Lamar Macroeconomics Qualifying Exam-302 Module Claremont Graduate University

advertisement

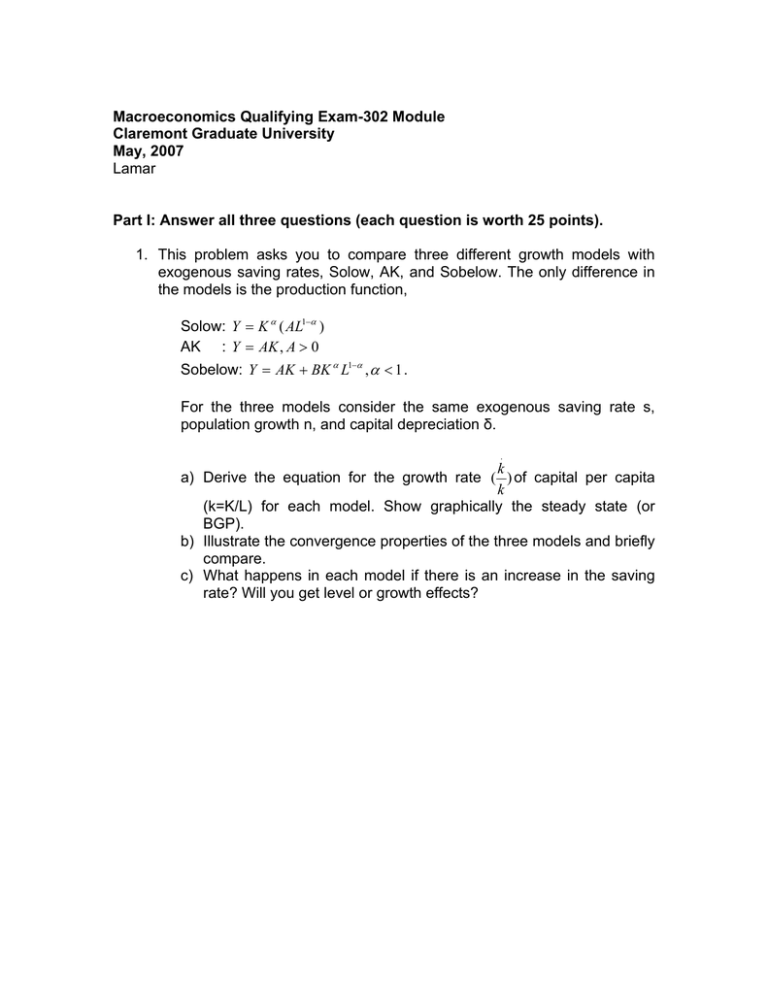

Macroeconomics Qualifying Exam-302 Module Claremont Graduate University May, 2007 Lamar Part I: Answer all three questions (each question is worth 25 points). 1. This problem asks you to compare three different growth models with exogenous saving rates, Solow, AK, and Sobelow. The only difference in the models is the production function, Solow: Y = K α ( AL1−α ) AK : Y = AK , A > 0 Sobelow: Y = AK + BK α L1−α , α < 1 . For the three models consider the same exogenous saving rate s, population growth n, and capital depreciation δ. . k a) Derive the equation for the growth rate ( ) of capital per capita k (k=K/L) for each model. Show graphically the steady state (or BGP). b) Illustrate the convergence properties of the three models and briefly compare. c) What happens in each model if there is an increase in the saving rate? Will you get level or growth effects? 2. Assume a country with perfect capital mobility and a flexible exchange rate. Assume the country experienced a decrease in the money supply. a) What is the effect of this policy in the Mundell-Fleming model with static expectations? What happens to output and the exchange rate? Draw a graph in (ε,Y) to illustrate your answer. b) Now assume that investors have rational expectations. Explain why the condition i = i * no longer holds. Write down the Uncovered Interest Parity condition no longer holds and explain the intuition behind it. c) Assume the IS is not very responsive to the real exchange rate (through net exports), so that it shifts very little when the exchange rate changes. What is the effect of the decrease in the money supply on output, the interest rate and the exchange rate under rational expectations?. Draw graphs in the (i,Y) and (ε, Y) spaces to illustrate your answer. d) How does your answer to c) changes if the IS is very responsive to changes in the exchange rate. ?. Draw graphs in the (i,Y) and (ε, Y) spaces to illustrate your answer. 3. Consider the following flexible price Rational Expectations model: Aggregate Supply : Yt = Y + α ( Pt − Pt e ) Aggregate Demand: Yt = M t − Pt Monetary policy function: M t = g 0 + g1 M t −1 + g 2Yt −1 + et ; 0 < g1 < 1; et is normally distributed N(0,δ) a) Find the rational expectations solution to Yt and Pt. b) Does the Policy Ineffectiveness Proposition holds? Why or why not? Part II. Do either question 4 or question 5. (25 points) 4. What is the prediction of the Solow model about cross-country convergence of income per effective worker? Does a rich country grow faster than a poor country? In case of convergence is it absolute or conditional? 5. Explain why a policy rule may be superior to a discretionary policy. In answering this question assume that aggregate supply is given by the Lucas − Supply Curve y = y + b(π − π e ) b >0, policy makers have a loss function given by 1 1 L = ( y − y*) + a(π − π *) 2 , where * represent optimal levels of output and 2 2 inflation respectively. Assume a policy maker chooses the inflation rate.