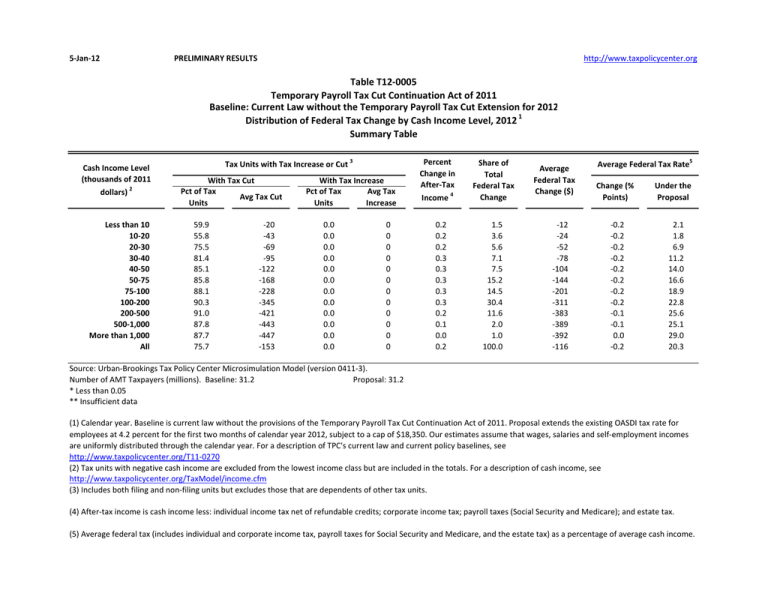

Table T12‐0005 Temporary Payroll Tax Cut Continuation Act of 2011 Baseline: Current Law without the Temporary Payroll Tax Cut Extension for 2012

advertisement

5‐Jan‐12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12‐0005 Temporary Payroll Tax Cut Continuation Act of 2011 Baseline: Current Law without the Temporary Payroll Tax Cut Extension for 2012 Distribution of Federal Tax Change by Cash Income Level, 2012 1 Summary Table Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units with Tax Increase or Cut 3 With Tax Cut Pct of Tax Avg Tax Cut Units 59.9 55.8 75.5 81.4 85.1 85.8 88.1 90.3 91.0 87.8 87.7 75.7 ‐20 ‐43 ‐69 ‐95 ‐122 ‐168 ‐228 ‐345 ‐421 ‐443 ‐447 ‐153 With Tax Increase Avg Tax Pct of Tax Units Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0 0 0 0 0 0 0 0 0 0 0 0 Percent Change in After‐Tax Income 4 Share of Total Federal Tax Change 0.2 0.2 0.2 0.3 0.3 0.3 0.3 0.3 0.2 0.1 0.0 0.2 1.5 3.6 5.6 7.1 7.5 15.2 14.5 30.4 11.6 2.0 1.0 100.0 Average Federal Tax Change ($) ‐12 ‐24 ‐52 ‐78 ‐104 ‐144 ‐201 ‐311 ‐383 ‐389 ‐392 ‐116 Average Federal Tax Rate5 Change (% Points) Under the Proposal ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.1 ‐0.1 0.0 ‐0.2 2.1 1.8 6.9 11.2 14.0 16.6 18.9 22.8 25.6 25.1 29.0 20.3 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐3). Number of AMT Taxpayers (millions). Baseline: 31.2 Proposal: 31.2 * Less than 0.05 ** Insufficient data (1) Calendar year. Baseline is current law without the provisions of the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal extends the existing OASDI tax rate for employees at 4.2 percent for the first two months of calendar year 2012, subject to a cap of $18,350. Our estimates assume that wages, salaries and self‐employment incomes are uniformly distributed through the calendar year. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 5‐Jan‐12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12‐0005 Temporary Payroll Tax Cut Continuation Act of 2011 Baseline: Current Law without the Temporary Payroll Tax Cut Extension for 2012 Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 59.9 55.8 75.5 81.4 85.1 85.8 88.1 90.3 91.0 87.8 87.7 75.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 Share of Total Federal Tax Change 0.2 0.2 0.2 0.3 0.3 0.3 0.3 0.3 0.2 0.1 0.0 0.2 1.5 3.6 5.6 7.1 7.5 15.2 14.5 30.4 11.6 2.0 1.0 100.0 Average Federal Tax Change Dollars ‐12 ‐24 ‐52 ‐78 ‐104 ‐144 ‐201 ‐311 ‐383 ‐389 ‐392 ‐116 Percent ‐8.4 ‐8.1 ‐2.9 ‐1.9 ‐1.6 ‐1.4 ‐1.2 ‐0.9 ‐0.5 ‐0.2 0.0 ‐0.8 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 ‐0.1 0.0 0.0 0.1 0.0 0.2 0.0 Under the Proposal 0.1 0.3 1.5 3.0 3.7 9.0 9.7 26.1 19.1 7.5 19.8 100.0 Average Federal Tax Rate5 Change (% Points) ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.1 ‐0.1 0.0 ‐0.2 Under the Proposal 2.1 1.8 6.9 11.2 14.0 16.6 18.9 22.8 25.6 25.1 29.0 20.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 23,654 28,341 20,820 17,491 13,844 20,187 13,838 18,707 5,808 1,003 503 165,201 Pre‐Tax Income Federal Tax Burden Percent of Total Average (dollars) Percent of Total 14.3 17.2 12.6 10.6 8.4 12.2 8.4 11.3 3.5 0.6 0.3 100.0 6,045 15,232 25,240 35,253 45,338 63,169 87,271 143,999 301,476 700,511 3,175,826 69,939 1.2 3.7 4.6 5.3 5.4 11.0 10.5 23.3 15.2 6.1 13.8 100.0 Average (dollars) 141 296 1,793 4,038 6,430 10,643 16,716 33,104 77,674 176,426 922,169 14,336 After‐Tax Income 4 Percent of Total Average (dollars) Percent of Total 0.1 0.4 1.6 3.0 3.8 9.1 9.8 26.2 19.1 7.5 19.6 100.0 5,904 14,936 23,447 31,215 38,909 52,526 70,555 110,895 223,802 524,085 2,253,657 55,604 1.5 4.6 5.3 5.9 5.9 11.5 10.6 22.6 14.2 5.7 12.4 100.0 Average Federal Tax Rate 5 2.3 1.9 7.1 11.5 14.2 16.9 19.2 23.0 25.8 25.2 29.0 20.5 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐3). Number of AMT Taxpayers (millions). Baseline: 31.2 Proposal: 31.2 * Less than 0.05 (1) Calendar year. Baseline is current law without the provisions of the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal extends the existing OASDI tax rate for employees at 4.2 percent for the first two months of calendar year 2012, subject to a cap of $18,350. Our estimates assume that wages, salaries and self‐employment incomes are uniformly distributed through the calendar year. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 5‐Jan‐12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12‐0005 Temporary Payroll Tax Cut Continuation Act of 2011 Baseline: Current Law without the Temporary Payroll Tax Cut Extension for 2012 Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table ‐ Single Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 56.3 43.9 66.4 75.4 84.6 83.5 83.7 79.4 72.4 67.7 66.8 63.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 Share of Total Federal Tax Change 0.2 0.1 0.2 0.2 0.3 0.3 0.3 0.2 0.1 0.0 0.0 0.2 4.1 7.4 11.0 13.7 13.2 21.5 12.3 12.9 3.2 0.5 0.3 100.0 Average Federal Tax Change Dollars ‐11 ‐18 ‐44 ‐72 ‐108 ‐143 ‐192 ‐238 ‐216 ‐191 ‐201 ‐61 Share of Federal Taxes Percent Change (% Points) ‐3.1 ‐2.1 ‐1.6 ‐1.4 ‐1.3 ‐1.1 ‐1.0 ‐0.7 ‐0.3 ‐0.1 0.0 ‐0.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.1 0.0 Under the Proposal 1.2 3.0 6.2 8.8 9.2 17.3 11.3 16.0 10.3 4.4 12.3 100.0 Average Federal Tax Rate5 Change (% Points) ‐0.2 ‐0.1 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.1 0.0 0.0 ‐0.2 Under the Proposal 5.7 5.6 11.1 14.7 18.5 20.7 22.9 23.7 25.7 25.5 32.2 18.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 18,677 19,704 12,248 9,316 6,007 7,366 3,136 2,656 714 138 67 80,620 Pre‐Tax Income Percent of Total Average (dollars) 23.2 24.4 15.2 11.6 7.5 9.1 3.9 3.3 0.9 0.2 0.1 100.0 5,934 15,064 25,068 35,203 45,161 62,176 86,024 139,722 307,687 678,159 3,141,069 36,344 Federal Tax Burden Percent of Total 3.8 10.1 10.5 11.2 9.3 15.6 9.2 12.7 7.5 3.2 7.2 100.0 After‐Tax Income 4 Average (dollars) Percent of Total Average (dollars) Percent of Total 350 856 2,814 5,262 8,472 13,002 19,909 33,323 79,219 172,818 1,011,418 6,859 1.2 3.1 6.2 8.9 9.2 17.3 11.3 16.0 10.2 4.3 12.2 100.0 5,584 14,208 22,254 29,940 36,689 49,173 66,115 106,399 228,467 505,341 2,129,652 29,486 4.4 11.8 11.5 11.7 9.3 15.2 8.7 11.9 6.9 2.9 6.0 100.0 Average Federal Tax Rate 5 5.9 5.7 11.2 15.0 18.8 20.9 23.1 23.9 25.8 25.5 32.2 18.9 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐3). * Less than 0.05 (1) Calendar year. Baseline is current law without the provisions of the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal extends the existing OASDI tax rate for employees at 4.2 percent for the first two months of calendar year 2012, subject to a cap of $18,350. Our estimates assume that wages, salaries and self‐employment incomes are uniformly distributed through the calendar year. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 5‐Jan‐12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12‐0005 Temporary Payroll Tax Cut Continuation Act of 2011 Baseline: Current Law without the Temporary Payroll Tax Cut Extension for 2012 Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table ‐ Married Tax Units Filing Jointly Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 62.7 77.5 80.4 80.5 79.7 84.5 88.8 92.0 93.7 91.0 91.4 86.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 Share of Total Federal Tax Change 0.3 0.2 0.2 0.2 0.2 0.3 0.3 0.3 0.2 0.1 0.0 0.2 0.2 0.9 1.6 2.5 3.7 11.4 15.9 42.1 17.1 3.0 1.5 100.0 Average Federal Tax Change Dollars ‐16 ‐38 ‐57 ‐75 ‐89 ‐138 ‐201 ‐325 ‐411 ‐426 ‐429 ‐207 Share of Federal Taxes Percent Change (% Points) 12.4 10.9 ‐12.8 ‐3.4 ‐2.3 ‐1.6 ‐1.3 ‐1.0 ‐0.5 ‐0.2 ‐0.1 ‐0.7 0.0 0.0 0.0 0.0 0.0 ‐0.1 ‐0.1 ‐0.1 0.0 0.0 0.2 0.0 Under the Proposal 0.0 ‐0.1 0.1 0.5 1.1 5.1 8.6 30.4 23.0 8.9 22.3 100.0 Average Federal Tax Rate5 Change (% Points) ‐0.3 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.2 ‐0.1 ‐0.1 0.0 ‐0.2 Under the Proposal ‐2.7 ‐2.4 1.5 5.9 8.4 13.3 17.3 22.6 25.6 25.1 28.5 22.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 1,412 2,711 3,358 3,936 4,904 9,775 9,326 15,280 4,920 831 416 57,183 Pre‐Tax Income Percent of Total Average (dollars) 2.5 4.7 5.9 6.9 8.6 17.1 16.3 26.7 8.6 1.5 0.7 100.0 5,472 15,812 25,426 35,482 45,674 64,093 87,934 145,189 300,780 704,723 3,104,064 131,340 Federal Tax Burden Percent of Total 0.1 0.6 1.1 1.9 3.0 8.3 10.9 29.5 19.7 7.8 17.2 100.0 Average (dollars) ‐130 ‐346 449 2,181 3,929 8,663 15,415 33,083 77,525 177,210 884,696 29,038 After‐Tax Income 4 Percent of Total Average (dollars) Percent of Total 0.0 ‐0.1 0.1 0.5 1.2 5.1 8.7 30.4 23.0 8.9 22.2 100.0 5,602 16,158 24,977 33,300 41,745 55,430 72,519 112,106 223,256 527,513 2,219,368 102,302 0.1 0.8 1.4 2.2 3.5 9.3 11.6 29.3 18.8 7.5 15.8 100.0 Average Federal Tax Rate 5 ‐2.4 ‐2.2 1.8 6.2 8.6 13.5 17.5 22.8 25.8 25.2 28.5 22.1 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐3). * Less than 0.05 (1) Calendar year. Baseline is current law without the provisions of the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal extends the existing OASDI tax rate for employees at 4.2 percent for the first two months of calendar year 2012, subject to a cap of $18,350. Our estimates assume that wages, salaries and self‐employment incomes are uniformly distributed through the calendar year. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 5‐Jan‐12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12‐0005 Temporary Payroll Tax Cut Continuation Act of 2011 Baseline: Current Law without the Temporary Payroll Tax Cut Extension for 2012 Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table ‐ Head of Household Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 77.5 85.1 93.8 95.9 95.2 96.0 94.5 96.4 94.5 93.7 83.4 90.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 Share of Total Federal Tax Change 0.2 0.2 0.3 0.3 0.3 0.3 0.3 0.3 0.1 0.1 0.0 0.3 2.5 9.5 14.8 16.1 14.1 20.2 11.8 8.7 1.8 0.3 0.1 100.0 Average Federal Tax Change Dollars ‐16 ‐37 ‐67 ‐93 ‐121 ‐168 ‐222 ‐295 ‐307 ‐275 ‐266 ‐88 Share of Federal Taxes Percent Change (% Points) 1.7 2.5 128.9 ‐3.5 ‐2.0 ‐1.6 ‐1.2 ‐0.9 ‐0.4 ‐0.2 0.0 ‐2.0 ‐0.1 ‐0.4 ‐0.3 ‐0.1 0.0 0.1 0.2 0.2 0.2 0.1 0.2 0.0 Under the Proposal ‐3.0 ‐8.1 ‐0.6 9.3 14.5 26.8 19.7 19.6 9.2 3.7 8.8 100.0 Average Federal Tax Rate5 Change (% Points) ‐0.2 ‐0.2 ‐0.3 ‐0.3 ‐0.3 ‐0.3 ‐0.3 ‐0.2 ‐0.1 0.0 0.0 ‐0.2 Under the Proposal ‐13.6 ‐9.7 ‐0.5 7.3 13.1 17.1 20.6 23.6 25.1 24.2 29.4 11.4 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,397 5,620 4,820 3,780 2,556 2,617 1,162 643 131 24 10 24,826 Pre‐Tax Income Percent of Total Average (dollars) 13.7 22.6 19.4 15.2 10.3 10.5 4.7 2.6 0.5 0.1 0.0 100.0 6,878 15,507 25,513 35,084 45,194 62,439 85,840 134,826 294,742 678,200 3,014,509 36,919 Federal Tax Burden Percent of Total 2.6 9.5 13.4 14.5 12.6 17.8 10.9 9.5 4.2 1.8 3.4 100.0 Average (dollars) ‐922 ‐1,461 ‐52 2,663 6,059 10,866 17,936 32,093 74,125 164,618 886,458 4,301 After‐Tax Income 4 Percent of Total Average (dollars) Percent of Total ‐2.9 ‐7.7 ‐0.2 9.4 14.5 26.6 19.5 19.3 9.1 3.7 8.7 100.0 7,799 16,968 25,565 32,421 39,135 51,573 67,904 102,733 220,617 513,582 2,128,051 32,618 3.3 11.8 15.2 15.1 12.4 16.7 9.7 8.2 3.6 1.5 2.7 100.0 Average Federal Tax Rate 5 ‐13.4 ‐9.4 ‐0.2 7.6 13.4 17.4 20.9 23.8 25.2 24.3 29.4 11.7 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐3). * Less than 0.05 (1) Calendar year. Baseline is current law without the provisions of the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal extends the existing OASDI tax rate for employees at 4.2 percent for the first two months of calendar year 2012, subject to a cap of $18,350. Our estimates assume that wages, salaries and self‐employment incomes are uniformly distributed through the calendar year. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 5‐Jan‐12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12‐0005 Temporary Payroll Tax Cut Continuation Act of 2011 Baseline: Current Law without the Temporary Payroll Tax Cut Extension for 2012 Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table ‐ Tax Units with Children Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 77.4 95.1 98.4 98.7 98.2 98.4 98.9 99.2 99.1 98.4 96.1 96.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 Share of Total Federal Tax Change 0.2 0.2 0.3 0.3 0.3 0.3 0.4 0.3 0.2 0.1 0.0 0.3 0.7 2.8 4.5 5.5 5.8 13.2 15.0 35.1 13.9 2.3 1.1 100.0 Average Federal Tax Change Dollars ‐17 ‐42 ‐72 ‐98 ‐126 ‐180 ‐247 ‐376 ‐464 ‐489 ‐489 ‐185 Percent 1.4 1.8 7.8 ‐5.2 ‐2.6 ‐1.8 ‐1.5 ‐1.1 ‐0.6 ‐0.3 ‐0.1 ‐1.0 Share of Federal Taxes Change (% Points) 0.0 0.0 ‐0.1 0.0 0.0 ‐0.1 ‐0.1 0.0 0.1 0.1 0.2 0.0 Under the Proposal ‐0.5 ‐1.6 ‐0.6 1.0 2.2 7.0 9.6 31.0 23.4 8.7 19.9 100.0 Average Federal Tax Rate5 Change (% Points) ‐0.3 ‐0.3 ‐0.3 ‐0.3 ‐0.3 ‐0.3 ‐0.3 ‐0.3 ‐0.2 ‐0.1 0.0 ‐0.2 Under the Proposal ‐19.2 ‐15.3 ‐3.9 5.1 10.6 15.3 18.5 23.5 26.7 26.5 29.7 20.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,846 5,948 5,713 5,081 4,169 6,587 5,463 8,400 2,702 430 199 48,707 Pre‐Tax Income Federal Tax Burden Percent of Total Average (dollars) Percent of Total 7.9 12.2 11.7 10.4 8.6 13.5 11.2 17.3 5.6 0.9 0.4 100.0 6,428 15,742 25,506 35,137 45,275 63,896 87,562 145,248 300,076 708,894 3,113,066 91,956 0.6 2.1 3.3 4.0 4.2 9.4 10.7 27.2 18.1 6.8 13.8 100.0 Average (dollars) ‐1,218 ‐2,367 ‐920 1,884 4,934 9,948 16,461 34,470 80,421 188,077 925,173 19,174 After‐Tax Income 4 Percent of Total Average (dollars) Percent of Total ‐0.5 ‐1.5 ‐0.6 1.0 2.2 7.0 9.6 31.0 23.3 8.7 19.7 100.0 7,645 18,109 26,426 33,254 40,341 53,948 71,101 110,778 219,655 520,818 2,187,894 72,782 0.8 3.0 4.3 4.8 4.7 10.0 11.0 26.3 16.7 6.3 12.3 100.0 Average Federal Tax Rate 5 ‐19.0 ‐15.0 ‐3.6 5.4 10.9 15.6 18.8 23.7 26.8 26.5 29.7 20.9 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐3). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law without the provisions of the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal extends the existing OASDI tax rate for employees at 4.2 percent for the first two months of calendar year 2012, subject to a cap of $18,350. Our estimates assume that wages, salaries and self‐employment incomes are uniformly distributed through the calendar year. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 5‐Jan‐12 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T12‐0005 Temporary Payroll Tax Cut Continuation Act of 2011 Baseline: Current Law without the Temporary Payroll Tax Cut Extension for 2012 Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table ‐ Elderly Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 3.9 5.2 21.0 30.3 40.6 47.1 51.9 54.8 62.5 56.6 65.9 29.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.1 0.1 0.8 2.3 4.3 6.1 16.9 15.6 32.5 15.9 3.2 2.2 100.0 Average Federal Tax Change Dollars 0 ‐1 ‐5 ‐12 ‐22 ‐38 ‐56 ‐96 ‐144 ‐149 ‐192 ‐29 Percent ‐0.9 ‐0.8 ‐0.8 ‐0.8 ‐0.9 ‐0.6 ‐0.5 ‐0.4 ‐0.2 ‐0.1 0.0 ‐0.3 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.0 Under the Proposal 0.0 0.3 0.7 1.5 1.9 6.9 8.5 22.6 20.4 9.1 28.1 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 ‐0.1 ‐0.1 ‐0.1 ‐0.1 ‐0.1 0.0 0.0 0.0 Under the Proposal 0.8 0.8 2.4 4.6 5.6 9.5 13.1 17.8 22.9 23.4 29.3 16.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,154 8,698 4,924 3,727 2,930 4,733 2,996 3,598 1,179 229 122 36,319 Pre‐Tax Income Federal Tax Burden Percent of Total Average (dollars) Percent of Total 8.7 24.0 13.6 10.3 8.1 13.0 8.3 9.9 3.3 0.6 0.3 100.0 6,651 14,806 24,706 35,197 45,938 62,567 87,118 142,540 304,739 685,254 3,174,793 69,121 0.8 5.1 4.9 5.2 5.4 11.8 10.4 20.4 14.3 6.3 15.5 100.0 Average (dollars) 51 120 600 1,619 2,577 5,954 11,489 25,516 69,957 160,228 930,613 11,159 After‐Tax Income 4 Percent of Total Average (dollars) Percent of Total 0.0 0.3 0.7 1.5 1.9 7.0 8.5 22.7 20.4 9.1 28.1 100.0 6,600 14,686 24,106 33,578 43,361 56,613 75,629 117,024 234,783 525,026 2,244,181 57,962 1.0 6.1 5.6 5.9 6.0 12.7 10.8 20.0 13.2 5.7 13.0 100.0 Average Federal Tax Rate 5 0.8 0.8 2.4 4.6 5.6 9.5 13.2 17.9 23.0 23.4 29.3 16.1 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐3). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law without the provisions of the Temporary Payroll Tax Cut Continuation Act of 2011. Proposal extends the existing OASDI tax rate for employees at 4.2 percent for the first two months of calendar year 2012, subject to a cap of $18,350. Our estimates assume that wages, salaries and self‐employment incomes are uniformly distributed through the calendar year. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.