17-Feb-12 PRELIMINARY RESULTS

advertisement

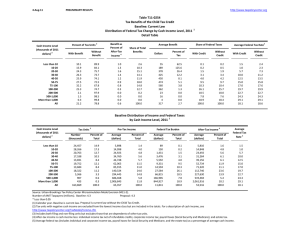

17-Feb-12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T12-0029 H.R. 3630: The Middle Class Tax Relief and Job Creation Act of 2012 Baseline: Current Law (Including Temporary Payroll Tax Cut Continuation Act of 2011) Distribution of Federal Tax Change by Cash Income Level, 2012 1 Summary Table Cash Income Level (thousands of 2011 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units with Tax Increase or Cut 3 With Tax Cut Pct of Tax Avg Tax Cut Units 58.3 54.3 73.7 78.9 82.6 83.4 86.6 89.5 90.5 87.6 87.4 74.0 -100 -218 -347 -480 -609 -833 -1,129 -1,716 -2,124 -2,254 -2,290 -770 With Tax Increase Pct of Tax Avg Tax Units Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0 0 0 0 0 0 0 0 0 0 0 0 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change Average Federal Tax Change ($) 1.0 0.8 1.1 1.2 1.3 1.3 1.4 1.4 0.9 0.4 0.1 1.0 1.5 3.6 5.7 7.0 7.4 14.9 14.4 30.5 11.9 2.1 1.1 100.0 -58 -118 -256 -379 -503 -695 -978 -1,535 -1,922 -1,974 -2,001 -570 Average Federal Tax Rate5 Change (% Points) Under the Proposal -1.0 -0.8 -1.0 -1.1 -1.1 -1.1 -1.1 -1.1 -0.6 -0.3 -0.1 -0.8 1.2 1.0 5.9 10.2 12.9 15.5 17.8 21.7 25.0 24.9 29.0 19.5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-3). Number of AMT Taxpayers (millions). Baseline: 31.2 Proposal: 31.2 * Less than 0.05 ** Insufficient data (1) Calendar year. Baseline is current law with the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal is H.R. 3630 which includes a full year extension of the payroll tax holiday where the OASDI tax rate is reduced two percentage points to 4.2% for the entire 2012 calendar year. Table captures effects of the additional ten month extension. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 17-Feb-12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12-0029 H.R. 3630: The Middle Class Tax Relief and Job Creation Act of 2012 Baseline: Current Law (Including Temporary Payroll Tax Cut Continuation Act of 2011) Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 58.3 54.3 73.7 78.9 82.6 83.4 86.6 89.5 90.5 87.6 87.4 74.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 1.0 0.8 1.1 1.2 1.3 1.3 1.4 1.4 0.9 0.4 0.1 1.0 Share of Total Federal Tax Change 1.5 3.6 5.7 7.0 7.4 14.9 14.4 30.5 11.9 2.1 1.1 100.0 Average Federal Tax Change Dollars Percent -58 -118 -256 -379 -503 -695 -978 -1,535 -1,922 -1,974 -2,001 -570 -45.0 -43.4 -14.7 -9.6 -8.0 -6.6 -5.9 -4.7 -2.5 -1.1 -0.2 -4.0 Share of Federal Taxes Change (% Points) -0.1 -0.1 -0.2 -0.2 -0.2 -0.2 -0.2 -0.2 0.3 0.2 0.8 0.0 Under the Proposal 0.1 0.2 1.4 2.8 3.6 8.8 9.5 25.9 19.4 7.7 20.5 100.0 Average Federal Tax Rate5 Change (% Points) -1.0 -0.8 -1.0 -1.1 -1.1 -1.1 -1.1 -1.1 -0.6 -0.3 -0.1 -0.8 Under the Proposal 1.2 1.0 5.9 10.2 12.9 15.5 17.8 21.7 25.0 24.9 29.0 19.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 23,654 28,341 20,820 17,491 13,844 20,187 13,838 18,707 5,808 1,003 503 165,201 14.3 17.2 12.6 10.6 8.4 12.2 8.4 11.3 3.5 0.6 0.3 100.0 Pre-Tax Income Average (dollars) 6,045 15,232 25,240 35,253 45,338 63,169 87,271 143,999 301,476 700,511 3,175,826 69,939 Percent of Total 1.2 3.7 4.6 5.3 5.4 11.0 10.5 23.3 15.2 6.1 13.8 100.0 Federal Tax Burden Average (dollars) 130 272 1,742 3,964 6,331 10,507 16,524 32,804 77,301 176,045 921,783 14,224 Percent of Total 0.1 0.3 1.5 3.0 3.7 9.0 9.7 26.1 19.1 7.5 19.7 100.0 After-Tax Income 4 Average (dollars) 5,915 14,959 23,498 31,290 39,007 52,662 70,747 111,195 224,175 524,466 2,254,043 55,715 Percent of Total 1.5 4.6 5.3 6.0 5.9 11.6 10.6 22.6 14.2 5.7 12.3 100.0 Average Federal Tax Rate 5 2.1 1.8 6.9 11.2 14.0 16.6 18.9 22.8 25.6 25.1 29.0 20.3 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-3). Number of AMT Taxpayers (millions). Baseline: 31.2 Proposal: 31.2 * Less than 0.05 (1) Calendar year. Baseline is current law with the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal is H.R. 3630 which includes a full year extension of the payroll tax holiday where the OASDI tax rate is reduced two percentage points to 4.2% for the entire 2012 calendar year. Table captures effects of the additional ten month extension. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 17-Feb-12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12-0029 H.R. 3630: The Middle Class Tax Relief and Job Creation Act of 2012 Baseline: Current Law (Including Temporary Payroll Tax Cut Continuation Act of 2011) Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 54.7 42.7 64.7 72.6 81.6 79.5 81.3 76.8 71.1 67.2 66.0 61.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 1.0 0.6 1.0 1.2 1.4 1.4 1.4 1.1 0.5 0.2 0.1 1.0 Share of Total Federal Tax Change 4.1 7.4 11.1 13.6 13.1 21.1 12.4 12.9 3.3 0.6 0.3 100.0 Average Federal Tax Change Dollars Percent -53 -90 -217 -349 -523 -687 -948 -1,164 -1,099 -984 -1,031 -297 -15.7 -10.7 -7.8 -6.7 -6.2 -5.3 -4.8 -3.5 -1.4 -0.6 -0.1 -4.4 Share of Federal Taxes Change (% Points) -0.1 -0.2 -0.2 -0.2 -0.2 -0.2 -0.1 0.1 0.3 0.2 0.6 0.0 Under the Proposal 1.0 2.8 6.0 8.6 9.0 17.1 11.2 16.2 10.6 4.5 12.9 100.0 Average Federal Tax Rate5 Change (% Points) -0.9 -0.6 -0.9 -1.0 -1.2 -1.1 -1.1 -0.8 -0.4 -0.2 0.0 -0.8 Under the Proposal 4.8 5.0 10.2 13.8 17.4 19.6 21.8 22.9 25.3 25.3 32.2 17.9 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 18,677 19,704 12,248 9,316 6,007 7,366 3,136 2,656 714 138 67 80,620 Percent of Total 23.2 24.4 15.2 11.6 7.5 9.1 3.9 3.3 0.9 0.2 0.1 100.0 Pre-Tax Income Average (dollars) 5,934 15,064 25,068 35,203 45,161 62,176 86,024 139,722 307,687 678,159 3,141,069 36,344 Percent of Total 3.8 10.1 10.5 11.2 9.3 15.6 9.2 12.7 7.5 3.2 7.2 100.0 Federal Tax Burden Average (dollars) 339 839 2,771 5,194 8,370 12,868 19,723 33,097 79,007 172,628 1,011,219 6,800 Percent of Total 1.2 3.0 6.2 8.8 9.2 17.3 11.3 16.0 10.3 4.3 12.3 100.0 After-Tax Income 4 Average (dollars) 5,594 14,226 22,297 30,009 36,791 49,308 66,301 106,625 228,679 505,531 2,129,851 29,544 Percent of Total 4.4 11.8 11.5 11.7 9.3 15.3 8.7 11.9 6.9 2.9 6.0 100.0 Average Federal Tax Rate 5 5.7 5.6 11.1 14.8 18.5 20.7 22.9 23.7 25.7 25.5 32.2 18.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-3). * Less than 0.05 (1) Calendar year. Baseline is current law with the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal is H.R. 3630 which includes a full year extension of the payroll tax holiday where the OASDI tax rate is reduced two percentage points to 4.2% for the entire 2012 calendar year. Table captures effects of the additional ten month extension. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 17-Feb-12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12-0029 H.R. 3630: The Middle Class Tax Relief and Job Creation Act of 2012 Baseline: Current Law (Including Temporary Payroll Tax Cut Continuation Act of 2011) Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 61.9 76.5 79.3 79.6 78.9 84.0 87.8 91.4 93.4 90.8 91.2 85.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 1.4 1.1 1.1 1.1 1.0 1.2 1.3 1.4 0.9 0.4 0.1 1.0 Share of Total Federal Tax Change 0.2 0.9 1.6 2.5 3.7 11.2 15.6 42.1 17.4 3.1 1.6 100.0 Average Federal Tax Change Dollars Percent -78 -185 -285 -369 -432 -665 -974 -1,603 -2,058 -2,160 -2,191 -1,017 53.9 48.4 -72.4 -17.5 -11.3 -7.8 -6.4 -4.9 -2.7 -1.2 -0.3 -3.5 Share of Federal Taxes Change (% Points) 0.0 0.0 -0.1 -0.1 -0.1 -0.2 -0.3 -0.4 0.2 0.2 0.8 0.0 Under the Proposal 0.0 -0.1 0.0 0.4 1.1 4.8 8.4 29.9 23.2 9.1 23.1 100.0 Average Federal Tax Rate5 Change (% Points) -1.4 -1.2 -1.1 -1.0 -1.0 -1.0 -1.1 -1.1 -0.7 -0.3 -0.1 -0.8 Under the Proposal -4.1 -3.6 0.4 4.9 7.5 12.3 16.2 21.5 25.0 24.8 28.4 21.2 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 1,412 2,711 3,358 3,936 4,904 9,775 9,326 15,280 4,920 831 416 57,183 Percent of Total 2.5 4.7 5.9 6.9 8.6 17.1 16.3 26.7 8.6 1.5 0.7 100.0 Pre-Tax Income Average (dollars) 5,472 15,812 25,426 35,482 45,674 64,093 87,934 145,189 300,780 704,723 3,104,064 131,340 Percent of Total 0.1 0.6 1.1 1.9 3.0 8.3 10.9 29.5 19.7 7.8 17.2 100.0 Federal Tax Burden Average (dollars) -145 -382 394 2,109 3,845 8,533 15,224 32,770 77,126 176,793 884,273 28,839 Percent of Total 0.0 -0.1 0.1 0.5 1.1 5.1 8.6 30.4 23.0 8.9 22.3 100.0 After-Tax Income 4 Average (dollars) 5,617 16,194 25,033 33,372 41,830 55,561 72,710 112,418 223,654 527,931 2,219,791 102,500 Percent of Total 0.1 0.8 1.4 2.2 3.5 9.3 11.6 29.3 18.8 7.5 15.8 100.0 Average Federal Tax Rate 5 -2.7 -2.4 1.6 5.9 8.4 13.3 17.3 22.6 25.6 25.1 28.5 22.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-3). * Less than 0.05 (1) Calendar year. Baseline is current law with the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal is H.R. 3630 which includes a full year extension of the payroll tax holiday where the OASDI tax rate is reduced two percentage points to 4.2% for the entire 2012 calendar year. Table captures effects of the additional ten month extension. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 17-Feb-12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12-0029 H.R. 3630: The Middle Class Tax Relief and Job Creation Act of 2012 Baseline: Current Law (Including Temporary Payroll Tax Cut Continuation Act of 2011) Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 75.6 82.4 91.0 92.5 91.0 92.2 90.9 95.8 92.9 93.5 82.9 87.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 1.0 1.1 1.3 1.4 1.5 1.6 1.6 1.5 0.7 0.3 0.1 1.3 Share of Total Federal Tax Change 2.5 9.5 14.9 16.0 14.0 20.0 11.8 9.0 1.9 0.3 0.1 100.0 Average Federal Tax Change Dollars -78 -180 -330 -454 -584 -816 -1,089 -1,492 -1,569 -1,422 -1,367 -431 Percent 8.3 12.1 282.6 -17.6 -9.8 -7.6 -6.1 -4.7 -2.1 -0.9 -0.2 -10.2 Share of Federal Taxes Change (% Points) -0.6 -2.0 -1.8 -0.8 0.1 0.8 0.9 1.2 0.8 0.4 1.0 0.0 Under the Proposal -3.7 -10.0 -2.3 8.5 14.6 27.5 20.6 20.7 10.1 4.1 9.8 100.0 Average Federal Tax Rate5 Change (% Points) -1.1 -1.2 -1.3 -1.3 -1.3 -1.3 -1.3 -1.1 -0.5 -0.2 -0.1 -1.2 Under the Proposal -14.8 -10.8 -1.8 6.0 11.9 15.8 19.4 22.5 24.5 24.0 29.4 10.3 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,397 5,620 4,820 3,780 2,556 2,617 1,162 643 131 24 10 24,826 Percent of Total 13.7 22.6 19.4 15.2 10.3 10.5 4.7 2.6 0.5 0.1 0.0 100.0 Pre-Tax Income Average (dollars) 6,878 15,507 25,513 35,084 45,194 62,439 85,840 134,826 294,742 678,200 3,014,509 36,919 Percent of Total 2.6 9.5 13.4 14.5 12.6 17.8 10.9 9.5 4.2 1.8 3.4 100.0 Federal Tax Burden Average (dollars) -937 -1,496 -117 2,574 5,945 10,706 17,723 31,803 73,823 164,344 886,194 4,216 Percent of Total -3.0 -8.0 -0.5 9.3 14.5 26.8 19.7 19.5 9.2 3.7 8.8 100.0 After-Tax Income 4 Average (dollars) 7,815 17,003 25,629 32,510 39,249 51,733 68,118 103,023 220,919 513,857 2,128,314 32,703 Percent of Total 3.3 11.8 15.2 15.1 12.4 16.7 9.8 8.2 3.6 1.5 2.7 100.0 Average Federal Tax Rate 5 -13.6 -9.7 -0.5 7.3 13.2 17.2 20.7 23.6 25.1 24.2 29.4 11.4 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-3). * Less than 0.05 (1) Calendar year. Baseline is current law with the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal is H.R. 3630 which includes a full year extension of the payroll tax holiday where the OASDI tax rate is reduced two percentage points to 4.2% for the entire 2012 calendar year. Table captures effects of the additional ten month extension. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 17-Feb-12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12-0029 H.R. 3630: The Middle Class Tax Relief and Job Creation Act of 2012 Baseline: Current Law (Including Temporary Payroll Tax Cut Continuation Act of 2011) Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 75.2 92.6 96.2 95.9 94.7 95.2 97.4 98.3 98.6 98.3 96.0 94.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 1.1 1.1 1.3 1.4 1.5 1.6 1.7 1.7 1.1 0.5 0.1 1.3 Share of Total Federal Tax Change 0.7 2.8 4.6 5.5 5.7 12.9 14.8 35.2 14.2 2.4 1.1 100.0 Average Federal Tax Change Dollars Percent -84 -207 -354 -481 -608 -866 -1,202 -1,856 -2,327 -2,492 -2,504 -910 6.8 8.6 35.8 -26.9 -12.6 -8.9 -7.4 -5.4 -2.9 -1.3 -0.3 -4.8 Share of Federal Taxes Change (% Points) -0.1 -0.2 -0.3 -0.2 -0.2 -0.3 -0.3 -0.2 0.5 0.3 0.9 0.0 Under the Proposal -0.6 -1.8 -0.9 0.8 2.0 6.7 9.3 30.8 23.8 9.0 20.8 100.0 Average Federal Tax Rate5 Change (% Points) -1.3 -1.3 -1.4 -1.4 -1.3 -1.4 -1.4 -1.3 -0.8 -0.4 -0.1 -1.0 Under the Proposal -20.5 -16.6 -5.3 3.7 9.3 14.0 17.2 22.2 25.9 26.1 29.6 19.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 3,846 5,948 5,713 5,081 4,169 6,587 5,463 8,400 2,702 430 199 48,707 7.9 12.2 11.7 10.4 8.6 13.5 11.2 17.3 5.6 0.9 0.4 100.0 Pre-Tax Income Average (dollars) 6,428 15,742 25,506 35,137 45,275 63,896 87,562 145,248 300,076 708,894 3,113,066 91,956 Percent of Total 0.6 2.1 3.3 4.0 4.2 9.4 10.7 27.2 18.1 6.8 13.8 100.0 Federal Tax Burden Average (dollars) -1,234 -2,408 -990 1,790 4,815 9,778 16,226 34,108 79,970 187,596 924,690 18,996 Percent of Total -0.5 -1.6 -0.6 1.0 2.2 7.0 9.6 31.0 23.4 8.7 19.9 100.0 After-Tax Income 4 Average (dollars) 7,662 18,149 26,496 33,348 40,460 54,118 71,336 111,140 220,106 521,299 2,188,376 72,959 Percent of Total 0.8 3.0 4.3 4.8 4.8 10.0 11.0 26.3 16.7 6.3 12.3 100.0 Average Federal Tax Rate 5 -19.2 -15.3 -3.9 5.1 10.6 15.3 18.5 23.5 26.7 26.5 29.7 20.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-3). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law with the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal is H.R. 3630 which includes a full year extension of the payroll tax holiday where the OASDI tax rate is reduced two percentage points to 4.2% for the entire 2012 calendar year. Table captures effects of the additional ten month extension. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 17-Feb-12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12-0029 H.R. 3630: The Middle Class Tax Relief and Job Creation Act of 2012 Baseline: Current Law (Including Temporary Payroll Tax Cut Continuation Act of 2011) Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 4.0 5.2 20.6 31.3 41.8 49.0 51.4 54.4 62.5 56.8 65.6 29.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 0.0 0.0 0.1 0.2 0.3 0.3 0.4 0.4 0.3 0.1 0.0 0.3 Share of Total Federal Tax Change 0.1 0.8 2.3 4.3 6.2 16.9 15.5 32.2 16.1 3.3 2.3 100.0 Average Federal Tax Change Dollars -2 -5 -24 -60 -110 -186 -271 -469 -716 -748 -982 -144 Percent -4.6 -3.9 -4.1 -3.7 -4.3 -3.2 -2.4 -1.8 -1.0 -0.5 -0.1 -1.3 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.1 -0.1 0.1 0.1 0.3 0.0 Under the Proposal 0.0 0.3 0.7 1.5 1.8 6.8 8.4 22.5 20.4 9.2 28.5 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 -0.1 -0.2 -0.2 -0.3 -0.3 -0.3 -0.2 -0.1 0.0 -0.2 Under the Proposal 0.7 0.8 2.3 4.4 5.3 9.2 12.8 17.5 22.7 23.3 29.3 15.9 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 3,154 8,698 4,924 3,727 2,930 4,733 2,996 3,598 1,179 229 122 36,319 8.7 24.0 13.6 10.3 8.1 13.0 8.3 9.9 3.3 0.6 0.3 100.0 Pre-Tax Income Average (dollars) 6,651 14,806 24,706 35,197 45,938 62,567 87,118 142,540 304,739 685,254 3,174,793 69,121 Percent of Total 0.8 5.1 4.9 5.2 5.4 11.8 10.4 20.4 14.3 6.3 15.5 100.0 Federal Tax Burden Average (dollars) 50 119 595 1,608 2,556 5,917 11,436 25,424 69,818 160,083 930,423 11,131 Percent of Total 0.0 0.3 0.7 1.5 1.9 6.9 8.5 22.6 20.4 9.1 28.1 100.0 After-Tax Income 4 Average (dollars) 6,600 14,687 24,111 33,589 43,382 56,650 75,682 117,116 234,922 525,171 2,244,370 57,991 Percent of Total 1.0 6.1 5.6 5.9 6.0 12.7 10.8 20.0 13.2 5.7 13.0 100.0 Average Federal Tax Rate 5 0.8 0.8 2.4 4.6 5.6 9.5 13.1 17.8 22.9 23.4 29.3 16.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-3). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law with the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal is H.R. 3630 which includes a full year extension of the payroll tax holiday where the OASDI tax rate is reduced two percentage points to 4.2% for the entire 2012 calendar year. Table captures effects of the additional ten month extension. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.