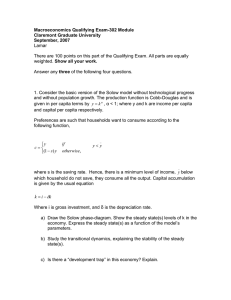

Francisco Alvarez-Cuadrado Econ 330 D1 Section 2 Exam 2 (Duration: 75 minutes) 1. (15%) Name the three approaches to compute GDP and briefly discuss how to compute one of them. 2. (15%) Since the consumer price index (CPI) maintains the basket of goods constant through time and uses the prices from each year, the inflation rate based in this index tends to understate the true increase in the cost of living for consumers. Comment and explain your answer. 3. (22.5%) The government of a centrally planned economy has asked you to provide them with advice on growth policy. Their goal is to maximize the absolute amount of national income devoted to consumption purposes and they can manipulate the economy’s saving rate, s , to achieve this goal. For the past several decades they have been steadily increasing the saving rate and this has lead to higher levels of output and consumption. Recently however, further increases in investment have ceased to increase consumption, in fact, although national income has increased continuously the amount consumed has actually declined. Explain why continuous increases in saving have ceased to yield higher consumption. 4. (35%) Take the following version of the Solow model characterized by the following set of equations already stated in per capita terms. Evolution of labor force: N (t +1) = (1 + n ) N (t ) Production function: Yi t = K i t Law of motion of capital: ΔK i t = Real wage rate: w t = 1− α K i t Real interest rate: r t + δ = α Ki t Consumption: Ci (t ) = (1 − s )Yi (t ) () () α () ( ( ) () ) δ +n s Yi t − Ki t 1+ n 1+ n () α () ( ) ( ( )) () ( ( )) α −1 a) Describe the concept of steady state. Solve analytically for the steady state level of output per worker. Imagine we had two identical countries, A and B, except for the fact that country A has a lower saving rate and a higher rate of population growth. In per capita terms, do you expect the citizens of A or B to be richer (or eventually richer)? Now let’s forget about the two countries and focus on a single economy that is in steady state. Consider the effects of an epidemic disease that kills half of the population. So population is initially N at N 0 and the disease moves it instantaneously to N1 with N1 = 0 while the rate of population 2 growth remains unchanged. b) Use the phase diagram –a graphical representation of the law of motion of capital per capita-- to illustrate the effects of the 50% reduction in population. Assume before the shock the economy is in steady state and label carefully this initial steady state, the effect of the shock, the final steady state and the transition from initial to final. 1 Francisco Alvarez-Cuadrado c) Draw the time path, i.e. the variable in question against time, for the growth rate of capital per worker, the level of output per worker, the interest rate and (the log of) aggregate output. Each of them in a separate figure where you should make sure to include several periods of the pre-shock steady state, the time of the shock, the transition to the final steady state, and several periods of the final steady state. 5. (12.5%) Consider a modified version of the Solow model that includes two small differences. One helps, the other one may require a bit of thinking. First, population P t = P is constant, so () aggregates are always equal to per capita variables times P. Second, as opposed to the version covered in class, where the population and the labor force coincided, in this version, a constant fraction θ ∈ 0,1 of the total population does not work because they are retired, so that ( ) N = (1 − θ ) P . The rest of the model is standard, so in aggregate terms α 1−α ( ) ( ( )) ( N ) Production function: Y t = K t Law of motion of capital: ΔK t = sY t − δ K t Real wage rate: () () () w (t ) = (1− α ) ( K (t )) ( N ) α −α a) Use a modified version of the Solow diagram to illustrate the steady state of this model. Make sure that your actual investment line is expressed in terms of θ and P. Discuss whether the economy will eventually move to this steady state. Over the last decades life expectancy has changed substantially, around 3.2 years per decade, while the retirement age has remained unchanged. Let’s model this reduction of the fraction of the population that is working as a one-time increase in θ , i.e. as an increase in the fraction of population retired. b) Use the equivalent to the Solow diagram (the one in a)) to illustrate the effects of this shock assuming the economy began in a steady state associated with the lower value of θ . Briefly discuss the effects of the shock. c) Draw the evolution through time of the wage after the shock analyzed in b). Make sure to include several periods of the pre-shock steady state, the time of the shock, the transition to the final steady state, and several periods of the final steady state. 2 Francisco Alvarez-Cuadrado Answer Key I won’t be talking about the exam until we see the grades together. Question 1 Three approaches: production, expenditure and income. The production measure of GDP adds the value of (final) goods and services produced in the economy, or equivalently the value added of all the productive units in the economy. The expenditure measure of GDP adds the value of total purchases of (final) goods and services in the economy. Following this approach GDP is given by the sum of consumption, investment, government expenditure and net exports. The income measure of GDP counts all the income generated in the production process in the economy. GDP is given by the sum of wages and profits generated through production. Question 2 As stated the CPI maintains the basket of goods constant, nonetheless as prices change through time the actual basket of goods purchased by consumers will change increasing the quantities of goods with declining prices and reducing the quantity of goods with increasing prices. Since by construction the CPI does not allow for this substitution from expensive to cheaper goods, it tends to overstate the true cost of living. As a result inflation measures based on the CPI tend to overstate, rather than understate, the true increase in prices. Question 3 Steady state consumption in the Solow model is given by is given by α ⎛ s ⎞ 1−α C = (1 − s )Yi = (1 − s ) ⎜ ⎝ δ + n ⎟⎠ On the one hand higher saving means lower resources left for consumption. This is captured by the first multiplicative term, (1 − s ) . On the one hand higher saving means higher capital and higher output and therefore higher consumption. This is captured by the second term. In this economy the continuous increases in saving have ceased to yield higher consumption because the first term began to dominate the second, i.e. the saving rate has become so large that although output has increased what is left for consumption after investment has actually decreased. * i * Question 4 3 Francisco Alvarez-Cuadrado 4 Francisco Alvarez-Cuadrado Question 5 5 Francisco Alvarez-Cuadrado 6 Francisco Alvarez-Cuadrado 7