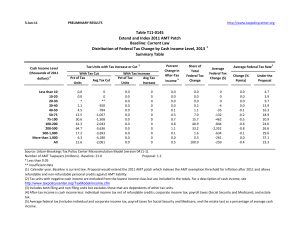

Table T08-0053 As Reported Out of Committee

advertisement

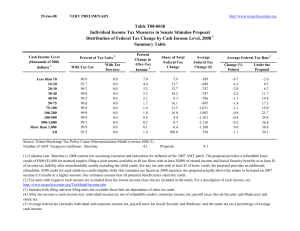

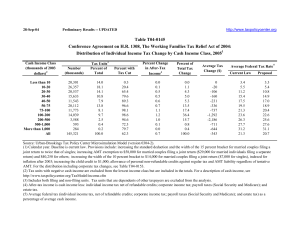

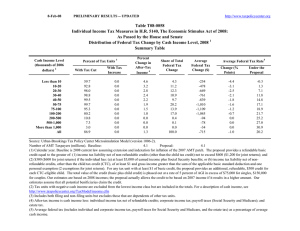

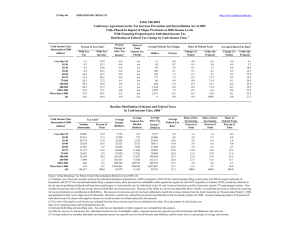

30-Jan-08 PRELIMINARY RESULTS -- UPDATED http://www.taxpolicycenter.org Table T08-0053 Individual Income Tax Measures in Senate Stimulus Proposal As Reported Out of Committee Distribution of Federal Tax Change by Cash Income Level, 2008 1 Summary Table Cash Income Level (thousands of 2006 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 60.9 93.7 98.3 99.0 99.5 99.8 99.8 98.5 71.4 12.1 5.0 91.8 With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 7.0 4.4 3.2 2.5 2.1 1.7 1.4 1.0 0.4 0.0 0.0 1.4 Share of Total Federal Tax Change Average Federal Tax Change ($) 6.0 14.0 13.0 10.4 8.5 16.5 11.8 16.2 3.3 0.1 0.0 100.0 -389 -649 -747 -787 -796 -895 -1,021 -1,082 -816 -122 -49 -775 Average Federal Tax Rate 5 Change (% Points) -6.7 -4.2 -2.9 -2.2 -1.7 -1.4 -1.1 -0.8 -0.3 0.0 0.0 -1.1 Under the Proposal -2.6 0.2 6.7 11.7 14.9 17.3 19.0 21.7 24.9 26.9 30.9 20.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 1006-2). Number of AMT Taxpayers (millions). Baseline: 4.1 Proposal: 4.1 (1) Calendar year. Baseline is 2008 current law assuming extension and indexation for inflation of the 2007 AMT patch. The proposal provides a refundable basic credit of $500 ($1,000 for married couples filing a joint return) available to all tax filers with at least $3000 of earned income and Social Security benefits or at least $1 of income tax liability after nonrefundable credits excluding the child credit. For any tax unit with at least $1 of basic credit, the proposal provides an additional, refundable, $300 credit for each child-tax-credit-eligible child. The combined credit phases out at a 5 percent rate above $150,000 of AGI ($300,000 for married couples filing jointly). Our estimates are based on 2008 incomes; the proposal actually allows the rebate to be based on 2007 income if it results in a higher amount. Our estimates assume that all potential beneficiaries claim the credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 30-Jan-08 PRELIMINARY RESULTS -- UPDATED http://www.taxpolicycenter.org Table T08-0053 Individual Income Tax Measures in Senate Stimulus Proposal As Reported Out of Committee Distribution of Federal Tax Change by Cash Income Level, 2008 1 Detail Table Cash Income Level (thousands of 2006 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 60.9 93.7 98.3 99.0 99.5 99.8 99.8 98.5 71.4 12.1 5.0 91.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 7.0 4.4 3.2 2.5 2.1 1.7 1.4 1.0 0.4 0.0 0.0 1.4 Share of Total Federal Tax Change 6.0 14.0 13.0 10.4 8.5 16.5 11.8 16.2 3.3 0.1 0.0 100.0 Average Federal Tax Change Dollars Percent -389 -649 -747 -787 -796 -895 -1,021 -1,082 -816 -122 -49 -775 -164.5 -95.3 -30.2 -15.6 -10.3 -7.5 -5.6 -3.4 -1.1 -0.1 0.0 -5.2 Share of Federal Taxes Change (% Points) -0.3 -0.7 -0.6 -0.4 -0.2 -0.3 -0.1 0.5 0.7 0.4 1.0 0.0 Under the Proposal -0.1 0.0 1.7 3.1 4.1 11.3 10.9 25.2 16.8 7.1 19.8 100.0 Average Federal Tax Rate5 Change (% Points) -6.7 -4.2 -2.9 -2.2 -1.7 -1.4 -1.1 -0.8 -0.3 0.0 0.0 -1.1 Under the Proposal -2.6 0.2 6.7 11.7 14.9 17.3 19.0 21.7 24.9 26.9 30.9 20.1 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2008 Cash Income Level (thousands of 2006 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 18,164 25,275 20,401 15,452 12,430 21,580 13,470 17,502 4,784 793 421 150,867 Percent of Total 12.0 16.8 13.5 10.2 8.2 14.3 8.9 11.6 3.2 0.5 0.3 100.0 Average Income (Dollars) 5,810 15,564 25,811 36,328 46,686 64,226 90,172 140,584 299,277 707,298 3,228,212 69,872 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 1006-2). Number of AMT Taxpayers (millions). Baseline: 4.1 Average Federal Tax Burden (Dollars) 236 681 2,474 5,046 7,758 12,011 18,154 31,563 75,288 190,695 996,442 14,831 Proposal: Average AfterTax Income 4 (Dollars) 5,574 14,883 23,337 31,281 38,928 52,215 72,018 109,021 223,989 516,603 2,231,770 55,041 Average Federal Tax Rate 5 4.1 4.4 9.6 13.9 16.6 18.7 20.1 22.5 25.2 27.0 30.9 21.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.0 3.7 5.0 5.3 5.5 13.2 11.5 23.3 13.6 5.3 12.9 100.0 1.2 4.5 5.7 5.8 5.8 13.6 11.7 23.0 12.9 4.9 11.3 100.0 0.2 0.8 2.3 3.5 4.3 11.6 10.9 24.7 16.1 6.8 18.8 100.0 4.1 (1) Calendar year. Baseline is 2008 current law assuming extension and indexation for inflation of the 2007 AMT patch. The proposal provides a refundable basic credit of $500 ($1,000 for married couples filing a joint return) available to all tax filers with at least $3000 of earned income and Social Security benefits or at least $1 of income tax liability after nonrefundable credits excluding the child credit. For any tax unit with at least $1 of basic credit, the proposal provides an additional, refundable, $300 credit for each child-tax-credit-eligible child. The combined credit phases out at a 5 percent rate above $150,000 of AGI ($300,000 for married couples filing jointly). Our estimates are based on 2008 incomes; the proposal actually allows the rebate to be based on 2007 income if it results in a higher amount. Our estimates assume that all potential beneficiaries claim the credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.