29-May-09 PRELIMINARY RESULTS Less than 10 10-20

advertisement

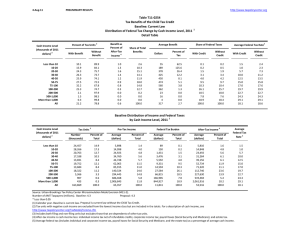

29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0300 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2012 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 66.9 65.4 75.1 81.8 84.6 87.1 89.2 80.4 35.4 19.5 14.5 75.7 With Tax Increase 0.0 0.5 0.4 0.6 0.3 0.1 0.0 0.0 0.0 0.0 0.0 0.2 Percent Change in After-Tax Income 4 4.7 2.6 2.3 2.1 1.7 1.4 1.1 0.7 0.1 0.1 0.0 1.0 Share of Total Federal Tax Change 4.9 10.3 12.8 11.9 9.6 18.1 12.4 17.9 1.6 0.3 0.2 100.0 Average Federal Tax Change ($) -255 -376 -535 -650 -660 -702 -760 -762 -240 -232 -269 -562 Average Federal Tax Rate 5 Change (% Points) -4.5 -2.4 -2.1 -1.8 -1.4 -1.1 -0.9 -0.5 -0.1 0.0 0.0 -0.7 Under the Proposal 1.0 3.0 8.7 13.1 15.9 18.4 20.6 23.9 26.9 28.4 33.8 22.6 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 17.7 (1) Calendar year. Baseline is current law. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0300 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 66.9 65.4 75.1 81.8 84.6 87.1 89.2 80.4 35.4 19.5 14.5 75.7 0.0 0.5 0.4 0.6 0.3 0.1 0.0 0.0 0.0 0.0 0.0 0.2 Percent Change in After-Tax Income 4 4.7 2.6 2.3 2.1 1.7 1.4 1.1 0.7 0.1 0.1 0.0 1.0 Share of Total Federal Tax Change 4.9 10.3 12.8 11.9 9.6 18.1 12.4 17.9 1.6 0.3 0.2 100.0 Average Federal Tax Change Dollars -255 -376 -535 -650 -660 -702 -760 -762 -240 -232 -269 -562 Percent -82.5 -45.1 -19.4 -12.1 -8.2 -5.7 -3.9 -2.2 -0.3 -0.1 0.0 -3.2 Share of Federal Taxes Change (% Points) -0.2 -0.3 -0.4 -0.3 -0.2 -0.3 -0.1 0.3 0.5 0.2 0.7 0.0 Under the Proposal 0.0 0.4 1.7 2.8 3.5 9.8 9.9 25.8 17.5 7.8 20.7 100.0 Average Federal Tax Rate5 Change (% Points) -4.5 -2.4 -2.1 -1.8 -1.4 -1.1 -0.9 -0.5 -0.1 0.0 0.0 -0.7 Under the Proposal 1.0 3.0 8.7 13.1 15.9 18.4 20.6 23.9 26.9 28.4 33.8 22.6 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,867 24,202 21,129 16,119 12,811 22,730 14,433 20,762 5,989 1,052 533 157,348 Percent of Total 10.7 15.4 13.4 10.2 8.1 14.5 9.2 13.2 3.8 0.7 0.3 100.0 Average Income (Dollars) 5,698 15,471 25,711 36,076 46,449 63,828 89,794 140,646 294,838 703,124 3,105,866 76,169 Average Federal Tax Burden (Dollars) 310 834 2,761 5,370 8,034 12,414 19,270 34,422 79,626 200,119 1,050,659 17,790 Average AfterTax Income 4 (Dollars) 5,388 14,637 22,949 30,706 38,416 51,415 70,524 106,224 215,213 503,005 2,055,206 58,378 Average Federal Tax Rate 5 5.4 5.4 10.7 14.9 17.3 19.5 21.5 24.5 27.0 28.5 33.8 23.4 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 3.1 4.5 4.9 5.0 12.1 10.8 24.4 14.7 6.2 13.8 100.0 1.0 3.9 5.3 5.4 5.4 12.7 11.1 24.0 14.0 5.8 11.9 100.0 0.2 0.7 2.1 3.1 3.7 10.1 9.9 25.5 17.0 7.5 20.0 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 17.7 (1) Calendar year. Baseline is current law. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0300 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 66.6 56.8 70.3 80.7 83.9 84.5 83.4 31.2 9.7 10.1 4.8 68.5 0.0 0.7 0.2 0.1 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.2 Percent Change in After-Tax Income 4 4.8 2.0 1.7 1.6 1.2 0.9 0.6 0.1 0.0 0.0 0.0 1.0 Share of Total Federal Tax Change 13.0 17.9 18.1 15.2 10.9 16.6 6.0 1.8 0.3 0.1 0.0 100.0 Average Federal Tax Change Dollars -249 -281 -374 -466 -426 -439 -382 -122 -81 -81 -76 -337 Percent -51.6 -20.1 -10.1 -7.0 -4.5 -3.0 -1.7 -0.3 -0.1 0.0 0.0 -3.4 Share of Federal Taxes Change (% Points) -0.4 -0.5 -0.4 -0.3 -0.1 0.1 0.2 0.6 0.3 0.2 0.4 0.0 Under the Proposal 0.4 2.5 5.6 7.0 8.1 18.5 12.2 18.9 10.2 4.5 12.2 100.0 Average Federal Tax Rate5 Change (% Points) -4.4 -1.8 -1.5 -1.3 -0.9 -0.7 -0.4 -0.1 0.0 0.0 0.0 -0.8 Under the Proposal 4.1 7.3 13.0 17.2 19.6 22.3 25.3 27.0 29.0 31.6 36.7 22.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 12,093 14,849 11,214 7,581 5,967 8,814 3,630 3,425 789 138 75 68,932 17.5 21.5 16.3 11.0 8.7 12.8 5.3 5.0 1.1 0.2 0.1 100.0 Average Income (Dollars) 5,684 15,322 25,573 36,006 46,386 62,955 88,784 136,925 299,674 695,858 2,961,621 43,878 Average Federal Tax Burden (Dollars) 483 1,400 3,710 6,645 9,506 14,498 22,839 37,103 86,825 220,104 1,085,900 10,073 Average AfterTax Income 4 (Dollars) 5,201 13,922 21,863 29,360 36,879 48,457 65,945 99,822 212,849 475,753 1,875,721 33,804 Average Federal Tax Rate 5 8.5 9.1 14.5 18.5 20.5 23.0 25.7 27.1 29.0 31.6 36.7 23.0 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.3 7.5 9.5 9.0 9.2 18.4 10.7 15.5 7.8 3.2 7.4 100.0 2.7 8.9 10.5 9.6 9.4 18.3 10.3 14.7 7.2 2.8 6.1 100.0 0.8 3.0 6.0 7.3 8.2 18.4 11.9 18.3 9.9 4.4 11.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). (1) Calendar year. Baseline is current law. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0300 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 50.1 66.2 67.0 69.9 77.3 85.7 90.3 93.2 40.5 21.2 16.5 77.5 0.0 0.0 0.3 1.9 0.8 0.2 0.1 0.0 0.0 0.0 0.0 0.3 Percent Change in After-Tax Income 4 5.0 3.8 3.7 3.0 2.6 1.8 1.3 0.9 0.1 0.1 0.0 0.9 Share of Total Federal Tax Change 1.0 4.7 8.4 8.6 8.3 18.5 17.1 29.9 2.6 0.5 0.3 100.0 Average Federal Tax Change Dollars Percent -225 -592 -882 -989 -1,045 -957 -952 -933 -267 -261 -311 -830 -89.0 -106.7 -49.1 -26.8 -17.7 -9.2 -5.4 -2.8 -0.3 -0.1 0.0 -2.7 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.2 -0.2 -0.2 -0.4 -0.2 0.0 0.5 0.2 0.7 0.0 Under the Proposal 0.0 0.0 0.2 0.7 1.1 5.1 8.3 29.3 21.4 9.5 24.4 100.0 Average Federal Tax Rate5 Change (% Points) -4.7 -3.7 -3.4 -2.7 -2.2 -1.5 -1.1 -0.7 -0.1 0.0 0.0 -0.7 Under the Proposal 0.6 -0.2 3.5 7.5 10.4 14.6 18.5 23.2 26.6 28.0 33.3 23.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,164 4,064 4,828 4,406 4,057 9,840 9,114 16,285 4,998 880 437 61,357 3.5 6.6 7.9 7.2 6.6 16.0 14.9 26.5 8.2 1.4 0.7 100.0 Average Income (Dollars) 4,748 15,973 25,857 36,192 46,612 64,984 90,400 141,926 294,061 704,704 3,067,872 126,020 Average Federal Tax Burden (Dollars) 253 555 1,795 3,696 5,909 10,462 17,634 33,901 78,523 197,246 1,022,576 30,683 Average AfterTax Income 4 (Dollars) 4,495 15,418 24,062 32,495 40,704 54,522 72,767 108,025 215,538 507,457 2,045,296 95,337 Average Federal Tax Rate 5 5.3 3.5 6.9 10.2 12.7 16.1 19.5 23.9 26.7 28.0 33.3 24.4 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.8 1.6 2.1 2.5 8.3 10.7 29.9 19.0 8.0 17.3 100.0 0.2 1.1 2.0 2.5 2.8 9.2 11.3 30.1 18.4 7.6 15.3 100.0 0.0 0.1 0.5 0.9 1.3 5.5 8.5 29.3 20.9 9.2 23.7 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). (1) Calendar year. Baseline is current law. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0300 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 82.8 89.1 93.3 96.4 96.6 96.6 96.6 41.6 11.1 15.2 5.5 90.3 0.0 0.0 1.0 0.2 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.2 Percent Change in After-Tax Income 4 4.4 3.0 2.3 2.0 1.6 1.4 0.8 0.2 0.1 0.0 0.0 1.6 Share of Total Federal Tax Change 5.9 18.1 20.3 18.2 11.4 18.5 6.1 1.3 0.2 0.0 0.0 100.0 Average Federal Tax Change Dollars -315 -482 -567 -640 -621 -687 -577 -192 -216 -112 -95 -542 Percent 61.9 67.3 -42.0 -14.0 -8.1 -5.6 -2.9 -0.6 -0.3 -0.1 0.0 -8.0 Share of Federal Taxes Change (% Points) -0.6 -1.8 -1.4 -0.7 0.0 0.7 1.0 1.4 0.6 0.2 0.6 0.0 Under the Proposal -1.3 -3.9 2.4 9.7 11.3 27.1 17.9 19.3 7.4 2.9 7.3 100.0 Average Federal Tax Rate5 Change (% Points) -4.8 -3.1 -2.2 -1.8 -1.3 -1.1 -0.7 -0.1 -0.1 0.0 0.0 -1.3 Under the Proposal -12.5 -7.7 3.0 10.9 15.2 18.4 21.9 24.8 25.7 26.7 34.1 14.9 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,467 4,998 4,757 3,777 2,442 3,577 1,399 895 150 24 11 24,547 10.1 20.4 19.4 15.4 10.0 14.6 5.7 3.7 0.6 0.1 0.0 100.0 Average Income (Dollars) 6,622 15,513 25,869 36,040 46,392 62,829 88,811 132,422 294,067 684,765 2,969,130 41,760 Average Federal Tax Burden (Dollars) -509 -717 1,351 4,562 7,663 12,250 20,042 33,071 75,703 182,588 1,013,529 6,757 Average AfterTax Income 4 (Dollars) 7,131 16,230 24,518 31,478 38,730 50,579 68,768 99,351 218,363 502,177 1,955,600 35,003 Average Federal Tax Rate 5 -7.7 -4.6 5.2 12.7 16.5 19.5 22.6 25.0 25.7 26.7 34.1 16.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.6 7.6 12.0 13.3 11.1 21.9 12.1 11.6 4.3 1.6 3.2 100.0 2.1 9.4 13.6 13.8 11.0 21.1 11.2 10.4 3.8 1.4 2.5 100.0 -0.8 -2.2 3.9 10.4 11.3 26.4 16.9 17.8 6.9 2.6 6.7 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). (1) Calendar year. Baseline is current law. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0300 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 83.1 96.4 97.6 98.6 98.7 98.8 98.9 94.7 39.4 18.6 14.1 92.1 0.0 0.0 0.4 0.1 0.0 0.0 0.0 0.1 0.0 0.0 0.0 0.1 Percent Change in After-Tax Income 4 5.1 3.7 3.8 3.4 2.8 2.0 1.5 1.0 0.1 0.1 0.0 1.2 Share of Total Federal Tax Change 2.3 8.0 12.2 12.1 9.7 17.2 13.8 22.1 1.9 0.3 0.2 100.0 Average Federal Tax Change Dollars Percent -350 -632 -944 -1,089 -1,114 -1,027 -1,047 -1,040 -306 -277 -329 -898 49.8 50.3 -108.7 -26.1 -15.2 -8.7 -5.5 -3.0 -0.4 -0.1 0.0 -4.0 Share of Federal Taxes Change (% Points) -0.1 -0.4 -0.5 -0.4 -0.3 -0.4 -0.2 0.3 0.8 0.3 0.8 0.0 Under the Proposal -0.3 -1.0 0.0 1.4 2.3 7.6 9.8 29.5 20.8 8.8 21.0 100.0 Average Federal Tax Rate5 Change (% Points) -5.6 -4.0 -3.7 -3.0 -2.4 -1.6 -1.2 -0.7 -0.1 0.0 0.0 -0.9 Under the Proposal -16.9 -12.0 -0.3 8.6 13.4 16.8 19.7 23.5 27.1 29.6 34.7 22.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,948 5,596 5,687 4,892 3,846 7,413 5,821 9,378 2,778 445 207 49,155 6.0 11.4 11.6 10.0 7.8 15.1 11.8 19.1 5.7 0.9 0.4 100.0 Average Income (Dollars) 6,225 15,695 25,809 36,039 46,542 64,136 90,376 141,540 292,361 702,705 3,097,146 95,419 Average Federal Tax Burden (Dollars) -702 -1,257 868 4,173 7,336 11,798 18,883 34,321 79,483 208,478 1,074,354 22,395 Average AfterTax Income 4 (Dollars) 6,927 16,952 24,941 31,866 39,205 52,338 71,492 107,220 212,878 494,227 2,022,791 73,024 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -11.3 -8.0 3.4 11.6 15.8 18.4 20.9 24.3 27.2 29.7 34.7 23.5 0.4 1.9 3.1 3.8 3.8 10.1 11.2 28.3 17.3 6.7 13.7 100.0 0.6 2.6 4.0 4.3 4.2 10.8 11.6 28.0 16.5 6.1 11.7 100.0 -0.2 -0.6 0.5 1.9 2.6 7.9 10.0 29.2 20.1 8.4 20.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0300 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 15.6 14.1 23.2 27.5 29.8 44.2 47.9 43.3 23.4 17.2 12.4 28.6 0.0 0.1 0.0 0.3 0.0 0.2 0.0 0.0 0.0 0.0 0.0 0.1 Percent Change in After-Tax Income 4 0.8 0.4 0.5 0.4 0.4 0.5 0.4 0.3 0.1 0.0 0.0 0.3 Share of Total Federal Tax Change 2.1 7.6 11.4 8.4 7.4 24.7 16.1 17.9 2.9 0.7 0.7 100.0 Average Federal Tax Change Dollars -48 -61 -115 -142 -168 -288 -330 -304 -131 -155 -253 -168 Percent -23.8 -14.2 -8.9 -5.8 -4.4 -3.8 -2.4 -1.0 -0.2 -0.1 0.0 -1.1 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.1 -0.1 -0.2 -0.1 0.0 0.2 0.1 0.3 0.0 Under the Proposal 0.1 0.5 1.3 1.5 1.8 7.1 7.4 19.5 19.6 10.6 30.6 100.0 Average Federal Tax Rate5 Change (% Points) -0.8 -0.4 -0.5 -0.4 -0.4 -0.5 -0.4 -0.2 0.0 0.0 0.0 -0.2 Under the Proposal 2.4 2.4 4.7 6.5 7.9 11.4 15.3 21.0 26.2 27.8 34.3 19.8 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,290 6,436 5,081 3,028 2,243 4,407 2,503 3,022 1,130 246 132 30,543 7.5 21.1 16.6 9.9 7.3 14.4 8.2 9.9 3.7 0.8 0.4 100.0 Average Income (Dollars) 6,340 15,603 25,455 35,926 46,389 64,259 88,731 141,022 303,653 708,629 3,089,249 75,737 Average Federal Tax Burden (Dollars) 200 430 1,301 2,459 3,849 7,632 13,877 29,872 79,640 197,347 1,059,059 15,182 Average AfterTax Income 4 (Dollars) 6,140 15,173 24,154 33,467 42,540 56,627 74,854 111,151 224,013 511,283 2,030,190 60,555 Average Federal Tax Rate 5 3.2 2.8 5.1 6.8 8.3 11.9 15.6 21.2 26.2 27.9 34.3 20.1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.6 4.3 5.6 4.7 4.5 12.2 9.6 18.4 14.8 7.5 17.7 100.0 0.8 5.3 6.6 5.5 5.2 13.5 10.1 18.2 13.7 6.8 14.5 100.0 0.1 0.6 1.4 1.6 1.9 7.3 7.5 19.5 19.4 10.5 30.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.