Macroeconomics Qualifying Exam-302 Module Claremont Graduate University September, 2011 Lamar

advertisement

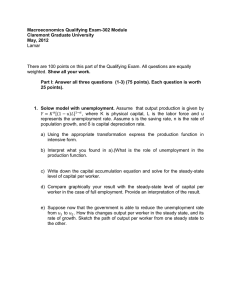

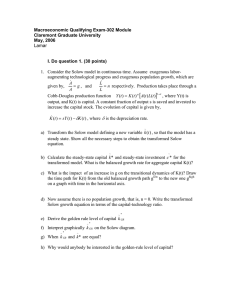

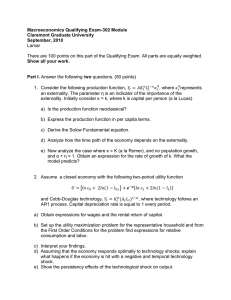

Macroeconomics Qualifying Exam-302 Module Claremont Graduate University September, 2011 Lamar There are 100 points on this part of the Qualifying Exam. All questions are equally weighted. Show all your work. Part I: Answer all three questions (each question is worth 25 points). 1. Think of a version of the Solow model with the following production function Y = AK + BK α L1−α , α < 1 , as in Jones and Manuelli (1990), where A and B are level constants. Population grows at an exogenous rate n. a) Is the production function neoclassical? b) Derive the equation for the growth rate of capital per capita. c) Analyze the convergence properties in the model. Consider all the possible cases. Does the model predict convergence between poor and rich countries? d) Is this a model of exogenous or endogenous growth? Explain what generates economic growth in this model. 2. Assume an economy with government that produces with the following technology, Yt = AK tα Gt1−α . A is a constant, and G represents government spending which is assumed to be desirable. To finance G the government collect income tax from individuals which are taxed at a rate τ. Tax revenue is proportional to income. Capital accumulates according to K& (t ) = sY (t ) − δK (t ) . Assume exogenous population L& =n . growth, which is given by L Yd G and y d ≡ , where Yd is L L disposable income do the necessary transformations to write down the capital accumulation equation in per-capita terms. a) Using the following definitions, g ≡ b) Assume that government spending is equal to tax collection in any period and write down the government budget constraint in per-capita terms. c) Using what you did in b) find and expression for economic growth and briefly explain your result. d) Show that y, c, g, and Y grow at a constant rate. e) What is effect of taxes on economic growth? Provide a brief explanation. f) Find the tax rate that maximizes economic growth. 3. Consider the classical model with perfect information, where a representative 1 producer (consumer) of good i supplies labor (in logs) according to li = ( pi − p) , 1− γ where γ f 1 , pi and p are the log of Pi and P respectively. a) What does the labor supplied by each individual implies for the labor supply? b) Assume that demand for good i is represented by the following loglinear demand function qi = y − η ( pi − p ) . Find the equilibrium output for each producer. What policy implication you can derive from this result? c) Now assume that information about prices is not perfect. Explain how labor supplied by each individual changes and what it implies for the labor supply? d) Assume Aggregate Demand is represented in logs by y = m – p. Solve the equilibrium in this model. What is the role of money in this model, and what this implies for the conduct of monetary policy? e) Assume that the monetary rule is given by , where c is the trend and ut is a white noise. Show algebraically the stability, or lack of it, between inflation and output. . Part II. Do either question 4 or question 5. (25 points) 4. How it is possible to keep the unemployment rate below the natural rate of unemployment permanently? Explain, using graph and equations, the previous question under the three following Phillips Curve models: a) Traditional Keynesian Phillips Curve. b) Expectations-Augmented Phillips Curve. c) Rational Expectations. 5. Consider an individual who lives T periods and whose lifetime utility is given by, ∑ , for simplicity assume a rate of time preference equal to zero. The typical individual has initial wealth A0 and earns income Yt over his/her lifetime. The individual can borrow/save at the interest rate zero. a) Set and solve the individual maximization problem and from the first order conditions obtain an expression for consumption at time t. Interpret the expression you found for Ct. b) Assume an unanticipated and transitory (say, one year) deviation in income. Find the change in consumption. Is it high/low? How the change in consumption depends on the remaining lifetime? Now assume uncertainty and Rational expectations, where the consumer solves the following maximization problem, max . .∑ 1 1 Assume that U(.) is strictly concave and separable. c) Find and interpret the Euler equation. d) Show that under rational Expectations consumption follows a random walk. Explain this result.