FACTORS LEADING TO DECENTRALIZATION OF OFFICE FIRMS: MUHAMMAD ASIM TUFAIL

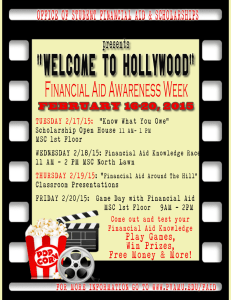

advertisement