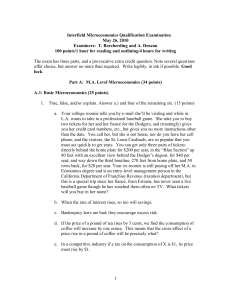

Spring 2012 Ph.D. Qualification Examination in Microeconomics May 30, 2012

advertisement

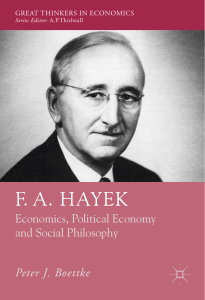

Spring 2012 Ph.D. Qualification Examination in Microeconomics May 30, 2012 Examiners: Borcherding and Tasoff 100 points/Five Hours* Please read all examination questions and outline answers during the first hour. Then answer questions in Sections A and A’, B, and C. *If you took Econ 318, you will answer the question in Section D. It adds 20 points to the examination. You will get an extra 45 minutes of time. Write legibly and don’t crowd your answer sheets. The latter are free to you. Recall what examiners can’t read they can give no marks. Good luck. Section A: Based on Economics 313 (25 points) Answer both A1 and A2 below. Note choices offered. A1. Some quickies: Pick any three of the five below: (10 points) (a) State and explain intuitively Hicks Third Law of Demand. Why is it important and useful? (b) Diminishing marginal rates of substitution for X and Y in consumption do not require diminishing marginal utilities for X and Y. Why? Give an example. (c) If indifference curves are vertically parallel, good X is not a normal-type of good. What is it then? (d) High income wage earners eat out more than those persons whose incomes are similar but whose incomes are largely from capital sources. Why? (e) When skilled wages rise in competitive but non-open economies, high tech capital intensive firms get larger. How come? A2. Simple problems. Pick one of three below (15 points) A2-a) Ken’s utility function is given by initial wealth is $2,500. , where W denotes Ken’s wealth. Suppose that (i) 1 of 9 (ii) Suppose Ken is offered to toss an unbalanced coin that shows head with probability 0.2. If he accepts to toss that coin, he will win $5,000 if it’s a head and will lose $1,000 if it’s a tail. Show that although the expected value of his wealth is higher than his initial wealth if he plays this game, Ken will refuse it. (iii) What is the maximum Ken is willing to pay to avoid the game in (ii)? How does that compare to what he is willing to pay to avoid the game in (i)? Explain this result. A2-b) (i) (ii) (iii) Answer briefly: Assuming costless interactions, what sort of institutions would be necessary to reach the socially optimal outcome. (iv) Answer briefly: What happens if interactions become costly, that is transaction costs are introduced into Coasean exchange? 2 of 9 A2-c) The American auto industry has had a near death experience. Through prudential behavior [Ford], government subsidies [GM, Chrysler], helpful foreigners [Chrysler], and outright nationalization followed by forming a new entity [GM], thing now look better for the American car industry. In all three entities [Chrysler, Ford and GM] the umbrella labor union, the United Brotherhood of Auto Workers, has had some hard going. A strong union from the end of the Great Depression through the 1970s, things slipped for the UAW pretty dramatically in the last couple of decades. The UAW membership contracted by 30 percent or more. Its power to keep its pension benefits at all was largely maintained by political force-the Bush-Obama-Canadian government bailouts in particular. Real wages have stopped rising and new workers are forced to work much more cheaply. In plants south of the Great Lakes region of Michigan, Indiana, Pennsylvania, and Ohio, plants are not union organized at all, most of which are run by Japanese and German competitors. Use the Marshall-Hicks product-factor analyses to show how the auto industry lost its economic power since the late 1970s/ early 1980s. In your analysis employ each of the Hicksiou four rules, but don’t derive them. Section A – Extra Credit (up to 5 points of missed credit) Choose only one of the two of these questions: Extra Credit A1: Generally speaking, modest homes are built on modest parcels of land; elaborate houses are built on expensive land. Why? (This is not an Akhian-Alen-BorcherdingSilberberg phenom, which you could explain instead.) Extra Credit A2: Coase claims that competitive firms always pick the sweet spot, P=MR=C, since at this point he holds P=AC, regardless of the success of the firms. True? 3 of 9 Section A’: Neo- Institutional Economics (20 points) Answer any two of the following five questions. A’1. Textbook Durability The late Jack Hirshleifer (along with co-authors David Hirshleifer and Amihai Glazier) now have a paperback edition of their iconic intermediate micro-theory text. Paperback texts have been standard editions in developing, poor countries for fifty years, but they are now beginning to become standard in the rich OECD countries. Does this suggest anything about the frequency of new editions, especially given the cheapness of electronic printing, or is it just a reflection of rising cost of hard-cover books? Predict the future, but recall that consumers have choices, no matter what a professor’s syllabus says about “required texts.”. Be sure to consider transactions costs and property rights along with technology in your answer. A’2. Insurance Contracts Health, fire and burglary insurance contracts typically are complex in construction when compared to life insurance. In the former, some items are not insured, or subject to “deductibles.” Others are subject to fractional compensation. Assume a dental insurance contract formed in a competitive environment: (i) What parts are likely insured and what are not? (ii) Sometimes check ups and cleanings are covered and sometimes not, but often required at least yearly. Why? (iii)Why are life insurance contracts, beyond the initial ascertainment of health status, typically not very complex? A’3. Freakonomics Deconstructed In their now famous Freakonomics volume, the two Steves – Levitt and Dubner – claim that real estate brokers chisel their clients. Professor Levitt and one of his students found that real estate brokers spent roughly ten days to two weeks longer selling their own houses and properties than when they worked for a client. Over two centuries before Adam Smith claimed share-cropping was also inefficient. A principle would seem to emerge here: If an agent gets less than 100% of 4 of 9 the value of her increment of effort they will offer less than the optimal effort. Critique the theory and implication of inefficiency in real estate brokering share-contracting of Smith and the Steves. A’4. Wisdom of the Old Guys Twenty years after his death, Hayek is again a rock star of economics, mentioned along with Friedman, Samuelson, Arrow, Coase, and Hayek’s close friend, Keynes, as the top scholars of the 20th century. Unlike the four more contemporary economists, neither Hayek nor Keynes assumed the individual was wholly rational, but was subject to “animal spirits,” appetites, and conflicting emotions. Both men argued that irrationality could be mitigated, but never “cured” by institutional constraints developed correctives. With this in mind, explain how Hayek and Keynes would testify in the recent Dodd-Frank hearings on the current financial debacle, comparing and contrasting their differing recommendations. A’5. Explain how the introduction of social capital, culture, and behavioral economics alters interpretation of the Coasian theory of the firm, particularly the Jensen-Meckling version. Be specific. Section A’ – Extra Credit (up to 5 points of missed credit) Answer only one of the two. Extra Credit A1: People tend to become more religious when they have children and when they retire. Why? Extra Credit A2: One term U.S. presidents are fairly uncommon. Scholars note that voters tend to re-elect sitting president more reliably if unemployment and inflation are low. Carter and Bush I were exceptions to this rule, but polls suggest that Obama may be one too, i.e. he’ll be re-elected even with relatively higher unemployment. What’s missing in the orthodox theory of reelections? 5 of 9 Section B: Based on Economics 316 (25 points) Answer either B1 or B2, but not both. B1. B2. 6 of 9 Section C: Based on Economics 317 (30 points) Answer either C1 or C2, but not both. C1. 7 of 9 C2. Section D: Based on Economics 318 (20 points) Note: Only students who have taken Econ 318 should answer this section. You have 50 extra minutes to answer this. Your total of points will be 120 instead of 100. Answer either D1 or D2, but not both! D1. 8 of 9 D2. 9 of 9