects have responsibility for performing the actual business processing and enforcing business rules. The persistence of business information in the underlying data store is accomplished through interaction with the data services tier. Each Business Object is implemented in the Claims system as an Entity Bean and its associated Dependent Objects. The Business Object is designed to be the smallest atomic object in the Insure3 Claims system. The word atomic in this context denotes that this object, as a whole, exists on its own as a business concept. A typical example would be an Invoice. Yes, there are Invoice Line Items, but they cannot exist without the Invoice. So Invoice becomes a Business Object, while Invoice Line Item is a Dependent object. 5 Insure3 Claims – Application Architecture Configuration and Customization Options Claims components can be tailored to accommodate different business needs in different ways. The decision as to which approach is provided for a given feature is based upon a prioritized assessment of configurability factors such as the frequency of change, who is expected to make the change, and the ease of performing the configuration. 1) Business Configurability Areas that are Business Configurable have been specially designed to allow maximum flexibility for all configurability factors. Business Configurable areas are architected using one of two patterns: • Data-driven. Use database rows to hold the configurable data, and provide maintenance screens to allow business or system administrators easy access to modify this information. Examples of areas where this level of business configurability is provided in Insure3 Claims include Code Tables, Exception Messages, Organization Structure and User Profile. Data configuration is used for these areas because they can change dynamically and rapidly. These areas need quick turnover and claims department staff cannot wait for a specialized technical resource to be available. • Integration with a Rules Engine. Insure3 Claims incorporates a Rule Engine façade that fronts Rules Engine adapters compatible with the JSR 94 Java Rules Engine API. Through this common mechanism it is possible to invoke any rule configured inside these rules engines from the Business Services tier. For details on the Java Rules Engine API specification please refer to http://www.jcp.org/en/jsr/detail?id=94. Examples of the types of rules that are configurable via Rules Engine are Incident and Claim File State Transition edits (i.e. pre-requisite constraints and triggered actions related to submitting an Incident or closing a Claim File), Fraud Indicators, and Automatic Adjuster Assignment. 2) Java Extension Points In some cases there is not a demonstrated need to make ongoing rapid changes. Areas that primarily require the ability to support variation between different insurers’ implementations have a Java Extension Point. A Java Interface is defined, along with a configurable way to specify which implementation should be used behind the interface. In most cases there is a default implementation 6 Insure3 Claims – Application Architecture provided with the core Insure3 Claims product, and it may be modified according to a customer’s specific needs during system implementation. Examples of this level of customization are numbering schemes (e.g. Incident, Claim File, Claimant and Claim number) and the Incident to Claim File Transition algorithm. Java extension points are used for areas of the system that only need to be tailored when the system is deployed, or areas that change very rarely. In these cases the system is either not yet in production or the wait for technical expertise to carry out a change does not negatively impact business operations. Enterprise Integration Tier The Insure3 Claims application does not exist in a vacuum, but rather is one player in a company’s insurance process. For example, in order for a First Notice of Loss to be successfully captured, information must be retrieved regarding the customer’s Policy. This data does not reside inside the Claims system, but in the Policy Administration System (PAS). As another example, when a Claim payment is made the details on the payment are recorded within the Claims system, but a request must forwarded to a Payment System to produce a check or trigger an electronic payment. Traditionally, integration efforts have had to deal with connecting two completely disparate systems, often written in two different languages, possibly even running on different platforms. This has caused no lack of troublesome integration issues, and added complexity and cost to integration efforts. Insure3 Claims mitigates these issues by using Web Services as the base technology in all our incoming and outgoing interfaces. Web Services combines XML as the data encoding standard with HTTP as the data transport protocol. Since both the client and the service provider can communicate using XML we remove the typical impedance mismatch between different languages and different platforms. A business object, in the Claims application tier, will represent each enterprise integration point. As an example, the interface with a Policy Administration System is handled by a component known as the Policy Admin Bridge. This component acts as a façade for all access to Policy data. Behind this interface the integration with one or more Policy systems can be supported by means of a Policy Admin Proxy object. Each proxy implements the same interface, which allows the core Claims application to communicate with multiple systems using the same language. It is the responsibility of the proxy object to properly form an XML request and to send this to the known address (URL endpoint) for the Policy Admin web service provider. 7 Insure3 Claims – Application Architecture Insure3 Claims has identified Enterprise Integration points with a number of other applications commonly found in an insurer’s systems environment such as Policy Administration, Customer Management, Document Management, Payment System, and Vendor Management. As an example, below is a view of the integration design for Policy Administration which allows for connecting to Castek’s Insure3 Policy as well as to one or more other existing Policy Admin Systems. Insure3 Claims Module Claim File Policy Snapshot Policy Admin System Bridge Factory Insure3 Policy Proxy Other Policy Proxy Insure3 Policy Web Existing Policy Admin System Web Snapshots The term snapshot is used in the Insure3 Claims system to mean a view of an entity, for a specific business point in time (“As Of” date), taking into account any backdated changes entered up to a specific system point in time (“As At” date). Furthermore this snapshot is for a specific usage, associating to a unique Claims entity. The snapshot stores the necessary data to allow Insure3 Claims to “reconnect” to the enterprise integration system and re-request data from that system. Typically a snapshot will store an internal Claims system identifier (which is an Object Identifier or OID), an external system identifier (which is a Globally Unique Identifier, or GUID, composed of a System Identifier string and a unique Object Identifier string), plus the “As Of” and “As At” dates needed to get the correct historical view of the information. The snapshot mechanism allows for minimizing storage of redundant data inside the claims system in situations where the external system can reliably be called upon to provide a consistent view of the external data on demand in real-time. 8 Insure3 Claims – Application Architecture Caching Enterprise Data Data that is retrieved from an Enterprise Integration Web Service can be expensive to obtain both in terms of response time (latency) and processing demand on the external system. Insure3 Claims has implemented an XML caching mechanism in order to optimize the retrieval of the same Policy data over the duration of a “session”. The length of this session is configurable and can vary by either the source system identifier or another system appropriate value. When a request is received in the Enterprise Integration Tier for a business object (e.g. Policy) that would normally be satisfied through an integration with another system, the cache is first checked for a copy of the object based upon its ID plus “As of” and “as At” dates; when a usable copy is found in the cache, this snapshot is returned to the Business Services Tier, avoiding the overhead of making the external service call to the source system. In addition, the cached copy can be used to ensure that data is still available for claims processing at times when the source system is unavailable, or when the source data is no longer in the other system. ClaimsPath and Service Provider Collaborative Communications Integration Castek’s ClaimsPath is an application that connects an insurer and all of the service providers involved in the claims resolution process, from first notice of loss to approval of invoices. ClaimsPath allows adjusters to connect and send assignments from their desktop directly to their service provider partners in the supply chain, as well as track and document all communications. Insure3 Claims’ first focus is on supporting the core claims business processes within an insurer. ClaimsPath could be used to extend claims management capabilities to include the insurer’s external supply chain partners, serving as a Vendor Management and Collaborative Communication module for Insure3 Claims. The design for integration with ClaimsPath for service provider communications is consistent the other explicitly identified external interfaces for Insure3 Claims. Castek has identified the points in claims business process workflows where the core Claims system will interact with a Service Provider Collaborative Communications system and an XML service-based interface has been specified to facilitate these interactions. System Listener Framework The Insure3 Claims product, like any enterprise application, has integration points to outside systems. Some of these integration points are critical to the successful handling of Claims, while others are optional and customer specific. 9 Insure3 Claims – Application Architecture Insure3 Claims is designed in accordance with the general principals of high cohesion and loose coupling. Basically this implies limiting the number of integration points that Insure3 Claims explicitly has to know about. The key integration points expected for typical claims application implementations are explicitly supported through specific mechanisms in the Enterprise Integration Tier. However, individual insurers may have other integration points. The System Listener framework provides a common standards-based approach to supporting these additional interfaces to existing systems and external entities. Every major business event completed in Insure3 Claims results in a Transactional XML (tXML) stream being generated. This XML is published through the System Listener component. The System Listener pushes this XML stream out to each Subscriber that has been registered. An implementation team can write custom Listener Subscriber objects, each of which will be able to use the data in the tXML for its own purpose. System Listener Listener Claims Component System Event System Listener Component Existing System Listener Listener External Service Data Services Tier The Data Services tier for the Insure3 Claims is a Database Server that has a JDBC 2.0 compliant driver and SQL-J support. SQL-J is a standard for integrating embedded SQL statements into Java. SQL-J syntax is simpler and more intuitive that native JDBC, plus it has the additional benefit of creating static SQL. Static queries are processed in a much more efficient manner than dynamic queries by the database engine. Also, bind information stored in the database catalog about the data access paths used to fulfil these static queries will allow a Database Administrator to further tune the database for optimal performance. The information persisted in the Data Services Tier is the most critical part of the system, and corruption is not an option. In order to provide the integrity needed, declarative Referential Integrity (RI) is enforced at the database level. These RI constraints enforce the relationship rules between database tables, including foreign key validation and cascade deletion. 10 Insure3 Claims – Application Architecture SUPPORTING TECHNOLOGIES The Insure3 Claims application has been architected using Java 2 Enterprise Edition (J2EE), ANSI SQL and XML as the primary enabling technologies. The widespread adoption of these technology standards for the development of enterprise applications facilitates integration of Insure3 Claims with a wide variety of Enterprise Application technologies and third party systems. The layered service oriented architecture and use of recognized best practice design patterns, as described earlier in this document, improve the maintainability of Insure3 Claims, and help to ensure that it can cost effectively be evolved over an extended lifetime in response to changing business conditions and priorities. These technologies also allow maximum flexibility in terms of potential for porting the application easily across different hardware platforms and vendor implementations of infrastructure software in the event that an insurer’s preferred computing environment changes over time. 11