1-Apr-07 PRELIMINARY RESULTS Less than 10 10-20

advertisement

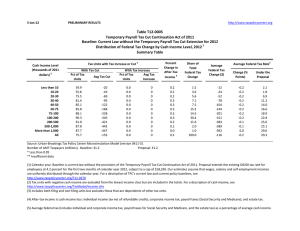

1-Apr-07 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T07-0115 Distribution of Federal Payroll and Income Taxes by Cash Income Class, 2006 1 Cash Income Class (thousands of 2006 dollars)2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units3 13.0 17.4 13.5 10.2 8.1 14.3 8.6 10.8 2.9 0.5 0.3 100.0 Percent of Tax Units With Positive: Payroll Tax4 52.5 60.2 76.5 83.7 86.0 88.2 91.1 93.3 91.2 89.0 88.7 77.2 Income Tax5 1.9 26.0 46.6 62.6 78.7 92.0 97.4 98.9 98.8 99.0 99.2 59.7 Average Tax Rate (Percent) 6 Payroll Tax 7.7 7.8 9.8 10.8 10.8 10.7 10.9 10.1 6.0 3.0 1.2 8.3 Income Tax -5.1 -4.4 -1.0 2.6 4.8 6.6 7.9 10.5 15.2 18.3 19.3 9.7 Percent with Payroll Tax Greater Than Income Tax All Tax Units 52.5 59.7 75.2 81.7 82.0 75.8 72.6 55.4 8.0 4.2 1.1 65.9 Wage Earners 99.9 99.3 98.5 97.7 95.5 86.4 80.4 60.1 9.0 5.0 1.3 85.5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 1006-2). (1) Calendar year. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) Includes the employee and employer portion of Social Security (OASDI) and Medicare (HI) taxes and self-employment taxes. (5) Income tax after refundable credits. (6) Tax as a percentage of cash income. Percent with Employee Share of Payroll Tax Greater Than Income Tax All Tax Units 52.5 59.4 62.2 49.0 44.4 39.0 30.7 12.0 2.3 2.0 0.8 43.9 Wage Earners 99.9 98.8 81.1 58.0 51.2 44.3 33.8 12.9 2.5 2.4 0.9 56.2