Macroeconomics Qualifying Exam-302 Module Claremont Graduate University May, 2012 Lamar

advertisement

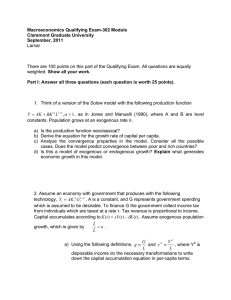

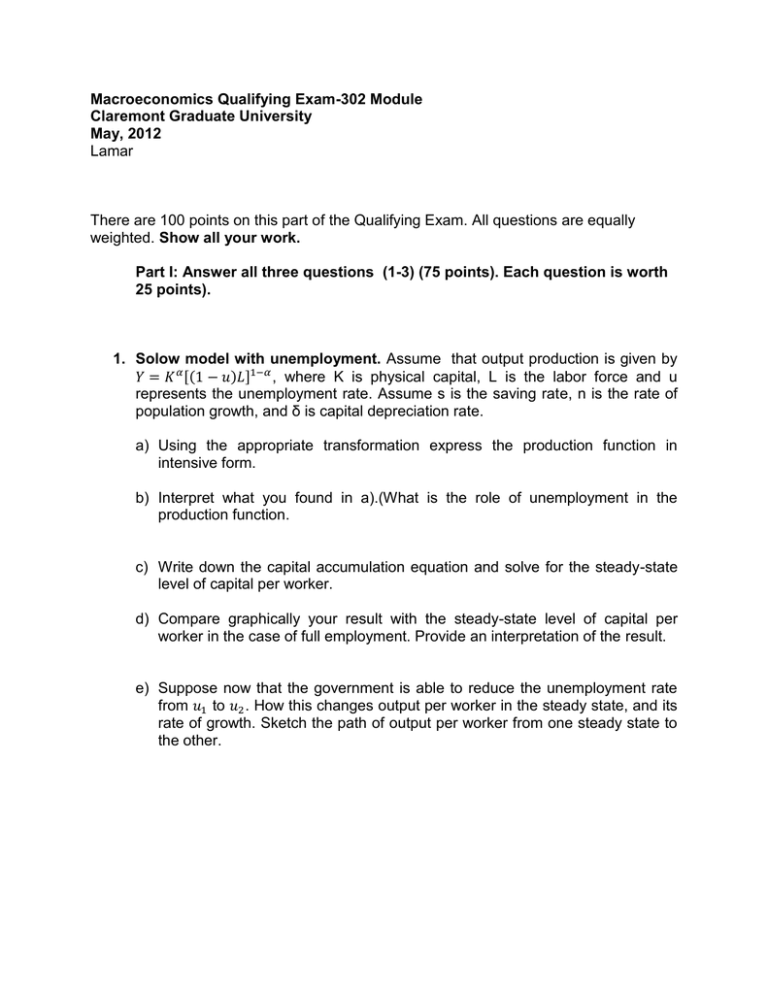

Macroeconomics Qualifying Exam-302 Module Claremont Graduate University May, 2012 Lamar There are 100 points on this part of the Qualifying Exam. All questions are equally weighted. Show all your work. Part I: Answer all three questions (1-3) (75 points). Each question is worth 25 points). 1. Solow model with unemployment. Assume that output production is given by [( ) ] , where K is physical capital, L is the labor force and u represents the unemployment rate. Assume s is the saving rate, n is the rate of population growth, and δ is capital depreciation rate. a) Using the appropriate transformation express the production function in intensive form. b) Interpret what you found in a).(What is the role of unemployment in the production function. c) Write down the capital accumulation equation and solve for the steady-state level of capital per worker. d) Compare graphically your result with the steady-state level of capital per worker in the case of full employment. Provide an interpretation of the result. e) Suppose now that the government is able to reduce the unemployment rate from to . How this changes output per worker in the steady state, and its rate of growth. Sketch the path of output per worker from one steady state to the other. 2. Assume a Lucas economy.There are n small producers producing identical products. Each one of the producers has the following labor supply function , [ ] a) Give an intertemporal interpretation to this equation. b) Derive the AS schedule. c) Show how the slope may differ between countries of the world depending on their past experiences with price changes. d) Assume Aggregate Demand is represented in logs by y = m – p. Solve the equilibrium in this model. What is the role of money in this model, and what this implies for the conduct of monetary policy? e) Assume that the monetary rule is given by ,where c is the trend and ut is a white noise. Show algebraically the relationship, between inflation and output. Interpret your result 3. Assume an unexpected increase in money supply. Explain the effects of this policy on the using the Phillips curve. In your answer consider the static Phillips curve, and the Expectations Augmented Phillips curve. Does the assumption about expectations matter? Back up your Phillips curve analysis with the corresponding equations, graphs, and economic reasoning. Also consider both the short-run and long-run analysis. II. Answer one of the following two questions (25 points). Each question is worth 25 points. 4. Consider an economy whose production function is ( ) , with A = 4K/L. Suppose a saving rate s, with 0 < s < 1, a population growth of n, and a depreciation rate δ, and 0 < θ < 1. a) Express the production function in the form y = ak. What is a? b) What are the growth rates of output, capital, output per capita, and capital per capita? c) Interpret a. The labor-augmenting technology, A, is proportional to the level of capital per worker, what this does say about the technology? d) What type of model is this? Justify your answer. 5. Consider an individual who lives T periods and whose lifetime utility is given by, ∑ ( ) , for simplicity assume a rate of time preference equal to zero. The typical individual has initial wealth A0 and earns income Yt over his/her lifetime. The individual can borrow/save at the interest rate zero. a) Set and solve the individual maximization problem and from the first order conditions obtain an expression for consumption at time t. Interpret the expression you found for Ct. b) Assume an unanticipated and transitory (say, one year) deviation in income. Find the change in consumption. Is it high/low? How the change in consumption depends on the remaining lifetime? Now assume uncertainty and Rational expectations, where the consumer solves the following maximization problem, ∑( ∑ ( ) ) ( ( ) ) Utility is strictly concave and separable. c) Find and interpret the Euler equation. d) Show that under rational Expectations consumption follows a random walk. What is the meaning of consumption follows a random walk? e) What is the implication of the formula you derived in d) for economic policy?