vii ACKNOWLEDGMENT ABSTRACT

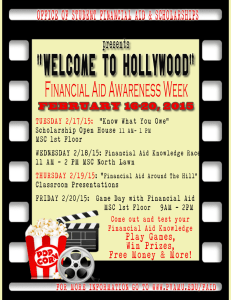

advertisement

vii TABLE OF CONTENT CHAPTER TITLE PAGE DECLARATION THESIS 1 DEDICATION ii ACKNOWLEDGMENT iii ABSTRACT iv ABSTRAK v TABLE OF CONTENT vii LIST OF TABLE xiv LIST OF FIGURE xvi LIST OF ABBREVIATIONS xviii LIST OF APPENDIX xxii INTRODUCTION 1 1.1 Prologue-Basic Parameters 1 1.2 ICT and the Global Village 2 1.3 Background of Study 4 1.4 Aim and Objectives of Study 6 1.5 Research Hypothesis 8 1.6 Research Questions 8 1.7 Scope of Study 9 1.8 Research Methodology 10 viii 2 1.9 Epilogue-Significance of Study 12 1.10 Organization of Thesis 13 DECENTRALIZATION OF TECHNOLOGY REGIONS, GROWTH AND CHANGE AND ITS IMPLICATION ON THE NATIONAL ECONOMY 15 2.1 Introduction 15 2.2 Evolution of ICT -The Brunt Towards Urban Area and CBD 16 2.3 Centralization to Decentralization. 19 2.4 Spatial Impacts of ICT on Urban Land Use 21 2.5 ICT and Office Development 24 2.5.1 Location Trend for Front and Back Offices 26 2.6 2.5.2 Back Office Development 29 2.5.3 Off-Shoring – Right Shoring 30 Influential Factors on Choice of Office Location 33 2.6.1 Rental Value and Operating Cost 33 2.6.2 Labor Skill and Labor Cost 35 2.6.3 Physical Requirement 37 2.6.4 Competitive Conditions for an Office Firm 38 2.7 2.6.5 Connectivity 38 2.6.6 Low Telecommunication Rates 39 2.6.7 Low Taxes 40 ICT and Cyber City in the Information Age 42 2.7.1 Planning Aspects of a Cyber City 44 2.7.2 Infrastructure and Network Society 46 2.7.3 Effects on the Contemporary Office Space 47 2.8 Role of Technology in a City’s and Regional Economy 47 ix 2.9 3 Conclusion 51 MULTIMEDIA SUPER CORRIDOR IN MALAYSIAN PROSPECT 55 3.1 Introduction 55 3.2 ICT in Malaysia 56 3.3 Knowledge Based Economy 57 3.3.1 The Concept of Knowledge-Based Economy58 3.3.2 Characteristics of a Knowledge-Based Economy 3.4 3.5 3.6 60 Development of ICT in Malaysia 62 3.4.1 National IT Agenda 62 3.4.2 Developing Labor Force 63 Globalizing of Kuala Lumpur Metropolitan Area (KLMA) 65 3.5.1 Change in Land use Pattern 66 3.5.2 Development of Cyber Cities in Malaysia 67 Multimedia Super Corridor (MSC) 67 3.6.1 Development of Multimedia Super Corridor 70 3.6.2 MSC Policies and Incentive 70 3.6.2.1 Bill of Guarantees 72 3.6.2.2 Multimedia Development Corporation (MDC) 73 3.6.2.3 Financial Incentives 73 3.6.2.4 Non-Financial Incentives 76 3.6.3 MSC Flagship Applications 80 3.6.4 MSC Flagship Application’s Development 81 3.7 Shared Services Development 81 3.7.1 Out Sourcing 82 x 3.7.1.1 Research and Development 3.8 in MSC 83 IT Shared Service and Contact Centers 84 3.8.1 Developed Infrastructure for Shared and Services 84 3.8.1.1 Facilities Offered in MSC 86 3.8.1.2 Multiple Communication Service Providers 88 3.8.1.3 Internet Infrastructure and Optic Fiber Backbone 3.8.1.4 IP Transit Services 88 90 3.8.2 MSC Performance Guarantee 90 3.8.2.1 Telecommunications 90 3.8.2.2 Power 91 3.8.2.3 Chilled Water 91 3.8.2.4 Competitive Cost of Doing Business 92 3.8.2.5 Office Accommodation and Land Lease 3.9 3.10 92 3.8.2.6 Payroll 93 3.8.2.7 Telecommunication Tariffs 95 An Overview of MSC and Its Progress 97 3.9.1 Companies Outlook 97 3.9.2 Employment Outlook 99 3.9.3 Technology Focus 100 3.9.4 Financial Outlook 101 3.9.5 Intellectual Property Outlook 104 Conclusion 105 xi 4 EVALUATION OF FACTORS LEADING TO OFFICE DECENTRALIZATION TO MULTIMEDIA SUPER CORRIDOR 106 4.1 Introduction 107 4.2 Research Design 4.3 Scope of Data Collection and Analysis 108 4.4 The Survey 110 4.4.1 The Population 111 4.4.2 The Study Area 112 4.4.3 The Questionnaire 113 4.4.4 The Sample Design 116 ` 109 4.4.5 Survey Method and Problems Encountered 118 4.5 4.6 5 Analysis Technique 119 4.5.1 Process of Analysis 120 Conclusion 121 THE CHARACTERISTICS OF FIRMS, FACTORS THAT INFLUENCE OFFICE LOCATION DECISION AND COMPANY’S RESPONSE TOWARDS MSC POLICIES 122 5.1 Introduction 122 5.2.1 Basic Characteristics of firms 123 5.2.1.1 Ownership of Firms 125 5.2.1.2 Firm’s nature and Share of business 126 5.2.1.3 Size of firms 130 5.2.1.4 Duration of Current and Previous Location of Firms 5.2.2 133 Office Division, Location and Mode of Communication 136 xii 5.3 Ownership of Office Premises 140 5.4 Mode of communication 142 5.5 Use of teleworking and arrangement with employees 5.6 144 Evaluation of incentives offered by MSC as location decision 148 5.7 Conclusion 154 6 FACTORS LEADING TO DECENTRALIZATION OF OFFICE FIRMS 155 6.1 Introduction 155 6.2 Setting up of variables 156 6.3 Factors influencing decision to relocate in the MSC area 6.4 156 Analysis of Response towards the Bill of Guarantees 156 6.4.1 MSC Status and Ownership of Companies 158 6.4.2 Location Time period and MSC status 159 6.4.3 Private and Public Listed companies and location Choice 160 6.4.4 The Location choice of Finance, Insurance and Real-estate Sectors 161 6.5 The Hypothesis of Study 162 6.6 Method for testing Hypothesis 163 6.7 Factors that drive Firms to Relocate 164 6.7.1 Factors Driving Companies to MSC Area 164 6.7.2 Factors Identified as Driver of Shift by Respondents 165 6.8 Testing of Hypothesis 168 6.9 Conclusion. 176 xiii 7 CONCLUSION AND RECOMMENDATION 178 7.1 Introduction 178 7.2 Information And Communication Technologies and Office Decentralization 179 7.3 The Focus of the Study 180 7.4 Major Findings of the Study 181 7.5 Additional Measures to Encourage Offices to Decentralize towards MSC 7.6 183 The Implication of the Study Findings to Urban Decentralization Policy 7.6.1 184 The Implementation of Decentralization Policy 185 7.7 The Contribution of study to Urban Planning 186 7.8 Recommendation for Future Studies 187 7.9 Conclusion 188 REFERENCES 189 Appendices A – B 201 xiv LIST OF TABLE TABLE NO TITLE PAGE 2.1 Global Economic Cycles 23 2.2 Transition to an Information Society 27 2.3 Top 15 Developing Countries Ranked by Sum of Outbound and Inbound Foreign Direct Investment as a Percentage of GDP (1997-2001) 3.1 41 Growth Competitiveness and Network Readiness Index Rankings 2003-2004 85 3.2 Cyber Cities within the MSC 86 3.3 Asia Pacific Market Sector Summary: 4th Quarter 2002 93 3.4 Loaded Cost per Person 94 3.5 Benchmark Figures of Salary for Technical Staff Employed by MSC Status Companies 95 5.1 Owner Ship of the Firms; according to sectors 124 5.2 Private and Public Listed companies 124 5.3 Ownership of Firms 126 5.4 Nature of Business 127 5.5 Firm Size in Terms of Employees 130 5.6 Firm Size in Terms of Equity Participation 131 5.7 Time located in this area 133 5.8 Previous Location of Company 134 5.9 Division of Office 137 5.10 Back Office Separate 139 5.11 Premises Rented and Ownership (Front-Office) 140 xv 5.12 Premises Rented and Ownership (Back-Office) 141 5.13 Mode of Communication Front and Back Office 143 5.14 Use of Teleworking in a Company 145 5.15 No of Employees 146 5.16 Days of Teleworking 147 5.17 Mode of Communication with Teleworkers 147 5.18 World Class Physical and Information Infrastructure 148 5.19 Unrestricted Employment of Foreign Workers 149 5.20 Freedom of Ownership 149 5.21 Global Sourcing of Funds 150 5.22 Tax Exemption 151 5.23 Intellectual Property Protection & Cyberlaws 151 5.24 No Censorship of Internet 152 5.25 Globally Competitive Telecom Tariffs 153 5.26 MSC Infrastructure tenders for MSC Companies 153 5.27 One-stop Super Shop MDC 154 6.1 Summary of Response of Companies to Bill of Guarantees 157 6.2 Driver to Move Office from Existing Location 166 6.3 Driver to Move Back-office from Existing Location 167 6.4 Ranks 170 6.5 Provide a world-class physical and information infrastructure 171 6.6 Allow unrestricted employment of local and foreign knowledge workers 6.7 Ensure freedom of ownership by exempting companies with MSC status from local ownership requirements 6.8 172 Give the freedom to source capital globally for MSC infrastructure and the right to borrow funds globally 6.9 172 173 Provide competitive financial incentives; include Pioneer Status (100% Tax Exemption) for up to ten years or an Investment Tax Allowance for up to five years, and no duties on the importation of multimedia equipment. 6.10 6.11 173 Become a regional leader in intellectual property protection and cyberlaws. 174 Ensure no censorship of the internet. 174 xvi 6.12 Provide globally competitive telecommunication tariffs. 6.13 Tender key MSC infrastructure contracts to leading companies willing to use the MSC as their regional hub. 6.14 6.15 175 175 Provide a high-powered agency to act as an effective one-stop super shop. 176 Summary of Mann-Whitney U test 177 xvii LIST OF FIGURES FIGURES NO TITLE PAGE 2.1 Technology Transitions and the Changing Space Economy 28 3.1 MSC- Cyber cities Area 71 3.2 Malaysia’s International IP Backbone Connectivity 89 3.3 Malaysia’s International Bandwidth Capacity 89 3.4 Office Rental Rates in other competitive areas 93 3.5 Telecommunications Rates for 2 Mbps 96 3.6 Telecommunications Rates for 34 Mbps 96 3.7 Current Operational Status 98 3.8 Paid-up Capital 98 3.9 Employment Outlook 99 3.10 Employment of Foreign Knowledge Workers 100 3.11 Technology Focus 101 3.12 Sales by Companies 102 3.13 Expenditures of Companies 102 3.14 Research and Development Expenditures 103 3.15 Profitable Companies 104 3.16 Intellectual Property Outlook 104 4.1 Research Method Flowchart 108 4.2 The Study Area 115 5.1 Cross Tabulation on Market Share and Nature of Companies 128 5.2 Cross Tabulation on Ownership and Market Share of Companies 129 5.3 Cross Tabulation of Firm Size in Terms of Employees and Ownership 131 5.4 Cross Tabulation on Firm Size and Market Share 132 5.5 Cross Tabulation on Previous Location and Firm Size 134 5.6 Cross Tabulation on Previous Location and Ownership 135 5.7 Cross Tabulation on Previous Location and Nature of Business 136 xviii 5.8 Cross Tabulation on Office Division and Firm Size 137 5.9 Cross Tabulation on Office Division and Ownership 138 5.10 Cross Tabulation on Office Division and Nature of Business 139 5.11 Cross Tabulation of Land Lease and Ownership 141 5.12 Cross Tabulation of Land Lease and Firm’s Size 142 5.13 Cross Tabulation of Land Lease and Nature of Business 142 5.14 Cross Tabulation of Communication Mode and Ownership 144 5.15 Cross Tabulation of Ownership and Use of Teleworking 145 5.16 Cross Tabulation of Business Nature and Use of Teleworking 146 6.1 Response of Foreign and Local Companies to MSC’s Bill of Guarantees 6.2 Response of Companies to MSC’s Bill of Guarantees by Time of Inception 6.3 159 Response of Public Listed and Private Companies to MSC’s Bill of Guarantees 6.4 158 160 Response of Sector wise Companies to MSC’s Bill of Guarantees 162 xviii LIST OF ABBREVIATION ATM - Asynchronous Transfer Mode APCN - Asia Pacific Cable Network APCN2 - Asia Pacific Cable Network 2 BOG - Bill of Guarantee BPO - Business Process Outsourcing ADSL - A Symmetric Digital Subscriber Line CBD - Central Business District CCC - City Command & Control Centre CCTV - Close Circuit Television EDI - Electronic Data Interchange E-commerce - Electronic Commerce E-community - Electronic Community E-economy - Electronic Economy FDI - Foreign Direct Investment FLAG - Fiber Loop Across Globe GDP - Growth Domestic Product GLC - Government Link Company FIRE - Finance Investment and Real estate HRD - Human Regional Development IBMS - Integrated Business Management System ICT - Information and Communication Technologies IP - Internet Protocol IPP - Intellectual Property Protection ITO - Information Technology Outsourcing IDN - Integrated Digital Network INTA - International Association for Urban Development ISDN - Integrated Service Digital Networks IT - Information Technology xix ITA - Investment Tax Allowance JV - Joint Venture K-economy - Knowledge Economy KLCC - Kuala Lumpur City Centre KLIA - Kuala Lumpur International Airport KLMA - Kuala Lumpur Metropolitan Area KLSE - Kuala Lumpur Stock Exchange LAN - Local Area Network MDC - Multimedia Development Corporation MESDAQ - Malaysian Exchange For Securities Dealing and Automatic Quotation MGS - Multimedia Super Corridor Grant Scheme MTDC - Multimedia Technical Development Corporation MMU - Multimedia University MNCs - Multi National Corporations MSC - Multimedia Super Corridor MSCVC - Multimedia Super Corridor Venture Capital MW - Mega Watt NASSCOM - National Associate of Software and Services Company NITA - National Information Technology Agenda NITC - National Information Technology Council PABX - Private Automatic Branch Exchange PMSB - Pendinginan Megajana Sdn.Bhd Psf - Per square foot R&D - Research & Development RM - Ringgit Malaysia RT - Refrigerant Ton SAFE - South Africa Far East SCADA - Supervisory Control of Data Acquisition SDH - Synchronous Digital Hierarchy SMEs - Small and Medium Enterprises SMW3 - South East Asia, Middle East, Western Europe~ 3 Submarine Cable Network STILL - Strategic Trusts Implementation Committee xx S&T - Science & Technology TNB - Tenaga National Berhad TM - Telekom Malaysia UPM - Universiti Putra Malaysia U.S.A - United Stated of America USD$ - United States Dollar U.K - United Kingdom VoIP - Voice over Internet Protocol VSAT - Very Small Aperture Terminal WAP - Wireless Application Protocol xxii LIST OF APPENDICES APPENDIX A B TITLE PAGE Questionnaire of Profile Survey- information of company and respondent 201 List of companies surveyed 205